Most people are aware that the United States has been experiencing record inflation, hitting a pace not seen since the early 1980s. Unfortunately, high inflation eventually triggers a recession, or a reduction in spending and economic output. After all the high inflation of 2021 and early 2022, economists have begun mentioning the dreaded r-word. For there to be an official recession, real GDP must have declined over two consecutive quarters.

The bad news? Q1 of 2022 saw such a decline in real GDP. The good news? The stock market always goes up in the long run. For beginning investors, it is crucial to remember this truth. When a recession hits, there is a lot of media sensationalism and gloom-and-doom prognosticating on social media. Don't let it scare you!

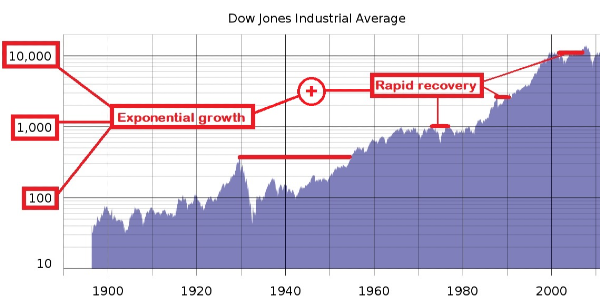

Although news reports may rattle new investors by talking about declines in the Dow Jones and S&P 500, those idexes all returned to their pre-crash levels relatively quickly. In four years, the Dow had fully recovered from its 2008 crash. And that crash precipitated the biggest recession since the Great Depression! Other market crashes, which did not culminate in economic recessions, saw even faster recoveries: The infamous Black Monday crash of October 1987 was fully erased in less than two years.

Even the granddaddy of all crashes, the Great Depression itself, saw the market fully recover in about two decades...and that was coming out of the depths of a stock market crash worsened by no meaningful government regulation. Today, active fiscal and monetary policy intervention, as well as regulatory agencies like the Securities and Exchange Commission (SEC) ensure that the stock market is far safer and more stable than it was in 1929. So, don't let the news of a market slide rattle your cage!

If you have been budgeting and ensuring a monthly amount of discretionary funds that you can invest, a bear market is a good time to buy shares of reliable stocks that will likely rebound. It is also important to keep in mind that there will be a bull market again. Those who win as long-term investors are those who maintain their investing discipline and avoid panic. Don't hit that sell button!

While recessionary fears often make people desire increased liquidity, meaning cash on hand, it is better to keep your money in the stock market. The market will recover, and only the stock market can beat inflation, which is still at record heights. Selling stocks to reap the cash will backfire when stocks begin to rise again. Since most individual investors are unlikely to buy back while stocks are at their lowest point, they will effectively be paying a premium. Had you not sold, you would end up owning more shares during the recovery and enjoyed a greater portfolio value.

Of course, some stocks do perform better than others during a recession. While you continue your regular investing, it may be worth it to adjust which stocks you buy. Next time, we will take a more in-depth look at how to build a more recession-proof stock portfolio!

Most people are aware that the United States has been experiencing record inflation, hitting a pace not seen since the early 1980s. Unfortunately, high inflation eventually triggers a recession, or a reduction in spending and economic output. After all the high inflation of 2021 and early 2022, economists have begun mentioning the dreaded r-word. For there to be an official recession, real GDP must have declined over two consecutive quarters.

The bad news? Q1 of 2022 saw such a decline in real GDP. The good news? The stock market always goes up in the long run. For beginning investors, it is crucial to remember this truth. When a recession hits, there is a lot of media sensationalism and gloom-and-doom prognosticating on social media. Don't let it scare you!

Although news reports may rattle new investors by talking about declines in the Dow Jones and S&P 500, those idexes all returned to their pre-crash levels relatively quickly. In four years, the Dow had fully recovered from its 2008 crash. And that crash precipitated the biggest recession since the Great Depression! Other market crashes, which did not culminate in economic recessions, saw even faster recoveries: The infamous Black Monday crash of October 1987 was fully erased in less than two years.

Even the granddaddy of all crashes, the Great Depression itself, saw the market fully recover in about two decades...and that was coming out of the depths of a stock market crash worsened by no meaningful government regulation. Today, active fiscal and monetary policy intervention, as well as regulatory agencies like the Securities and Exchange Commission (SEC) ensure that the stock market is far safer and more stable than it was in 1929. So, don't let the news of a market slide rattle your cage!

If you have been budgeting and ensuring a monthly amount of discretionary funds that you can invest, a bear market is a good time to buy shares of reliable stocks that will likely rebound. It is also important to keep in mind that there will be a bull market again. Those who win as long-term investors are those who maintain their investing discipline and avoid panic. Don't hit that sell button!

While recessionary fears often make people desire increased liquidity, meaning cash on hand, it is better to keep your money in the stock market. The market will recover, and only the stock market can beat inflation, which is still at record heights. Selling stocks to reap the cash will backfire when stocks begin to rise again. Since most individual investors are unlikely to buy back while stocks are at their lowest point, they will effectively be paying a premium. Had you not sold, you would end up owning more shares during the recovery and enjoyed a greater portfolio value.

Of course, some stocks do perform better than others during a recession. While you continue your regular investing, it may be worth it to adjust which stocks you buy. Next time, we will take a more in-depth look at how to build a more recession-proof stock portfolio!