How do Value Investors find Stocks?

The greatest value investors used to scan the morning newspaper for interesting stocks to do more research on. Nowadays, value investors have a multitude of websites, videos, and groups they can rely on for new potential stocks to buy at a bargain.

The key is to have a value investing strategy that will filter a list of stocks and focus you in on just a few opportunities. Without a reliable strategy built before searching, even the best list of bargain stocks will give you bad ideas.

For new investors getting into value investing, do your first analysis on a company you are familiar with. Ideally, this company will have a product you use, or maybe it’s a company you’re familiar with from your profession. Any stocks with great products are good stocks to analyze first. It allows you to analyze a business you understand while you learn the nuances of an investor presentation.

How to search for stocks?

In The Little Book that Still Beats the Market, Joel Greenblatt argues that value investments need to rank the highest for two metrics:

- Return on Capital: EBIT/(Net Working Capital + Net Fixed Assets) or EBIT/(Tangible Capital Employed)

- Earnings Yield: EBIT/Enterprise Value

To find the highest ranked value stocks based on this criteria, you can see a list at magicformulainvesting.com.

In simple terms, return on capital calculates how much money a company makes with the actual capital used to make that money. EBIT is earnings before interest and taxes. Removing interest and taxes allows you to compare companies with different debt and tax liabilities. Tangible capital employed focuses on assets like factories and buildings that are needed to make the money and ignores assets like goodwill and other intangible assets.

Earnings yield measures the amount of money made for the total market capitalization plus the total debt held by the company (the enterprise value). The theory is that enterprise value is the full purchase price of the business.

How to find undervalued stocks right now?

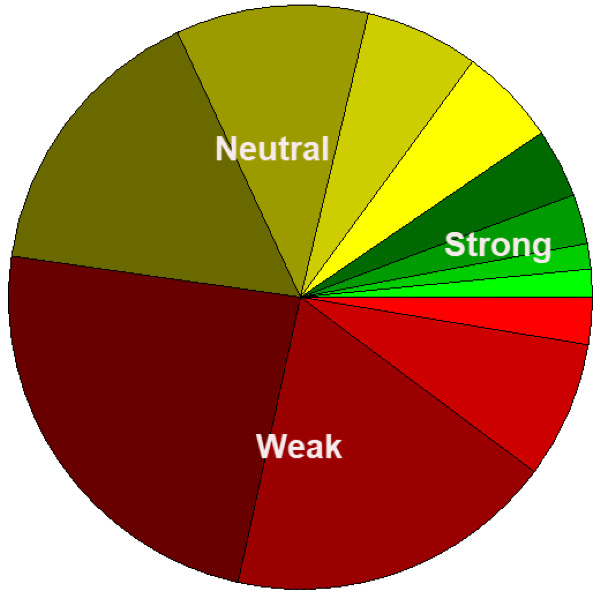

A good resource to find undervalued stocks right now is the StockBossUp.com page of top value investing stocks. This page showcases the top value stocks proposed by the StockBossUp community. Each member is rated by their performance, volatility, and diversity with the best member ideas listed daily.

How to Spot Undervalued Stocks?

Value investors spot undervalued stocks when a company they are monitoring has an irregular change in price relative to their financial fundamentals. There is no silver bullet metric that will indicate that a stock is undervalued.

Dividend Yield

Novice investors like to flock to high dividend yields believing this is a signal of undervaluation. For example, a shipping company once had a 15% dividend. This looked to be a great opportunity; however, upon deeper examination, it was revealed that the dividend was being used to pay out cash for the sell-off of multiple bulk-container ships. Once the ships were sold, the stock fell 40%. High dividend yield doesn’t always indicate a bargain opportunity. Instead, it could indicate the company is distressed.

Book value to price

When the price of a company falls below the book value, this could indicate the company is undervalued relative to its net assets on hand. When the market let’s the price of a stock fall below its book value, it has indicated one of two signals:

- Market Fear – The market is irrationally selling off stocks irrespective of the company’s intrinsic value.

- Market Skepticism – The market believes the company will start losing money, so its net assets are at risk of falling.

The latter scenario will show itself in the next earnings report. If earnings are negative, the market does not have to price the company above its book value.

