Image Source: National Retail Properties 2021 Annual Report

Published on November 20th, 2022, by Samuel Smith

Real Estate Investment Trusts (i.e., “REITs”) are tax-advantaged income vehicles that have become increasingly popular with investors and institutions in recent years. This is because they do not have to pay any income tax at the corporate level but instead serve as pass-through entities. In exchange for this benefit, they must meet specific guidelines, including paying out at least 90% of taxable income to shareholders through dividends. As a result, high-yield and dividend-growth investors generally love REITs and dedicate a considerable portion of their portfolios to them.

However, while REITs do not have to pay corporate income tax, shareholders typically must pay tax on the dividend income they receive from them. This income is generally taxed in one of three ways:

- Capital Gains – this portion of the dividend consists of gains generated from asset sales and are taxed as capital gains.

- Return of Capital – this portion of the dividend is not taxable, as it involves a reduction in the investor’s cost basis. This cash flow typically either comes from the rental income that is written off via depreciation accounting rules for the underlying real estate or is not covered by cash flow at all and instead is being funded with cash reserves and/or debt. Eventually, capital gains taxes will be paid on this portion of the income if/when the shareholder decides to sell his shares.

- Ordinary income – is the portion of the dividend income that remains after the capital gains and return of capital portions are deducted. It is taxed at the shareholder’s top income tax bracket, though it is exempted from FICA taxes. This is in contrast to the “qualified dividends” that many companies pay, which are taxed at long-term capital gains rates, which are generally equal to or less than the top income tax bracket of the individual shareholder.

Out of these classifications of REIT dividends, return of capital is the most desirable as it defers all taxation on the dividends until the REIT shares are sold. Capital gains are the next most desirable, given that the capital gains tax rate is typically lower than the income tax rate, making the ordinary income classification the least desirable of REIT dividend classifications. Another critical tax consideration to keep in mind when holding REITs in a taxable account is that they benefit from the 20% pass-thru income deduction. Given that REITs are classified as pass-thru entities, 20% of their dividends are exempted from taxation, further limiting the tax liability for shareholders holding REITs in a taxable account.

What this means is that if you hold a REIT with a meaningfully high percentage of its dividends being classified as a return of capital for the long term, when combined with the 20% pass-thru income deduction, the tax burden may wind up being quite reasonable in a taxable account. In this article, we will discuss seven REITs that paid out a meaningful percentage of their dividends as a return of capital in 2021 as a starting point for investors who want to invest in tax-efficient REITs in a taxable account. Note that this breakdown often changes from year to year. The breakdown for the previous year’s dividends is typically announced in January, so it is impossible to predict future taxation classifications with certainty.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

Click here to instantly download your free spreadsheet of all REITs Stocks now, along with important investing metrics.

#1. National Retail Properties (NNN)

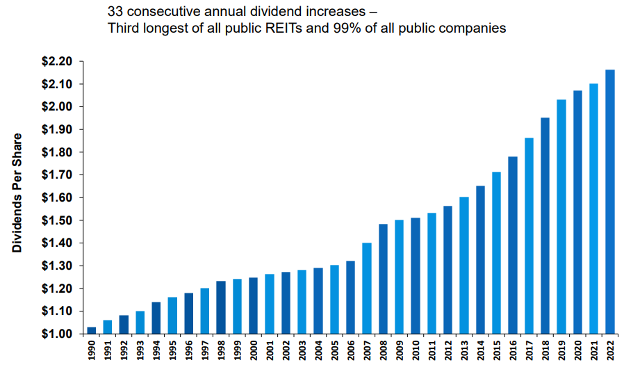

NNN is a triple net lease REIT that primarily owns single-tenant free-standing retail real estate. The business model is a low risk given that the tenant bears all responsibility for operating expenses, insurance, and property maintenance, the leases are lengthy in terms and have seniority on the balance sheet, and NNN’s management carefully does the underwriting. Its tremendous track record of generating stable and regularly growing cash flow from its real estate portfolio has enabled the REIT to increase its dividend for 33 consecutive years, making it a Dividend Aristocrat. On top of that, the dividend yield is pretty attractive at 4.9% as of this writing.

In 2021, its dividend breakdown was as follows: 76.9406% was classified as ordinary income, and 23.0594% was classified as return of capital. When combined with the 20% pass-thru income deduction, NNN qualifies as a pretty tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on National Retail Properties (preview of page 1 of 3 shown below):

