Watch this article's companion video here:

https://youtu.be/kni95HQAuOc

Why Book Value per Share Matters to New Investors

So, you’re a new investor. You’re getting your feet wet, and you start learning a few investment terms. You hear that earnings per share is very important. You get a little more sophisticated and you learn about the price to earnings ratio.

Maybe you get a dab of beta, a pinch of enterprise value, and exposure to the greeks. All of these are important and interesting statistics.

But my own, personal belief, is that the number one metric with the most importance that a new investor gets the least exposure to, has got to be book value per share.

My own belief is that if more new investors realized the power of this metric, they could significantly improve their investment performance by better evaluating a stock with significantly more confidence.

Image Source: Image by Wolfgang Stemme from Pixabay. A nuclear power plant is an example of a highly capital intensive project funded by utilities. The book value of this asset is found on the utilities balance sheets.

And the most important sectors that you can use book value per share most effectively are utilities and industrials. These two sectors are highly capital intensive with significant capital used to build major plants and facilities. And with high amounts of capital, you can exploit the best feature of the metric: an army of accountants have already valued your company.

They’ve measured, calculated, and assessed your companies value as its book value. If the company had to be dissolved today, these accountants estimate you would receive the book value per share in cash.

What is Book Value? How do you Calculate it?

Book value measures an investor’s equity and is the sum of all the assets a company has minus all the debts. Book value per share lets you know how much net assets per share you’ve purchased. This can then be compared to a stock’s price per share.

Examples of a company’s assets

And what’s so great about book value is that it is painstakingly counted, measured, and reported by the company’s Chief Financial Officer and that officer’s brigade of accountants. And because of laws and regulations, accountants are required to follow accounting procedures to accurately price the book value of the company.

Examples of a company’s liabilities

Book Value per Share and its Use with intrinsic Value

So why is this value so important? Well, if a company has a ton of cash and property, its book value will be higher. In the extreme example, if a company has $10 in cash per share and is priced at $5 per share, you’re effectively buying $10 for $5.

And you might think, “no, the stock market isn’t dumb enough to offer such opportunities” well you really don’t believe in the effectiveness of fear.

There have been many cases during market corrections where the price of major blue-chip stocks fell below that actual book value of the company. And barring exceptions of some poorly managed companies, the price of these companies would bounce back up after market fears resided.

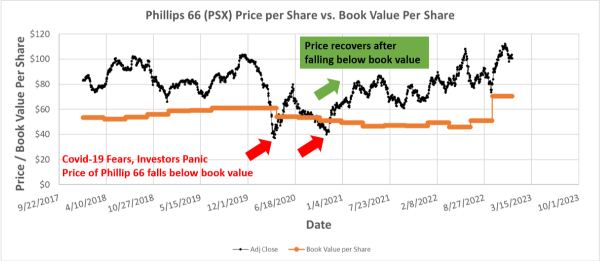

Price recovery of Phillips 66 after price fell below book value

In normal market conditions, the price of a stock will hover around its book value per share plus the future earnings it will receive.

Southern Company price following calculated intrinsic value

You can see this phenomenon in a price chart of the utility stock Southern Company. The price constantly corrected back to the book value per share plus discounted earnings repeatedly throughout the year. This comes even as investors tried to use the utility as a hedge against a correcting market.

Read More: How to Measure the Intrinsic Value of a Utility Stock

The problem, I believe, is that new investors only get the story about earnings per share. And while yes, this is a major part of the evaluation process, for utilities and industrials, its only half the story. When you have both book value and earnings taken into consideration, you suddenly have a very clear picture of when you should accumulate shares of a utility and when you should consider it overvalued.

But now that I’ve raved about book value per share, it’s time to share my warnings for you. As a new investor, think of yourself as a detective. Your goal is to sniff out the truth from a company’s executive team, the news, and “experts” and really try to get a picture of reality. Just knowing the truth of a company’s position is a very lucrative skill.

How to Check BVPS Accuracy

For book value per share, there are many pitfalls you need to uncover to be sure you’re not falling into a trap. And to be honest, we could spend an hour going through different pitfalls, but the two you need to first watch out for, as a new investor, is goodwill and capital projects.

Goodwill is an intangible asset that reflects the value a company paid to acquire another company minus that other company’s book value. Goodwill is what your company thinks the acquisition is worth. If the executive team was wrong about this investment, this Goodwill will one day be stricken off the balance sheet. Keep an eye on goodwill whenever your company makes a major acquisition.

Image by Jürgen Rübig from Pixabay. Construction site of a capital project

Capital projects is another problem child on the balance sheet. Capital projects have cost overruns, timeline overruns, and scope changes. No project goes perfectly, but some capital projects, like Southern Company’s Vogtle Plant, have had billions in cost overruns and years in delays. If something goes wrong and that plant cannot produce nuclear powered electricity, the company’s accountants would be forced to write down this asset. This will set in motion a collapse in book value per share and ultimately the market will adjust down the stock price.

