Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

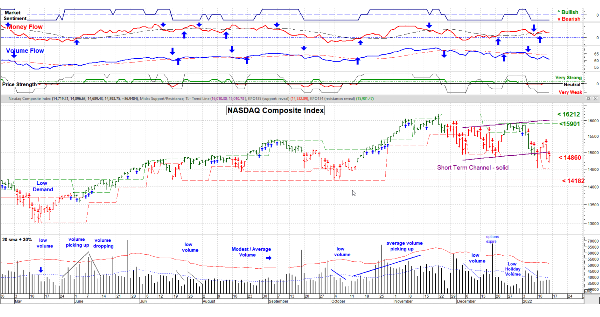

Apologies to pop culture but if anyone is saying that they got this market figured out, run, don’t walk away from them. Consolidating price formations are not easy to figure out and they really shouldn’t be. Right now there is a case to be made for Bearish and Bullish, but for, now neither is that terribly clear.

I remain in the camp that says price action is in a consolidating trading range. Yes, the NASDAQ Composite Index did close below my 14860 support level but then pop right up above it on Friday. Also I note that larger volumes are coming in on up bars like on Monday of this week. (“buying the dips”?) So what to do in this situation? I rotate out of weakness (Technology & Growth) toward what’s doing better (strength). That would be Energy and Financials / Banks. South American sectors are showing early signs of a rebound too. Things to keep in mind: Fourth quarter earnings are starting and the ongoing Covid and Ukrainian situations. Inflation is a ‘pesto issue’ IMHO because did anyone really think that interest rates could stay this low, for this long without increasing? Prices will be going up, but likely not as much as the current rate of increase. The Fed’s mandate of full employment has been met; next step is to keep inflation to around 2%. Since we’ve been increasing at a 7% rate that means increasing rates to slow things down. Hence Energy and Financials like that environment.

I’m about 75% invested and watching for some news item to throw a monkey wrench into this equilibrium. There are a lot of moving parts out there and the investors are not sure if they should go, or stay. Have a good week. ……….. Tom ………… (chart by MetaStock; used with permission; more discussion at: www.special-risk.net )

I/we have a position in an asset mentioned