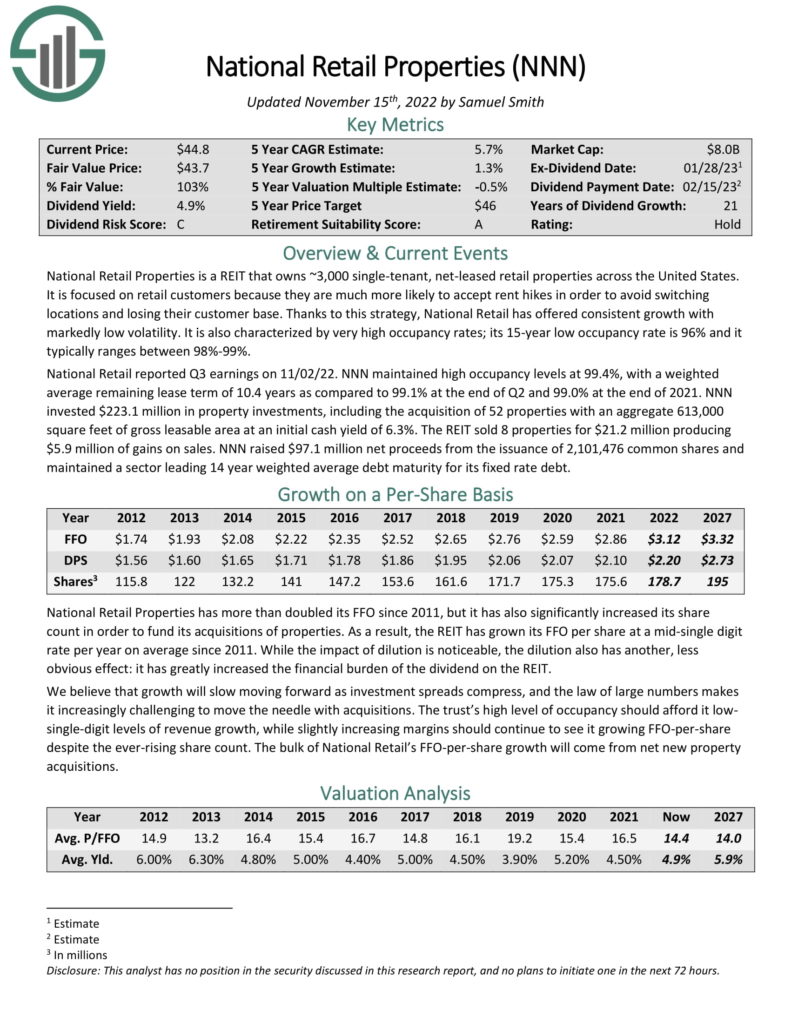

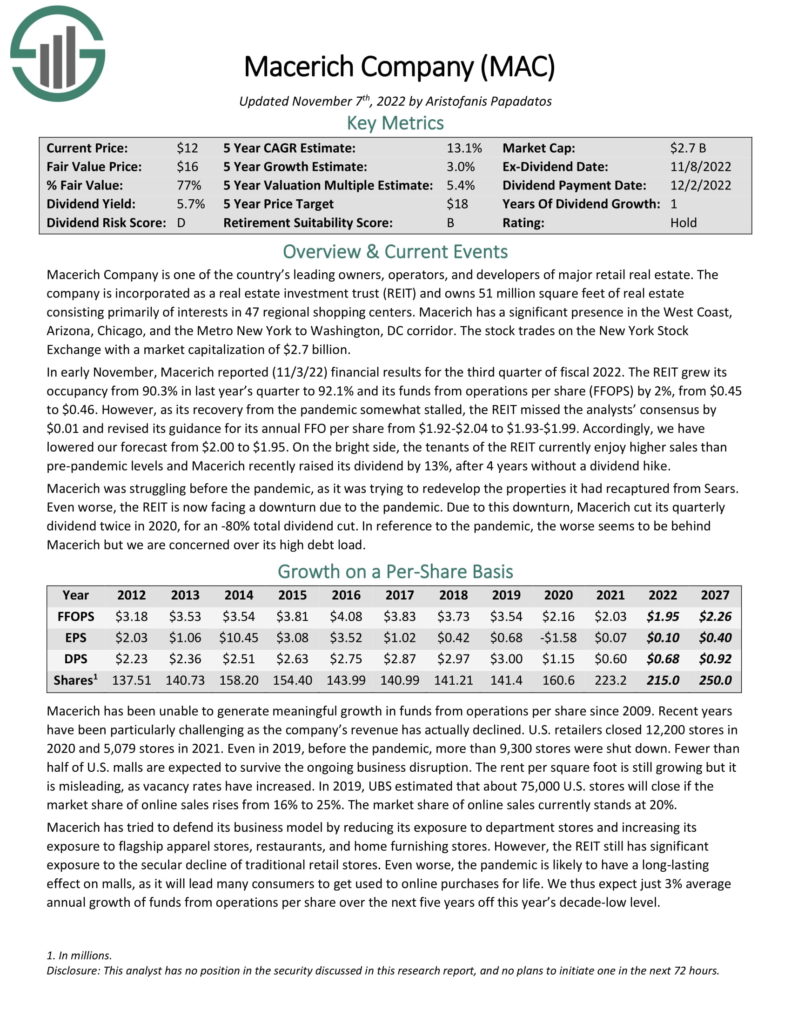

#2. Macerich (MAC)

MAC primarily owns class-A malls in leading markets across the United States. While it has struggled in recent years due to a surge in tenant bankruptcies due to the rise of e-commerce and the COVID-19 lockdowns, its properties today are thriving, and MAC’s board of directors just hiked its dividend. While its dividend track record is poor and the balance sheet could use further deleveraging in the current environment, its properties are among the best positioned to thrive long-term in the mall sector. On top of that, its dividend yield is currently at 5.1%.

