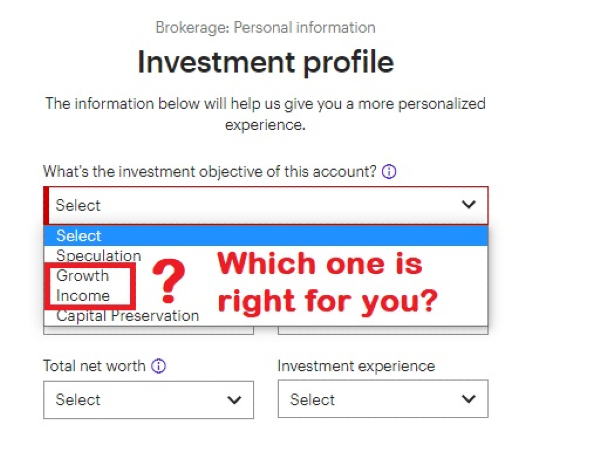

You've decided to take the plunge and invest in stocks! Congratulations! You are setting yourself up for long-term gains that will drastically exceed those found with any interest-bearing accounts, such as savings accounts, CDs, and bonds. But, when setting up your investment account, it asks whether you are investing for income or growth. What does that mean?

Investing for Income

When you invest for income, you are choosing to receive quarterly (every 3 months) dividend payments. For each share of stock you own, you are entitled to a small percent of a corporation's profits. Every quarter, you will receive a small amount of money (meaning, $1.00 or less) per share that you own.

When you invest for income, you are choosing to receive quarterly (every 3 months) dividend payments. For each share of stock you own, you are entitled to a small percent of a corporation's profits. Every quarter, you will receive a small amount of money (meaning, $1.00 or less) per share that you own.

Dividend stocks are stocks that typically give the highest dividend payments (relative to share price). This is known as dividend yield. You can search online for the stocks with the highest dividend yields, which are typically around the 5% mark. These tend to be corporations with lots of cash flow and are well-established. Energy companies are typically featured on lists of best dividend yield stocks.

As large, established corporations that sell goods and services to make cash flow, dividend stocks rarely see the type of rapid growth that make investors "get rich quick." If you are investing for income, the regular dividends are going to be your primary source of value. While each share may only pay a dollar per quarter, owning thousands of shares nets you a healthy monthly income. There is also a tax advantage to dividend income: It is taxed at a lower rate than earned income from your job!

When people talk about passive income, they are often talking about dividend income. And buying stocks for dividend income certainly does not mean you cannot sell those shares of stock if you need additional cash for an emergency. However, taking the quarterly dividends means the number of shares you own does not grow automatically - you will have to buy additional shares yourself.

Investing for Growth

Investing for growth means picking stocks that are likely to increase substantially in value. This can be done by either picking corporations that seem poised for breakthroughs in innovation and/or sales, or by choosing to reinvest dividends. If you choose to reinvest dividends rather than receive them in cash, those dividend payments automatically purchase more shares of that investment.

Investing for growth means picking stocks that are likely to increase substantially in value. This can be done by either picking corporations that seem poised for breakthroughs in innovation and/or sales, or by choosing to reinvest dividends. If you choose to reinvest dividends rather than receive them in cash, those dividend payments automatically purchase more shares of that investment.

Investors who are building a nest egg for retirement and trying to grow their wealth choose to reinvest their dividends. This has the same effect as compound interest, as it builds upon itself over time. When you receive dividends, they automatically buy more stock, which gets you more dividends the next quarter...repeat for years!

The advantage of investing for growth is that it increases the size of your stock portfolio over time. Also, if you do not take dividend payments, there is no tax burden. The downside, of course, is that you do not receive any supplement to your income. If you have sufficient income through your job, it may be wise to focus on investing for growth and letting the compounding nature of reinvesting dividends slowly - but steadily - increase the number of shares you own.

Warning: Not All Stocks Pay Dividends!

Whichever route you choose, make sure to do your research! Corporations are not required to pay dividends on their shares of stock. While most big corporations listed on the S&P 500 pay dividends, corporate boards can change the amount each quarter if they wish. Some corporations are known for maintaining high dividend payments even during recessions, while others are more prone to reduce them.

