When it comes to investing, many people may fear losing money. After all, the media is full of stories about people who "gambled" money on "hot stocks" and lost. Unfortunately, these dramatic stories may scare people away from investing. When deciding to invest, you should know that there are many stocks to suit your level of risk tolerance.

What is Risk Tolerance?

It's pretty simple: risk tolerance is how much risk you are willing to take. Some people have a high risk tolerance and are willing to take a higher chance of loss in order to receive greater rewards. Others have a low risk tolerance and want an almost guaranteed return on investment, even if that return is relatively low. In layman's terms, those who like to say "go big or go home" tend to have a high risk tolerance, while those who prefer to say "better safe than sorry" tend to have a low risk tolerance.

The Risk-Return Relationship

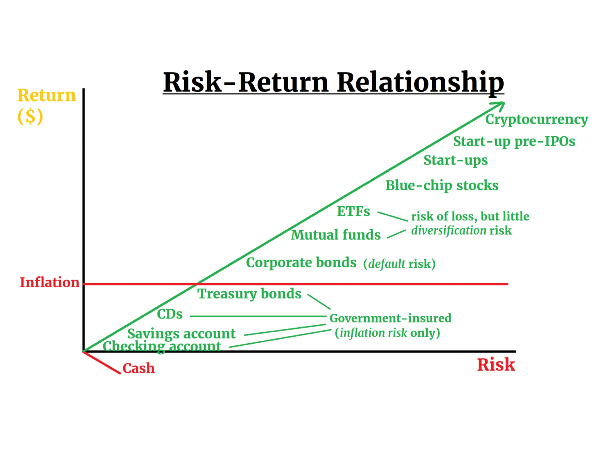

Obviously, every investor wants to maximize their return. However, the return is based on the level of risk required to pursue it. When it comes to investments, and in most of life in general, there is a direct relationship between risk and return. "Sure bets" do not have to offer much return to attract investors, while long shots and unproven newcomers must offer lots of potential profit. How much risk you are willing to accept, or should accept, depends on a number of factors: age, financial stability, investment goals, etc.

Risk Tolerance Factors

The younger you are, the less risk you have to accept in choosing stocks. You can afford to "play it safe" because you have more time to build up a portfolio and a nest egg (total amount of wealth). However, those who wait to invest until retirement is only a few decades away will have to accept greater risk to achieve a certain nest egg value. Reaching $2 million is easier if you start investing in the stock market at 22 than at 42!

Income and financial stability are also key. Investors who know they have sufficient income to add to their investments every month can afford to take more risks on individual investments. If a stock does go "bust," they can afford to rebuild their portfolio. Those who have unstable income or a rough budgeting situation will need to avoid risky stocks. Having to avoid too much risk, however, means losing out on potential gains in value!

Finally, investment goals can determine your level of risk tolerance. The faster you want to generate wealth, the more risk you must accept. If you want to invest as a source of income, relying on dividend payments, you will also have to accept more risk and invest heavily. Because of this, it is important to have a clear plan before investing seriously. Do you need to put a substantial portion of each paycheck into your stock portfolio, or should investments be more limited?

Higher Risk, Higher Return: Pre-IPOs and IPOs

Those with low risk tolerance tend to stick to stocks that are popular, stable, and have a lengthy track record of success. These stocks, from large corporations, are often called blue chip stocks. They are likely to have solid long-run growth, even though market crashes and economic depressions may temporarily cut their value. Most portfolios rely heavily on these widely-known companies.

If you want faster returns, you must accept smaller, faster-growing, up-and-coming investments. These companies are often called start-ups, and may offer pre-IPO deals to investors who have indicated interest in the company. An IPO, or initial public offering, is when a corporation's common stock goes out for sale on a stock exchange. In order to get the most return, investors may try to buy shares privately. Qualified investors and accredited investors are individuals who buy shares of stock directly from a new corporation before it "goes public" with an IPO.

However, pre-IPO purchases of stock typically require minimum investment amounts, meaning you cannot "play it safe" and only buy a few shares. Thus, there is greater financial risk. Also, buying a stock immediately upon an IPO is also rather risky, as its value can fluctuate rapidly. Investors should be aware that pre-IPO and IPO offerings come with greater risk than stock from corporations that have been around for decades.

Managing Risk: Knowledge is Power

If you are willing to invest in start-ups, make sure you do your homework! Research the company before buying shares, especially in a pre-IPO where there is a substantial minimum buy-in. Are there any reviews of the company's product or service? Have they attracted other investors? Do they have partnerships with other companies? Investor communities online may offer good insights to gauging start-ups, but always conduct your own research before clicking to purchase!

