Is Astra Space Inc (ASTR) a Buy

Astra Space Inc. is a Buy but with asterisks. Future revenue is not confirmed and every mission Astra Space Inc. launches in the next two years will be company critical. Astra has failed a mission this year, but they deserve a break as it was one of their first launches. However, more launch failures in the future could be trouble for the company.

ASTR is likely a 5 year hold. Honestly, ASTR may need to be a 20 year hold to realize its full potential. And realistically, if they do not execute, they will be a big sell in just a few months.

Potential 50% drop in price from here

Even if Astra Space Inc. runs their business plan flawlessly, the stock could still fall 50% from here. The company is a small-cap stock with a total market cap of less than $1 Billion today. Elon Musk could buy them out and it would, at least today, be a side note in the news.

This means only a few fickle investment firms can crash the price of Astra. ASTR stock has fallen 90% from its all-time highs in just two years. Another 50% drop is very possible, so be prepared for high volatility.

High Risk, Can't Analyze with Value Investing

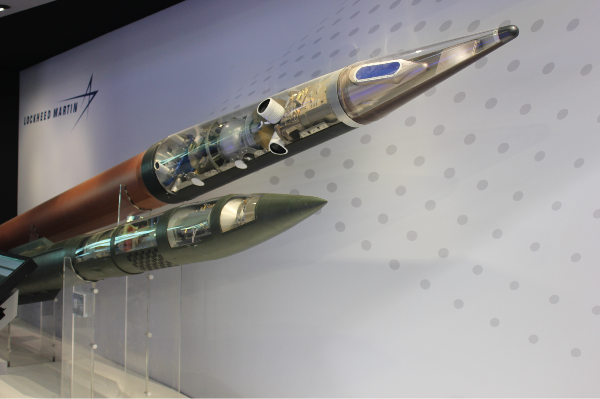

When I conducted an analysis of Lockheed Martin, I could use financial metrics to estimate an intrinsic value. Their revenue, costs, and earnings were relatively consistent. That is not the case with Astra.

Astra is a startup. So, when analyzing ASTR, the key is execution and leadership. The stock will only go up if leadership executes their vision. That vision is cost effective rocket launches weekly! In the deeper analysis, you will see why financials cannot be used reliably right now to understand ASTR's intrinsic value.

Future Acquisition or Blue Chip?

The space industry will start to merge as bigger players acquire smaller ones. For example, in 2018, Orbital ATK was acquired by Northrop Grumman. This could potential happen to Astra Space Inc. if they can prove their vision.

On the other hand, if Astra Space Inc. succeeds in cornering the space delivery market, ASTR could itself become a major, permanent player in the space sector. The next two years could prove which direction the company heads.

Regardless of their path, if Astra Space Inc. can deliver, both paths would be lucrative for their investors.

High Reward, Large Moat

I think of Astra Space Inc (and to be fair, possibly incorrectly) as the FedEx of space. Or think about the millions of ship containers crossing our oceans everyday. That amount of trade is inevitably going to happen in space. If ASTR can survive, they will become one of only a handful of carriers of space cargo in the world.

Source: nasa.gov

This year, leadership noted that Astra is the 4th most frequent orbital launch provider. They are behind only SpaceX, Russia, and China. They are also tied with the United Launch Alliance, a joint venture between Lockheed Martin and Boeing.

While the big companies want to get people into space, I see Astra wanting to become the cargo ship for space. And they are a first mover. Astra could see a competitive advantage for two decades if they become the transporter of choice into space.

Is Astra Space Stock Ready for Real Revenues?

Astra Space must first have a proven backlog before any revenues will come in. Based on their recent quarterly call, each launch earns ~$2 Million in revenue. We will use this for our analysis, with an understanding that this will be a rough estimate. From just their press releases, it looks like they may have the following backlog:

Beyond these contracts, Astra is also selling Spacecraft engines. The leadership team could not give revenue numbers per unit on the latest investor call. They did say they would look into making it available on the next call.

They did confirm that gross margins on each unit was positive. As of the latest call, the team confirmed 61 Spacecraft engines on order. The team noted that 25% of costs were materials. So if we estimate that the engines are sold at $0.5 million, then the revenue from the engines maybe ~$31 million.

Looking at public records, we can estimate that Astra's backlog is somewhere around $400 Million. At a weekly launch, this is almost a 4 year backlog. Hence, Astra's critical path now looks to be execution.

Successful Launches and Future Launches

Source: nasa.gov

Tropics Mission

Astra's Tropics campaign with NASA is looking to launch before the storm season. This would be before the summer. The campaign will send satellites into space that will monitor cyclones and better predict cyclone paths.

This launch helps to emphasize Astra's mission to "Improve Life on Earth from Space". The mission looks to be delayed only by licensing. The leadership team said the rockets are ready, even referring to them as "rockets in a box".

Scaling Preparation

Capex Investment

Astra's Alameda facility has completed its factory expansion. The facility looks to be ready for a weekly production rate.

Capital expenditures are looking to taper off next quarter. The capital was deployed to increase automation and drive down cost. The facility will be shown during the Spacetech day webcast.

Invested Capital, Proof on Spacetech Day

Astra Space Inc. will be hosting Spacetech day on May 12th. You can still sign up for the Spacetech day webcast.

Spacetech day will showcase how leadership invested their capital expenditures. Investors can see how they drive down rocket manufacturing costs and scale production. The virtual tour of their new production facility will showcase their production innovations.

Bottom Line

If Astra has the relationships built with NASA and the Space Force to put payloads into space, then all they need now is execution. They need to show that they can execute a weekly production rate from their plant. They also need to show that they can launch rockets routinely and successfully.