In 2021, its dividend breakdown was as follows: 6% was classified as ordinary income, 24.667% was classified as capital gains, and 69.333% was classified as return of capital. When combined with the 20% pass-thru income deduction, MAC qualifies as a very tax-efficient source of income.

Click here to download our most recent Sure Analysis report on Macerich (preview of page 1 of 3 shown below):

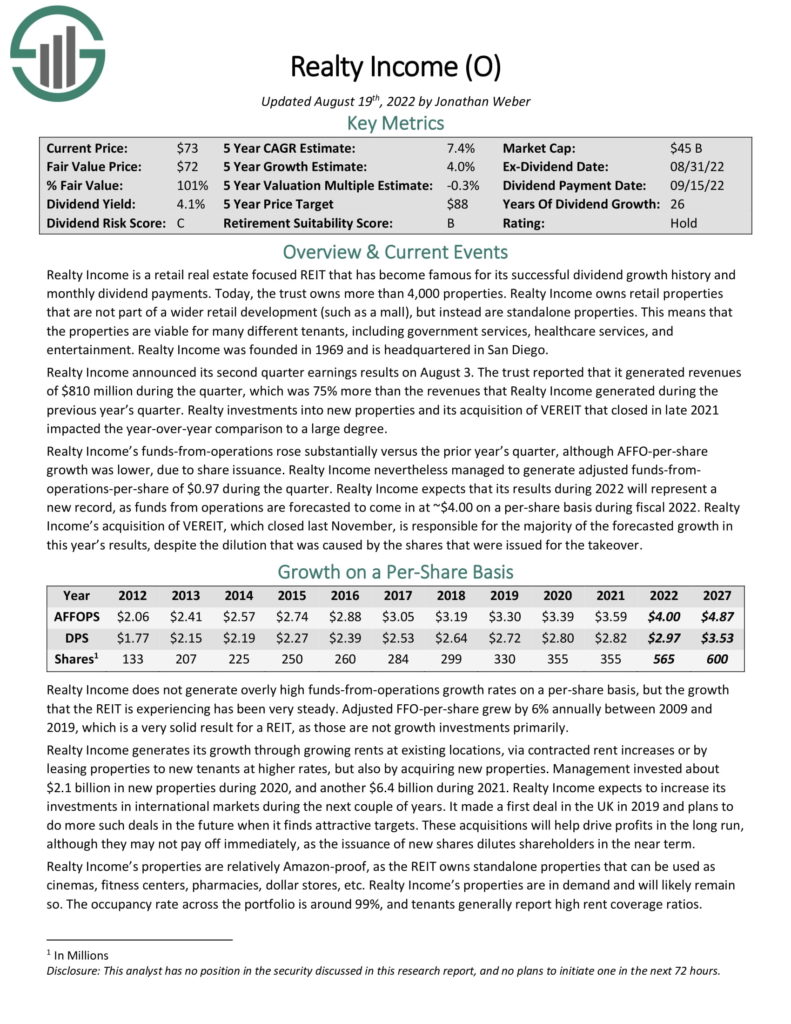

#3. Realty Income (O)

O is not labeled “The Monthly Dividend Company” for nothing: it has a tremendous track record of paying monthly dividends that grow year-over-year. Its dividend growth streak makes it a Dividend Aristocrat. On top of that, management has implemented its conservative triple net lease business model to near perfection, delivering market-crushing total returns throughout its publicly traded existence since the 1990s and building the most extensive portfolio of triple net lease real estate in the world. The balance sheet is also stellar, with one of the highest credit ratings in the REIT sector, giving it a cost of capital advantage over peers and implying that it is one of the lowest-risk real estate investments available. With a 4.6% current dividend yield, it is also a healthy source of current income.

In 2021, its dividend breakdown was as follows: 30.958% was classified as ordinary income, 1.747% was classified as capital gains, and 67.295% was classified as return of capital. When combined with the 20% pass-thru income deduction, O qualifies as a very tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

#4. VICI Properties (VICI)

