Heading into 2023, US equities looked like they were heading into a sea of troubles, with inflation out of control and a recession on the horizon. While stocks had their ups and downs during the year, they ended the year strong, and recouped, at least in the aggregate, most of the losses from 2022. That positive result notwithstanding, the recovery was uneven, with a big chunk of the increase in market capitalization coming from seven companies (Facebook, Amazon, Apple, Microsoft, Alphabet, NVidia and Tesla) and wide divergences in performance across stocks, in performance. As we move into 2024, it looks like expectations have been reset, with most forecasters now expecting the economy to glide in for a soft landing and interest rates to decline, and while that may seem like good news, it will represent a challenge for equity market investors.

Looking Back at the S&P 500 in 2023

Almost a year ago, I wrote a post about what 2023 held for stocks, and it reflected the dark mood in markets, and in the face of investor gloom, looked at how the expectations game would play out for equities. In that post, I noted that if inflation subsided quickly, and the economy stayed out of a recession, stocks had upside, and that is the scenario that played out in 2023. Stocks ended the year well, with November and December both delivering strong up movements, and while this left investors feeling good about the year, it was a rocky year. In the graph below, I look at the monthly levels on the index and price returns, by month:

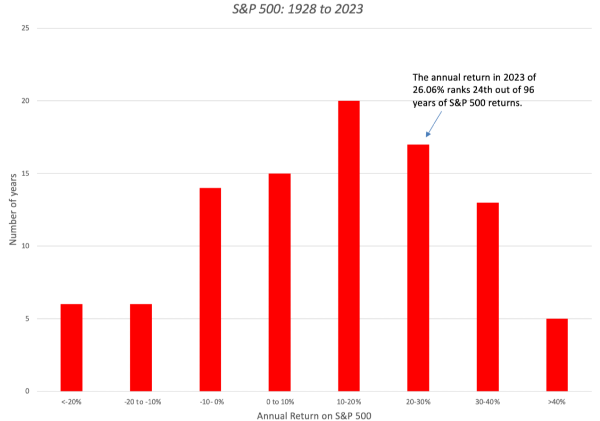

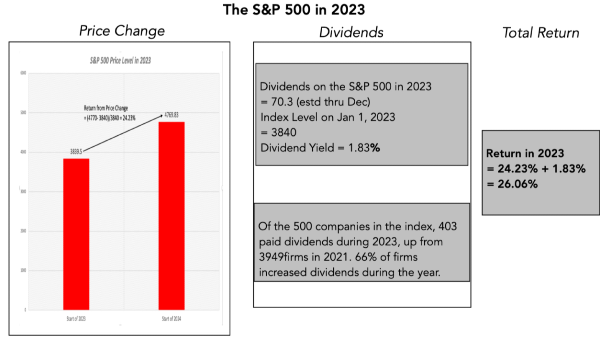

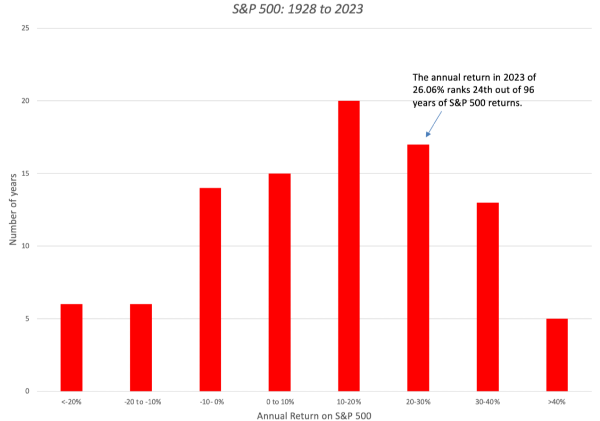

On a month-to-month basis, stocks started the year well and had a good first half, before entering a tough third quarter where they gave back most of those gains. Over the course of the year, the S&P 500 rose from 3840 to 4770, an increase of 24.23% for the year, which when added to the dividend yield of 1.83% translated into a return of 26.06% for the year:

To get historical context, I compared the returns in 2023 to annual returns on the S&P 500 going back to 1928:

Download historical return data

It was a good year, ranking 24th out of the 95 years of data that I have in my dataset, a relief after the -18.04% return in 2022.

