Is Value Investing Risky?

A value investing strategy may be utilized to create high returns for low risk. However, the risk with value investing fluctuates depending on the individual investor and their implementation of the strategy. Since there is no such thing as a value stock, you can’t measure the strategy’s risk using metrics from certain stocks. For example, a stock’s price volatility and beta are metrics that can be used to measure risk.

Value investing weeds out overvalued stocks from a portfolio when used correctly. In the long term, overvalued stocks will revert down to their intrinsic value. Hence, value investing can give signals to de-risk when the market is overvalued and overheated.

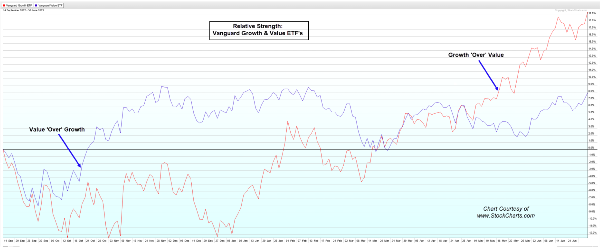

Cutting out overvalued stocks allows value investors to protect their risk profile; however, by potentially selling too early, they risk missing out on price momentum in the market. Value investing ETFs seem to fit this risk profile. A value investing ETF will have a lower downturn compared to the rest of the market, but the ETF will also miss out on huge growth events in the market.

This places value investment ETFs in a similar risk profile to utility stocks. Utility stocks have lower drawdowns and price volatility versus the broader market; however, they do not have significant price appreciation during market growth.

VTV ETF

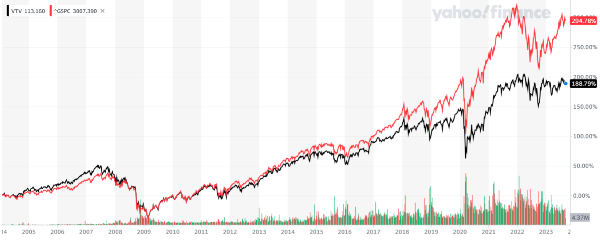

Taking a look at the price of Vanguard Value Index Fund (VTV) versus the S&P 500, we find that the ETF hasn’t been able to keep up with the S&P 500 since its inception.

This ETF uses 5 metrics to rank a basket of stocks and choose the top ones as the most “value stocks”.

- Book to Price

- Future Earnings per Price

- Historical Earnings per Price

- Dividends to Price

- Sales to Price

Some key details about this ETF:

This means that the ETF is unable to reconstitute fast enough to take advantage of sudden value opportunities that may only last days. For example, when Western Alliance suddenly dropped to $11 back in the Spring of 2023, that price only last hours before market circuit breakers stopped trading. Upon reopening, the stock had recovered up to $23. This turned out to be a great example of a bargain stock. Unfortunately, VTV couldn’t take on an opportunity like this as stocks are only added quarterly.

Is Value or Growth Investing Riskier?

When value investing and growth investing are used appropriately, value investing should typically be less risky. However, experts like Tayo Femi-Fowode would contend that value investing and growth investing are one in the same.

The difference may be as simple as an investor’s sell point. Both value stocks and growth stocks are purchased because they are believed to be a bargain. But while the value investor may be satisfied to sell the stock when it has surpassed its intrinsic value, a growth investor recognizes that their stock’s intrinsic value is rapidly rising. The growth investor will allow momentum to drive up the price of their stock before selling.

Ultimately, this would make growth investing riskier, but with higher opportunity for return. The risk not only comes from price appreciation, but the risk of misjudging the increasing intrinsic value of a growth stock. For every Google there is a AMC.

What Mistakes Make Value Investing Riskier?

A value investing strategy becomes much riskier when you make a mistake implementing the strategy. Implementation mistakes can significantly change your risk profile. Avoid these mistakes to avoid increasing risk.

Changing your Strategy

Stick with your strategy! In The Little Book that Still Beats the market, changing your strategy midway is one of the biggest mistakes you can make. When you start a portfolio using a value investing strategy, stick with it! It may take years, but it will bear fruit. By changing strategies, or using another strategy in conjunction, you add risk to your portfolio.

Selling too Early

You’ve already evaluated this stock to be great. You also realize that it’s intrinsic value increases every quarter. Selling too early is a critical mistake new value investors make. Even a 60% increase may not be enough. Value investors are comfortable holding gains that are 3x or even 10x gains. Be sure to reassess the stock on a regular basis and be comfortable with holding stocks for the long term.

Not Understanding the Company

In our guide on valuing stocks, the first step is to evaluate the company’s growth opportunities and management strength. Missing this step puts you at risk of buying a value trap.

What Strategies Make Value Investing Less Risky?

When you use a value strategy correctly, you can break the conventional risk profile. This means that you can increase your profits without increasing risks. In practice, this can mean higher returns without significant drawdowns.

Choose a Risk Factor and Stick with it

In value investing, you don’t have to be in every stock. By keeping a consistent risk factor, you ground yourself. A constant risk factor makes you wait for the right opportunities. This keeps capital on the sidelines when stocks are overvalued, and lets you allocate capital when there are profit opportunities.

