All right, today we’re diving into a completely fresh approach to investing—one that combines cutting-edge AI with tried-and-true fundamentals. And to illustrate this method, we’re zeroing in on a company almost everyone has on their radar: Moderna. We all know the hype cycle: headlines shout about breakthroughs and blockbuster revenues, but behind that noise, few investors ever drill into the real numbers. Without that foundation, you risk getting swept up in a narrative that can lead to costly mistakes. By the end of this article, you’ll see how everyday investors can harness AI to slice through the hype and focus only on what truly matters.

The Quantitative and Qualitative Divide

Smart investment decisions demand two equally important elements. On one side, you have the qualitative: the company’s vision, leadership, product pipeline, and long-term potential. That’s the story that grips your imagination. On the other side sits the quantitative: revenue, profits, cash reserves, debt levels—those cold, hard facts that serve as a reality check. Relying solely on narrative is like baking a cake without flour. Ignoring qualitative insight, meanwhile, is attempting to fly blind into the future. To succeed, you need both halves of the coin—and a way to bring them together seamlessly.

Meet the AI Dream Team

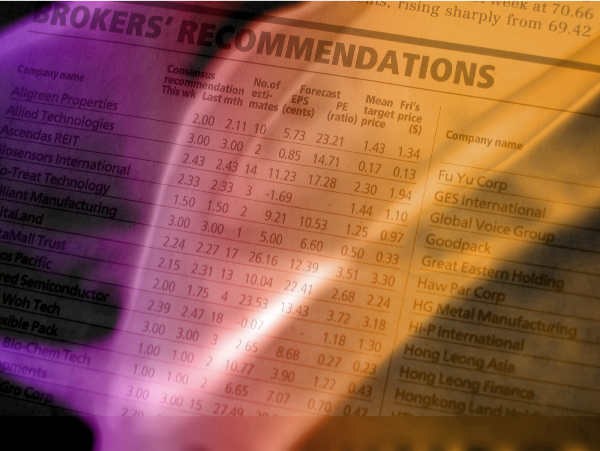

Enter Best of Us Investors’ founder, Carrie Grinkmire, and his dynamic AI duo: Samantha and Bard. Think of them as AI analysts on steroids. Samantha is the spreadsheet savant—she lives for detailed balance sheets, margin percentages, and liquidity ratios. Bard, by contrast, is the visionary storyteller—he translates technical roadmaps and clinical trial timelines into a compelling narrative about where the company could be heading. This tag-team AI setup levels the playing field, giving individual investors access to insights that were once locked behind Wall Street paywalls.

Samantha’s Cold, Hard Numbers

We put Moderna to the Samantha test first. What jumps off the page? A red flag of epic proportions: revenue has plunged more than 70% from its pandemic peak. What once felt like free-flowing cash has slowed to a trickle, and losses have mounted. Yet there’s an equally eye-opening counterpoint: Moderna’s balance sheet looks like a fortress. The company boasts a staggering 7.5 billion dollars in cash and investments and carries almost no debt. That isn’t just a buffer—it’s rocket fuel for future development. With that runway, Moderna can fund clinical trials, expand manufacturing, and navigate regulatory hurdles without scrambling for capital.

Samantha even assigns grades to quantify these dynamics:

- Profitability: D

- Liquidity: A

- Solvency: A

How can a company earn top marks for liquidity and solvency while flunking profitability? That contrast captures the core puzzle in Moderna’s financials today.

Bard’s Qualitative Big Picture

Numbers alone don’t tell the whole story. That’s where Bard steps in. He lays out a timeline of potential game-changers that could rewrite Moderna’s future:

- 2025: Launch of a groundbreaking CMV vaccine

- 2026: Data readout for a personalized cancer vaccine

- 2028: Ambition to secure approvals for up to 10 new products

Bard then maps these innovations onto massive addressable markets. Think respiratory vaccines beyond COVID—flu, RSV—plus oncology and rare diseases. If even one of these candidates hits commercial success, Moderna’s revenue trajectory could snap back with a vengeance. Bard’s narrative puts the losses in perspective: today’s red ink could be tomorrow’s green pasture.