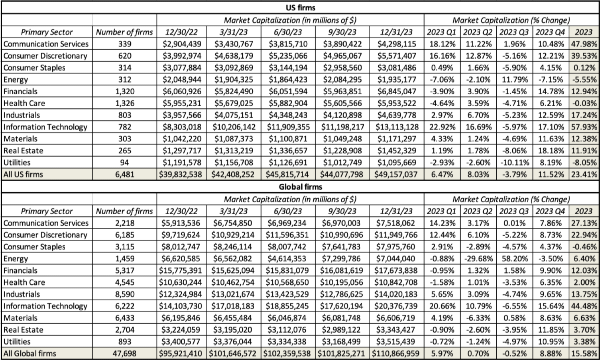

The solid comeback in stocks, though, came with caveats. The first is that it was an uneven recovery, if you break stocks down be sector, which I have, for both US and global stocks, in the table below:

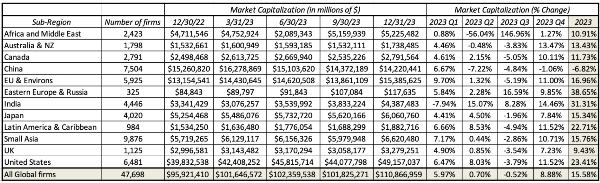

As you can see, technology was the biggest winner of the year, up almost 58% (44%) for US (global) stocks, with communication services and consumer discretionary as the next best performers. Energy, one of the few survivors of the 2022 market sell-off, had a bad year, as did utilities and consumer staples. Breaking equities down by sub-region, and looking across the globe, I computed the change in aggregate market capitalization, by region:

While US stocks accounted for about $9.5 trillion of the $14 trillion increase in equity market capitalization across the world, two regions did even better, at least on a percentage basis. The first was Eastern Europe and Russia, coming back from a massive sell-off in the prior two years and the other was India, which saw an increase of $1 trillion in market cap, and a 31.3% increase in market capitalization.

Looking forward at the S&P 500 for 2024

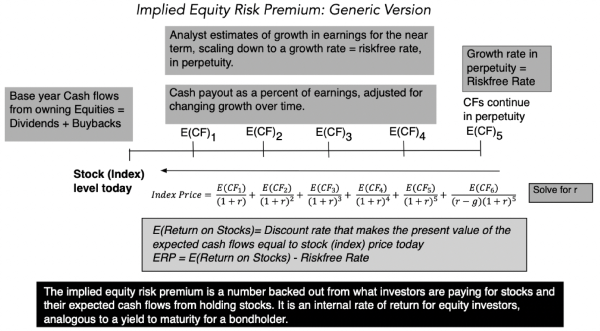

While there is comfort in looking backwards, slicing and dicing data in the hope of getting clues for the future, investing is about the future. Much as we like to believe that history repeats itself, and find patterns even when they do not exist, the nature of markets makes them difficult to forecast, precisely because they are driven not by what actually happens to the economy, inflation and other fundamentals, but by how these results compare to expectations. Going into 2024, investors are clearly in a better mood about what is to come this year, than they were a year ago, but they are pricing in that better mood. To capture the market's mood, I back out the expected return (and equity risk premium) that investors are pricing in, through an implied equity risk premium:

Put simply, the expected return is an internal rate of return derived from the pricing of stocks, and the expected cash flows from holding them, and is akin to a yield to maturity on bonds.