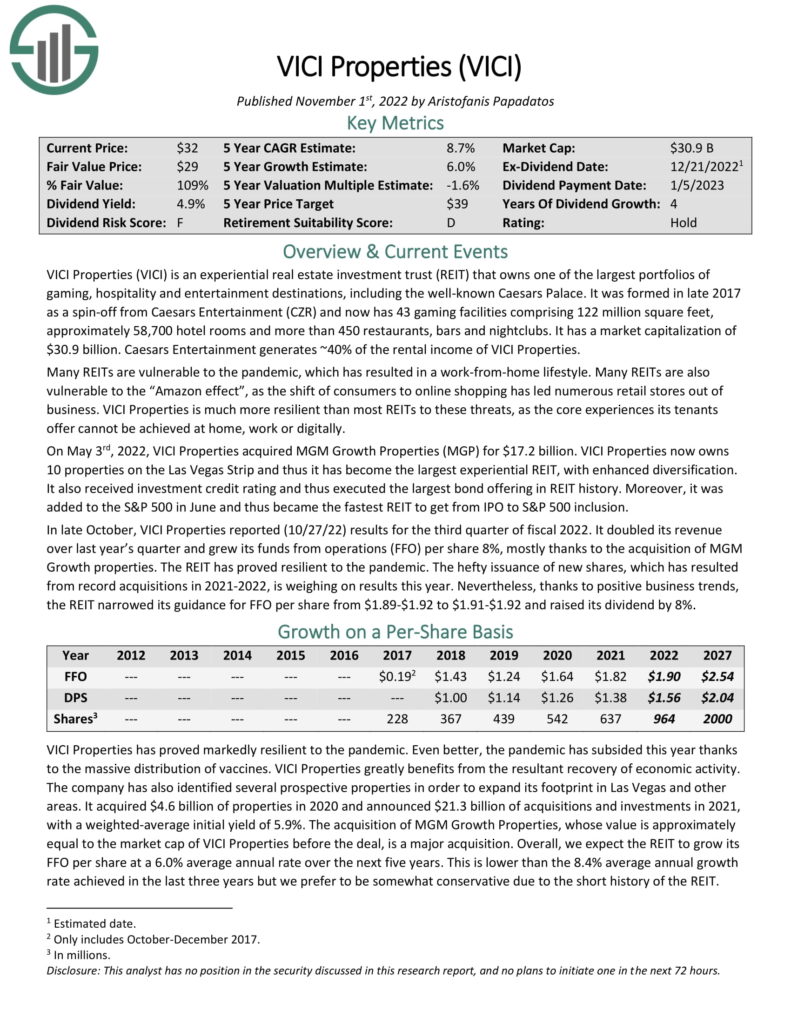

VICI owns an extensive portfolio of casinos – including the well-known Caesars Palace – as well as hundreds of restaurants, bars, and nightclubs. It implements a triple net lease business model, leading to stable and consistently growing rental income from its real estate portfolio. As a result, it has been able to generate increasing dividends per share each year since going public back in 2017 and is expected to continue doing so for years to come. On top of that, its 4.9% current dividend yield makes it a good pick for income-focused investors.

In 2021, its dividend breakdown was as follows: 52.652% was classified as ordinary income, and 47.348% was classified as return of capital. When combined with the 20% pass-thru income deduction, VICI qualifies as a very tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on VICI Properties (preview of page 1 of 3 shown below):

#5. UMH Properties (UMH)

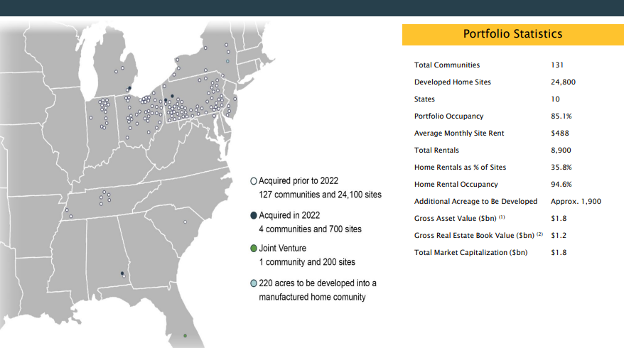

UMH owns manufactured housing communities across the United States and currently owns tens of thousands of properties in over 100 communities in the Midwest and Northeast.