But if you can be a detective, and watch out for these kinds of issues, then book value per share gives you a good sense of the value of a company. Pair that up with earnings and interest rates, and suddenly you can calculate intrinsic value. And once you have intrinsic value, you can open your eyes to see what stock prices really follow.

BVPS Commonly Asked Questions

What is a good book value per share?

For sectors that require capital to conduct their business, book value per share should be roughly 30% to 50% of the company’s price per share. Sectors that require intensive capital investment include utilities due to their large infrastructure, industrials due to their large facilities, and finance as they need capital to make loans.

Sectors like technology typically do not hold capital. Tech companies are expected to grow, so capital needs to be used to grow the business. Note that the lines of a tech company start to blur with large blue-chip companies. Companies like Google have enormous IT infrastructure and accumulated cash that they cannot use fast enough.

Is a High Book Value per Share Good or Bad?

A “high” book value per share we will define as above the price per share. This is typically a good thing for a potential investor. A “high” book value per share may mean the stock is undervalued due to market fears. However, if a stock has a high book value per share, but you notice there is no broader market correction, you need to be very careful. Some investors may already know that the company will need to lower their book value per share in their next quarterly report. This may be due to a failed capital project, the sell-off of assets, or a burn-off of cash.

Do You Want a Higher Book Value per Share?

For capital intensive sectors like utilities, industrials, and finance you want to see a higher book value per share every quarter. As the company takes in earnings, they should be utilizing those earnings for more capital projects and investments. Capital projects and investments are added to the book value each quarter.

What is a Bad Book Value per Share?

When a company’s book value per share falls every quarter, that is a bad sign. That signals that investments the company made did not materialize into useful assets. A negative book value is a bad sign as well. This indicates that they have more debt than assets to cover the debt. This doesn’t always mean that the company is in trouble. A company with very strong earnings can take on more debt to fund new enterprises. Sometimes new business opportunities require expenses that cannot be converted into an asset.

What Causes Book Value to Increase?

Book value can increase in a few ways:

- When a company earns cash, that cash increases book value

- When a company acquires another company, if that company becomes more productive, its total value on the company’s books may go up

- When new investment is added to the company, book value will increase. Book value per share may not increase depending on how many shares the new investors purchase.

- Intangible assets like intellectual property or brand recognition may increase book value as these properties become more useful to the customer.

Final Thoughts

As a new investor, get familiar with book value. A team of accountants worked hard to measure the company’s book value, making it easier for you to value the company. Book value combined with earnings can help measure a company’s intrinsic value. The price of a utility stock will typically follow the intrinsic value of a company.

Further Readings - Stock Ideas

Further Readings - A Guide to Investing in Utilities

Watch this article's companion video here:

https://youtu.be/kni95HQAuOc

Watch this article's companion video here:

https://youtu.be/kni95HQAuOc

Why Book Value per Share Matters to New Investors

So, you’re a new investor. You’re getting your feet wet, and you start learning a few investment terms. You hear that earnings per share is very important. You get a little more sophisticated and you learn about the price to earnings ratio. Maybe you get a dab of beta, a pinch of enterprise value, and exposure to the greeks. All of these are important and interesting statistics. But my own, personal belief, is that the number one metric with the most importance that a new investor gets the least exposure to, has got to be book value per share. My own belief is that if more new investors realized the power of this metric, they could significantly improve their investment performance by better evaluating a stock with significantly more confidence.

Image Source: Image by Wolfgang Stemme from Pixabay. A nuclear power plant is an example of a highly capital intensive project funded by utilities. The book value of this asset is found on the utilities balance sheets.

And the most important sectors that you can use book value per share most effectively are utilities and industrials. These two sectors are highly capital intensive with significant capital used to build major plants and facilities. And with high amounts of capital, you can exploit the best feature of the metric: an army of accountants have already valued your company.

They’ve measured, calculated, and assessed your companies value as its book value. If the company had to be dissolved today, these accountants estimate you would receive the book value per share in cash.

What is Book Value? How do you Calculate it?

Book value measures an investor’s equity and is the sum of all the assets a company has minus all the debts. Book value per share lets you know how much net assets per share you’ve purchased. This can then be compared to a stock’s price per share.

Examples of a company’s assets

And what’s so great about book value is that it is painstakingly counted, measured, and reported by the company’s Chief Financial Officer and that officer’s brigade of accountants. And because of laws and regulations, accountants are required to follow accounting procedures to accurately price the book value of the company.