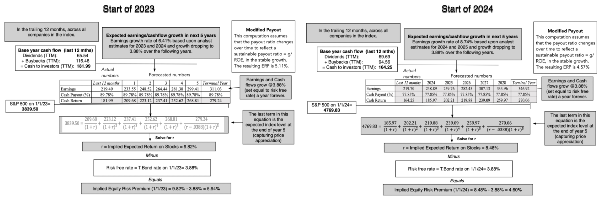

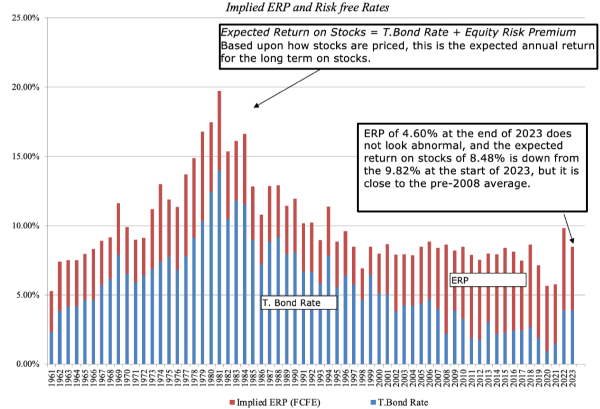

To see how expectations and pricing have changed over the course of the year, I compare the implied equity risk premium (ERP) from the start of 2023 with the same number at the start of 2024

2023 ERP & 2024 ERP

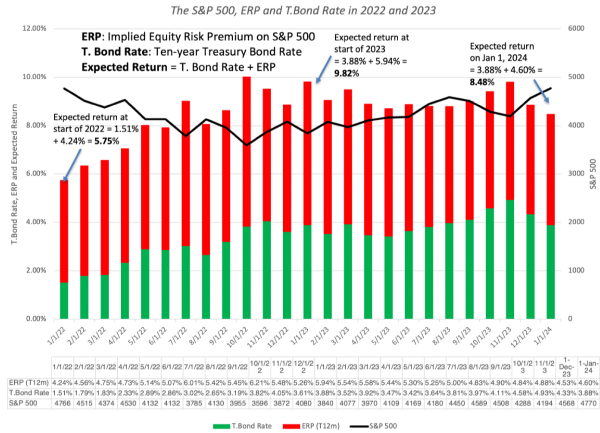

At the start of 2023, in the midst of the market's pessimism of what the coming years would deliver, stocks were priced to earn a 9.82% annual return and a 5.94% equity risk premium. In contrast, at the start of 2024, the lifting of fear has led to higher prices, a more upbeat forecast of earnings and an expected return of 8.48% and an equity risk premium of 4.60%. I do compute this expected return and the equity risk premium at the start of each month, and the last 24 months have been a roller coaster ride:

While equity risk premiums and expected returns rose strongly in 2022, registering the largest single-year increase in history, they declined over 2023, as hope has gained an upper hand over fear.

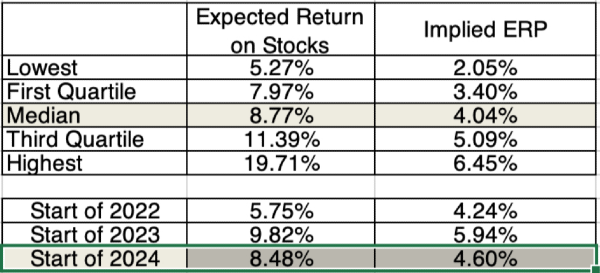

To the question of whether 8.48% is a reasonable expectation for an annual return for US stocks, and 4.60% a sufficient equity risk premium, I looked at the historical estimates for these numbers going back to 1960:

Download historical ERP

While stocks had expected returns exceeding 10% for much of the 1970s and 1980s, the culprit was high interest rates, and as interest rates have declined in this century, expected returns have come down as well. The post-2008 time period also was a period of historically low interest rates, and expected returns bottomed out in 2021, before rising again in 2022. In the table below, I look at the expected returns and equity risk premiums at the start of 2022, 2023 and 2024 against the distribution of the corresponding variables between 1960 and 2024:

Download historical ERP

It is comforting, if you are an equity investor, to see that the expected returns are only slightly lower than the median value over the longer period, and the equity risk premium is above historical norms.

