Is Value Investing Profitable?

Value investing still holds up today as a profitable investing strategy. Stable companies that are fundamental to the U.S. economy can provide strong returns when you use value investing strategies.

Note that value investing doesn’t provide immediate profits. Stocks will take roughly two years to show a profit. When a stock is overvalued, the same phenomenon applies. It will take roughly 2 years for an overvalued stock to correct back down to its intrinsic value.

The amount of profit that you can earn varies. In the past, bank stocks have been misvalued so badly that they increased 80% in value over two years. Even utility stocks, which historically appreciate slowly, can see 40% gains in two years. These profitability gains were (somewhat) predictable due to the quantitative analysis of value investing.

Value Stocks do not Exist

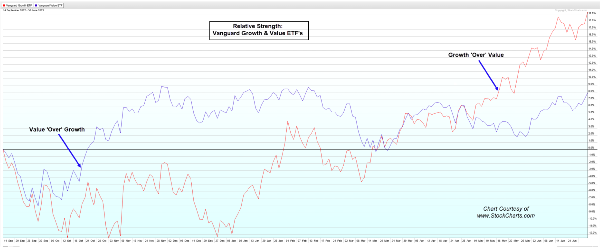

One of the most confusing headlines about value investing is that value stock ETFs or value stocks are underperforming. There is no such thing as a value stock or a basket of value stocks.

There are consistent stocks that value investors prefer. These companies align with an ever-increasing intrinsic value because:

- They have a competitive advantage, or moat, that they protect.

- A competent management team with a long-term growth plan.

- A disciplined approach to managing the company.

These preferred stocks have similar signs:

But these preferred stocks can still be overvalued. Even though a stock has predictable earnings growth, cash-flow, and revenue, the market has the potential to overvalue any stock. Overvaluing a stock doesn’t mean the market is irrational. For example, the overall market may use these preferred stocks as safe havens if the market is in correction.

The market cannot park money anywhere else, so they hedge their capital in certain “safe stocks”. These stocks are overvalued so they will not be profitable in the long term. But in the short term, they help to preserve capital.

The Worst Value Stock: Berkshire Hathaway

Berkshire Hathaway, to be clear, is a fine investment. The company has phenomenal growth and a proven track record of success. But purely by the numbers, Berkshire Hathaway trades at a premium.

The reason for this may be due to Berkshire Hathaway’s reputation. The public trusts the company and demand a premium to sell away their shares. Hence, value investors will typically avoid Berkshire Hathaway even though the company may invest based on value investing principles.

Is Value Investing a Good Strategy?

Just because value investing is a profitable strategy, it doesn’t mean it’s a good strategy. There are pros and cons to value investing that one must consider before using a value investing strategy.

If your goal is to hold stock positions for at least two years, and are satisfied with 20% to 40% earnings in that time period, then value investing may be right for you.

Value investing also has some perks that make it an ideal strategy for some investors:

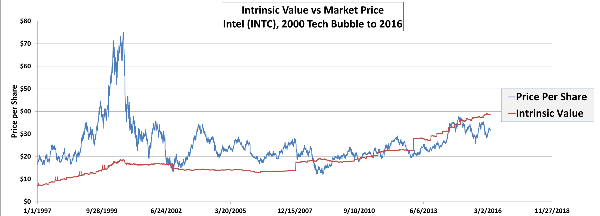

- Value investing helps to see market bubbles. Value investors are usually the first to hedge their capital to avoid an incoming market correction as they can see overvaluations in their analysis. The significant overvaluation of intel was an indicator of the tech bubble.

- After a market crash, value investing helps find the bottom. “Never catch a falling knife”. When a stock crashes, investors warn about trying to predict when to find the bottom. But as a value investor, you’re not interested in the bottom, you just know when a stock is significantly undervalued. By dollar-cost averaging, value investors can invest a portion of their capital at the very bottom of a market crash.

