Consumer stocks are divided into two categories. One is consumer discretionary stocks also called consumer cyclical stocks. The other one is consumer staples also known as consumer defensive stocks. Let us explore more about these stocks. So that you can get enough information before investing anyone of these stocks.

This term means luxury services and goods that customers would find appealing. Moreover, are willing to pay for it if they had the money. Examples are consumer durables items, designer clothing, entertainment, recreational activities, and automobiles.

OR

Consumer cyclicals are a class of stocks that are dependent on the business cycle. Industries like automotive, housing, entertainment, and retail are all affected by consumer cyclicals. The category can be further divided into durable sections and those that are not. Physical goods like hardware and vehicles are durable cycles. In contrast, consumables like cleaning products, clothing, and food are non-durable cycles

Types of Consumer Discretionary Stocks

The consumer discretionary sector is divided down into a many sub-industries. The following are four of the larger consumer discretionary sub-sectors:

- Retailers

- Automobiles and automobile components

- Hotels, restaurants and leisure

- Household durable goods

Consumer cyclical vs Consumer discretionary Explanation

Businesses that sell non-essential goods are consumer cyclicals. The phrase comes from the fact that most people who buy the products are individuals. And that product sales (and the stock prices that go along with them) fluctuate over time. Also known as consumer discretionary.

Many companies in the consumer discretionary sector stand out as being among the best in their respective fields like:

How to invest in cyclical and consumer discretionary stocks?

You can invest in the consumer discretionary industry in many ways. Like using mutual funds, exchange-traded funds (ETFs), and individual stocks, among other options. There are fewer costs but higher risks when investing in a company through individual stocks. ETFs and mutual funds have higher fees. But provide more diversification, reducing your risk exposure.

The potential returns on consumer discretionary stocks can be very high. Especially when the economy is doing well and consumer spending is high. Investors can determine when to enter the market. Because the sector's performance is correlated with the health of the economy. To determine whether now might be a good time to start investing in the industry. Investors can track economic indicators. Economic indicators include the unemployment rate, consumer spending, personal savings rate, etc.

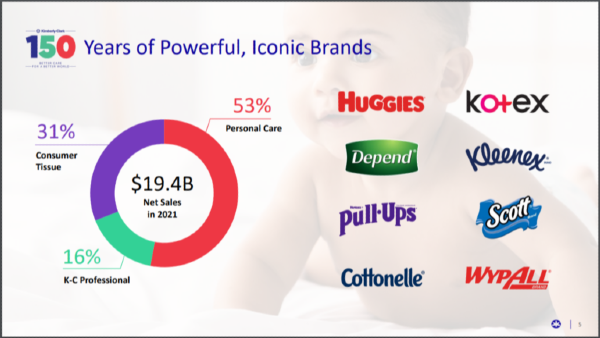

Consumer staples are a group of necessary goods used by consumers. This category also includes things like foods and drinks, furniture, and hygiene products. No matter their financial situation, people won't drop these items from their budgets. Consumer goods are non-cyclical. This means that regardless of how well the economy is doing, they are always in demand all year long. Consumer staples are resistant to business cycles. Regardless of price volatility, people maintain a constant demand for consumer staples.

To put it another way, the consumer staples industry is also known as defensive. Regardless of the state of the economy, its performance is steady and resilient, not veering much in either direction. As a result, investors seeking stable growth and low volatility frequently turn to consumer staples.

Consumer defensive vs Consumer cyclical

Consumer discretionary purchases are sometimes contrasted with their opposite, consumer essentials. The economic cycle affects both product classifications. When the economy is stable, consumers spend more on discretionary goods. During contractionary phases of an economy, consumers usually earn less money. They focus on buying consumer defense goods like consumer basics.

Example of Consumer Staple Stock | Defensive Stock

Recently, McDonald's reaffirmed its status as a top defensive stock.

Despite being a restaurant chain, it features aspects of a consumer goods corporation. Everyone must eat, and McDonald's makes it simple to grab a cheap and convenient lunch.

Yes, America's most well-known coffee chain also seems to be regaining its mojo. Investors sent shares down on concerns about increased competitors and a trend toward edgier. And neighborhood coffee shops, but Starbucks' outstanding quarterly performance restored hope.

In general, pharmaceutical firms, like Pfizer in our instance, are excellent recession-proof investments. Thanks to its solid cash and lack of cyclicality, Pfizer is in this position. Nobody can foresee the future or determine. Where interest rates and inflation will be in one or five years.

Consumer non-cyclical stocks are held by businesses that produce or offer necessities that people cannot live without. Consumer non-cyclical stocks include utilities, pharmaceuticals, and retail businesses like Walmart.

The stock of Coca-Cola is regarded as defensive. A defensive stock is one that consistently pays dividends and generates steady earnings.

Consumer stocks are divided into two categories. One is consumer discretionary stocks also called consumer cyclical stocks. The other one is consumer staples also known as consumer defensive stocks. Let us explore more about these stocks. So that you can get enough information before investing anyone of these stocks.

What are Cyclical and Consumer Discretionary Stocks?

This term means luxury services and goods that customers would find appealing. Moreover, are willing to pay for it if they had the money. Examples are consumer durables items, designer clothing, entertainment, recreational activities, and automobiles.

