On one side, the end of the pandemic revived many businesses to the pre-Covid situation; it has negatively affected the growth of other companies.

Many tech-based business models, including Best Buy Co, flourished during the shutdown of the world. As soon as the world came out of its isolation, it caused a drastic drop in the profits and revenues of these retail companies.

Best Buy made many breakthroughs during the pandemic when people started making a living from the comfort of their homes, ultimately increasing the demand for electronic gadgets like laptops. On the other hand, many people spend their time using video games purchased from Best Buy.

Now the question arises, "Is BBY a Buy or Sell?" after the recent increase in inflation where consumers are pulling back their spending on consumer electronics. In addition, they are shifting their consumption drastically toward necessities and energy. In this scenario, is it wise to invest or hold the best buy stock, which performs well when the consumer sentiment is improving?

Soon, we don't see a halt in rising energy prices and interest rates. The hawkish FED is taking a toll on the retail industry, where demand has lowered, and spending patterns have been limited to the necessities of life. Let’s try to discover the Best Buy Stock!

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE) and its SRE Stock Forecast, Edison International Stock (EIX), Dominion Energy Stock (D) and NRG Energy Stock

What Does Best Buy Co. Inc Do?

Best Buy, formerly an audio store, has an exciting history. It started as a smaller stereo business in 1966, when Richard M. Schulz, CEO of Best Buy, kickstarted his business with his savings. He also secured a loan on his family's house for this venture.

Soon, the business expanded further and earned millions in revenue. In 1981, the Sound of Music was rebranded as Best Buy with seven stores. Moreover, it extended its products to selling VCRs and home appliances. In 1985, it was made a public limited company and was listed on the NYSE.

Best Buy makes huge revenues from the computer and other electronic gadgets, including video games and mobile phones. Geek Squad, Magnolia Audio Video, and Pacific Sales are the subsidiaries of Best Buy. Moreover, it has also operated in Canada, Europe, and China.

Best Buy Stock Price

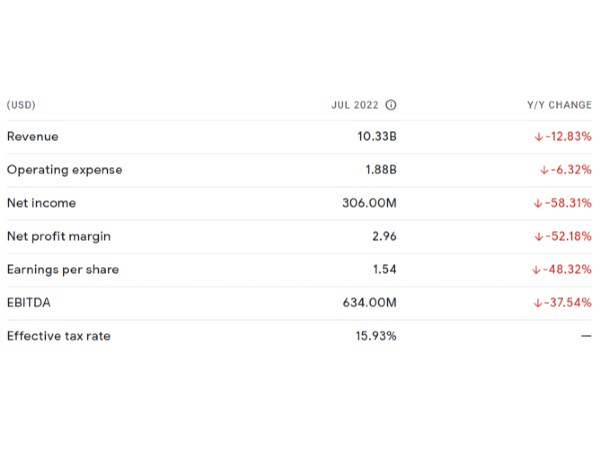

Best Buy Stock has gone down by 37.55% year-to-date (YTD). The revenues of Best Buy Stock were 12.83% down year on year basis in the quarterly report of July 2022. The net income fell by 58.31% and stood at 306 million. Earnings-per-share also slid away by 48.32% due to the low demand for electronic products amid rising inflation.

| Stock Metrics |

Values |

| Market Capitalization |

15.29B USD |

| 52-Week Range |

$60.78 - $141.97 |

| P/E Ratio |

8.53 |

| Outstanding Shares |

226 million |

| Beta |

1.14 |

| Dividend Yield |

5.52% |

| CDP Climate Change Score |

A |

| EPS (TTM) |

7.47 |

The Return on Assets is 11.49%, much better than the industry average of 6.60%. The Price-to-earnings ratio of Best Buy stock is close to the industry average of 7.40. Similarly, the Enterprise value or EBITDA, 4.96, is similar to the industry average of 4.54.

Likewise, the Best Buy Stock is valued at the correct level as its price-to-book value is in line with the industry average of 5.14. So, we can say that the fundamentals are vital for Best Buy Stock.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

Will Best Buy Stock Go Up?