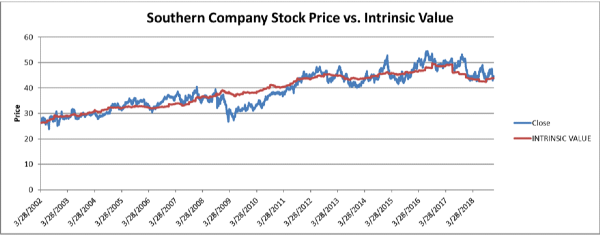

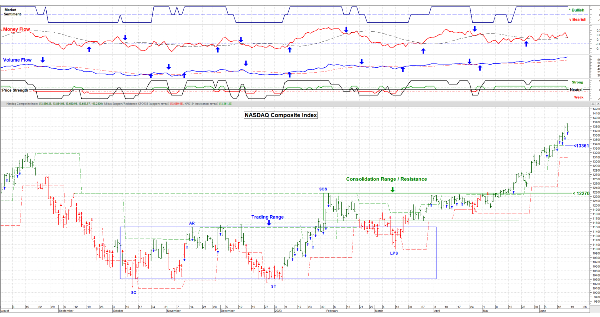

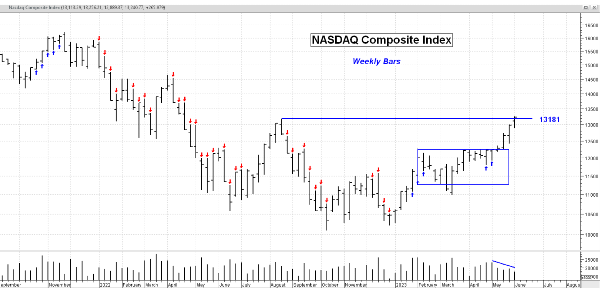

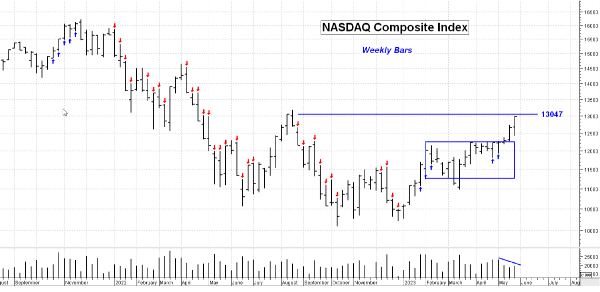

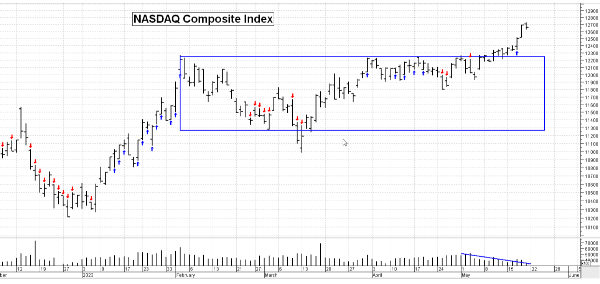

• Patience wins out. Stocks inevitably correct back to their intrinsic value. This process may take years to play out. You can see this in this graph of Southern Company’s stock price vs Intrinsic value:

))

))

This predictability isn’t perfect. But with the right analysis, value investing will provide high, consistent returns.

If Value Investing is Effective, Why is it Not Used?

Value investing isn’t a straightforward analysis. When you start value investing you need to assess the company’s management team and strategy before digging into their financials.

Assessing management is very subjective and is a skill that takes practice to hone. This is the first barrier to entry.

The second barrier is quantitative analysis. This is the process and inevitable calculation of the intrinsic value. After calculating intrinsic value, investors have a hard time trusting their value because:

- Intrinsic value changes. At a minimum, intrinsic value changes after every quarterly update. This is why there is historically more price volatility around quarterly earnings calls. For stocks value investors prefer, intrinsic value will gradually climb up at a consistent rate.

- Intrinsic value is a function of multiple variables. Oh no, math! Many investors get confused because they think just one ratio like the P/E ratio is all you need to determine the intrinsic value. But intrinsic value is really affected by multiple variables.

An intrinsic value is a function of the following:

- Book Value – The total net assets controlled by the company. This value takes into consideration cash on hand, assets like buildings and inventory, and its debt. The book value is a snapshot of the company if you remove its potential growth or earnings potential.

- Earnings forecast – The earnings forecast is the hardest variable as it is only an estimate. The earnings forecast is an amalgamation of your qualitative analysis, the company’s own forecast, and market opportunity.

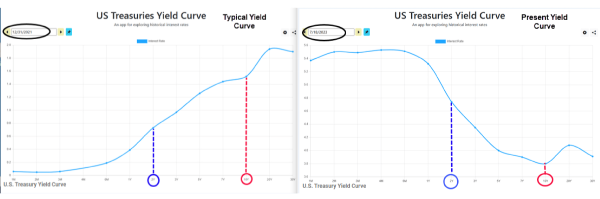

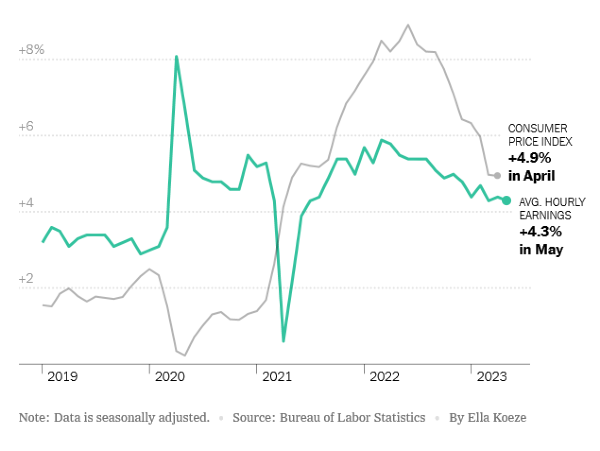

- Interest rates – Typically, the 10-year t-note is used as your standard interest rate. The Federal Reserve sets interest rates. These rates give investors a “risk-free” rate to discount the earnings potential of the stock.

