Year-end tax planning in October? It is not too early, my friends.

There are plenty of things to do now to prepare yourself for taxes next year. And there's good reason to, as well. Putting it off and not understanding where you are financially is something that many people do, which causes unnecessary stress, and unexpected tax bills come April next year.

This is a fantastic time to review your tax liability, i.e. what you think you owe now, and what you might owe by the end of the year. There are a number of reasons you might owe more than you think, as noted in this Forbes article.

Did you take some cash from your 401(k) or IRA to cover some Covid-related costs or shortfalls? They weren't tax free distributions.

Did you make some gains from Robinhood trading this year, or maybe dip into crypto? Watch out for some capital gains taxes.

Did you get one of those $1200 stimulus checks? The government wants some of it back in taxes next year.

Did your employer take advantage of that "payroll tax holiday?" It's not a tax cut. It's a tax delay, and only for a few months. Don't get surprised by this when the time comes.

It would be good to get a handle on things well in advance, so you can plan for it. There are even some strategies to lower that potential bill next year.

The American Income Tax Opportunity (i.e. FREE MONEY)

Look, I tried my best to make that headline exciting.

If you are a student, you might be missing out on some free cash from the government. The American Opportunity Tax Credit is a credit for qualified education expenses paid when attaining higher education.

The big part - you can get a maximum annual credit of $2,500 per eligible student. And another thing – if you are busy with school and not earning much, and you don't owe any taxes that you need the credit for, you can have 40% of any remaining amount of the credit (up to $1k) refunded to you.

Start building your wealth today! Freeman Capital provides dedicated wealth management and affordable investment planning.

Year-end tax planning in October? It is not too early, my friends.

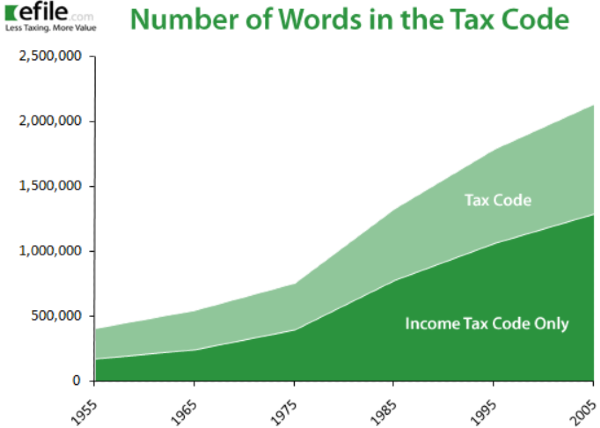

Source: eFile

There are plenty of things to do now to prepare yourself for taxes next year. And there's good reason to, as well. Putting it off and not understanding where you are financially is something that many people do, which causes unnecessary stress, and unexpected tax bills come April next year.

This is a fantastic time to review your tax liability, i.e. what you think you owe now, and what you might owe by the end of the year. There are a number of reasons you might owe more than you think, as noted in this Forbes article.

Did you take some cash from your 401(k) or IRA to cover some Covid-related costs or shortfalls? They weren't tax free distributions.

Did you make some gains from Robinhood trading this year, or maybe dip into crypto? Watch out for some capital gains taxes.

Did you get one of those $1200 stimulus checks? The government wants some of it back in taxes next year.

Did your employer take advantage of that "payroll tax holiday?" It's not a tax cut. It's a tax delay, and only for a few months. Don't get surprised by this when the time comes.

It would be good to get a handle on things well in advance, so you can plan for it. There are even some strategies to lower that potential bill next year.

The American Income Tax Opportunity (i.e. FREE MONEY)

Look, I tried my best to make that headline exciting.

If you are a student, you might be missing out on some free cash from the government. The American Opportunity Tax Credit is a credit for qualified education expenses paid when attaining higher education.

The big part - you can get a maximum annual credit of $2,500 per eligible student. And another thing – if you are busy with school and not earning much, and you don't owe any taxes that you need the credit for, you can have 40% of any remaining amount of the credit (up to $1k) refunded to you.

Start building your wealth today! Freeman Capital provides dedicated wealth management and affordable investment planning.