Introduction

Nvidia is an American multinational company listed as Nvidia Corporation. Its line of business is the technology and tech products and is incorporated in Delaware headquarters in Santa Clara, California. Application programming interface APIs for data science, Graphics processing units GPUs, system on a-chip units SoCs for mobile computing, and high-performance computing are designed by this software and fabless company. The mission statement is "NVIDIA has pioneered accelerated computing to tackle challenges that otherwise can't be solved. Our work in AI and computer graphics is transforming industries valued at more than $100 trillion, from gaming to healthcare to transportation, and profoundly impacting society."

Investment

Since Nvidia is leading in GPUs so they are increasing the capital of this segment. Furthermore, the company is entering the market of cloud computing and data centers. Nvidia is categized as a highly innovative company in the past and the pioneer of the semiconductor industry. With its ARM-based superchip, the company is also penetrating the CPUs market segment. Nvidia will maintain high efficiency in Graphics, AI, and performance computing as a result the company will observe more growth. By the end of this financial year, NVDA's stock price will hit up to $220, with a 23.67% upside potential.

An Overview of Nvidia's product

NVIDIA Corporation (NASDAQ: NVDA), the company invented GPU in 1999 which help the growth of the PC gaming market. Nowadays NVIDIA's systems are installed in millions of computers, also accessible in cloud and TOP500 supercomputers. Their next goal is to be part of the new era of computing called modern Artificial Intelligence (AI). Its business is divided into two segments: Graphics, and Computing and Networking. Graphics segments include "GPUs, Quadro/NVIDIA RTX, video gaming streaming platforms, game consoles, enterprise workstations, GeForce NOW game streaming service and infrastructure, vGPU software for cloud-based virtual and visual computing, desktops, laptops, and gaming computers." The networking and Computing segment comprises "High-performance computing and accelerated computing, systems of AI platform and solutions, data center platforms and networking solutions."

The company generates most of its revenue from gaming sectors which contributed 46% of the total income last year and 25% CAGR (compounded annual growth rate) over five years. According to NVIDIA counts, it is confirmed that over 200 million gamers are using its GeForce technology as well as the market share of GPU is 78% which makes it the leader in the global market.

The second most dominant growth driver is its Data centers. With 66% CAGR and 40% of the revenue in the financial year 2022, it is leading in supercomputing, AI platform, and deep learning.

Two other growth drivers contain Professional visualization and Automotive. Last year their revenue was $2.1b and $566m and had a CAGR of 20% and 3% respectively. It is predicted that the automotive market will boom in the coming years as the company invested much capital in this market.

NVIDIA Valuation

By using discounted cash flow model, we can easily forecast the valuation of NVIDIA's stock price for the coming five years. The street consensus forecasted the value of five years which says that the company will generate 19.52% free cash flow (FCF) and will raise its profitability at 20.27% CAGR in the next five years. However, the revenue of the company will increase a bit slowly at 16.01% CAGR.

Possible Risk

There are many strong, well-established competitors in the market which is a potential threat for NVIDIA. In the GPU market segment, Intel is having 60% of the market share while NVIDIA and AMD have 21% and 19% respectively. Moreover, Apple recently announced that they are going to manufacture superior chips but they didn't show any intention to sell its chips to other manufacturing companies, this is not 100% sure that they will not sell its chips. Since the GPU of NVIDIA is used in cryptocurrency for crypto mining in past, they get huge direct profit from it because of the sudden popularity of cryptocurrency.

Due to politics, manufacturing capacity, and pricing the semiconductor manufacturing company face considerable risk. In addition, every company is facing post-COVID-19 and the Russia-Ukraine war impact negatively and NVIDIA is also included in it.