Bridging Numbers and Story

Here’s the million-dollar question every investor faces: when numbers and narrative diverge, which do you trust? Do you side with current financials showing a struggling business, or with the optimistic pipeline story? Betting solely on present-day metrics can leave you too conservative. Banking only on hope risks blowing up your portfolio if the science falters. The smarter path is synthesis—melding both views into a unified analysis that balances upside potential against downside risk.

The Perfect Score of 50

Samantha’s proprietary model delivers that synthesis in one clear metric: 50 out of 100. Don’t mistake 50 for mediocrity. In this framework, 50 represents the ideal equilibrium between thrilling growth possibilities and sober financial realities. It signals a high-wire act: speculative enough to chase big returns, but grounded enough to temper irrational exuberance. A score like this screams “speculative hold.” You’re neither diving in headfirst nor sitting on the sidelines. Instead, you’re carving out a calculated position that acknowledges both the peril and the promise.

Price Paths and Scenarios

Armed with that 50-point score, the model outlines a range of possible price outcomes by 2028:

- Conservative Scenario: Share price could slide toward $40 if clinical setbacks or market conditions deteriorate.

- Base Case: A gradual recovery toward current levels if pipeline progress is steady but unspectacular.

- Aggressive Scenario: A breakout rally to around $170 if multiple late-stage candidates gain approval and capture market share.

This isn’t a crystal ball. It’s a data-driven roadmap that illuminates the spectrum of outcomes, helping you allocate capital with eyes wide open.

The Final Recommendation

After all the heavy lifting—Samantha’s data deep dive, Bard’s story arc, and the synthesis into a single score—the verdict is clear: Moderna is a speculative buy or hold. This isn’t for ultra-conservative portfolios. It’s best suited to investors who can stomach volatility and view this as a tactical slice within a diversified lineup. Go in small, stay nimble, and keep tabs on both quarterly results and clinical milestones. That balanced vigilance is what separates informed investors from gamblers.

A Universal Framework

What we’ve just done with Moderna is more than a one-off case study. It’s a replicable playbook you can apply to any company:

- Get the numbers: extract revenue trends, profitability, debt levels, and cash buffers.

- Understand the story: map out product roadmaps, market sizes, leadership vision, and competitive moats.

- Synthesize insights: use a structured model to weigh quantitative reality against qualitative potential.

This three-step protocol is your confidence booster. It moves you from reactionary guesses to proactive decisions.

Empowering Everyday Investors

For Carrie Grinkmire, this mission is deeply personal. He’s committed to democratizing the analyst toolkit so that regular investors—parents saving for college, retirees funding their nest eggs, young professionals building wealth—can access the same rigor and sophistication once reserved for institutional titans. By leveraging AI agents like Samantha and Bard, you no longer need expensive terminals or insider networks. You just need curiosity, discipline, and a willingness to embrace both story and stats.

Are You Ready to Invest Differently?

So here’s the final call to action: will you continue following headline noise and gut feelings, or will you adopt a smarter, clearer way to invest? The power to transform your approach is at your fingertips. Pulling the trigger with conviction means knowing you’ve balanced risk and reward through robust analysis, not guesswork. It’s time to change the way you invest—and to seize the future with both eyes wide open.

All right, today we’re diving into a completely fresh approach to investing—one that combines cutting-edge AI with tried-and-true fundamentals. And to illustrate this method, we’re zeroing in on a company almost everyone has on their radar: Moderna. We all know the hype cycle: headlines shout about breakthroughs and blockbuster revenues, but behind that noise, few investors ever drill into the real numbers. Without that foundation, you risk getting swept up in a narrative that can lead to costly mistakes. By the end of this article, you’ll see how everyday investors can harness AI to slice through the hype and focus only on what truly matters.

The Quantitative and Qualitative Divide

Smart investment decisions demand two equally important elements. On one side, you have the qualitative: the company’s vision, leadership, product pipeline, and long-term potential. That’s the story that grips your imagination. On the other side sits the quantitative: revenue, profits, cash reserves, debt levels—those cold, hard facts that serve as a reality check. Relying solely on narrative is like baking a cake without flour. Ignoring qualitative insight, meanwhile, is attempting to fly blind into the future. To succeed, you need both halves of the coin—and a way to bring them together seamlessly.