- Revenue – When a stock is going through rapid growth, they will focus purely on revenue growth and use incoming investments to continue running their operations. This allows the company to continue growing even though they may have negative earnings. A classic example of a company using this strategy is Amazon

Is Value Investing Still Profitable Today?

Value investing is an evergreen strategy. Value investing is fundamental to how the market prices stocks. Thanks to momentum investing, markets will always misprice assets in the market.

Also, markets have multiple participants with different goals. Stocks will be sold off in the short term due to market fear, giving value investors an opportunity to buy up undervalued assets.

The Bottom Line

Value investing is a profitable strategy today just like it was a century ago. New investors get confused by the concept of a “value stock”, but there are no stocks that are consistently good for value investors to invest in. Value investors have a stock preference. A stock with consistent earnings growth and a stable business strategy typically garners favor with value investors. But these preferred stocks can still be overvalued by the market, so they aren’t always a “value stock”.

Value investing is a proven, effective strategy in the long-term. However, new investors may avoid value investing because qualitative analysis is difficult and intrinsic value is confusing as its always moving and a function of multiple variables.

https://youtu.be/-cHFLeTbGSY

Is Value Investing Profitable?

Value investing still holds up today as a profitable investing strategy. Stable companies that are fundamental to the U.S. economy can provide strong returns when you use value investing strategies.

Note that value investing doesn’t provide immediate profits. Stocks will take roughly two years to show a profit. When a stock is overvalued, the same phenomenon applies. It will take roughly 2 years for an overvalued stock to correct back down to its intrinsic value.

The amount of profit that you can earn varies. In the past, bank stocks have been misvalued so badly that they increased 80% in value over two years. Even utility stocks, which historically appreciate slowly, can see 40% gains in two years. These profitability gains were (somewhat) predictable due to the quantitative analysis of value investing.

Value Stocks do not Exist

One of the most confusing headlines about value investing is that value stock ETFs or value stocks are underperforming. There is no such thing as a value stock or a basket of value stocks.

There are consistent stocks that value investors prefer. These companies align with an ever-increasing intrinsic value because:

These preferred stocks have similar signs:

But these preferred stocks can still be overvalued. Even though a stock has predictable earnings growth, cash-flow, and revenue, the market has the potential to overvalue any stock. Overvaluing a stock doesn’t mean the market is irrational. For example, the overall market may use these preferred stocks as safe havens if the market is in correction.

The market cannot park money anywhere else, so they hedge their capital in certain “safe stocks”. These stocks are overvalued so they will not be profitable in the long term. But in the short term, they help to preserve capital.

The Worst Value Stock: Berkshire Hathaway

Berkshire Hathaway, to be clear, is a fine investment. The company has phenomenal growth and a proven track record of success. But purely by the numbers, Berkshire Hathaway trades at a premium.

The reason for this may be due to Berkshire Hathaway’s reputation. The public trusts the company and demand a premium to sell away their shares. Hence, value investors will typically avoid Berkshire Hathaway even though the company may invest based on value investing principles.

Is Value Investing a Good Strategy?

Just because value investing is a profitable strategy, it doesn’t mean it’s a good strategy. There are pros and cons to value investing that one must consider before using a value investing strategy. If your goal is to hold stock positions for at least two years, and are satisfied with 20% to 40% earnings in that time period, then value investing may be right for you.

Value investing also has some perks that make it an ideal strategy for some investors:

• Patience wins out. Stocks inevitably correct back to their intrinsic value. This process may take years to play out. You can see this in this graph of Southern Company’s stock price vs Intrinsic value:

This predictability isn’t perfect. But with the right analysis, value investing will provide high, consistent returns.

If Value Investing is Effective, Why is it Not Used?

Value investing isn’t a straightforward analysis. When you start value investing you need to assess the company’s management team and strategy before digging into their financials.

Assessing management is very subjective and is a skill that takes practice to hone. This is the first barrier to entry.

The second barrier is quantitative analysis. This is the process and inevitable calculation of the intrinsic value. After calculating intrinsic value, investors have a hard time trusting their value because:

An intrinsic value is a function of the following:

Is Value Investing Still Profitable Today?

Value investing is an evergreen strategy. Value investing is fundamental to how the market prices stocks. Thanks to momentum investing, markets will always misprice assets in the market.

Also, markets have multiple participants with different goals. Stocks will be sold off in the short term due to market fear, giving value investors an opportunity to buy up undervalued assets.

The Bottom Line

Value investing is a profitable strategy today just like it was a century ago. New investors get confused by the concept of a “value stock”, but there are no stocks that are consistently good for value investors to invest in. Value investors have a stock preference. A stock with consistent earnings growth and a stable business strategy typically garners favor with value investors. But these preferred stocks can still be overvalued by the market, so they aren’t always a “value stock”.

Value investing is a proven, effective strategy in the long-term. However, new investors may avoid value investing because qualitative analysis is difficult and intrinsic value is confusing as its always moving and a function of multiple variables.

https://youtu.be/-cHFLeTbGSY