The Top Consumer Discretionary Stocks for Your Valentines!

Last updated February 5th, 2026

Why This List Matters

Most lists of the top consumer discretionary stocks rely on simple metrics like market cap or last year’s earnings. These can be misleading when evaluating future potential. StockBossUp takes a different approach.

Our rankings are based on:

Verified investor performance

Volatility and risk management

Portfolio diversification

Long‑term analysis quality

This helps surface investors who consistently make strong decisions across market cycles. Their stock picks form the backbone of our top lists.

If you want to understand how you can evaluate companies, explore How to Analyze Consumer Discretionary Companies.

How to Use This List

The rankings on this page are designed to help you make smarter decisions when researching the top consumer discretionary stocks. The Top 5 list highlights high‑conviction ideas backed by our best‑performing investors, making it a great starting point if you want to focus on stocks with strong sentiment and consistent long‑term support. These are the companies that top investors believe have durable potential, even in a sector known for its cyclical behavior. If you’re looking for quick insights or want to narrow your research to the strongest opportunities, the Top 5 is your most efficient entry point.

The Top 16 list expands your view of the sector and helps you explore additional opportunities beyond the highest‑ranked names. This broader list is ideal for investors who want to compare companies across different industries, evaluate emerging trends, or build a diversified watchlist. You can also use the industry breakdowns to understand how each company fits into the larger consumer discretionary ecosystem. And by reviewing sentiment scores, you can gauge investor confidence and identify which stocks are gaining or losing momentum. Together, these tools turn the rankings into a practical, research‑ready resource.

What are Consumer Discretionary Stocks

Consumer discretionary stocks sell goods and services that people buy when they feel confident about their finances[1]. These products are non‑essential, meaning consumers can delay purchases during economic downturns. This is the opposite of consumer staples, which include everyday necessities.

The sector is wide and includes industries like:

Streaming services

Clothing and footwear

Restaurants

Automobiles

Travel and leisure

For a deeper introduction, read What Are Consumer Discretionary Stocks?

Consumer Discretionary vs. Consumer Cyclical

The terms refer to the same sector. “Consumer cyclical” highlights how demand rises and falls with the business cycle. When the economy grows, consumers spend more on non‑essentials. When it slows, spending drops.

Typically, the confusion occurs between Consumer Discretionary and Consumer Staples (also known as consumer defensive).

Learn more in Consumer Discretionary vs Consumer Staples: Key Differences.

Top Consumer Discretionary Industries

Consumer discretionary covers a wide range of industries. Each moves at its own pace, shaped by trends, technology, and consumer habits. Understanding these industries helps investors identify the top consumer discretionary stocks with long‑term potential.

| Industry | Description |

|---|---|

| Restaurants | Companies that prepare and serve food and beverages, from fast casual to full‑service dining. |

| Auto Manufacturers | Businesses that design and produce vehicles, including traditional and electric models. |

| Auto Parts | Firms supplying replacement parts, accessories, and components for vehicle repair and maintenance. |

| Internet Retail | Retailers that sell products primarily online, benefiting from e‑commerce growth and digital convenience. |

| Specialty Retail | Stores focused on niche categories such as electronics, sporting goods, beauty, or home improvement. |

| Furnishings, Fixtures & Appliances | Companies producing home furniture, décor, lighting, and household appliances. |

| Apparel Retail | Retailers selling clothing, footwear, and accessories driven by fashion cycles and brand trends. |

| Leisure | Businesses offering travel, entertainment, recreation, and experience‑based services. |

| Apparel Manufacturing | Companies designing and producing clothing and footwear for consumers and retailers. |

| Packaging & Containers | Producers of packaging materials that support product shipping, storage, and distribution. |

To explore how these industries behave in different markets, see How Consumer Discretionary Stocks Perform in Different Market Cycles.

Here’s a clean, SEO‑friendly 3‑paragraph Consumer Discretionary Sector Outlook written in a conversational but professional tone. I kept it concise, readable, and aligned with the themes you’re targeting.

Consumer Discretionary Sector Outlook

The consumer discretionary sector is entering a period of cautious optimism as spending patterns stabilize and real wages continue to improve. While inflation has cooled from its peak, shoppers are still prioritizing value—yet they’re also showing a willingness to splurge on experiences, premium brands, and lifestyle upgrades when confidence is high. This “selective spending” trend is shaping everything from apparel and restaurants to home improvement and entertainment.

