Welcome back to another dividend stock watch list article! The stock market is still down almost 19% year-to-date, but the last full week of October there definitely was a big push!

What does that mean? Undervalued dividend stocks to buy now, baby! As a frugal individual and dividend investor, I love nothing more than buying dividend stocks on sale! Bring it on recession and upcoming interest rate hikes, just bring it!

Therefore, as I do every month, here is the Dividend Stock Watch List for November 2022!

Dividend stock watch list

Another dividend stock watch list! The stock market has been more volatile than ever since the pandemic of 2020. What does that mean? New undervalued dividend stocks are coming to light baby! It’s all about buying dividend income producing stocks – the best source of passive income source on your journey to financial freedom!

The stock market, specifically the S&P 500, is still below 4,000. I didn’t think we’d be here, with all of the negative news going on. However, the quarterly earning releases increased the stock market to finish off October.

From the all-time highs of 4,800, dropping to almost 3,500 and holding steady at 3,900. We were in recent bear territory, but have come back up from being down over 20% to now down 19%. What a volatile time period we are in! Chart is below:

Interest rates are still low on your savings, including high yield savings, accounts, as well as money market accounts & funds. However, rates will still rise over the next 6 months, with another 75 basis point rate hike coming. Ally, where I hold a significant amount of cash, is yielding 2.35%. However, there is one specific Bank / Fintech application that I use so much more now…

I keep MORE savings in my SoFi savings account – as it earns me – now – 2.50% on my checking AND savings account! Completely blowing other products out of the water.

In addition, I’ve been buying stocks on SoFi’s investing application (hint, if you sign up YOU get free stock! You can automatically buy partial shares as frequent as you want. Absolutely love investing with SoFi and cannot stop recommending their platform.

Related: 3 Financial Freedom Products I am using to finish off 2022

In addition, given the uncertainty, I continue to make weekly investments into Vanguard Exchange Traded Funds (ETFs). The specific ETF my wife and I have been loading up on is Vanguard High Dividend Yield (VYM). We are investing approximately $600 per week into Vanguard (pending the VYM stock price), to stay invested in the market, during the uncertain times. In addition, I am also investing $60 per day into Vanguard S&P 500 ETF (VOO)!

Related: Why I’m Investing $500 Weekly with Vanguard ETFs

Related: Dividend Investing Strategy Added – BUYING $50 per day of VOO

Therefore, on the road to financial freedom, acquiring assets that produce cash flow or income is the goal! Like I always say, there is always a diamond in the rough. How do I find an undervalued dividend stock? Time to introduce our beloved Dividend Diplomat Stock Screener!

Dividend Diplomat Stock Screener

If you don’t know already, we keep the stock screener metrics to THREE SIMPLE items. They are:

1.) Price to Earnings Ratio – We look for a price to earnings ratio < than the overall Stock Market.

2.)Payout Ratio – We aim for a payout ratio between of less than 60%.

3.)Dividend Growth – We like to see history of dividend growth in a company.

See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

https://youtu.be/oimCqajeCIk

Time to find the answer to… how did the dividend stocks on my watch list grade on the stock screener?

Dividend stock watch list

Here is the list of dividend stocks that are on my radar going into the month of November 2022. I typically like to keep it at 2-3 dividend stocks, keeping the focus locked in. Finding dividend stocks isn’t easy, but there are also other factors, such as composition of my portfolio by industry (such as – am I overweight/underweight in an industry), as well as exposure to one stock and the concentration there.

There, the dividend stocks on my list cater to those other facets when building a dividend stock portfolio. This is a fairly defensive, consumer-goods intensive, dividend stock watch list!

Diageo (DEO)

Diageo (DEO) is still on the dividend stock watch list yet again. The stock price keeps coming down over the course of the year, like the rest of the stock market. Diageo is a deep liquor and adult beverage company. They are in 180 countries, over 200 brands of alcoholic beverages with over 27,000 employees, based in England. They remain on my dividend stock watch list. Why? Diageo stock was originally on my watch list at $190.44. Then the stock dropped in September to $179.58. Now, Diageo stock is now down another $11 since last article to $168.01. Therefore, since the first entrance on the watch list, the stock price is down $22 or close to 12%.

Therefore, this increases the dividend yield and dividend stock metric ratios. That is what I think it’s now an even better time to buy this stock, who doesn’t love a stock when it is on sale? Diageo is a recession proof stock, as, sadly, people flock to drinking during tough times. I’ll cheers to the good times, folks!

