Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

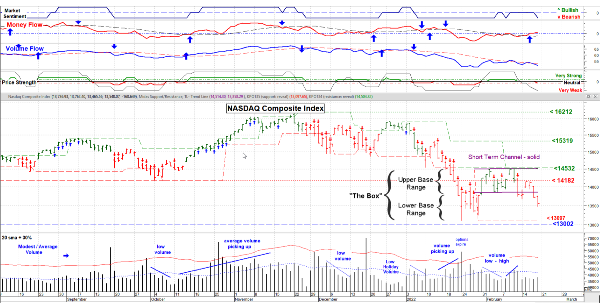

Feb. 18, 2022 – This market has been in a very large trading range which I’ve labeled as “The Box” on the chart below. I’ve broken it down into the “Upper Range” and the “lower Range”. The “Upper Range” is where the trades go when the market leans toward optimism, the “Lower Range” where it gets more pessimistic.

You’ll note that with the latest news about Ukraine that we’ve returned to the Lower level. Since the U.S. markets are closed on Monday (keep an eye open for indications in the international markets) we’ll have to see how they react to the news that came out after the market close on Friday. I’m thinking that we’ll see the lower end of that low range. 13097 (previous swing low) / 1300 levels look very “do-able” right now.

But then what? If the economy was weak, I’d say we were in for more of a drop, but it isn’t. Note the rather low volume late last week . . . . Traders are waiting; they’re not buying or selling much. Leads me to think that we'll make a double bottom then recover IF things don’t spiral out of control in Eastern Europe; a big “IF”. Friday was options expiration day and there were a lot of Puts just below the previous lows. These were likely bought as protection. The question was this protection rolled over (renewed) or just left to expire? If the markets go much below the lows there could be an “air pocket” taking the market lower. I think it all depends on how “hot” the news is out of Ukraine.

On the bright side, we could easily see a big move up on positive news. We have to stay nimble and keep things in perspective. The world may have “issues” but is not necessarily falling apart. The U.S. is in an enviable position of having a strong, growing economy and low unemployment. Not exactly conditions for a major crash.

I/we have no positions in any asset mentioned, but may initiate a position over the next 7 days