Examples of a company’s liabilities

Book Value per Share and its Use with intrinsic Value

So why is this value so important? Well, if a company has a ton of cash and property, its book value will be higher. In the extreme example, if a company has $10 in cash per share and is priced at $5 per share, you’re effectively buying $10 for $5. And you might think, “no, the stock market isn’t dumb enough to offer such opportunities” well you really don’t believe in the effectiveness of fear. There have been many cases during market corrections where the price of major blue-chip stocks fell below that actual book value of the company. And barring exceptions of some poorly managed companies, the price of these companies would bounce back up after market fears resided.

Price recovery of Phillips 66 after price fell below book value

In normal market conditions, the price of a stock will hover around its book value per share plus the future earnings it will receive.

Southern Company price following calculated intrinsic value

You can see this phenomenon in a price chart of the utility stock Southern Company. The price constantly corrected back to the book value per share plus discounted earnings repeatedly throughout the year. This comes even as investors tried to use the utility as a hedge against a correcting market.

The problem, I believe, is that new investors only get the story about earnings per share. And while yes, this is a major part of the evaluation process, for utilities and industrials, its only half the story. When you have both book value and earnings taken into consideration, you suddenly have a very clear picture of when you should accumulate shares of a utility and when you should consider it overvalued. But now that I’ve raved about book value per share, it’s time to share my warnings for you. As a new investor, think of yourself as a detective. Your goal is to sniff out the truth from a company’s executive team, the news, and “experts” and really try to get a picture of reality. Just knowing the truth of a company’s position is a very lucrative skill.

How to Check BVPS Accuracy

For book value per share, there are many pitfalls you need to uncover to be sure you’re not falling into a trap. And to be honest, we could spend an hour going through different pitfalls, but the two you need to first watch out for, as a new investor, is goodwill and capital projects. Goodwill is an intangible asset that reflects the value a company paid to acquire another company minus that other company’s book value. Goodwill is what your company thinks the acquisition is worth. If the executive team was wrong about this investment, this Goodwill will one day be stricken off the balance sheet. Keep an eye on goodwill whenever your company makes a major acquisition.

Image by Jürgen Rübig from Pixabay. Construction site of a capital project

Capital projects is another problem child on the balance sheet. Capital projects have cost overruns, timeline overruns, and scope changes. No project goes perfectly, but some capital projects, like Southern Company’s Vogtle Plant, have had billions in cost overruns and years in delays. If something goes wrong and that plant cannot produce nuclear powered electricity, the company’s accountants would be forced to write down this asset. This will set in motion a collapse in book value per share and ultimately the market will adjust down the stock price. But if you can be a detective, and watch out for these kinds of issues, then book value per share gives you a good sense of the value of a company. Pair that up with earnings and interest rates, and suddenly you can calculate intrinsic value. And once you have intrinsic value, you can open your eyes to see what stock prices really follow.

BVPS Commonly Asked Questions

What is a good book value per share?

For sectors that require capital to conduct their business, book value per share should be roughly 30% to 50% of the company’s price per share. Sectors that require intensive capital investment include utilities due to their large infrastructure, industrials due to their large facilities, and finance as they need capital to make loans. Sectors like technology typically do not hold capital. Tech companies are expected to grow, so capital needs to be used to grow the business. Note that the lines of a tech company start to blur with large blue-chip companies. Companies like Google have enormous IT infrastructure and accumulated cash that they cannot use fast enough.

Is a High Book Value per Share Good or Bad?

A “high” book value per share we will define as above the price per share. This is typically a good thing for a potential investor. A “high” book value per share may mean the stock is undervalued due to market fears. However, if a stock has a high book value per share, but you notice there is no broader market correction, you need to be very careful. Some investors may already know that the company will need to lower their book value per share in their next quarterly report. This may be due to a failed capital project, the sell-off of assets, or a burn-off of cash.

Do You Want a Higher Book Value per Share?

For capital intensive sectors like utilities, industrials, and finance you want to see a higher book value per share every quarter. As the company takes in earnings, they should be utilizing those earnings for more capital projects and investments. Capital projects and investments are added to the book value each quarter.

What is a Bad Book Value per Share?

When a company’s book value per share falls every quarter, that is a bad sign. That signals that investments the company made did not materialize into useful assets. A negative book value is a bad sign as well. This indicates that they have more debt than assets to cover the debt. This doesn’t always mean that the company is in trouble. A company with very strong earnings can take on more debt to fund new enterprises. Sometimes new business opportunities require expenses that cannot be converted into an asset.

What Causes Book Value to Increase?

Book value can increase in a few ways:

Final Thoughts

As a new investor, get familiar with book value. A team of accountants worked hard to measure the company’s book value, making it easier for you to value the company. Book value combined with earnings can help measure a company’s intrinsic value. The price of a utility stock will typically follow the intrinsic value of a company.

Further Readings - Stock Ideas

Further Readings - A Guide to Investing in Utilities

Watch this article's companion video here:

https://youtu.be/kni95HQAuOc