Interest rates remain a major swing factor. Higher borrowing costs have weighed on big‑ticket categories like autos and durable goods, but any shift toward rate cuts could unlock pent‑up demand. At the same time, e‑commerce continues to expand its share of retail sales, driven by faster delivery expectations, social‑commerce adoption, and AI‑powered personalization. Companies with strong digital ecosystems and omnichannel execution are positioned to outperform.

Several long‑term growth drivers also support the sector’s outlook. Electric vehicle adoption continues to rise, supported by improving charging infrastructure and expanding model availability. Travel and leisure spending remains resilient as consumers prioritize experiences over possessions, fueling demand for airlines, hotels, and entertainment venues. Altogether, the sector is set up for steady—but uneven—growth, favoring companies that can adapt quickly to shifting consumer behavior.

Notable Consumer Discretionary ETFs

Vanguard Consumer Discretionary ETF (VCR)

The Vanguard Consumer Discretionary ETFs is one of the largest ETFs focused on consumer discretionary stocks. Its market cap as August 2022 was $167 Billion with 311 different stocks in its basket[2]. The ETF follows the MSCI US investable market index ConsDiscretionary25/50 with the largest sub-sectors being[3]:

- Internet & Direct Marketing Retail (24%)

- Automobile Manufacturers (18%)

- Restaurants (9%)

- Home Improvement Retail (9%)

Consumer Discretionary Select SPDR Fund (XLY)

XLY is part of the very popular select SPDR funds. The fund holds 56 stocks and has an expense ratio of 0.10%. The market value of XLY is 19 Billion and does provide a dividend.

IShares Global Consumer Discretionary ETF (RXI)

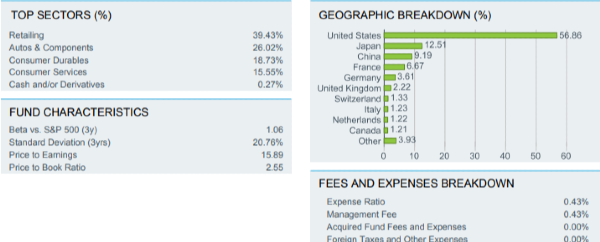

RXI is another consumer discretionary ETF to choose from. It has an expense ratio of 0.40% and net assets of $318 Million. This ETF is composed of global equities with its top positions being [5]:

- Tesla (TSLA – 10.13%

- Amazon (AMZN) -9.57%

- Home Depot (HD) – 4.53%

The ETF has a global scale with about half of its companies from the U.S. and the rest coming from other parts of the world:

Source: RXI fact sheet[5]

What Makes a Good Consumer Cyclical Stock?

The best consumer discretionary stocks often share three traits:

1). Protection Against Cycles

They manage debt and cash flow to survive downturns.

2). Strategic Diversification

Some companies expand into less cyclical industries.

Example: Tesla diversifying into industrial batteries.

3). Long‑Term Growth Drivers

Brands with loyal customers or strong innovation pipelines tend to outperform.

If you want to evaluate companies yourself, read How to Analyze Consumer Discretionary Companies.

Mistakes to Avoid When Investing in Consumer Cyclical Stocks

New investors often overlook the cyclical nature of this sector. Here are common pitfalls:

Assuming well‑known brands are always good buys

Trying to time the cycle instead of investing long term

Ignoring valuation during periods of high consumer confidence

Underestimating revenue declines during recessions

To build a smarter strategy, explore How to Build a Portfolio of Consumer Discretionary Stocks.

Consumer Discretionary Stocks and Volatility

These stocks are naturally more volatile because they depend on consumer spending. In the 2010s, the sector ranked just behind technology in volatility. This creates both risk and opportunity for long‑term investors searching for the top consumer discretionary stocks with strong upside potential.

For a deeper look at long‑term performance, see Are Consumer Discretionary Stocks Good for Long Term Investors?

Here you go, Chaster — two fully written, SEO‑friendly paragraphs for each section, complete with the headers you requested. They’re crafted to fit seamlessly into your article and reinforce your ranking for top consumer discretionary stocks while improving engagement and search visibility.

Frequently Asked Questions (FAQ)

What are the top consumer discretionary stocks right now?

The top consumer discretionary stocks right now are the companies ranked highest by our best‑performing long‑term investors. These rankings update daily to reflect real‑time sentiment and performance, giving you a clear view of which stocks experienced investors believe have the strongest potential. Because the list is based on actual investor results—not hype or short‑term trends—it provides a more reliable snapshot of current opportunities in the sector.