Best Buy Co. Inc's forecast is solid even when the stock price has plummeted to its lowest since last year. However, the stock price forecast is still optimistic if we look back at the historical price trends of Best Buy Stock. Best Buy Stock has always recovered from the changing marketing dynamics, adopting the latest retail trends.

This year, BBY adopted the digital stores method to boost their earnings. Nevertheless, the demand for BBY products is still low due to the bearish market trends. However, the analysts expect the price in the upcoming 52 weeks to be between $57.39 and $80.74 after the bearish consumer sentiments end. Earnings of BBY are expected to grow by 9.97% year on year basis.

Read Also: Visa (V) and Bank of America (BAC)

Best Buy Co. Inc ESG Report

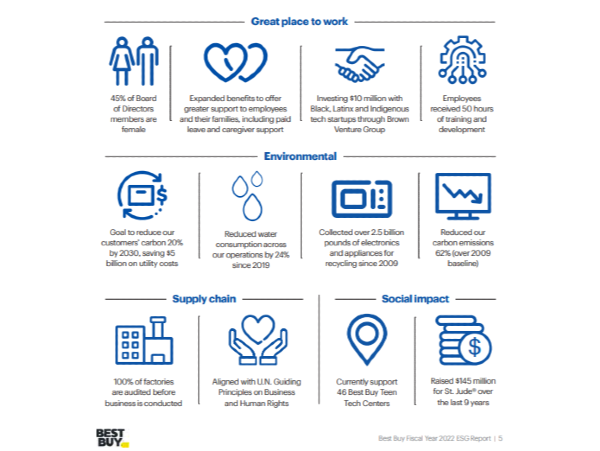

Best buy has performed much better and improved its CDP (Climate Disclosure Project) score. Going beyond the disclosure, awareness, and management levels, they achieved the highest score by getting an A score for leadership in Carbon Reduction and Disclosure in 2015.

Committed to achieving sustainability, BBY is striving to reduce carbon emissions and make this planet free of harmful and toxic gases. Best Buy aims to become a leader in the retail industry of the USA. In their pledge to be carbon-free by 2040, they launched the most extensive e-waste recycling program in the US. This initiative aims to encourage people to adopt sustainable activities while throwing away their waste.

They have recycled 2.5 billion pounds of e-waste in 2022, as described proudly in their ESG annual report. On the other hand, the company is performing impressively by ensuring diversity and efficiency at their workplace, with 45% of the women as members of directors and delivering 50 hours of training and courses.

On the environmental aspect, the retail company reduced carbon emissions by 62% as the 2009 baseline. That's an outstanding achievement, and they are socially delivering excellent services by offering 46 Best Buy Teen Tech centers and raised $145 million for St. Jude since 2013.

You can read the complete Best Buy ESG Report 2022 here.

The Bottom Line

After all this discussion, you might be confused about whether BBY is a buy or sell stock. The analysts suggest that investors hold this stock to diversify their portfolio due to the recuperating nature of this stock.

As soon as the market recovers from the bearish market, the retail industry will be back on track with higher consumer demand for electronics and computer gadgets.

Besides, the BBY offers an excellent opportunity for investors who want to invest in undervalued stocks. Currently, this stock is below the fair value of $78.09.

On one side, the end of the pandemic revived many businesses to the pre-Covid situation; it has negatively affected the growth of other companies. Many tech-based business models, including Best Buy Co, flourished during the shutdown of the world. As soon as the world came out of its isolation, it caused a drastic drop in the profits and revenues of these retail companies.

Best Buy made many breakthroughs during the pandemic when people started making a living from the comfort of their homes, ultimately increasing the demand for electronic gadgets like laptops. On the other hand, many people spend their time using video games purchased from Best Buy.

Now the question arises, "Is BBY a Buy or Sell?" after the recent increase in inflation where consumers are pulling back their spending on consumer electronics. In addition, they are shifting their consumption drastically toward necessities and energy. In this scenario, is it wise to invest or hold the best buy stock, which performs well when the consumer sentiment is improving?