Market Analysis

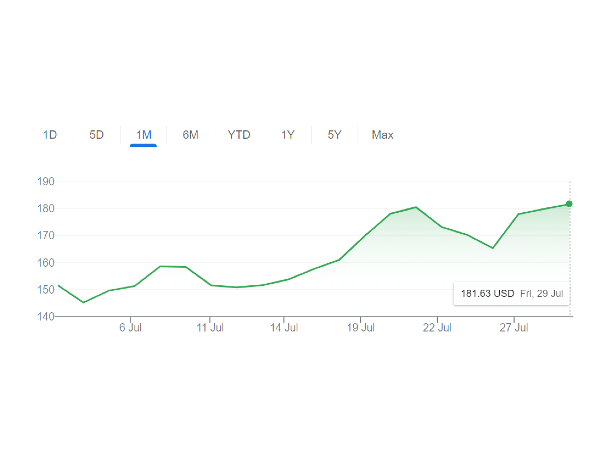

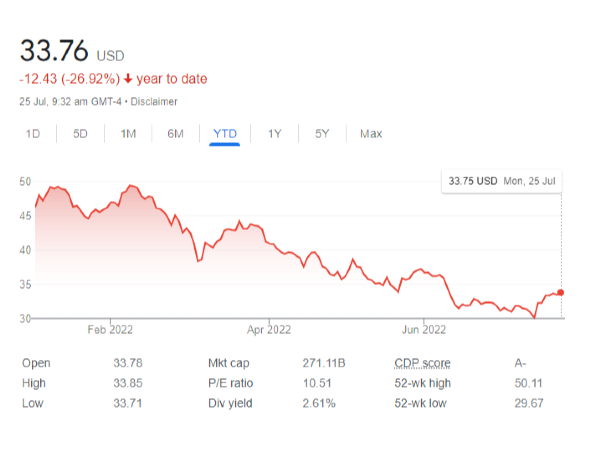

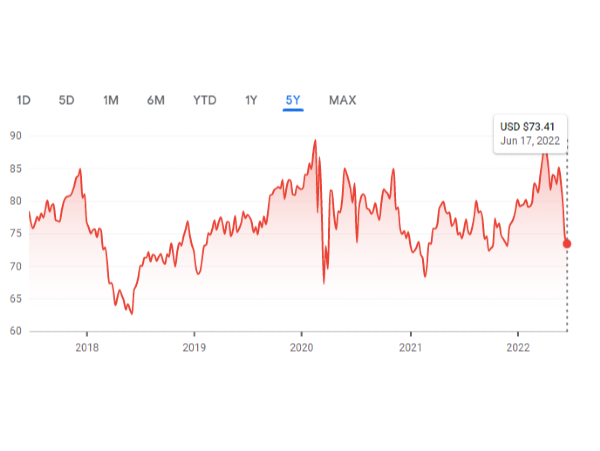

On 22 Nov 2021, the stock reached its maximum height of value of $346.47 which is its all-time-high (ATH) price. Later on, after the breakout of the COVID-19 pandemic, the stock price falls to $45.17 on 18 Mar 2020 but after a short time, it bounce back as well on 1 Jan 2022 it reached $301.63. Unfortunately, the year 2022 has not been good for almost every company and their stocks prices movement is still downward nevertheless it is expected this trend will reverse in the last months of this year.

A monthly forecast of NVIDIA 2022

$181 on 1 August

$185 on 15 August

$195 on 15 September

$204 on 15 November

$223 on 15 December

$234 on 15 January (2023)

By the end of 2025, the price of NVIDIA will be expected to hit $560 keeping the natural factors ceteris paribus.

As we know that not every forecasting is 100% accurate so you should also apply your knowledge and expertise to conclude a decision on whether or not to invest in Nvidia stock.

For more idea click the following link

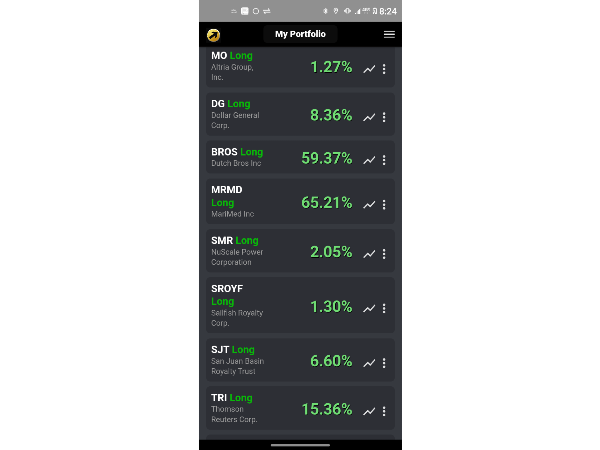

https://www.stockbossup.com/main/myProfile

Introduction

Nvidia is an American multinational company listed as Nvidia Corporation. Its line of business is the technology and tech products and is incorporated in Delaware headquarters in Santa Clara, California. Application programming interface APIs for data science, Graphics processing units GPUs, system on a-chip units SoCs for mobile computing, and high-performance computing are designed by this software and fabless company. The mission statement is "NVIDIA has pioneered accelerated computing to tackle challenges that otherwise can't be solved. Our work in AI and computer graphics is transforming industries valued at more than $100 trillion, from gaming to healthcare to transportation, and profoundly impacting society."