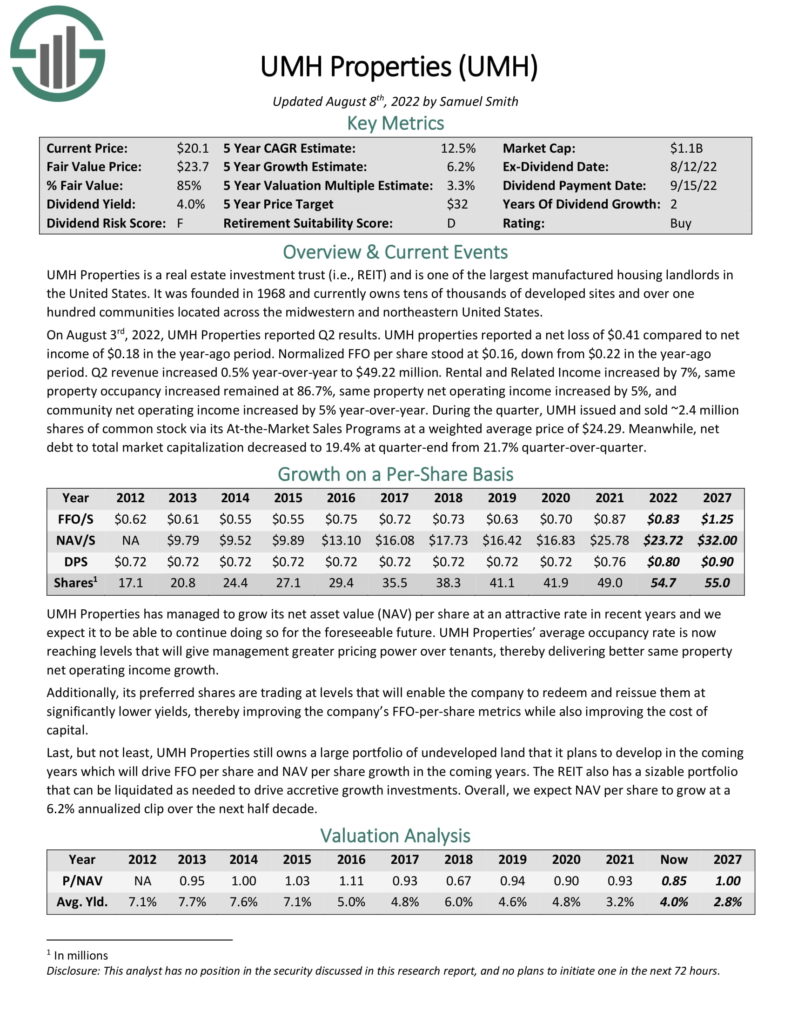

For many years UMH struggled to grow its dividend and FFO per share. However, since 2020 the company’s growth engine has finally kicked into high gear. FFO per share increased from $0.63 in 2019 to $0.87 in 2021, and the dividend per share finally began to grow along with it. In 2021, UMH paid out $0.76 per share in dividends and is currently paying out a $0.80 annualized dividend. Today, its dividend yields 4.6%, making it a solid pick for income-oriented investors.

In 2021, its dividend breakdown was as follows: 3.241683% was classified as ordinary income, 0.264344% was classified as capital gains, and 96.493973% was classified as return of capital. When combined with the 20% pass-thru income deduction, UMH clearly qualifies as a highly tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on UMH Properties (preview of page 1 of 3 shown below):

#6. Clipper Realty Inc. (CLPR)

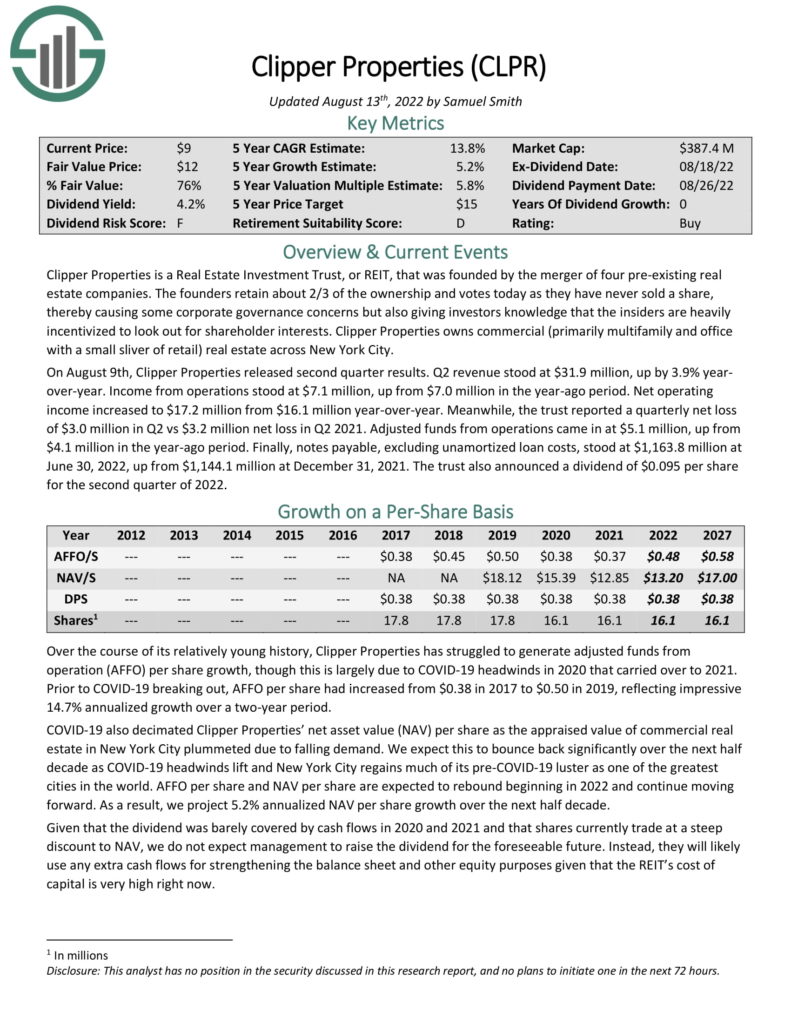

CLPR primarily owns multifamily and office real estate in New York City and is owned roughly two-thirds by the founders of the REIT. It was a merger between four pre-existing real estate businesses and went public in 2017. It has paid out a flat $0.38 annualized dividend each year since going public, even though the COVID-19 headwinds of 2020 and 2021 hit New York city especially hard. It currently offers investors a dividend yield of 5.1%, making it an attractive pick for investors looking for predictable current income alongside exposure to quality real estate in one of the world’s greatest cities.