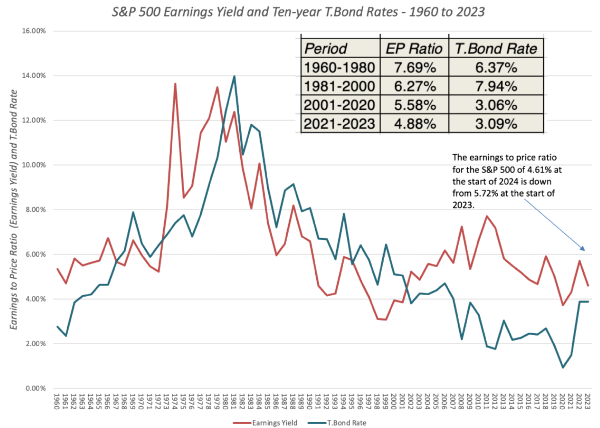

Needless to say, there are other metrics, measuring the cheapness or expensiveness of equities, that investors may find more troubling. In particular, the earnings yield (the inverse of the PE ratio) for US equities will give investors pause:

Download historical EP

Note that the EP ratio, after a surge last year, has dropped back towards 2022 levels, with the caveat being that treasury bond rates are much higher now than they were then, an attractive alternative to equities that did not exist two years ago.

Taking a Stand - Market Valuations into 2024

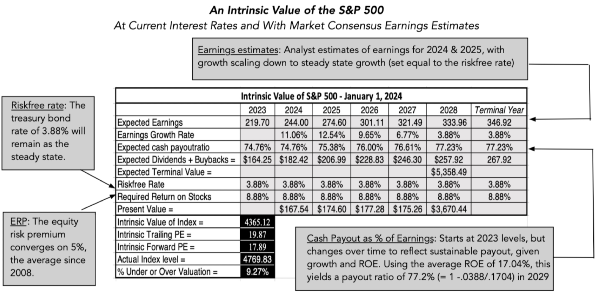

I am not a market timer, but I do value the market at regular intervals, more to get a measure of what the market is pricing in, than to forecast future movements. In valuing the index, I follow the intrinsic value rulebook, where the value is determined by expectations of cash flows in the future, discounted back to adjust their risk.

To get expected cash flows, I start with expectations of earnings from the equities that comprise the index. For the S&P 500, the most widely followed equity index, I use the consensus estimates of aggregate earnings for 2024 and 2025, from analysts. I know that mistrust of analysts runs high, and the perception that they are cheerleaders for individual companies is often well founded, but I will stick with these forecasts for a simple reason. Having tracked analyst forecasts for four decades,I have found that analyst estimates of aggregated earnings for the index are unbiased, with analysts under estimating earnings in almost as many years as they over estimate them.

The cash flows to equity investors, especially in the United States, have increasingly taken the form of buybacks, not just supplementing but supplanting dividends. In 2023, dividends and buybacks on the S&P 500 index amounted to $1.367 trillion, 164.25 in index units, with 57.6% of these cash flows coming from buybacks. As a percent of earnings, the cumulative cash returned represented 74.8% of earnings in that year, representing a decline from payout ratios during this century (2000-2022); the median payout ratio for this period was 83%.

With these earnings and cash flows as starting points, and assuming that the treasury bond rate of 3.88% is a fair interest rate, I value the S&P 500:

Download valuation spreadsheet

Note that I forecast earnings beyond 2025, by assuming that growth scales down to the growth rate of the economy, estimated to be roughly equal to the riskfree rate. Unlike early in 2023, when stocks looked slightly under valued, with consensus earnings numbers and prevailing rates, stocks look over valued by about 9.2%, with a similar structure today.