OR

Consumer cyclicals are a class of stocks that are dependent on the business cycle. Industries like automotive, housing, entertainment, and retail are all affected by consumer cyclicals. The category can be further divided into durable sections and those that are not. Physical goods like hardware and vehicles are durable cycles. In contrast, consumables like cleaning products, clothing, and food are non-durable cycles

Types of Consumer Discretionary Stocks

The consumer discretionary sector is divided down into a many sub-industries. The following are four of the larger consumer discretionary sub-sectors:

Consumer cyclical vs Consumer discretionary Explanation

Businesses that sell non-essential goods are consumer cyclicals. The phrase comes from the fact that most people who buy the products are individuals. And that product sales (and the stock prices that go along with them) fluctuate over time. Also known as consumer discretionary.

Examples of Cyclical Stocks | Discretionary Stock

Many companies in the consumer discretionary sector stand out as being among the best in their respective fields like:

Athletic apparel and footwear-Nike (NYSE:NKE)

Automobile Industry-Tesla (NASDAQ: TSLA)

Coffeehouse chain-Starbucks (NASDAQ: SBUX)

Restaurant chain-McDonald's (NYSE: MCD)

Off-price retailer-TJX Companies (NYSE: TJX)

Family entertainment-Disney (NYSE: DIS)

Movies entertainment-Netflix (NASDAQ: NFLX)

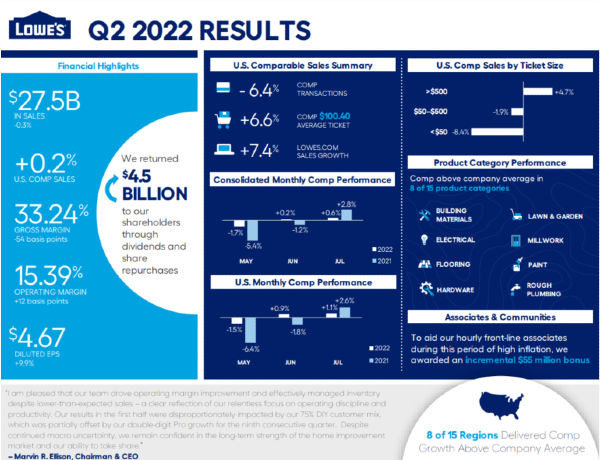

Home improvement retail online-Home Depot (NYSE: HD)

How to invest in cyclical and consumer discretionary stocks?

You can invest in the consumer discretionary industry in many ways. Like using mutual funds, exchange-traded funds (ETFs), and individual stocks, among other options. There are fewer costs but higher risks when investing in a company through individual stocks. ETFs and mutual funds have higher fees. But provide more diversification, reducing your risk exposure.

The potential returns on consumer discretionary stocks can be very high. Especially when the economy is doing well and consumer spending is high. Investors can determine when to enter the market. Because the sector's performance is correlated with the health of the economy. To determine whether now might be a good time to start investing in the industry. Investors can track economic indicators. Economic indicators include the unemployment rate, consumer spending, personal savings rate, etc.

Consumer Staples definition

Consumer staples are a group of necessary goods used by consumers. This category also includes things like foods and drinks, furniture, and hygiene products. No matter their financial situation, people won't drop these items from their budgets. Consumer goods are non-cyclical. This means that regardless of how well the economy is doing, they are always in demand all year long. Consumer staples are resistant to business cycles. Regardless of price volatility, people maintain a constant demand for consumer staples.

To put it another way, the consumer staples industry is also known as defensive. Regardless of the state of the economy, its performance is steady and resilient, not veering much in either direction. As a result, investors seeking stable growth and low volatility frequently turn to consumer staples.

Consumer defensive vs Consumer cyclical

Consumer discretionary purchases are sometimes contrasted with their opposite, consumer essentials. The economic cycle affects both product classifications. When the economy is stable, consumers spend more on discretionary goods. During contractionary phases of an economy, consumers usually earn less money. They focus on buying consumer defense goods like consumer basics.

Example of Consumer Staple Stock | Defensive Stock

Is McDonald's a defensive stock?

Recently, McDonald's reaffirmed its status as a top defensive stock.

Despite being a restaurant chain, it features aspects of a consumer goods corporation. Everyone must eat, and McDonald's makes it simple to grab a cheap and convenient lunch.

Is Starbucks a consumer staple?

Yes, America's most well-known coffee chain also seems to be regaining its mojo. Investors sent shares down on concerns about increased competitors and a trend toward edgier. And neighborhood coffee shops, but Starbucks' outstanding quarterly performance restored hope.

Is Pfizer a defensive stock?

In general, pharmaceutical firms, like Pfizer in our instance, are excellent recession-proof investments. Thanks to its solid cash and lack of cyclicality, Pfizer is in this position. Nobody can foresee the future or determine. Where interest rates and inflation will be in one or five years.

Is Walmart consumer cyclical?

Consumer non-cyclical stocks are held by businesses that produce or offer necessities that people cannot live without. Consumer non-cyclical stocks include utilities, pharmaceuticals, and retail businesses like Walmart.

Is Coca-Cola a defensive stock?

The stock of Coca-Cola is regarded as defensive. A defensive stock is one that consistently pays dividends and generates steady earnings.