In 2021, its dividend breakdown was as follows: 50% was classified as ordinary income, and 50% was classified as return of capital. When combined with the 20% pass-thru income deduction, CLPR qualifies as a very tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on Clipper Realty Inc. (preview of page 1 of 3 shown below):

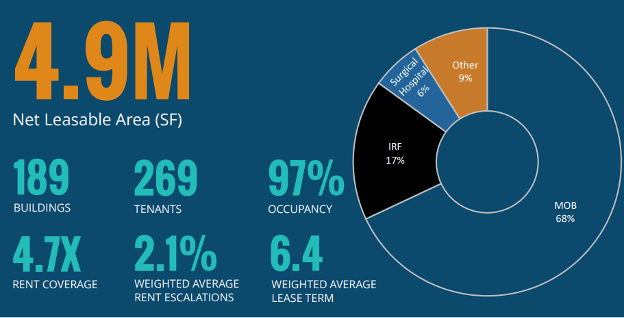

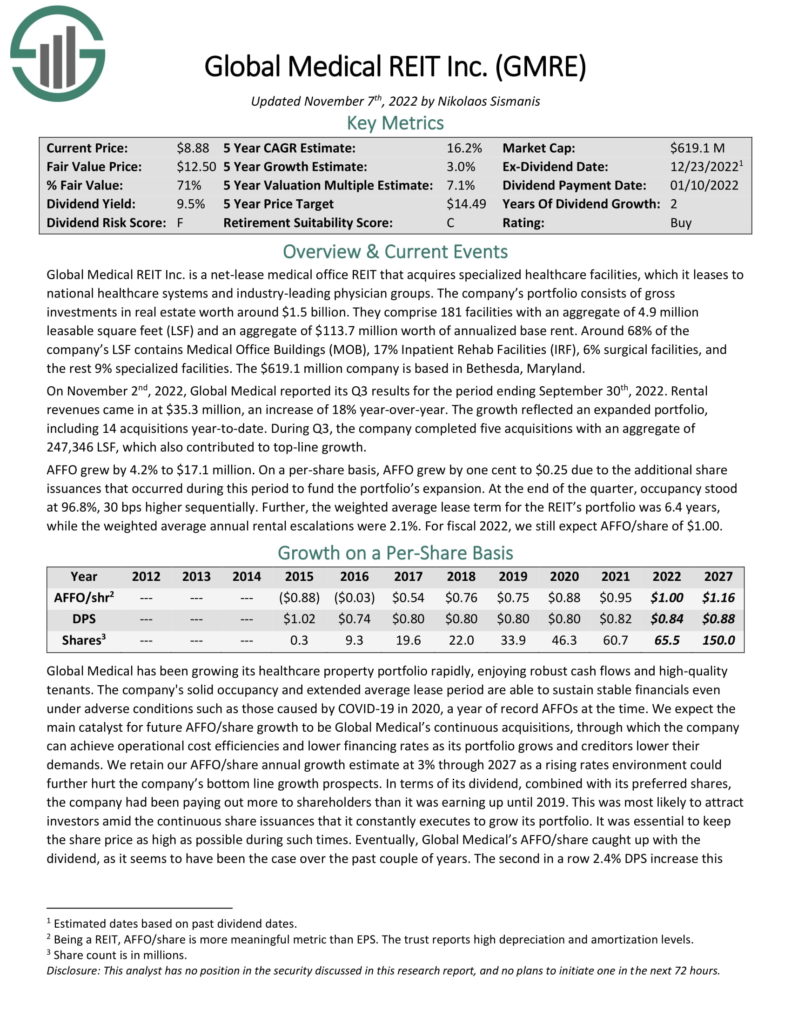

#7. Global Medical REIT (GMRE)

GMRE is a net-lease medical office REIT that owns and leases out specialized healthcare facilities, including medical office buildings, inpatient rehab facilities, surgical facilities, and other specialized facilities. Since going public in 2015, GMRE has seen its adjusted funds from operations per share increase steadily. As a result, the dividend has proven to be relatively stable as well, increasing from $0.74 per share in 2016 to $0.82 in 2021. The current annualized dividend payout is $0.84, and the current yield is a whopping 9%. The dividend payout is expected to increase slightly moving forward, making it an enticing choice for investors looking for current income and at least some growth.

In 2021, its dividend breakdown was as follows: 66.43% was classified as ordinary income, 2.35% as long-term capital gains, and 31.22% as the return of capital. When combined with the 20% pass-thru income deduction, GMRE qualifies as a relatively decent tax-efficient source of dependable income, though not quite as efficient as some of the other options presented here.

Click here to download our most recent Sure Analysis report on Global Medical REIT (preview of page 1 of 3 shown below):

Conclusion

REITs are known for being very tax-efficient at the corporate level, typically only having to worry about paying property taxes and being entirely exempted from the costly corporate income tax. Furthermore, pass-through entities get a 20% income tax exemption on their dividend payouts to shareholders, making them even more attractive as tax-advantaged investments.

On top of that, the real estate intensity of the business model often means that they get to write off a significant portion of their rental income as the depreciation of their assets. While many REITs do not have much depreciation to write off, some get to classify a surprisingly large percentage of their dividends as depreciation, making them remarkably tax-efficient even in a taxable account.

The downside is that REITs only reveal the tax classification of their dividends after they have been paid out, so it can be difficult for investors to know which REITs are best to hold in a taxable account as opposed to a tax-advantaged account like an IRA or 401k. As a result, some may simply play it safe and hold all REITs – especially the highest-yielding ones – in a tax-advantaged account. That said, if you notice that a specific REIT has developed a recent pattern of paying out a high percentage of its dividends as a return of capital, there is a good chance that it will remain that way for the foreseeable future as this may simply be due to its unique business model.