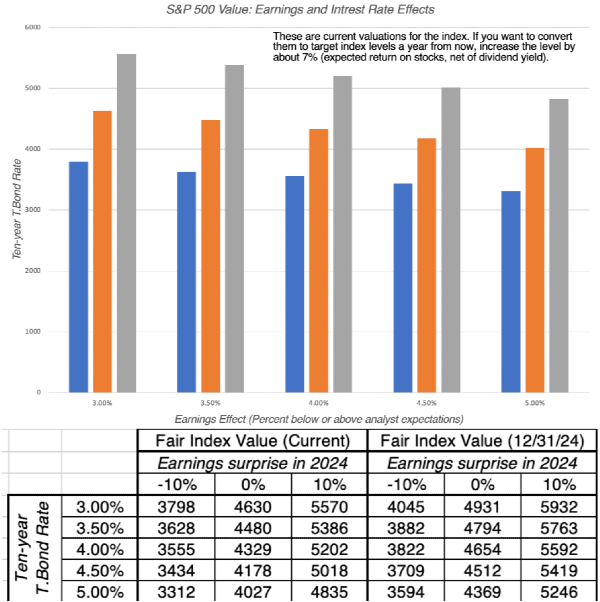

As with any market valuation, there are risks embedded in this value. First, the consensus view that the economy will come in for a soft landing may be wrong, with a recession or a stronger recovery both in the cards; the earnings numbers will be lower than analyst estimates in a recession and higher with a stronger economy. Second, while the market is building in expectations of interest rates declining in 2024, a significant portion of that optimism comes from a delusion that the Fed can raise or lower rates at well. After all, the treasury bond rate, a much stronger driver of equity values than short term treasury rates, remained unchanged in 2023, even as the Fed repeatedly raised the Fed Fund rates, and it is very likely that the future path of the treasury bond rate will depend more on the vagaries of inflation than on the whims of Jerome Powell. In the graph below, I look at the fair index level as a function of assumptions about earnings surprises and interest rates:

Note that I report the fair index values currently, and to convert them into target levels for the index a year from now, you have to take the future value of the index, using the expected return on stocks (net of dividend yield). For instance, to get the expected index level at the end of 2024, if rates stay at around 4% and earnings come in 10% above expectations, is as follows:

Fair value of the index in current terms = 5202

Expected annual return on equities = T.Bond rate + ERP = 4% + 5% = 9%

Expected price appreciation on equities = Expected annual return - Dividend yield = 9% - 1.5% = 7.5%

Expected index level on 12/31/2024 (r =4%, Earnings 10% above expected) = 5202 (1.075) = 5592

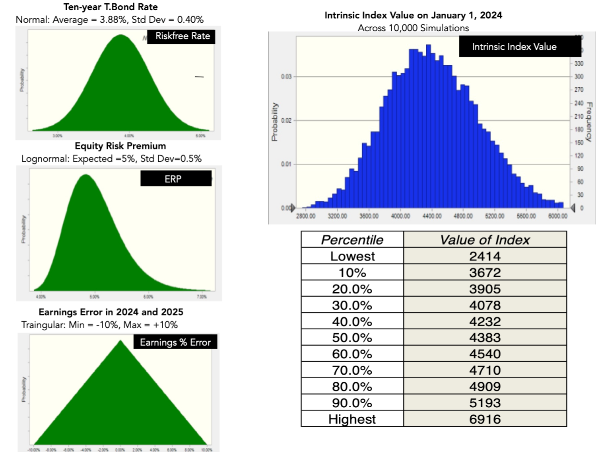

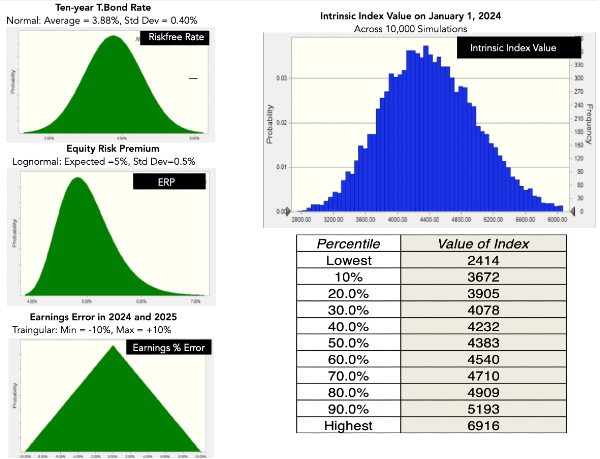

As you can see, you would need earnings to come in above expectations, for the current index level (4750 on January 16) to be justified, with lower interest rates providing an assist. While what-if tables like the one above are useful tools for dealing with uncertainties, a more complete assessment of uncertainty requires that I be explicit about the uncertainties I face on each input, resulting in a simulation:

Simulation run with Crystal Ball, an Excel add-on

Not surprisingly, with uncertainties built in, the fair value of the index has a wide range, but using the first and ninth decile, a reasonable range for the fair value would 3670 - 5200, and at the January 16 closing level of 4750, there is about a 70% chance that the market is over valued.