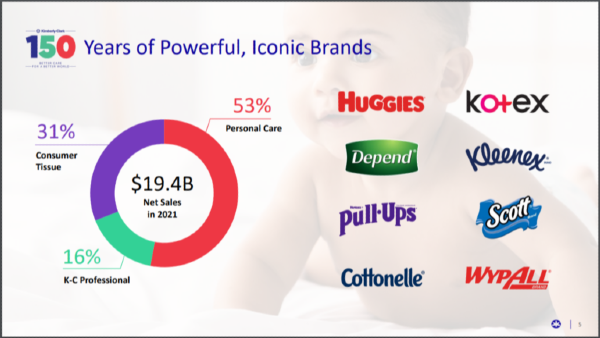

Here is a summary in picture form of some of their brands:

Diageo, since they sell and distribute alcoholic beverages, tend to fare better during recessionary and inflationary time periods. Most People continue to drink and consume, and Diageo passes on cost increases down to the consumer. In addition, they recently released their latest earnings – net sales are up a staggering 21.4%!

First, however, we MUST run Diageo through the Dividend Diplomats Stock Screener, which is focused on these 3 metrics.

1.) Price to Earnings Ratio:

Earnings is approximately $8.15 in earnings per share. Therefore, the stock is trading at approximately 20.6x current earnings. Next year, analysts do estimate to be approximately $8.75 in EPS. However, the stock is still trading a tad on the high side, but showing more value here!

2.) Payout Ratio:

Diageo’s dividend is paid 2x per year – once in April and the second dividend in October. This is an American Depository Receipt (ADR), since they are based in UK. Therefore, they announce their dividend in Pence, but the conversion is approximately $4.077 in a forward, total dividend. They stick to a 50% dividend payout ratio policy (i.e. 1.8 to 2.2 earning coverage). Therefore, they are always in that sweet spot, the perfect payout ratio range.

3.) Dividend Growth:

Since they are an International based company, Diageo’s dividend growth is hard to say. Therefore, I thought the chart would be nice to showcase below. The trend is up needless to say, over the last 10 years. Drinks keep flowing and the dividend keeps growing!

The dividend yield is at 2.42%, up from September’s watch list dividend yield of 2.28%. In addition, Diageo yields well above the S&P 500 and is a better yield on average than the majority of high quality stocks. I’ve owned them for years and this is definitely a recession and inflation proof stock – always being used and can pass on the costs to the consumer.

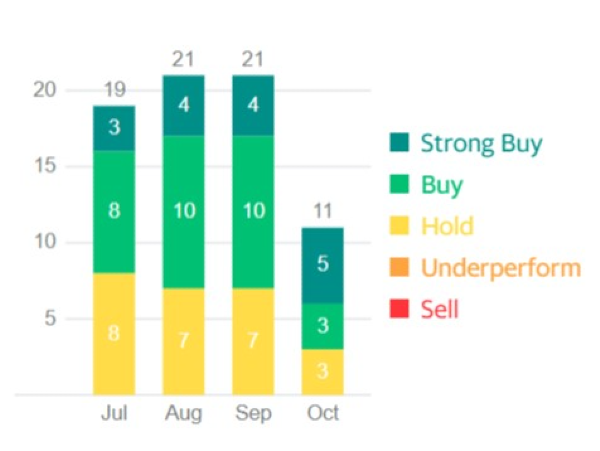

United Parcel Services (UPS)

UPS is a recognizable company across the world. Given the world is built on e-commerce and shipping/logistics, UPS plays a major part in the global economy.

UPS is set to earn over $100B in revenue and they’ve been able to have a solid year in 2022, by passing on costs to the consumer.

UPS has a current ratio of 1.39x, with $11B in cash and equivalents. Therefore, UPS has the ability to stay agile and mobile during an ever-changing global economy.

UPS has also consistently raised their dividend every year. They also increased their dividend 50% this year. What a great dividend growth stock, right?!

Let’s run UPS through the dividend stock metrics, to see if this could be a dividend stock to buy now.

1.) P/E Ratio: UPS analysts are anticipating $12.37 of earnings for the year 2022. At a share price of $167.17, the price to earnings ratio is 13.51x.

2.) Dividend Payout Ratio: UPS pays a quarterly dividend of $1.52 per share or $6.08 per year. That equates to a dividend payout ratio of less than 50%. UPS has no doubt they can pay and increase the dividend going forward.

3.) Dividend Growth Rate: UPS has increased the dividend for over 12 years, with an average dividend growth rate of over 6%. As stated earlier, they increased their dividend by almost 50% in the last year!

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for UPS is now yielding 3.64!

Other Dividend Stocks to buy

I am also considering, as a quick hitter approach here, my eyes are on a few other stocks. Those stocks are 3M (MMM), T. Rowe Price (TROW), Paramount (PARA) and GSK (GSK). Stocks that are just beat up, no doubt.

I own each stock and am constantly evaluating the stock market, to see if there are undervalued dividend stocks to buy in this wild market.