Whichever route you choose, make sure to do your research! Corporations are not required to pay dividends on their shares of stock. While most big corporations listed on the S&P 500 pay dividends, corporate boards can change the amount each quarter if they wish. Some corporations are known for maintaining high dividend payments even during recessions, while others are more prone to reduce them.

Smaller corporations may offer stock dividends rather than cash dividends, giving investors free additional shares. These are less common than cash dividends, but can quickly increase the number of shares an investor owns. These stocks tend to be more speculative (risky). Therefore, if you want an income stream from your stocks, check to make sure the corporation pays cash dividends rather than stock dividends!

You've decided to take the plunge and invest in stocks! Congratulations! You are setting yourself up for long-term gains that will drastically exceed those found with any interest-bearing accounts, such as savings accounts, CDs, and bonds. But, when setting up your investment account, it asks whether you are investing for income or growth. What does that mean?

Investing for Income When you invest for income, you are choosing to receive quarterly (every 3 months) dividend payments. For each share of stock you own, you are entitled to a small percent of a corporation's profits. Every quarter, you will receive a small amount of money (meaning, $1.00 or less) per share that you own.

When you invest for income, you are choosing to receive quarterly (every 3 months) dividend payments. For each share of stock you own, you are entitled to a small percent of a corporation's profits. Every quarter, you will receive a small amount of money (meaning, $1.00 or less) per share that you own.

Dividend stocks are stocks that typically give the highest dividend payments (relative to share price). This is known as dividend yield. You can search online for the stocks with the highest dividend yields, which are typically around the 5% mark. These tend to be corporations with lots of cash flow and are well-established. Energy companies are typically featured on lists of best dividend yield stocks.

As large, established corporations that sell goods and services to make cash flow, dividend stocks rarely see the type of rapid growth that make investors "get rich quick." If you are investing for income, the regular dividends are going to be your primary source of value. While each share may only pay a dollar per quarter, owning thousands of shares nets you a healthy monthly income. There is also a tax advantage to dividend income: It is taxed at a lower rate than earned income from your job!

When people talk about passive income, they are often talking about dividend income. And buying stocks for dividend income certainly does not mean you cannot sell those shares of stock if you need additional cash for an emergency. However, taking the quarterly dividends means the number of shares you own does not grow automatically - you will have to buy additional shares yourself.

Investing for Growth Investing for growth means picking stocks that are likely to increase substantially in value. This can be done by either picking corporations that seem poised for breakthroughs in innovation and/or sales, or by choosing to reinvest dividends. If you choose to reinvest dividends rather than receive them in cash, those dividend payments automatically purchase more shares of that investment.

Investing for growth means picking stocks that are likely to increase substantially in value. This can be done by either picking corporations that seem poised for breakthroughs in innovation and/or sales, or by choosing to reinvest dividends. If you choose to reinvest dividends rather than receive them in cash, those dividend payments automatically purchase more shares of that investment.

Investors who are building a nest egg for retirement and trying to grow their wealth choose to reinvest their dividends. This has the same effect as compound interest, as it builds upon itself over time. When you receive dividends, they automatically buy more stock, which gets you more dividends the next quarter...repeat for years!

The advantage of investing for growth is that it increases the size of your stock portfolio over time. Also, if you do not take dividend payments, there is no tax burden. The downside, of course, is that you do not receive any supplement to your income. If you have sufficient income through your job, it may be wise to focus on investing for growth and letting the compounding nature of reinvesting dividends slowly - but steadily - increase the number of shares you own.

Warning: Not All Stocks Pay Dividends! Whichever route you choose, make sure to do your research! Corporations are not required to pay dividends on their shares of stock. While most big corporations listed on the S&P 500 pay dividends, corporate boards can change the amount each quarter if they wish. Some corporations are known for maintaining high dividend payments even during recessions, while others are more prone to reduce them.

Whichever route you choose, make sure to do your research! Corporations are not required to pay dividends on their shares of stock. While most big corporations listed on the S&P 500 pay dividends, corporate boards can change the amount each quarter if they wish. Some corporations are known for maintaining high dividend payments even during recessions, while others are more prone to reduce them.

Smaller corporations may offer stock dividends rather than cash dividends, giving investors free additional shares. These are less common than cash dividends, but can quickly increase the number of shares an investor owns. These stocks tend to be more speculative (risky). Therefore, if you want an income stream from your stocks, check to make sure the corporation pays cash dividends rather than stock dividends!