Ultimately, REITs are most valued for their income, and investors will typically be best served by focusing primarily on the dividend yield, valuation, management, balance sheet strength, and underlying real estate quality over the tax intricacies of the dividends. Still, it is worthwhile for investors in high-income tax brackets who own a substantial REIT portfolio to try to hold more tax-efficient REITs in taxable accounts. Note that this is not tax advice, and readers are strongly encouraged to do their due diligence before investing.

You may also be looking for appealing stocks from a certain stock market sector to ensure appropriate diversification within your portfolio. If that is the case, you will find the following resources useful:

You may also wish to consider other investments within the major market indices. Our downloadable list of small-cap U.S. stocks can be accessed below:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Image Source: National Retail Properties 2021 Annual Report

Published on November 20th, 2022, by Samuel Smith

Real Estate Investment Trusts (i.e., “REITs”) are tax-advantaged income vehicles that have become increasingly popular with investors and institutions in recent years. This is because they do not have to pay any income tax at the corporate level but instead serve as pass-through entities. In exchange for this benefit, they must meet specific guidelines, including paying out at least 90% of taxable income to shareholders through dividends. As a result, high-yield and dividend-growth investors generally love REITs and dedicate a considerable portion of their portfolios to them.

However, while REITs do not have to pay corporate income tax, shareholders typically must pay tax on the dividend income they receive from them. This income is generally taxed in one of three ways:

Out of these classifications of REIT dividends, return of capital is the most desirable as it defers all taxation on the dividends until the REIT shares are sold. Capital gains are the next most desirable, given that the capital gains tax rate is typically lower than the income tax rate, making the ordinary income classification the least desirable of REIT dividend classifications. Another critical tax consideration to keep in mind when holding REITs in a taxable account is that they benefit from the 20% pass-thru income deduction. Given that REITs are classified as pass-thru entities, 20% of their dividends are exempted from taxation, further limiting the tax liability for shareholders holding REITs in a taxable account.

What this means is that if you hold a REIT with a meaningfully high percentage of its dividends being classified as a return of capital for the long term, when combined with the 20% pass-thru income deduction, the tax burden may wind up being quite reasonable in a taxable account. In this article, we will discuss seven REITs that paid out a meaningful percentage of their dividends as a return of capital in 2021 as a starting point for investors who want to invest in tax-efficient REITs in a taxable account. Note that this breakdown often changes from year to year. The breakdown for the previous year’s dividends is typically announced in January, so it is impossible to predict future taxation classifications with certainty.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

Click here to instantly download your free spreadsheet of all REITs Stocks now, along with important investing metrics.

#1. National Retail Properties (NNN)

NNN is a triple net lease REIT that primarily owns single-tenant free-standing retail real estate. The business model is a low risk given that the tenant bears all responsibility for operating expenses, insurance, and property maintenance, the leases are lengthy in terms and have seniority on the balance sheet, and NNN’s management carefully does the underwriting. Its tremendous track record of generating stable and regularly growing cash flow from its real estate portfolio has enabled the REIT to increase its dividend for 33 consecutive years, making it a Dividend Aristocrat. On top of that, the dividend yield is pretty attractive at 4.9% as of this writing.

Source: Investor Presentation

In 2021, its dividend breakdown was as follows: 76.9406% was classified as ordinary income, and 23.0594% was classified as return of capital. When combined with the 20% pass-thru income deduction, NNN qualifies as a pretty tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on National Retail Properties (preview of page 1 of 3 shown below):

#2. Macerich (MAC)

MAC primarily owns class-A malls in leading markets across the United States. While it has struggled in recent years due to a surge in tenant bankruptcies due to the rise of e-commerce and the COVID-19 lockdowns, its properties today are thriving, and MAC’s board of directors just hiked its dividend. While its dividend track record is poor and the balance sheet could use further deleveraging in the current environment, its properties are among the best positioned to thrive long-term in the mall sector. On top of that, its dividend yield is currently at 5.1%.

In 2021, its dividend breakdown was as follows: 6% was classified as ordinary income, 24.667% was classified as capital gains, and 69.333% was classified as return of capital. When combined with the 20% pass-thru income deduction, MAC qualifies as a very tax-efficient source of income.

Click here to download our most recent Sure Analysis report on Macerich (preview of page 1 of 3 shown below):

#3. Realty Income (O)

O is not labeled “The Monthly Dividend Company” for nothing: it has a tremendous track record of paying monthly dividends that grow year-over-year. Its dividend growth streak makes it a Dividend Aristocrat. On top of that, management has implemented its conservative triple net lease business model to near perfection, delivering market-crushing total returns throughout its publicly traded existence since the 1990s and building the most extensive portfolio of triple net lease real estate in the world. The balance sheet is also stellar, with one of the highest credit ratings in the REIT sector, giving it a cost of capital advantage over peers and implying that it is one of the lowest-risk real estate investments available. With a 4.6% current dividend yield, it is also a healthy source of current income.

In 2021, its dividend breakdown was as follows: 30.958% was classified as ordinary income, 1.747% was classified as capital gains, and 67.295% was classified as return of capital. When combined with the 20% pass-thru income deduction, O qualifies as a very tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

#4. VICI Properties (VICI)

VICI owns an extensive portfolio of casinos – including the well-known Caesars Palace – as well as hundreds of restaurants, bars, and nightclubs. It implements a triple net lease business model, leading to stable and consistently growing rental income from its real estate portfolio. As a result, it has been able to generate increasing dividends per share each year since going public back in 2017 and is expected to continue doing so for years to come. On top of that, its 4.9% current dividend yield makes it a good pick for income-focused investors.

