Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

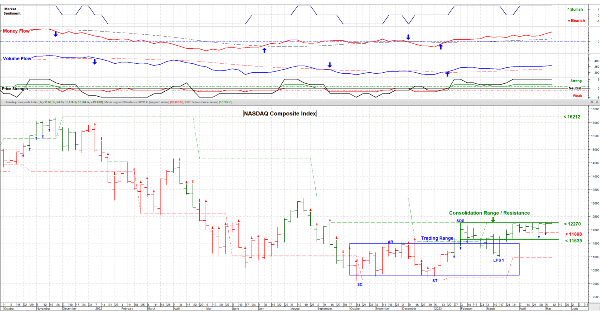

May 12, 2023 – As the 1st quarter earnings season winds down we still have not been able to break out of the “Stair Step” consolidation pattern. The upper level is firmly a resistance point (12270 level). The chart below is of the weekly NASDAQ Composite Index and I thought that it’s time to get a broader perspective.

Overall, I’m optimistic and bullish but that may not be well placed until we get a decisive break out on increasing volume. Right now on the daily bar chart (not shown) each of the rallies higher is on light volume compared to the corrections lower on heavier volume. It just looks like a traders market (“Buy the Dips & Sell the Rips”) and not quite time for investors to weigh in. I want to see more volume on up days and less on down days; one must be patient. Sectors that seem to be doing better are Mexico, Brazil, Technology and select Pharma stocks. China . . . not so much. The table below is of the Short Term Sector Strength (shown on website only)

Ok then. For the next 4 weeks I’ll be traveling and as such won’t be as timely writing this blog. Rest assured that I remain vigilant on the markets, just that I’m not fond of writing on a small laptop. So writings may not be every weekend (like I’ve been doing for years now), but more on an “as needed” basis and shorter. My readers may need a vacation too. Take Care and have a graceful entry to Summer. It may again be a time for the Summer Doldrums to set in and the “Sell in May” crowd to take over. We’ll see. …………. Tom ……………..

Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission. More info at: www.Special-Risk.net .