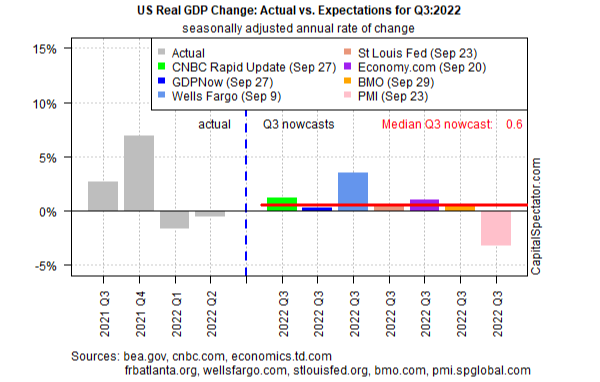

Some people have short memories or perhaps they are just born optimists. The level of debt in the USA is growing at the fastest rate since the recession hit. The Federal Reserve Bank of New York has reported that the current level of consumer debt is $11.52 trillion higher than it was towards the end of the recession in 2011. The figures include mortgages, credit cards, auto and student loans. One of the causes for concern is that around 30% of Americans have more credit card debt than the value of their emergency fund. Many have no emergency fund at all so they certainly would not be able to pay off their credit card debt if called to do so without borrowing other funds.

There has been some loosening of the criteria for providing credit since the recession receded; credit card limits have increased by $2.91 trillion since the low point. Spending of course has risen and that is directly as a result of increased consumer confidence that is something that the economy needs to create growth. Employment has fallen significantly and has returned to pre-recession levels. It does not mean that the economy is yet on steady ground and that is a warning to everyone. Even if debt is now more manageable that does not mean that there is any significant increase in the numbers of people saving, either to create an emergency fund or for providing for retirement.

Lack of Savings

Significantly however an increasing number of Americans were reported to be concerned at their lack of savings in a report published recently by BankRate. It does not mean that to date they are acting on their concerns.

Mortgage companies are relaxing after some years of real horror and the good news is that there is also a very progressive online financial sector. That sector is able to play a role in any American’s plans to improve their financial circumstances, either by providing funds to pay off onerous debt which can at the same time release more of monthly income to begin the process of saving.

Sensible Logic

It is important to realize that sector has a perfectly sensible logic behind its approval policy. It argues that the recession caught out many people who had never had problems before. They were helpless in the face of what was happening worldwide. Now that the problems were receding those same people were likely to try their best to normalize their lives. If they had regular income and a loan looked affordable why should they not repay their financial liabilities?

Those people that have a bad credit score need to look to these online lenders for help. Obviously everyone should have a strategy which includes a properly prepared budget in order to get out of financial trouble. One of the major tools at the disposal of consumers is a loan granted to those with bad credit.

Those people who are still managing to stay in control of their finances but are perhaps running too much credit card debt and therefore are paying needlessly paying significant interest each month should look to such lenders as well. If there is a way to reduce monthly expenditure as a result then the chances of building up savings in some form increase.

Good Online Lenders

It is obviously important to select a loans with no credit check lender whose website demonstrates that offers are competitive and the terms and conditions of any loan perfectly transparent. There is temptation when it comes to finance and there are companies that seek to dupe applicants with requests for money in advance or add hidden charges at a later date. These companies are to be avoided at all costs.

The whole process is done online. A simple application procedure asks for identity details, income and bank account information. That is sufficient for a quick decision and if the amount being sought looks to be affordable then applicants can expect the funds to be transferred into their accounts within hours. Anyone that is uneasy about their financial situation should look at what credit can offer them. If it is a loan that actually helps to improve their circumstances, and that is certainly possible, then it is time to act.

Some people have short memories or perhaps they are just born optimists. The level of debt in the USA is growing at the fastest rate since the recession hit. The Federal Reserve Bank of New York has reported that the current level of consumer debt is $11.52 trillion higher than it was towards the end of the recession in 2011. The figures include mortgages, credit cards, auto and student loans. One of the causes for concern is that around 30% of Americans have more credit card debt than the value of their emergency fund. Many have no emergency fund at all so they certainly would not be able to pay off their credit card debt if called to do so without borrowing other funds.

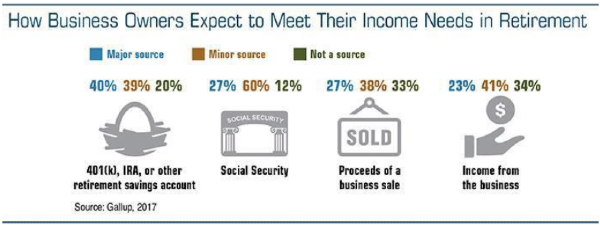

There has been some loosening of the criteria for providing credit since the recession receded; credit card limits have increased by $2.91 trillion since the low point. Spending of course has risen and that is directly as a result of increased consumer confidence that is something that the economy needs to create growth. Employment has fallen significantly and has returned to pre-recession levels. It does not mean that the economy is yet on steady ground and that is a warning to everyone. Even if debt is now more manageable that does not mean that there is any significant increase in the numbers of people saving, either to create an emergency fund or for providing for retirement.

Lack of Savings

Significantly however an increasing number of Americans were reported to be concerned at their lack of savings in a report published recently by BankRate. It does not mean that to date they are acting on their concerns.

Mortgage companies are relaxing after some years of real horror and the good news is that there is also a very progressive online financial sector. That sector is able to play a role in any American’s plans to improve their financial circumstances, either by providing funds to pay off onerous debt which can at the same time release more of monthly income to begin the process of saving.

Sensible Logic

It is important to realize that sector has a perfectly sensible logic behind its approval policy. It argues that the recession caught out many people who had never had problems before. They were helpless in the face of what was happening worldwide. Now that the problems were receding those same people were likely to try their best to normalize their lives. If they had regular income and a loan looked affordable why should they not repay their financial liabilities?

Those people that have a bad credit score need to look to these online lenders for help. Obviously everyone should have a strategy which includes a properly prepared budget in order to get out of financial trouble. One of the major tools at the disposal of consumers is a loan granted to those with bad credit.

Those people who are still managing to stay in control of their finances but are perhaps running too much credit card debt and therefore are paying needlessly paying significant interest each month should look to such lenders as well. If there is a way to reduce monthly expenditure as a result then the chances of building up savings in some form increase.

Good Online Lenders

It is obviously important to select a loans with no credit check lender whose website demonstrates that offers are competitive and the terms and conditions of any loan perfectly transparent. There is temptation when it comes to finance and there are companies that seek to dupe applicants with requests for money in advance or add hidden charges at a later date. These companies are to be avoided at all costs.

The whole process is done online. A simple application procedure asks for identity details, income and bank account information. That is sufficient for a quick decision and if the amount being sought looks to be affordable then applicants can expect the funds to be transferred into their accounts within hours. Anyone that is uneasy about their financial situation should look at what credit can offer them. If it is a loan that actually helps to improve their circumstances, and that is certainly possible, then it is time to act.

Originally Posted on allthingsfinance.net