Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

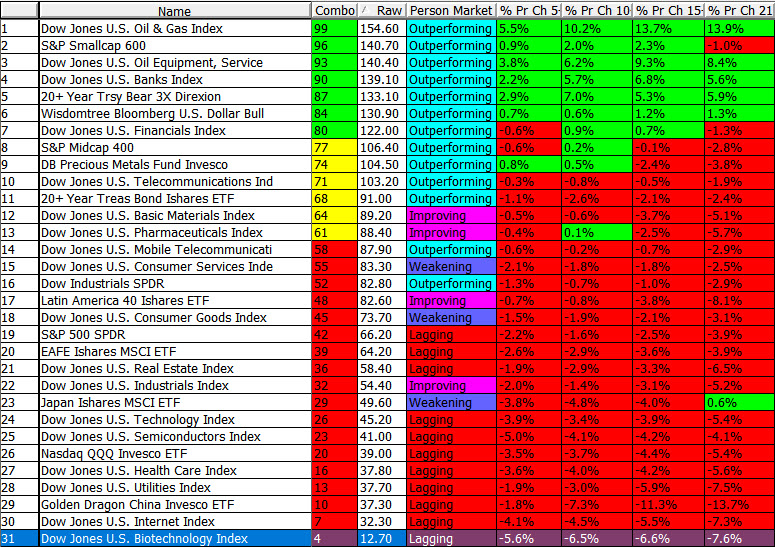

Oct. 1, 2021 – Apologies to The Wizard of Oz but this market got “spooked” this week. Yes the overall market breath (the number of stocks leading the indexes higher) was getting narrower and narrower. The old adage comes back: “When the market is weak, it reacts poorly to bad (or perceived bad) news, and if strong, it ignores it.” This market is weak.

There is plenty to worry about: FED tapering, Inflation, Supply Chain issues, Debt Ceiling and the Pandemic. While all of this could become serious to economic growth the current economy is doing pretty darn good. But, the stock market lives in the future and is looking out 6 to 12 months ahead.

Thursday the NASDAQ Composite Index dropped below the 14530 support level but recovered on Friday. That puts us back to mid-August and mid-July levels. 14178 is the next support level, and I need to see strength above 15380 (resistance) before I’m comfortable with an “all clear”. Putting it into perspective, the NASDAQ has dropped 5.19% and the S&P 500 3.93% since the (about) 9/3/21 peak. A 4% to 5% correction is pretty minor; at least so far. I’m sounding optimistic because late this week ETF’s saw a net inflow of dollars, and the biggest increases went to small cap and the leveraged “Q’s” (tech index). Sounds like some folks are also optimistic and “buying the dips”. But not so fast investors. The Money and Volume Flow indexes are still pretty negative. Let’s wait for confirmation; it shouldn’t take very long. Look for volume increases on up bars.

More discussion at: www.special-risk.net Have a good week. ............. Tom .............

I/we have a position in an asset mentioned