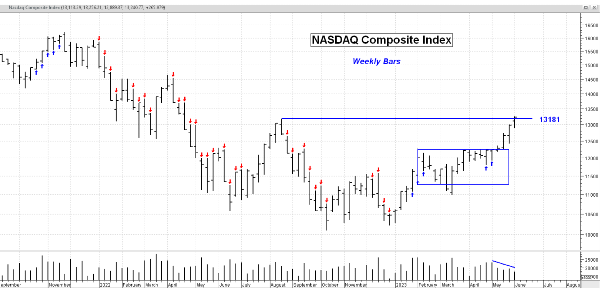

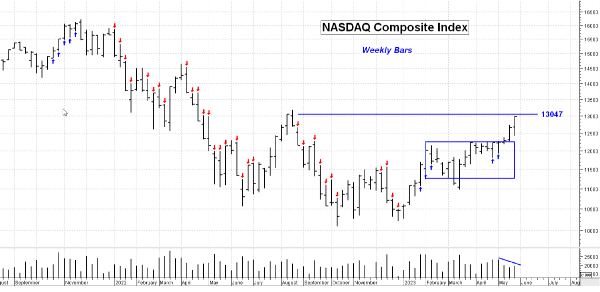

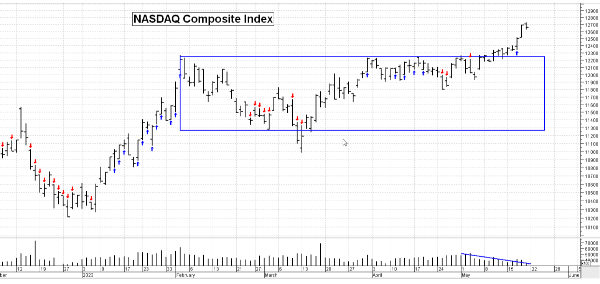

June 9, 2023 – Well now . . . we’ve done pretty well lately, but as I detailed last week, fueled mainly by 5-6 “Big Tech” stocks that dominate the market indexes. I’m starting to see some broadening (like Consumer Discretionary stocks) but Large Cap and Tech still rule (especially semiconductors & AI names).

But wait . . . there’s more ! Next week we get CPI (Consumer Price Index) and the FED meets with results on Wednesday 6/14. The markets are expecting an interest rate pause, but will they get it? It sure looks like good news is baked into this market and optimism abounds. Jobless claims are up, but the market sees this as ‘Good’ because it may temper the FED into the pause. ‘Bad News’ is good.

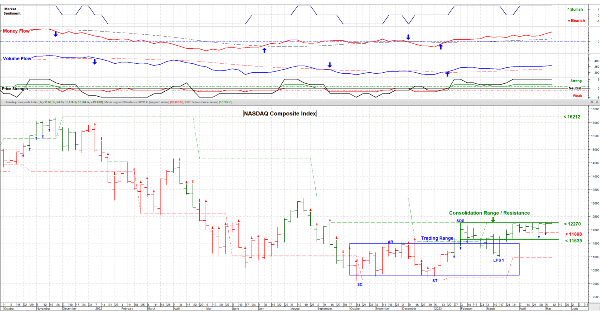

Add to that renewed interest in Small Cap stocks *(more speculative) *and the options market (as measured by the VIX Index) as a lack of fear at these very low levels. Are we back to “Risk On” or is this just a set up for a major correction? I am expecting a correction but the clue as to how big will be in the volume being traded. Low volume over a couple of days – Low Worries, Big Volume over many days, Big Worries. The options market shows us that hedging has gone out of style as of late. With fear and concern leaving stage right . . . what could go wrong? That’s a good question and I don’t have a good answer right now but I’m watching. For the time being I’m moderately invested with still some cash available. I’m thinking this may be a light correction and an opportunity, but . . .

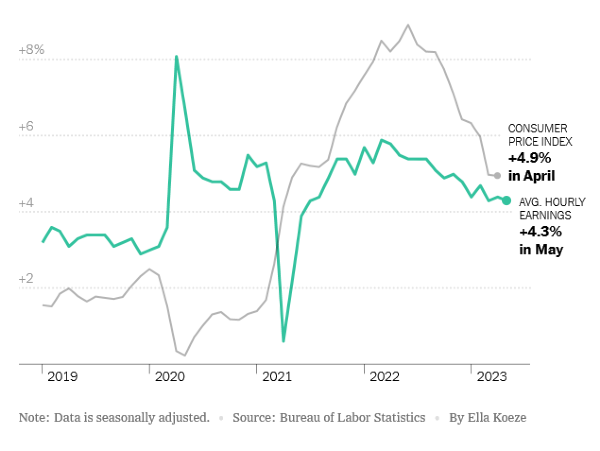

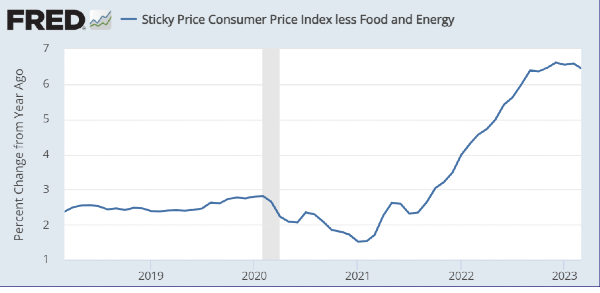

With all of the talk about wages and inflation I thought it would be good to show a chart that has both on it. You can make your own conclusions, but looks like the rate of inflation (not prices, just the rate that they rise) is slowly going down.

The table of the Short Term Sector Strength is shown on my website: www.Special-Risk.net.

Have a good week and keep your eyes open on how this market reacts on Wednesday afternoon. ….. Tom ……

Table by HighGrowthStockInvestor.com; used with permission.

June 9, 2023 – Well now . . . we’ve done pretty well lately, but as I detailed last week, fueled mainly by 5-6 “Big Tech” stocks that dominate the market indexes. I’m starting to see some broadening (like Consumer Discretionary stocks) but Large Cap and Tech still rule (especially semiconductors & AI names).

But wait . . . there’s more ! Next week we get CPI (Consumer Price Index) and the FED meets with results on Wednesday 6/14. The markets are expecting an interest rate pause, but will they get it? It sure looks like good news is baked into this market and optimism abounds. Jobless claims are up, but the market sees this as ‘Good’ because it may temper the FED into the pause. ‘Bad News’ is good.

Add to that renewed interest in Small Cap stocks *(more speculative) *and the options market (as measured by the VIX Index) as a lack of fear at these very low levels. Are we back to “Risk On” or is this just a set up for a major correction? I am expecting a correction but the clue as to how big will be in the volume being traded. Low volume over a couple of days – Low Worries, Big Volume over many days, Big Worries. The options market shows us that hedging has gone out of style as of late. With fear and concern leaving stage right . . . what could go wrong? That’s a good question and I don’t have a good answer right now but I’m watching. For the time being I’m moderately invested with still some cash available. I’m thinking this may be a light correction and an opportunity, but . . .

With all of the talk about wages and inflation I thought it would be good to show a chart that has both on it. You can make your own conclusions, but looks like the rate of inflation (not prices, just the rate that they rise) is slowly going down.

The table of the Short Term Sector Strength is shown on my website: www.Special-Risk.net.

Have a good week and keep your eyes open on how this market reacts on Wednesday afternoon. ….. Tom ……

Table by HighGrowthStockInvestor.com; used with permission.