I am sure that you will disagree with one or more of the inputs that I have used to value the index, and I welcome that disagreement. Rather than point out to me the error of my ways, please download the spreadsheet containing the intrinsic valuation, and you should be able to replace my assumptions about earnings, cash payout and interest rates, and arrive at your own estimates of index value.

Caveat emptor!

Before you take my market prognostications at face value, please consider my open disclosure that I am a terrible market timer and try to avoid it in my investing. In short, I do not plan to act on my market valuation by buying puts on the index, or scaling down by portfolio's equity exposure. If you are wondering why I bother valuing the index, there are two reasons. First, there are times in the past, when the overvaluation of the market is so large that it operates as a red flag on investing in equities, as an asset class, in general. That signal worked in early 2000 but did not in early 2008, and it is thus a noisy one. Second, and more generally, though, valuing the market allows you to make sense of, and tolerance for, bullish and bearish views on the market that may diverge from your own views. Thus, investors and analysts who believe that rates will continue to decline, with a strong economy delivering higher-than-expected earnings, will see significant upside in this market, just as investors and analysts who believe that stubbornly higher inflation will cause rates to rise, and that earnings will come in well below expectations will be more likely to be part of the doomsday crowd. Just as in 2023, there will be times in 2024 when one side or the other will think that it has decisively won the argument, just to see a reversal in the next period.

YouTube Video

https://youtu.be/5u5Pom4gfKY

Datasets

1.) Historical Returns on Stocks, Bonds, Gold and Real Estate - 1928 -2023

2). Historical Implied Equity Risk Premiums and Expected Returns - 1960- 2023

Spreadsheets

Implied ERP calculator - January 1, 2024

Valuation of the S&P 500 on January 1, 2024

Heading into 2023, US equities looked like they were heading into a sea of troubles, with inflation out of control and a recession on the horizon. While stocks had their ups and downs during the year, they ended the year strong, and recouped, at least in the aggregate, most of the losses from 2022. That positive result notwithstanding, the recovery was uneven, with a big chunk of the increase in market capitalization coming from seven companies (Facebook, Amazon, Apple, Microsoft, Alphabet, NVidia and Tesla) and wide divergences in performance across stocks, in performance. As we move into 2024, it looks like expectations have been reset, with most forecasters now expecting the economy to glide in for a soft landing and interest rates to decline, and while that may seem like good news, it will represent a challenge for equity market investors.

Looking Back at the S&P 500 in 2023

Almost a year ago, I wrote a post about what 2023 held for stocks, and it reflected the dark mood in markets, and in the face of investor gloom, looked at how the expectations game would play out for equities. In that post, I noted that if inflation subsided quickly, and the economy stayed out of a recession, stocks had upside, and that is the scenario that played out in 2023. Stocks ended the year well, with November and December both delivering strong up movements, and while this left investors feeling good about the year, it was a rocky year. In the graph below, I look at the monthly levels on the index and price returns, by month:

On a month-to-month basis, stocks started the year well and had a good first half, before entering a tough third quarter where they gave back most of those gains. Over the course of the year, the S&P 500 rose from 3840 to 4770, an increase of 24.23% for the year, which when added to the dividend yield of 1.83% translated into a return of 26.06% for the year:

To get historical context, I compared the returns in 2023 to annual returns on the S&P 500 going back to 1928:

Download historical return data

It was a good year, ranking 24th out of the 95 years of data that I have in my dataset, a relief after the -18.04% return in 2022. The solid comeback in stocks, though, came with caveats. The first is that it was an uneven recovery, if you break stocks down be sector, which I have, for both US and global stocks, in the table below:

As you can see, technology was the biggest winner of the year, up almost 58% (44%) for US (global) stocks, with communication services and consumer discretionary as the next best performers. Energy, one of the few survivors of the 2022 market sell-off, had a bad year, as did utilities and consumer staples. Breaking equities down by sub-region, and looking across the globe, I computed the change in aggregate market capitalization, by region:

While US stocks accounted for about $9.5 trillion of the $14 trillion increase in equity market capitalization across the world, two regions did even better, at least on a percentage basis. The first was Eastern Europe and Russia, coming back from a massive sell-off in the prior two years and the other was India, which saw an increase of $1 trillion in market cap, and a 31.3% increase in market capitalization.