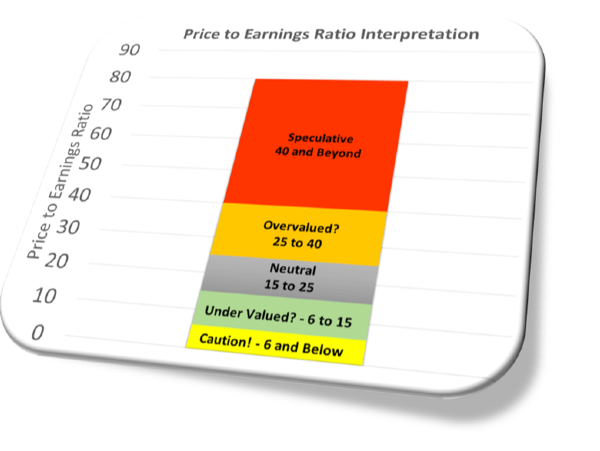

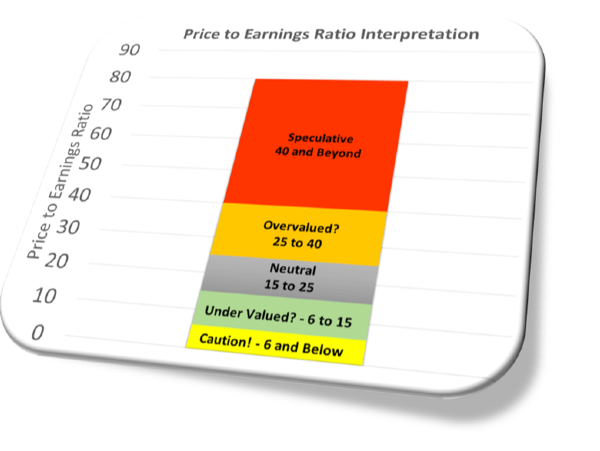

Price to Earnings Ratio

The validity of the price to earnings ratio fluctuates based on the type of stock you’re assessing. The price to earnings ratio is great when you glance at a stock. But the P/E ratio only gives you a slice of the full picture. It doesn’t consider sales growth, earnings growth, or book value. On its own, the P/E ratio doesn’t give you any information that will lead you to making an investment decision.

How do you find deeply undervalued stocks?

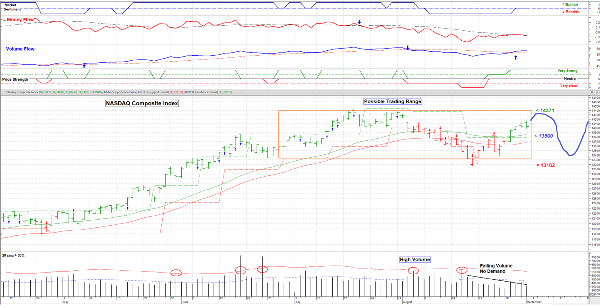

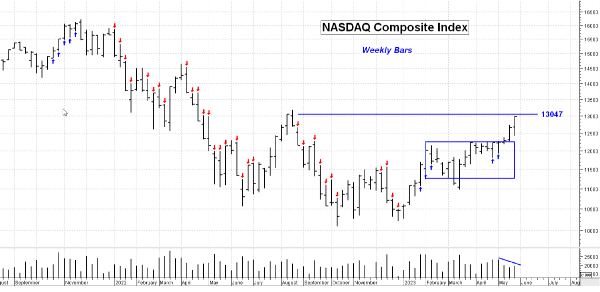

A stock becomes deeply undervalued when an event independent of that stock causes fear across an entire sector or the entire market. You will notice these events because the cause of these events will be independent of the fundamentals around your company.

Below are examples of events that caused stocks to be deeply undervalued.

The 2009 Financial Crisis

The 2009 financial crisis was focused mainly on financial stocks. In more focus, the crisis was really caused by insurance companies and insurance products. This crisis was independent of industrial stocks, so even though industrial stocks also fell, they were deeply undervalued by the market.

The Flash Crash of 2015

The 2015 flash crash was caused by numerous factors and fed by herd mentality. These crashes were a result of traders, not investors, and so it brought an opportunity for value investors to buy stocks hit by the sudden price movement.

Covid-19

Covid-19 was another crisis that caused stocks to tumble, independent of their underlying fundamentals. During the pandemic, it was hard at times to see these investment opportunities as life suddenly changed for billions of people. However, value investors who monitor stock opportunities and have intrinsic values and risk factors pre-determined are able to take advantage of these rare opportunities.

How to estimate intrinsic values?

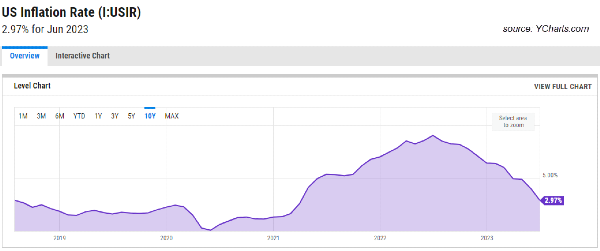

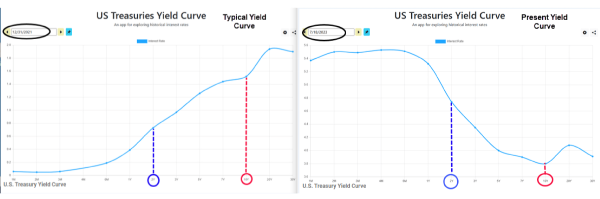

You can estimate intrinsic value using book value, earnings, estimated earnings growth, and the current interest rate on the 10-year t-note. These factors can be used in a discounted model to give an estimated intrinsic value. These factors can be used to predict, with some correlation, the two-year return on investment for the stock.

