Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

Dec. 10, 2021 – It sure looks like this market is in a consolidation phase. We’ve gone through a period of weakness and bounced back a bit. Overall, things don’t look that bad but the market is not convinced just yet . . . and that’s OK. The chart below shows that weakness and partial recovery with the market concerned about 3 things: Inflation, Covid and the Evergrande bond default.

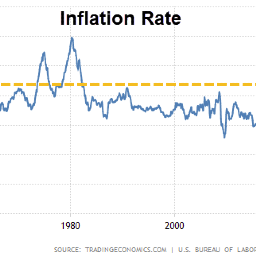

The Evergrande default is all about a very large Chinese real estate developer who overbuilt and now can’t make the interest payments on its bonds / loans. Concerns about it rippling through the Chinese, then Emerging Market economy is what it’s all about. The Chinese government will (likely) not let that happens. Next, Covid. This remains a wild card but there are signs that it may not have an outsized effect on the economy. It remains a genuine concern and requires our attention. Lastly, inflation. The sudden spike upward has caught many by surprise, but it’s really about the sudden surge in demand. During the past 2 years businesses have throttled back due to lack of demand and a fear of recession. That was real. But now demand has quickly increased and the supply chain can’t turn on a dime. The chart below shows the inflation rates over the past +60 years. I’ve drawn a line across the current rate to see what happened at that inflation level.

The times of roughly equivalent inflation rates were the mid 1970’s and early 1980’s. How did the markets hold up during that time and afterward? In the big picture, market dips but nothing very dramatic. Of note is that the previous peaks of inflation were preceded by high interest rates and excessive supply, but not excessive demand; a big difference. This market has come a long way and quickly. It’s overdue for a breather / consolidation of prices. Unless Covid spikes up and threatens the economy, this spike of inflation is likely a passing thing. Demand being greater than supply is very much an economic stimulate. We’re not likely to slip into a recession, at least not yet. (sorry about the chart: Stock team Up technical issues) For more charts and discussion: www.special-risk.net