Dividend Stock Watch List Conclusion

Dividend investing is real and is happening! Here is our latest video covering three undervalued dividend growth stocks are getting crushed this year:

Of course, prior to making any purchase, I definitely will make sure to run them through the Dividend Diplomat Stock Screener once more.

Two different industries and two completely different price points. If Diageo (DEO) hits below $160, it will be hard not to buy a share or two. In addition, I love UPS at these prices, they hit every single dividend stock metric!

Related: 5 Reasons Dividend Income is the Easiest Passive Income Source

As you have noticed, I have trickled many articles on this page. The goal is to educate new dividend investors out there, or to sharpen the terminology for current dividend investors. As always, stick to your investment strategy and dividend stocks will be there. What do you think of these stocks above? Thank you, good luck and happy investing everyone!

-Lanny

Welcome back to another dividend stock watch list article! The stock market is still down almost 19% year-to-date, but the last full week of October there definitely was a big push!

What does that mean? Undervalued dividend stocks to buy now, baby! As a frugal individual and dividend investor, I love nothing more than buying dividend stocks on sale! Bring it on recession and upcoming interest rate hikes, just bring it!

Therefore, as I do every month, here is the Dividend Stock Watch List for November 2022!

Dividend stock watch list

Another dividend stock watch list! The stock market has been more volatile than ever since the pandemic of 2020. What does that mean? New undervalued dividend stocks are coming to light baby! It’s all about buying dividend income producing stocks – the best source of passive income source on your journey to financial freedom!

The stock market, specifically the S&P 500, is still below 4,000. I didn’t think we’d be here, with all of the negative news going on. However, the quarterly earning releases increased the stock market to finish off October.

From the all-time highs of 4,800, dropping to almost 3,500 and holding steady at 3,900. We were in recent bear territory, but have come back up from being down over 20% to now down 19%. What a volatile time period we are in! Chart is below:

Interest rates are still low on your savings, including high yield savings, accounts, as well as money market accounts & funds. However, rates will still rise over the next 6 months, with another 75 basis point rate hike coming. Ally, where I hold a significant amount of cash, is yielding 2.35%. However, there is one specific Bank / Fintech application that I use so much more now…

I keep MORE savings in my SoFi savings account – as it earns me – now – 2.50% on my checking AND savings account! Completely blowing other products out of the water.

In addition, I’ve been buying stocks on SoFi’s investing application (hint, if you sign up YOU get free stock! You can automatically buy partial shares as frequent as you want. Absolutely love investing with SoFi and cannot stop recommending their platform.

Related: 3 Financial Freedom Products I am using to finish off 2022

In addition, given the uncertainty, I continue to make weekly investments into Vanguard Exchange Traded Funds (ETFs). The specific ETF my wife and I have been loading up on is Vanguard High Dividend Yield (VYM). We are investing approximately $600 per week into Vanguard (pending the VYM stock price), to stay invested in the market, during the uncertain times. In addition, I am also investing $60 per day into Vanguard S&P 500 ETF (VOO)!

Related: Why I’m Investing $500 Weekly with Vanguard ETFs

Related: Dividend Investing Strategy Added – BUYING $50 per day of VOO

Therefore, on the road to financial freedom, acquiring assets that produce cash flow or income is the goal! Like I always say, there is always a diamond in the rough. How do I find an undervalued dividend stock? Time to introduce our beloved Dividend Diplomat Stock Screener!

Dividend Diplomat Stock Screener

If you don’t know already, we keep the stock screener metrics to THREE SIMPLE items. They are:

1.) Price to Earnings Ratio – We look for a price to earnings ratio < than the overall Stock Market. 2.)Payout Ratio – We aim for a payout ratio between of less than 60%. 3.)Dividend Growth – We like to see history of dividend growth in a company. See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

https://youtu.be/oimCqajeCIk

Time to find the answer to… how did the dividend stocks on my watch list grade on the stock screener?

Dividend stock watch list

Here is the list of dividend stocks that are on my radar going into the month of November 2022. I typically like to keep it at 2-3 dividend stocks, keeping the focus locked in. Finding dividend stocks isn’t easy, but there are also other factors, such as composition of my portfolio by industry (such as – am I overweight/underweight in an industry), as well as exposure to one stock and the concentration there.

There, the dividend stocks on my list cater to those other facets when building a dividend stock portfolio. This is a fairly defensive, consumer-goods intensive, dividend stock watch list!

Diageo (DEO)

Diageo (DEO) is still on the dividend stock watch list yet again. The stock price keeps coming down over the course of the year, like the rest of the stock market. Diageo is a deep liquor and adult beverage company. They are in 180 countries, over 200 brands of alcoholic beverages with over 27,000 employees, based in England. They remain on my dividend stock watch list. Why? Diageo stock was originally on my watch list at $190.44. Then the stock dropped in September to $179.58. Now, Diageo stock is now down another $11 since last article to $168.01. Therefore, since the first entrance on the watch list, the stock price is down $22 or close to 12%.