However, a company that is mis-managed, lacking a moat, or beaten by new competition may collapse in stock price regardless of its intrinsic value.

How do Value Investors find Stocks?

The greatest value investors used to scan the morning newspaper for interesting stocks to do more research on. Nowadays, value investors have a multitude of websites, videos, and groups they can rely on for new potential stocks to buy at a bargain.

The key is to have a value investing strategy that will filter a list of stocks and focus you in on just a few opportunities. Without a reliable strategy built before searching, even the best list of bargain stocks will give you bad ideas.

For new investors getting into value investing, do your first analysis on a company you are familiar with. Ideally, this company will have a product you use, or maybe it’s a company you’re familiar with from your profession. Any stocks with great products are good stocks to analyze first. It allows you to analyze a business you understand while you learn the nuances of an investor presentation.

How to search for stocks?

In The Little Book that Still Beats the Market, Joel Greenblatt argues that value investments need to rank the highest for two metrics:

To find the highest ranked value stocks based on this criteria, you can see a list at magicformulainvesting.com.

In simple terms, return on capital calculates how much money a company makes with the actual capital used to make that money. EBIT is earnings before interest and taxes. Removing interest and taxes allows you to compare companies with different debt and tax liabilities. Tangible capital employed focuses on assets like factories and buildings that are needed to make the money and ignores assets like goodwill and other intangible assets.

Earnings yield measures the amount of money made for the total market capitalization plus the total debt held by the company (the enterprise value). The theory is that enterprise value is the full purchase price of the business.

How to find undervalued stocks right now?

A good resource to find undervalued stocks right now is the StockBossUp.com page of top value investing stocks. This page showcases the top value stocks proposed by the StockBossUp community. Each member is rated by their performance, volatility, and diversity with the best member ideas listed daily.

How to Spot Undervalued Stocks?

Value investors spot undervalued stocks when a company they are monitoring has an irregular change in price relative to their financial fundamentals. There is no silver bullet metric that will indicate that a stock is undervalued.

Dividend Yield

Novice investors like to flock to high dividend yields believing this is a signal of undervaluation. For example, a shipping company once had a 15% dividend. This looked to be a great opportunity; however, upon deeper examination, it was revealed that the dividend was being used to pay out cash for the sell-off of multiple bulk-container ships. Once the ships were sold, the stock fell 40%. High dividend yield doesn’t always indicate a bargain opportunity. Instead, it could indicate the company is distressed.

Book value to price

When the price of a company falls below the book value, this could indicate the company is undervalued relative to its net assets on hand. When the market let’s the price of a stock fall below its book value, it has indicated one of two signals:

The latter scenario will show itself in the next earnings report. If earnings are negative, the market does not have to price the company above its book value.

Price to Earnings Ratio

The validity of the price to earnings ratio fluctuates based on the type of stock you’re assessing. The price to earnings ratio is great when you glance at a stock. But the P/E ratio only gives you a slice of the full picture. It doesn’t consider sales growth, earnings growth, or book value. On its own, the P/E ratio doesn’t give you any information that will lead you to making an investment decision.

How do you find deeply undervalued stocks?

A stock becomes deeply undervalued when an event independent of that stock causes fear across an entire sector or the entire market. You will notice these events because the cause of these events will be independent of the fundamentals around your company.

Below are examples of events that caused stocks to be deeply undervalued.

The 2009 Financial Crisis

The 2009 financial crisis was focused mainly on financial stocks. In more focus, the crisis was really caused by insurance companies and insurance products. This crisis was independent of industrial stocks, so even though industrial stocks also fell, they were deeply undervalued by the market.

The Flash Crash of 2015

The 2015 flash crash was caused by numerous factors and fed by herd mentality. These crashes were a result of traders, not investors, and so it brought an opportunity for value investors to buy stocks hit by the sudden price movement.

Covid-19

Covid-19 was another crisis that caused stocks to tumble, independent of their underlying fundamentals. During the pandemic, it was hard at times to see these investment opportunities as life suddenly changed for billions of people. However, value investors who monitor stock opportunities and have intrinsic values and risk factors pre-determined are able to take advantage of these rare opportunities.

How to estimate intrinsic values?

You can estimate intrinsic value using book value, earnings, estimated earnings growth, and the current interest rate on the 10-year t-note. These factors can be used in a discounted model to give an estimated intrinsic value. These factors can be used to predict, with some correlation, the two-year return on investment for the stock. However, a company that is mis-managed, lacking a moat, or beaten by new competition may collapse in stock price regardless of its intrinsic value.