Many start-ups may offer pitch decks on their websites that show the company's strengths, according to its leaders. Make sure to also look for potential pitfalls of the new company, including market conditions that may not be conducive to sales. In order to have a good working knowledge of market conditions, it is important to be informed! Watch and read the news to know about levels of unemployment, inflation, and the potential for recessions. Is a start-up going to experience good business conditions, or might it struggle and collapse?

When it comes to investing, many people may fear losing money. After all, the media is full of stories about people who "gambled" money on "hot stocks" and lost. Unfortunately, these dramatic stories may scare people away from investing. When deciding to invest, you should know that there are many stocks to suit your level of risk tolerance.

What is Risk Tolerance?

It's pretty simple: risk tolerance is how much risk you are willing to take. Some people have a high risk tolerance and are willing to take a higher chance of loss in order to receive greater rewards. Others have a low risk tolerance and want an almost guaranteed return on investment, even if that return is relatively low. In layman's terms, those who like to say "go big or go home" tend to have a high risk tolerance, while those who prefer to say "better safe than sorry" tend to have a low risk tolerance.

The Risk-Return Relationship

Obviously, every investor wants to maximize their return. However, the return is based on the level of risk required to pursue it. When it comes to investments, and in most of life in general, there is a direct relationship between risk and return. "Sure bets" do not have to offer much return to attract investors, while long shots and unproven newcomers must offer lots of potential profit. How much risk you are willing to accept, or should accept, depends on a number of factors: age, financial stability, investment goals, etc.

Risk Tolerance Factors

The younger you are, the less risk you have to accept in choosing stocks. You can afford to "play it safe" because you have more time to build up a portfolio and a nest egg (total amount of wealth). However, those who wait to invest until retirement is only a few decades away will have to accept greater risk to achieve a certain nest egg value. Reaching $2 million is easier if you start investing in the stock market at 22 than at 42!

Income and financial stability are also key. Investors who know they have sufficient income to add to their investments every month can afford to take more risks on individual investments. If a stock does go "bust," they can afford to rebuild their portfolio. Those who have unstable income or a rough budgeting situation will need to avoid risky stocks. Having to avoid too much risk, however, means losing out on potential gains in value!

Finally, investment goals can determine your level of risk tolerance. The faster you want to generate wealth, the more risk you must accept. If you want to invest as a source of income, relying on dividend payments, you will also have to accept more risk and invest heavily. Because of this, it is important to have a clear plan before investing seriously. Do you need to put a substantial portion of each paycheck into your stock portfolio, or should investments be more limited?

Higher Risk, Higher Return: Pre-IPOs and IPOs

Those with low risk tolerance tend to stick to stocks that are popular, stable, and have a lengthy track record of success. These stocks, from large corporations, are often called blue chip stocks. They are likely to have solid long-run growth, even though market crashes and economic depressions may temporarily cut their value. Most portfolios rely heavily on these widely-known companies.

If you want faster returns, you must accept smaller, faster-growing, up-and-coming investments. These companies are often called start-ups, and may offer pre-IPO deals to investors who have indicated interest in the company. An IPO, or initial public offering, is when a corporation's common stock goes out for sale on a stock exchange. In order to get the most return, investors may try to buy shares privately. Qualified investors and accredited investors are individuals who buy shares of stock directly from a new corporation before it "goes public" with an IPO.

However, pre-IPO purchases of stock typically require minimum investment amounts, meaning you cannot "play it safe" and only buy a few shares. Thus, there is greater financial risk. Also, buying a stock immediately upon an IPO is also rather risky, as its value can fluctuate rapidly. Investors should be aware that pre-IPO and IPO offerings come with greater risk than stock from corporations that have been around for decades.

Managing Risk: Knowledge is Power

If you are willing to invest in start-ups, make sure you do your homework! Research the company before buying shares, especially in a pre-IPO where there is a substantial minimum buy-in. Are there any reviews of the company's product or service? Have they attracted other investors? Do they have partnerships with other companies? Investor communities online may offer good insights to gauging start-ups, but always conduct your own research before clicking to purchase!

Many start-ups may offer pitch decks on their websites that show the company's strengths, according to its leaders. Make sure to also look for potential pitfalls of the new company, including market conditions that may not be conducive to sales. In order to have a good working knowledge of market conditions, it is important to be informed! Watch and read the news to know about levels of unemployment, inflation, and the potential for recessions. Is a start-up going to experience good business conditions, or might it struggle and collapse?