Therefore, this increases the dividend yield and dividend stock metric ratios. That is what I think it’s now an even better time to buy this stock, who doesn’t love a stock when it is on sale? Diageo is a recession proof stock, as, sadly, people flock to drinking during tough times. I’ll cheers to the good times, folks!

Here is a summary in picture form of some of their brands:

Diageo, since they sell and distribute alcoholic beverages, tend to fare better during recessionary and inflationary time periods. Most People continue to drink and consume, and Diageo passes on cost increases down to the consumer. In addition, they recently released their latest earnings – net sales are up a staggering 21.4%!

First, however, we MUST run Diageo through the Dividend Diplomats Stock Screener, which is focused on these 3 metrics.

1.) Price to Earnings Ratio:

Earnings is approximately $8.15 in earnings per share. Therefore, the stock is trading at approximately 20.6x current earnings. Next year, analysts do estimate to be approximately $8.75 in EPS. However, the stock is still trading a tad on the high side, but showing more value here!

2.) Payout Ratio:

Diageo’s dividend is paid 2x per year – once in April and the second dividend in October. This is an American Depository Receipt (ADR), since they are based in UK. Therefore, they announce their dividend in Pence, but the conversion is approximately $4.077 in a forward, total dividend. They stick to a 50% dividend payout ratio policy (i.e. 1.8 to 2.2 earning coverage). Therefore, they are always in that sweet spot, the perfect payout ratio range.

3.) Dividend Growth:

Since they are an International based company, Diageo’s dividend growth is hard to say. Therefore, I thought the chart would be nice to showcase below. The trend is up needless to say, over the last 10 years. Drinks keep flowing and the dividend keeps growing!

The dividend yield is at 2.42%, up from September’s watch list dividend yield of 2.28%. In addition, Diageo yields well above the S&P 500 and is a better yield on average than the majority of high quality stocks. I’ve owned them for years and this is definitely a recession and inflation proof stock – always being used and can pass on the costs to the consumer.

United Parcel Services (UPS)

UPS is a recognizable company across the world. Given the world is built on e-commerce and shipping/logistics, UPS plays a major part in the global economy.

UPS is set to earn over $100B in revenue and they’ve been able to have a solid year in 2022, by passing on costs to the consumer.

UPS has a current ratio of 1.39x, with $11B in cash and equivalents. Therefore, UPS has the ability to stay agile and mobile during an ever-changing global economy.

UPS has also consistently raised their dividend every year. They also increased their dividend 50% this year. What a great dividend growth stock, right?!

Let’s run UPS through the dividend stock metrics, to see if this could be a dividend stock to buy now.

1.) P/E Ratio: UPS analysts are anticipating $12.37 of earnings for the year 2022. At a share price of $167.17, the price to earnings ratio is 13.51x.

2.) Dividend Payout Ratio: UPS pays a quarterly dividend of $1.52 per share or $6.08 per year. That equates to a dividend payout ratio of less than 50%. UPS has no doubt they can pay and increase the dividend going forward.

3.) Dividend Growth Rate: UPS has increased the dividend for over 12 years, with an average dividend growth rate of over 6%. As stated earlier, they increased their dividend by almost 50% in the last year!

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for UPS is now yielding 3.64!

Other Dividend Stocks to buy

I am also considering, as a quick hitter approach here, my eyes are on a few other stocks. Those stocks are 3M (MMM), T. Rowe Price (TROW), Paramount (PARA) and GSK (GSK). Stocks that are just beat up, no doubt.

I own each stock and am constantly evaluating the stock market, to see if there are undervalued dividend stocks to buy in this wild market.

Dividend Stock Watch List Conclusion

Dividend investing is real and is happening! Here is our latest video covering three undervalued dividend growth stocks are getting crushed this year:

Of course, prior to making any purchase, I definitely will make sure to run them through the Dividend Diplomat Stock Screener once more.

Two different industries and two completely different price points. If Diageo (DEO) hits below $160, it will be hard not to buy a share or two. In addition, I love UPS at these prices, they hit every single dividend stock metric!

Related: 5 Reasons Dividend Income is the Easiest Passive Income Source

As you have noticed, I have trickled many articles on this page. The goal is to educate new dividend investors out there, or to sharpen the terminology for current dividend investors. As always, stick to your investment strategy and dividend stocks will be there. What do you think of these stocks above? Thank you, good luck and happy investing everyone!

-Lanny

Originally Posted on dividenddiplomats.com