Always be investing. While many people may panic at the word "recession" and desire to hold cash rather than keep their money in the market, you never want to panic sell your stocks. In the long run, the stock market always goes up, and is a necessity to grow your wealth. Savings accounts, CDs, and bonds simply don't offer enough return to overcome inflation.

Not selling your stocks during a recession doesn't mean you have to sit passively! If an economic downturn is on the way, it may be time to shift your new investments to stocks that are relatively recession proof. While we often talk in general terms about "the market" or "the economy", not all industries are affected to the same degree by downturns in GDP, consumer confidence, or international trade wars. Simply put, investors should know which industries are more sensitive to changes in different parts of the economy.

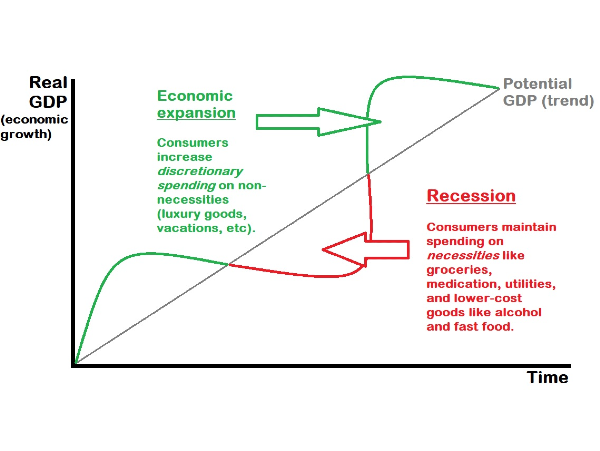

Let's look at industries that are resistant to recessions, or downturns in GDP (gross domestic product, or national output) that last more than six months. According to the business cycle, commonly known as the "boom and bust cycle," recessions are inevitable. At some point, growth slows, often triggered by high inflation and a pullback on spending. But, as you might expect, we don't cut our spending equally across the board!

Many industries produce goods and services that are highly demand inelastic, meaning demand doesn't "stretch" much in response to changing conditions. Our purchase of these things tends to remain stable. Often, this is because these goods and services are considered necessities. Food, medication, and alcohol are three common examples. While we may purchase less expensive brands of food and alcohol, our total quantity demanded tends to remain about the same.

Alcoholic beverage producers and sellers, grocery store chains, and pharmaceutical companies tend to be good recession-proof investments because they make and sell both higher-end "designer" products and lower-cost "store brand" substitutes. During good times, you drink to celebrate - beer, wine, champagne! During bad times, however, you may drink to relieve stress - hard liquor.

During recessions, people prioritize the basics, including groceries and medication. Fast food also does surprisingly well, for a couple of reasons. First, people may stress-eat during trying economic times. Secondly, fast food may be seen as a suitable substitute for more expensive, sit-down restaurants. Therefore, while people who may have been laid off during a recession no longer visit their favorite fast food joint (or, nowadays, order on a delivery app), their places are often taken by middle-class consumers who are still employed but want to cut expenses. Thus, the "window" of customers for fast food remains relatively full.

Think of it this way: If you lost your job and had to live on unemployment benefits, meaning a significantly constricted budget, what would you continue to buy? What counts as a necessity? Utilities like electricity and heat? Food? Prescription medication? These stocks do well during recessions. Things that can more easily be cut during downturns in the business cycle, often called cyclical stocks, are likely to lose value during recessions.

So, even if the United States dips into a recession, keep investing! But you may want to shift some money into shares in stable, proven corporations that deal in recession-proof necessities like groceries, medication, and utilities. Also, substitute-rich industries like alcohol and fast food remain popular during recessions for offering low-cost stress relievers and suitable substitutes for higher-cost beverages and food that consumers enjoyed during the boom.

Always be investing. While many people may panic at the word "recession" and desire to hold cash rather than keep their money in the market, you never want to panic sell your stocks. In the long run, the stock market always goes up, and is a necessity to grow your wealth. Savings accounts, CDs, and bonds simply don't offer enough return to overcome inflation.

Not selling your stocks during a recession doesn't mean you have to sit passively! If an economic downturn is on the way, it may be time to shift your new investments to stocks that are relatively recession proof. While we often talk in general terms about "the market" or "the economy", not all industries are affected to the same degree by downturns in GDP, consumer confidence, or international trade wars. Simply put, investors should know which industries are more sensitive to changes in different parts of the economy.

Let's look at industries that are resistant to recessions, or downturns in GDP (gross domestic product, or national output) that last more than six months. According to the business cycle, commonly known as the "boom and bust cycle," recessions are inevitable. At some point, growth slows, often triggered by high inflation and a pullback on spending. But, as you might expect, we don't cut our spending equally across the board!

Many industries produce goods and services that are highly demand inelastic, meaning demand doesn't "stretch" much in response to changing conditions. Our purchase of these things tends to remain stable. Often, this is because these goods and services are considered necessities. Food, medication, and alcohol are three common examples. While we may purchase less expensive brands of food and alcohol, our total quantity demanded tends to remain about the same.

Alcoholic beverage producers and sellers, grocery store chains, and pharmaceutical companies tend to be good recession-proof investments because they make and sell both higher-end "designer" products and lower-cost "store brand" substitutes. During good times, you drink to celebrate - beer, wine, champagne! During bad times, however, you may drink to relieve stress - hard liquor.

During recessions, people prioritize the basics, including groceries and medication. Fast food also does surprisingly well, for a couple of reasons. First, people may stress-eat during trying economic times. Secondly, fast food may be seen as a suitable substitute for more expensive, sit-down restaurants. Therefore, while people who may have been laid off during a recession no longer visit their favorite fast food joint (or, nowadays, order on a delivery app), their places are often taken by middle-class consumers who are still employed but want to cut expenses. Thus, the "window" of customers for fast food remains relatively full.

Think of it this way: If you lost your job and had to live on unemployment benefits, meaning a significantly constricted budget, what would you continue to buy? What counts as a necessity? Utilities like electricity and heat? Food? Prescription medication? These stocks do well during recessions. Things that can more easily be cut during downturns in the business cycle, often called cyclical stocks, are likely to lose value during recessions.

So, even if the United States dips into a recession, keep investing! But you may want to shift some money into shares in stable, proven corporations that deal in recession-proof necessities like groceries, medication, and utilities. Also, substitute-rich industries like alcohol and fast food remain popular during recessions for offering low-cost stress relievers and suitable substitutes for higher-cost beverages and food that consumers enjoyed during the boom.