Be Conservative on Growth Estimates

Earnings growth is the most volatile inputs when calculating intrinsic value. Be conservative when estimating earnings growth. If you’re wrong, you’ll likely be wrong on the upside. When you incorrectly evaluate earnings growth, the intrinsic value you calculate could be orders of magnitude off if you forecast wrong. To help you visualize the growth, use a stock selection guide chart to see if the trend is up, straight, and parallel.

https://youtu.be/T4brhI0F3Xc

Is Value Investing Risky?

A value investing strategy may be utilized to create high returns for low risk. However, the risk with value investing fluctuates depending on the individual investor and their implementation of the strategy. Since there is no such thing as a value stock, you can’t measure the strategy’s risk using metrics from certain stocks. For example, a stock’s price volatility and beta are metrics that can be used to measure risk.

Value investing weeds out overvalued stocks from a portfolio when used correctly. In the long term, overvalued stocks will revert down to their intrinsic value. Hence, value investing can give signals to de-risk when the market is overvalued and overheated.

Cutting out overvalued stocks allows value investors to protect their risk profile; however, by potentially selling too early, they risk missing out on price momentum in the market. Value investing ETFs seem to fit this risk profile. A value investing ETF will have a lower downturn compared to the rest of the market, but the ETF will also miss out on huge growth events in the market.

This places value investment ETFs in a similar risk profile to utility stocks. Utility stocks have lower drawdowns and price volatility versus the broader market; however, they do not have significant price appreciation during market growth.

VTV ETF

Taking a look at the price of Vanguard Value Index Fund (VTV) versus the S&P 500, we find that the ETF hasn’t been able to keep up with the S&P 500 since its inception.

Source: Yahoo! Finance

This ETF uses 5 metrics to rank a basket of stocks and choose the top ones as the most “value stocks”.

Some key details about this ETF:

This means that the ETF is unable to reconstitute fast enough to take advantage of sudden value opportunities that may only last days. For example, when Western Alliance suddenly dropped to $11 back in the Spring of 2023, that price only last hours before market circuit breakers stopped trading. Upon reopening, the stock had recovered up to $23. This turned out to be a great example of a bargain stock. Unfortunately, VTV couldn’t take on an opportunity like this as stocks are only added quarterly.

Is Value or Growth Investing Riskier?

When value investing and growth investing are used appropriately, value investing should typically be less risky. However, experts like Tayo Femi-Fowode would contend that value investing and growth investing are one in the same.

The difference may be as simple as an investor’s sell point. Both value stocks and growth stocks are purchased because they are believed to be a bargain. But while the value investor may be satisfied to sell the stock when it has surpassed its intrinsic value, a growth investor recognizes that their stock’s intrinsic value is rapidly rising. The growth investor will allow momentum to drive up the price of their stock before selling.

Ultimately, this would make growth investing riskier, but with higher opportunity for return. The risk not only comes from price appreciation, but the risk of misjudging the increasing intrinsic value of a growth stock. For every Google there is a AMC.

What Mistakes Make Value Investing Riskier?

A value investing strategy becomes much riskier when you make a mistake implementing the strategy. Implementation mistakes can significantly change your risk profile. Avoid these mistakes to avoid increasing risk.

Changing your Strategy

Stick with your strategy! In The Little Book that Still Beats the market, changing your strategy midway is one of the biggest mistakes you can make. When you start a portfolio using a value investing strategy, stick with it! It may take years, but it will bear fruit. By changing strategies, or using another strategy in conjunction, you add risk to your portfolio.

Selling too Early

You’ve already evaluated this stock to be great. You also realize that it’s intrinsic value increases every quarter. Selling too early is a critical mistake new value investors make. Even a 60% increase may not be enough. Value investors are comfortable holding gains that are 3x or even 10x gains. Be sure to reassess the stock on a regular basis and be comfortable with holding stocks for the long term.

Not Understanding the Company

In our guide on valuing stocks, the first step is to evaluate the company’s growth opportunities and management strength. Missing this step puts you at risk of buying a value trap.

What Strategies Make Value Investing Less Risky?

When you use a value strategy correctly, you can break the conventional risk profile. This means that you can increase your profits without increasing risks. In practice, this can mean higher returns without significant drawdowns.

Choose a Risk Factor and Stick with it

In value investing, you don’t have to be in every stock. By keeping a consistent risk factor, you ground yourself. A constant risk factor makes you wait for the right opportunities. This keeps capital on the sidelines when stocks are overvalued, and lets you allocate capital when there are profit opportunities.

Be Conservative on Growth Estimates

Earnings growth is the most volatile inputs when calculating intrinsic value. Be conservative when estimating earnings growth. If you’re wrong, you’ll likely be wrong on the upside. When you incorrectly evaluate earnings growth, the intrinsic value you calculate could be orders of magnitude off if you forecast wrong. To help you visualize the growth, use a stock selection guide chart to see if the trend is up, straight, and parallel.

https://youtu.be/T4brhI0F3Xc