Soon, we don't see a halt in rising energy prices and interest rates. The hawkish FED is taking a toll on the retail industry, where demand has lowered, and spending patterns have been limited to the necessities of life. Let’s try to discover the Best Buy Stock!

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE) and its SRE Stock Forecast, Edison International Stock (EIX), Dominion Energy Stock (D) and NRG Energy Stock

What Does Best Buy Co. Inc Do?

Best Buy, formerly an audio store, has an exciting history. It started as a smaller stereo business in 1966, when Richard M. Schulz, CEO of Best Buy, kickstarted his business with his savings. He also secured a loan on his family's house for this venture.

Soon, the business expanded further and earned millions in revenue. In 1981, the Sound of Music was rebranded as Best Buy with seven stores. Moreover, it extended its products to selling VCRs and home appliances. In 1985, it was made a public limited company and was listed on the NYSE.

Best Buy makes huge revenues from the computer and other electronic gadgets, including video games and mobile phones. Geek Squad, Magnolia Audio Video, and Pacific Sales are the subsidiaries of Best Buy. Moreover, it has also operated in Canada, Europe, and China.

Best Buy Stock Price

Best Buy Stock has gone down by 37.55% year-to-date (YTD). The revenues of Best Buy Stock were 12.83% down year on year basis in the quarterly report of July 2022. The net income fell by 58.31% and stood at 306 million. Earnings-per-share also slid away by 48.32% due to the low demand for electronic products amid rising inflation.

The Return on Assets is 11.49%, much better than the industry average of 6.60%. The Price-to-earnings ratio of Best Buy stock is close to the industry average of 7.40. Similarly, the Enterprise value or EBITDA, 4.96, is similar to the industry average of 4.54.

Likewise, the Best Buy Stock is valued at the correct level as its price-to-book value is in line with the industry average of 5.14. So, we can say that the fundamentals are vital for Best Buy Stock.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

Will Best Buy Stock Go Up?

Best Buy Co. Inc's forecast is solid even when the stock price has plummeted to its lowest since last year. However, the stock price forecast is still optimistic if we look back at the historical price trends of Best Buy Stock. Best Buy Stock has always recovered from the changing marketing dynamics, adopting the latest retail trends.

This year, BBY adopted the digital stores method to boost their earnings. Nevertheless, the demand for BBY products is still low due to the bearish market trends. However, the analysts expect the price in the upcoming 52 weeks to be between $57.39 and $80.74 after the bearish consumer sentiments end. Earnings of BBY are expected to grow by 9.97% year on year basis.

Read Also: Visa (V) and Bank of America (BAC)

Best Buy Co. Inc ESG Report

Best buy has performed much better and improved its CDP (Climate Disclosure Project) score. Going beyond the disclosure, awareness, and management levels, they achieved the highest score by getting an A score for leadership in Carbon Reduction and Disclosure in 2015.

Committed to achieving sustainability, BBY is striving to reduce carbon emissions and make this planet free of harmful and toxic gases. Best Buy aims to become a leader in the retail industry of the USA. In their pledge to be carbon-free by 2040, they launched the most extensive e-waste recycling program in the US. This initiative aims to encourage people to adopt sustainable activities while throwing away their waste.

They have recycled 2.5 billion pounds of e-waste in 2022, as described proudly in their ESG annual report. On the other hand, the company is performing impressively by ensuring diversity and efficiency at their workplace, with 45% of the women as members of directors and delivering 50 hours of training and courses.

On the environmental aspect, the retail company reduced carbon emissions by 62% as the 2009 baseline. That's an outstanding achievement, and they are socially delivering excellent services by offering 46 Best Buy Teen Tech centers and raised $145 million for St. Jude since 2013.

You can read the complete Best Buy ESG Report 2022 here.

The Bottom Line

After all this discussion, you might be confused about whether BBY is a buy or sell stock. The analysts suggest that investors hold this stock to diversify their portfolio due to the recuperating nature of this stock.

As soon as the market recovers from the bearish market, the retail industry will be back on track with higher consumer demand for electronics and computer gadgets.

Besides, the BBY offers an excellent opportunity for investors who want to invest in undervalued stocks. Currently, this stock is below the fair value of $78.09.