Investment

Since Nvidia is leading in GPUs so they are increasing the capital of this segment. Furthermore, the company is entering the market of cloud computing and data centers. Nvidia is categized as a highly innovative company in the past and the pioneer of the semiconductor industry. With its ARM-based superchip, the company is also penetrating the CPUs market segment. Nvidia will maintain high efficiency in Graphics, AI, and performance computing as a result the company will observe more growth. By the end of this financial year, NVDA's stock price will hit up to $220, with a 23.67% upside potential.

An Overview of Nvidia's product

NVIDIA Corporation (NASDAQ: NVDA), the company invented GPU in 1999 which help the growth of the PC gaming market. Nowadays NVIDIA's systems are installed in millions of computers, also accessible in cloud and TOP500 supercomputers. Their next goal is to be part of the new era of computing called modern Artificial Intelligence (AI). Its business is divided into two segments: Graphics, and Computing and Networking. Graphics segments include "GPUs, Quadro/NVIDIA RTX, video gaming streaming platforms, game consoles, enterprise workstations, GeForce NOW game streaming service and infrastructure, vGPU software for cloud-based virtual and visual computing, desktops, laptops, and gaming computers." The networking and Computing segment comprises "High-performance computing and accelerated computing, systems of AI platform and solutions, data center platforms and networking solutions." The company generates most of its revenue from gaming sectors which contributed 46% of the total income last year and 25% CAGR (compounded annual growth rate) over five years. According to NVIDIA counts, it is confirmed that over 200 million gamers are using its GeForce technology as well as the market share of GPU is 78% which makes it the leader in the global market. The second most dominant growth driver is its Data centers. With 66% CAGR and 40% of the revenue in the financial year 2022, it is leading in supercomputing, AI platform, and deep learning. Two other growth drivers contain Professional visualization and Automotive. Last year their revenue was $2.1b and $566m and had a CAGR of 20% and 3% respectively. It is predicted that the automotive market will boom in the coming years as the company invested much capital in this market.

NVIDIA Valuation

By using discounted cash flow model, we can easily forecast the valuation of NVIDIA's stock price for the coming five years. The street consensus forecasted the value of five years which says that the company will generate 19.52% free cash flow (FCF) and will raise its profitability at 20.27% CAGR in the next five years. However, the revenue of the company will increase a bit slowly at 16.01% CAGR.

Possible Risk

There are many strong, well-established competitors in the market which is a potential threat for NVIDIA. In the GPU market segment, Intel is having 60% of the market share while NVIDIA and AMD have 21% and 19% respectively. Moreover, Apple recently announced that they are going to manufacture superior chips but they didn't show any intention to sell its chips to other manufacturing companies, this is not 100% sure that they will not sell its chips. Since the GPU of NVIDIA is used in cryptocurrency for crypto mining in past, they get huge direct profit from it because of the sudden popularity of cryptocurrency. Due to politics, manufacturing capacity, and pricing the semiconductor manufacturing company face considerable risk. In addition, every company is facing post-COVID-19 and the Russia-Ukraine war impact negatively and NVIDIA is also included in it.

Market Analysis

On 22 Nov 2021, the stock reached its maximum height of value of $346.47 which is its all-time-high (ATH) price. Later on, after the breakout of the COVID-19 pandemic, the stock price falls to $45.17 on 18 Mar 2020 but after a short time, it bounce back as well on 1 Jan 2022 it reached $301.63. Unfortunately, the year 2022 has not been good for almost every company and their stocks prices movement is still downward nevertheless it is expected this trend will reverse in the last months of this year.

A monthly forecast of NVIDIA 2022

$181 on 1 August $185 on 15 August $195 on 15 September $204 on 15 November $223 on 15 December $234 on 15 January (2023) By the end of 2025, the price of NVIDIA will be expected to hit $560 keeping the natural factors ceteris paribus. As we know that not every forecasting is 100% accurate so you should also apply your knowledge and expertise to conclude a decision on whether or not to invest in Nvidia stock.

For more idea click the following link https://www.stockbossup.com/main/myProfile