Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

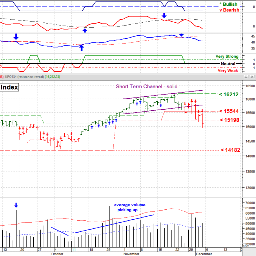

Dec. 3, 2021 - At the close Friday we’re at / near an import support level, both from a previous price level and a few other technical prices levels (50 ma, Fibonacci, etc.). The next couple of days are where we will find out whether the market stops and at least stabilizes or continues to show weakness.

The most obvious issue is the COVID Omicron strain and the Russian activity on the boarder of Ukraine. “A weak market will react badly to bad news while a strong market will ignore it.” This market is overvalued and needs a breather even though we’re in a strong seasonal period. If we can’t hold near this level the next line in the sand for support is the early October lows of 14182. The VIX remains high indicating more Put buying than Call buying so traders are in full bore hedge mode buying protection. The other concern is the FED. Will they cut back (i.e. taper) the purchase of bonds and how much? This market is addicted to cheap money, no doubt about it. ( more discussion at: www.special-risk.net )

I/we have a position in an asset mentioned