Leadership said that, due to rapid innovation, that a success rate of 66% is good. In the next two years, that needs to quickly drive up to a typical quality control point of 95%. If this occurs, I could see a potential upswing in Astra stock price regardless of the market.

On the other hand, if Astra fails to deliver, expect share dilution to occur as they ask the capital markets for more money. They will likely receive that capital injection, but it will cost current shareholders.

More Coverage

I/we have a position in an asset mentioned

Is Astra Space Inc (ASTR) a Buy

Astra Space Inc. is a Buy but with asterisks. Future revenue is not confirmed and every mission Astra Space Inc. launches in the next two years will be company critical. Astra has failed a mission this year, but they deserve a break as it was one of their first launches. However, more launch failures in the future could be trouble for the company.

ASTR is likely a 5 year hold. Honestly, ASTR may need to be a 20 year hold to realize its full potential. And realistically, if they do not execute, they will be a big sell in just a few months.

Potential 50% drop in price from here

Even if Astra Space Inc. runs their business plan flawlessly, the stock could still fall 50% from here. The company is a small-cap stock with a total market cap of less than $1 Billion today. Elon Musk could buy them out and it would, at least today, be a side note in the news.

This means only a few fickle investment firms can crash the price of Astra. ASTR stock has fallen 90% from its all-time highs in just two years. Another 50% drop is very possible, so be prepared for high volatility.

High Risk, Can't Analyze with Value Investing

When I conducted an analysis of Lockheed Martin, I could use financial metrics to estimate an intrinsic value. Their revenue, costs, and earnings were relatively consistent. That is not the case with Astra.

Astra is a startup. So, when analyzing ASTR, the key is execution and leadership. The stock will only go up if leadership executes their vision. That vision is cost effective rocket launches weekly! In the deeper analysis, you will see why financials cannot be used reliably right now to understand ASTR's intrinsic value.

Future Acquisition or Blue Chip?

The space industry will start to merge as bigger players acquire smaller ones. For example, in 2018, Orbital ATK was acquired by Northrop Grumman. This could potential happen to Astra Space Inc. if they can prove their vision.

On the other hand, if Astra Space Inc. succeeds in cornering the space delivery market, ASTR could itself become a major, permanent player in the space sector. The next two years could prove which direction the company heads.

Regardless of their path, if Astra Space Inc. can deliver, both paths would be lucrative for their investors.

High Reward, Large Moat

I think of Astra Space Inc (and to be fair, possibly incorrectly) as the FedEx of space. Or think about the millions of ship containers crossing our oceans everyday. That amount of trade is inevitably going to happen in space. If ASTR can survive, they will become one of only a handful of carriers of space cargo in the world.

Source: nasa.gov

This year, leadership noted that Astra is the 4th most frequent orbital launch provider. They are behind only SpaceX, Russia, and China. They are also tied with the United Launch Alliance, a joint venture between Lockheed Martin and Boeing.

While the big companies want to get people into space, I see Astra wanting to become the cargo ship for space. And they are a first mover. Astra could see a competitive advantage for two decades if they become the transporter of choice into space.

Is Astra Space Stock Ready for Real Revenues?

Astra Space must first have a proven backlog before any revenues will come in. Based on their recent quarterly call, each launch earns ~$2 Million in revenue. We will use this for our analysis, with an understanding that this will be a rough estimate. From just their press releases, it looks like they may have the following backlog:

Beyond these contracts, Astra is also selling Spacecraft engines. The leadership team could not give revenue numbers per unit on the latest investor call. They did say they would look into making it available on the next call.

They did confirm that gross margins on each unit was positive. As of the latest call, the team confirmed 61 Spacecraft engines on order. The team noted that 25% of costs were materials. So if we estimate that the engines are sold at $0.5 million, then the revenue from the engines maybe ~$31 million.

Looking at public records, we can estimate that Astra's backlog is somewhere around $400 Million. At a weekly launch, this is almost a 4 year backlog. Hence, Astra's critical path now looks to be execution.

Successful Launches and Future Launches

Source: nasa.gov

Tropics Mission

Astra's Tropics campaign with NASA is looking to launch before the storm season. This would be before the summer. The campaign will send satellites into space that will monitor cyclones and better predict cyclone paths.

This launch helps to emphasize Astra's mission to "Improve Life on Earth from Space". The mission looks to be delayed only by licensing. The leadership team said the rockets are ready, even referring to them as "rockets in a box".

Scaling Preparation

Capex Investment

Astra's Alameda facility has completed its factory expansion. The facility looks to be ready for a weekly production rate.

Capital expenditures are looking to taper off next quarter. The capital was deployed to increase automation and drive down cost. The facility will be shown during the Spacetech day webcast.

Invested Capital, Proof on Spacetech Day

Astra Space Inc. will be hosting Spacetech day on May 12th. You can still sign up for the Spacetech day webcast.

Spacetech day will showcase how leadership invested their capital expenditures. Investors can see how they drive down rocket manufacturing costs and scale production. The virtual tour of their new production facility will showcase their production innovations.

Bottom Line

If Astra has the relationships built with NASA and the Space Force to put payloads into space, then all they need now is execution. They need to show that they can execute a weekly production rate from their plant. They also need to show that they can launch rockets routinely and successfully.

Leadership said that, due to rapid innovation, that a success rate of 66% is good. In the next two years, that needs to quickly drive up to a typical quality control point of 95%. If this occurs, I could see a potential upswing in Astra stock price regardless of the market.

On the other hand, if Astra fails to deliver, expect share dilution to occur as they ask the capital markets for more money. They will likely receive that capital injection, but it will cost current shareholders.

More Coverage

I/we have a position in an asset mentioned