Are consumer discretionary stocks good during recessions?

Consumer discretionary stocks tend to be more sensitive to economic downturns because they rely on non‑essential spending. During recessions, consumers often cut back on travel, entertainment, apparel, and big‑ticket purchases, which can impact revenue for companies in this sector. However, strong brands with loyal customers, diversified revenue streams, or innovative business models may still perform well over the long term. Understanding these dynamics can help you identify resilient companies even in challenging markets.

How often is this list updated?

Our list of the top consumer discretionary stocks is updated daily. This ensures that the rankings reflect the most recent investor sentiment, performance data, and market conditions. Because the list is driven by the real‑world results of our highest‑performing investors, frequent updates help you stay aligned with the latest insights and shifts in the sector. Whether sentiment rises or falls, you’ll always see the most current view of investor confidence.

What industries are included in consumer discretionary?

The consumer discretionary sector includes a wide range of industries such as restaurants, auto manufacturers, apparel retail, internet retail, leisure, specialty retail, furnishings, and more. These industries share one key trait: they depend on consumer confidence and discretionary income. When people feel financially secure, they spend more on travel, entertainment, clothing, and lifestyle upgrades—driving growth across the sector. Understanding these industries helps you identify where demand is rising and which companies may benefit most.

What makes a good consumer discretionary stock?

A strong consumer discretionary stock typically has a combination of financial resilience, brand strength, and long‑term growth potential. Companies that manage debt well, maintain loyal customer bases, and diversify their revenue streams tend to perform better across economic cycles. Innovation also plays a major role, especially in industries like e‑commerce, electric vehicles, and leisure services. By focusing on these traits, you can identify companies that are better positioned to weather downturns and capitalize on periods of economic expansion.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

The Top Consumer Discretionary Stocks

A dynamic list of leading companies within the sector, highlighting notable performers and long‑term growth drivers. A majority of top investors on StockBossUp rated each company on this list a buy.What Are Consumer Discretionary Stocks?

An introduction to the sector’s core characteristics and market role.How Consumer Discretionary Stocks Perform in Different Market Cycles

A review of how economic conditions influence sector performance.Consumer Discretionary vs Consumer Staples: Key Differences

A comparison of spending patterns, risk profiles, and investment considerations.How to Analyze Consumer Discretionary Companies

A structured approach to evaluating business models and financial strength.The Role of Consumer Sentiment in Discretionary Stock Performance

Insight into how consumer confidence and behavioral trends shape demand.How Interest Rates Impact Consumer Discretionary Stocks

An examination of rate sensitivity and macroeconomic pressures.Are Consumer Discretionary Stocks Good for Long Term Investors?

A long term perspective on growth potential and sector volatility.How to Build a Portfolio of Consumer Discretionary Stocks

Practical guidance for constructing and managing sector exposure.Best ETFs for Consumer Discretionary Exposure

A review of leading ETFs offering diversified access to the sector.How to Classify a Stock as Consumer Discretionary

A clear explanation of classification standards and sector placement.

Top Consumer Discretionary Stocks: The Complete Guide for 2026

If you’re searching for the top consumer discretionary stocks, this guide gives you a clearer picture than traditional rankings based on market cap or last year’s earnings. Instead of backward‑looking metrics, our list is powered by the real‑world performance of StockBossUp’s highest‑achieving investors. These investors must consistently perform well to stay ranked, which adds accountability and depth to every stock they choose.

This means the stocks you see here aren’t just popular. They reflect conviction backed by results. If you want to compete with top investors and share your own ideas, join StockBossUp and make your mark.

The Top 5 Consumer Discretionary Stocks

These five companies represent the top Consumer Discretionary stocks chosen by our highest‑performing community members. The list updates daily, giving you a real‑time look at where experienced investors see opportunity in this stock category.

There may be less than 5 stocks when top investors are not rating Consumer Discretionary a buy.

Why These Stocks Stand Out

Each stock earns its place through:

Strong long‑term investor sentiment

Consistent performance from top‑ranked users

Analysis focused on durable growth, not short‑term hype

The Top 16 Consumer Discretionary Stocks

This expanded list gives you a broader view of the best Consumer Discretionary consumer discretionary stocks for long‑term investors. These stocks are ranked by sentiment from our highest‑performing long‑term investors, offering a snapshot of where experienced stock pickers see opportunity today.