Meet the AI Dream Team

Enter Best of Us Investors’ founder, Carrie Grinkmire, and his dynamic AI duo: Samantha and Bard. Think of them as AI analysts on steroids. Samantha is the spreadsheet savant—she lives for detailed balance sheets, margin percentages, and liquidity ratios. Bard, by contrast, is the visionary storyteller—he translates technical roadmaps and clinical trial timelines into a compelling narrative about where the company could be heading. This tag-team AI setup levels the playing field, giving individual investors access to insights that were once locked behind Wall Street paywalls.

Samantha’s Cold, Hard Numbers

We put Moderna to the Samantha test first. What jumps off the page? A red flag of epic proportions: revenue has plunged more than 70% from its pandemic peak. What once felt like free-flowing cash has slowed to a trickle, and losses have mounted. Yet there’s an equally eye-opening counterpoint: Moderna’s balance sheet looks like a fortress. The company boasts a staggering 7.5 billion dollars in cash and investments and carries almost no debt. That isn’t just a buffer—it’s rocket fuel for future development. With that runway, Moderna can fund clinical trials, expand manufacturing, and navigate regulatory hurdles without scrambling for capital.

Samantha even assigns grades to quantify these dynamics:

How can a company earn top marks for liquidity and solvency while flunking profitability? That contrast captures the core puzzle in Moderna’s financials today.

Bard’s Qualitative Big Picture

Numbers alone don’t tell the whole story. That’s where Bard steps in. He lays out a timeline of potential game-changers that could rewrite Moderna’s future:

Bard then maps these innovations onto massive addressable markets. Think respiratory vaccines beyond COVID—flu, RSV—plus oncology and rare diseases. If even one of these candidates hits commercial success, Moderna’s revenue trajectory could snap back with a vengeance. Bard’s narrative puts the losses in perspective: today’s red ink could be tomorrow’s green pasture.

Bridging Numbers and Story

Here’s the million-dollar question every investor faces: when numbers and narrative diverge, which do you trust? Do you side with current financials showing a struggling business, or with the optimistic pipeline story? Betting solely on present-day metrics can leave you too conservative. Banking only on hope risks blowing up your portfolio if the science falters. The smarter path is synthesis—melding both views into a unified analysis that balances upside potential against downside risk.

The Perfect Score of 50

Samantha’s proprietary model delivers that synthesis in one clear metric: 50 out of 100. Don’t mistake 50 for mediocrity. In this framework, 50 represents the ideal equilibrium between thrilling growth possibilities and sober financial realities. It signals a high-wire act: speculative enough to chase big returns, but grounded enough to temper irrational exuberance. A score like this screams “speculative hold.” You’re neither diving in headfirst nor sitting on the sidelines. Instead, you’re carving out a calculated position that acknowledges both the peril and the promise.

Price Paths and Scenarios

Armed with that 50-point score, the model outlines a range of possible price outcomes by 2028:

This isn’t a crystal ball. It’s a data-driven roadmap that illuminates the spectrum of outcomes, helping you allocate capital with eyes wide open.

The Final Recommendation

After all the heavy lifting—Samantha’s data deep dive, Bard’s story arc, and the synthesis into a single score—the verdict is clear: Moderna is a speculative buy or hold. This isn’t for ultra-conservative portfolios. It’s best suited to investors who can stomach volatility and view this as a tactical slice within a diversified lineup. Go in small, stay nimble, and keep tabs on both quarterly results and clinical milestones. That balanced vigilance is what separates informed investors from gamblers.

A Universal Framework

What we’ve just done with Moderna is more than a one-off case study. It’s a replicable playbook you can apply to any company:

This three-step protocol is your confidence booster. It moves you from reactionary guesses to proactive decisions.

Empowering Everyday Investors

For Carrie Grinkmire, this mission is deeply personal. He’s committed to democratizing the analyst toolkit so that regular investors—parents saving for college, retirees funding their nest eggs, young professionals building wealth—can access the same rigor and sophistication once reserved for institutional titans. By leveraging AI agents like Samantha and Bard, you no longer need expensive terminals or insider networks. You just need curiosity, discipline, and a willingness to embrace both story and stats.

Are You Ready to Invest Differently?

So here’s the final call to action: will you continue following headline noise and gut feelings, or will you adopt a smarter, clearer way to invest? The power to transform your approach is at your fingertips. Pulling the trigger with conviction means knowing you’ve balanced risk and reward through robust analysis, not guesswork. It’s time to change the way you invest—and to seize the future with both eyes wide open.