Looking forward at the S&P 500 for 2024

While there is comfort in looking backwards, slicing and dicing data in the hope of getting clues for the future, investing is about the future. Much as we like to believe that history repeats itself, and find patterns even when they do not exist, the nature of markets makes them difficult to forecast, precisely because they are driven not by what actually happens to the economy, inflation and other fundamentals, but by how these results compare to expectations. Going into 2024, investors are clearly in a better mood about what is to come this year, than they were a year ago, but they are pricing in that better mood. To capture the market's mood, I back out the expected return (and equity risk premium) that investors are pricing in, through an implied equity risk premium:

Put simply, the expected return is an internal rate of return derived from the pricing of stocks, and the expected cash flows from holding them, and is akin to a yield to maturity on bonds. To see how expectations and pricing have changed over the course of the year, I compare the implied equity risk premium (ERP) from the start of 2023 with the same number at the start of 2024

2023 ERP & 2024 ERP

At the start of 2023, in the midst of the market's pessimism of what the coming years would deliver, stocks were priced to earn a 9.82% annual return and a 5.94% equity risk premium. In contrast, at the start of 2024, the lifting of fear has led to higher prices, a more upbeat forecast of earnings and an expected return of 8.48% and an equity risk premium of 4.60%. I do compute this expected return and the equity risk premium at the start of each month, and the last 24 months have been a roller coaster ride:

While equity risk premiums and expected returns rose strongly in 2022, registering the largest single-year increase in history, they declined over 2023, as hope has gained an upper hand over fear. To the question of whether 8.48% is a reasonable expectation for an annual return for US stocks, and 4.60% a sufficient equity risk premium, I looked at the historical estimates for these numbers going back to 1960:

Download historical ERP

While stocks had expected returns exceeding 10% for much of the 1970s and 1980s, the culprit was high interest rates, and as interest rates have declined in this century, expected returns have come down as well. The post-2008 time period also was a period of historically low interest rates, and expected returns bottomed out in 2021, before rising again in 2022. In the table below, I look at the expected returns and equity risk premiums at the start of 2022, 2023 and 2024 against the distribution of the corresponding variables between 1960 and 2024:

Download historical ERP

It is comforting, if you are an equity investor, to see that the expected returns are only slightly lower than the median value over the longer period, and the equity risk premium is above historical norms. Needless to say, there are other metrics, measuring the cheapness or expensiveness of equities, that investors may find more troubling. In particular, the earnings yield (the inverse of the PE ratio) for US equities will give investors pause:

Download historical EP

Note that the EP ratio, after a surge last year, has dropped back towards 2022 levels, with the caveat being that treasury bond rates are much higher now than they were then, an attractive alternative to equities that did not exist two years ago.

Taking a Stand - Market Valuations into 2024

I am not a market timer, but I do value the market at regular intervals, more to get a measure of what the market is pricing in, than to forecast future movements. In valuing the index, I follow the intrinsic value rulebook, where the value is determined by expectations of cash flows in the future, discounted back to adjust their risk. To get expected cash flows, I start with expectations of earnings from the equities that comprise the index. For the S&P 500, the most widely followed equity index, I use the consensus estimates of aggregate earnings for 2024 and 2025, from analysts. I know that mistrust of analysts runs high, and the perception that they are cheerleaders for individual companies is often well founded, but I will stick with these forecasts for a simple reason. Having tracked analyst forecasts for four decades,I have found that analyst estimates of aggregated earnings for the index are unbiased, with analysts under estimating earnings in almost as many years as they over estimate them. The cash flows to equity investors, especially in the United States, have increasingly taken the form of buybacks, not just supplementing but supplanting dividends. In 2023, dividends and buybacks on the S&P 500 index amounted to $1.367 trillion, 164.25 in index units, with 57.6% of these cash flows coming from buybacks. As a percent of earnings, the cumulative cash returned represented 74.8% of earnings in that year, representing a decline from payout ratios during this century (2000-2022); the median payout ratio for this period was 83%. With these earnings and cash flows as starting points, and assuming that the treasury bond rate of 3.88% is a fair interest rate, I value the S&P 500:

Download valuation spreadsheet

Note that I forecast earnings beyond 2025, by assuming that growth scales down to the growth rate of the economy, estimated to be roughly equal to the riskfree rate. Unlike early in 2023, when stocks looked slightly under valued, with consensus earnings numbers and prevailing rates, stocks look over valued by about 9.2%, with a similar structure today. As with any market valuation, there are risks embedded in this value. First, the consensus view that the economy will come in for a soft landing may be wrong, with a recession or a stronger recovery both in the cards; the earnings numbers will be lower than analyst estimates in a recession and higher with a stronger economy. Second, while the market is building in expectations of interest rates declining in 2024, a significant portion of that optimism comes from a delusion that the Fed can raise or lower rates at well. After all, the treasury bond rate, a much stronger driver of equity values than short term treasury rates, remained unchanged in 2023, even as the Fed repeatedly raised the Fed Fund rates, and it is very likely that the future path of the treasury bond rate will depend more on the vagaries of inflation than on the whims of Jerome Powell. In the graph below, I look at the fair index level as a function of assumptions about earnings surprises and interest rates:

Note that I report the fair index values currently, and to convert them into target levels for the index a year from now, you have to take the future value of the index, using the expected return on stocks (net of dividend yield). For instance, to get the expected index level at the end of 2024, if rates stay at around 4% and earnings come in 10% above expectations, is as follows: Fair value of the index in current terms = 5202 Expected annual return on equities = T.Bond rate + ERP = 4% + 5% = 9% Expected price appreciation on equities = Expected annual return - Dividend yield = 9% - 1.5% = 7.5% Expected index level on 12/31/2024 (r =4%, Earnings 10% above expected) = 5202 (1.075) = 5592 As you can see, you would need earnings to come in above expectations, for the current index level (4750 on January 16) to be justified, with lower interest rates providing an assist. While what-if tables like the one above are useful tools for dealing with uncertainties, a more complete assessment of uncertainty requires that I be explicit about the uncertainties I face on each input, resulting in a simulation:

Simulation run with Crystal Ball, an Excel add-on

Not surprisingly, with uncertainties built in, the fair value of the index has a wide range, but using the first and ninth decile, a reasonable range for the fair value would 3670 - 5200, and at the January 16 closing level of 4750, there is about a 70% chance that the market is over valued. I am sure that you will disagree with one or more of the inputs that I have used to value the index, and I welcome that disagreement. Rather than point out to me the error of my ways, please download the spreadsheet containing the intrinsic valuation, and you should be able to replace my assumptions about earnings, cash payout and interest rates, and arrive at your own estimates of index value.

Caveat emptor!

Before you take my market prognostications at face value, please consider my open disclosure that I am a terrible market timer and try to avoid it in my investing. In short, I do not plan to act on my market valuation by buying puts on the index, or scaling down by portfolio's equity exposure. If you are wondering why I bother valuing the index, there are two reasons. First, there are times in the past, when the overvaluation of the market is so large that it operates as a red flag on investing in equities, as an asset class, in general. That signal worked in early 2000 but did not in early 2008, and it is thus a noisy one. Second, and more generally, though, valuing the market allows you to make sense of, and tolerance for, bullish and bearish views on the market that may diverge from your own views. Thus, investors and analysts who believe that rates will continue to decline, with a strong economy delivering higher-than-expected earnings, will see significant upside in this market, just as investors and analysts who believe that stubbornly higher inflation will cause rates to rise, and that earnings will come in well below expectations will be more likely to be part of the doomsday crowd. Just as in 2023, there will be times in 2024 when one side or the other will think that it has decisively won the argument, just to see a reversal in the next period.

YouTube Video

https://youtu.be/5u5Pom4gfKY

Datasets

1.) Historical Returns on Stocks, Bonds, Gold and Real Estate - 1928 -2023 2). Historical Implied Equity Risk Premiums and Expected Returns - 1960- 2023

Spreadsheets

Implied ERP calculator - January 1, 2024 Valuation of the S&P 500 on January 1, 2024

Originally Posted on aswathdamodaran.blogspot.com