In 2021, its dividend breakdown was as follows: 52.652% was classified as ordinary income, and 47.348% was classified as return of capital. When combined with the 20% pass-thru income deduction, VICI qualifies as a very tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on VICI Properties (preview of page 1 of 3 shown below):

#5. UMH Properties (UMH)

UMH owns manufactured housing communities across the United States and currently owns tens of thousands of properties in over 100 communities in the Midwest and Northeast.

Source: Investor Presentation

For many years UMH struggled to grow its dividend and FFO per share. However, since 2020 the company’s growth engine has finally kicked into high gear. FFO per share increased from $0.63 in 2019 to $0.87 in 2021, and the dividend per share finally began to grow along with it. In 2021, UMH paid out $0.76 per share in dividends and is currently paying out a $0.80 annualized dividend. Today, its dividend yields 4.6%, making it a solid pick for income-oriented investors.

In 2021, its dividend breakdown was as follows: 3.241683% was classified as ordinary income, 0.264344% was classified as capital gains, and 96.493973% was classified as return of capital. When combined with the 20% pass-thru income deduction, UMH clearly qualifies as a highly tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on UMH Properties (preview of page 1 of 3 shown below):

#6. Clipper Realty Inc. (CLPR)

CLPR primarily owns multifamily and office real estate in New York City and is owned roughly two-thirds by the founders of the REIT. It was a merger between four pre-existing real estate businesses and went public in 2017. It has paid out a flat $0.38 annualized dividend each year since going public, even though the COVID-19 headwinds of 2020 and 2021 hit New York city especially hard. It currently offers investors a dividend yield of 5.1%, making it an attractive pick for investors looking for predictable current income alongside exposure to quality real estate in one of the world’s greatest cities.

In 2021, its dividend breakdown was as follows: 50% was classified as ordinary income, and 50% was classified as return of capital. When combined with the 20% pass-thru income deduction, CLPR qualifies as a very tax-efficient source of dependable income.

Click here to download our most recent Sure Analysis report on Clipper Realty Inc. (preview of page 1 of 3 shown below):

#7. Global Medical REIT (GMRE)

GMRE is a net-lease medical office REIT that owns and leases out specialized healthcare facilities, including medical office buildings, inpatient rehab facilities, surgical facilities, and other specialized facilities. Since going public in 2015, GMRE has seen its adjusted funds from operations per share increase steadily. As a result, the dividend has proven to be relatively stable as well, increasing from $0.74 per share in 2016 to $0.82 in 2021. The current annualized dividend payout is $0.84, and the current yield is a whopping 9%. The dividend payout is expected to increase slightly moving forward, making it an enticing choice for investors looking for current income and at least some growth.

Source: Investor Presentation

In 2021, its dividend breakdown was as follows: 66.43% was classified as ordinary income, 2.35% as long-term capital gains, and 31.22% as the return of capital. When combined with the 20% pass-thru income deduction, GMRE qualifies as a relatively decent tax-efficient source of dependable income, though not quite as efficient as some of the other options presented here.

Click here to download our most recent Sure Analysis report on Global Medical REIT (preview of page 1 of 3 shown below):

Conclusion

REITs are known for being very tax-efficient at the corporate level, typically only having to worry about paying property taxes and being entirely exempted from the costly corporate income tax. Furthermore, pass-through entities get a 20% income tax exemption on their dividend payouts to shareholders, making them even more attractive as tax-advantaged investments.

On top of that, the real estate intensity of the business model often means that they get to write off a significant portion of their rental income as the depreciation of their assets. While many REITs do not have much depreciation to write off, some get to classify a surprisingly large percentage of their dividends as depreciation, making them remarkably tax-efficient even in a taxable account.

The downside is that REITs only reveal the tax classification of their dividends after they have been paid out, so it can be difficult for investors to know which REITs are best to hold in a taxable account as opposed to a tax-advantaged account like an IRA or 401k. As a result, some may simply play it safe and hold all REITs – especially the highest-yielding ones – in a tax-advantaged account. That said, if you notice that a specific REIT has developed a recent pattern of paying out a high percentage of its dividends as a return of capital, there is a good chance that it will remain that way for the foreseeable future as this may simply be due to its unique business model.

Ultimately, REITs are most valued for their income, and investors will typically be best served by focusing primarily on the dividend yield, valuation, management, balance sheet strength, and underlying real estate quality over the tax intricacies of the dividends. Still, it is worthwhile for investors in high-income tax brackets who own a substantial REIT portfolio to try to hold more tax-efficient REITs in taxable accounts. Note that this is not tax advice, and readers are strongly encouraged to do their due diligence before investing.

You may also be looking for appealing stocks from a certain stock market sector to ensure appropriate diversification within your portfolio. If that is the case, you will find the following resources useful:

You may also wish to consider other investments within the major market indices. Our downloadable list of small-cap U.S. stocks can be accessed below:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Originally Posted on suredividend.com