Goog earnings for the second quarter of 2022 were a near miss from achieving their target earnings. Nevertheless, the investors were seen as confident after a few hours of the announcement of the Alphabet stock.

The Alphabet stock activity climbed up by 4% after-hours trading, and the shares gained momentum since Alphabet shared the quarterly reports. The primary revenue was drawn from the Google advertisement, YouTube and the Google search.

Alphabet Inc.

Alphabet Inc is a parent company of both Goog and Googl. Established in 2015, this American multinational corporation was listed on New York Stock Exchange (NYSE) in 2015. Alphabet has categorized the stocks into Class A and Class C.

Read about why is Apple dividend so low? and Will Meta Stock Go Up?

Class A represents stocks with the highest value, and only more mature investors can invest in these stocks. These shares provide voting rights to the shareholders. On the other hand, class C stocks are those without the entitlement of any shareholder votes.

Which is better?

Well, an investor with a forever holding period in mind should buy Class A shares. Conversely, if you want to keep Alphabet shares for a shorter time, then Class C shares are the best for you.

Alphabet had shown solid growth and resilient earnings during the Covid-19 due to the digital advertising boom and YouTube Ads. People were googling everything from products to buy online to providing services virtually.

After the Covid-19, the recovery phase ended with an overheated economy, causing inflation to rise; Alphabet stocks revenues also jumped up. However, the current economic slowdown has caused Alphabet stocks to dip in earnings and revenues.

Read my Analysis of the Visa (V), Netflix (NFLX) and Bank of America (BAC)

Goog Earnings Quarter 2 Report

The Quarter 2 report by the Alphabet stock has shown higher revenues yet slightly lower than expected ones. Still, the Alphabet stock showed solid results compared to other NASDAQ stocks.

The earnings-per-share (EPS) was reported at $1.21 lower than the expectations of $1.28

The revenues increased was only 13% this quarter against the 62% last year in the same quarter. The Goog CFO has shown optimism about the future resilient growth due to the heavy research & development investment into the Cloud services and the algorithms- the backbone of the Alphabet Corporation.

The Goog revenues reached $69.7 billion compared to $61.9 billion in 2021. The significant drag on profits was the higher spending on the latest projects and sales and marketing. A Breakdown of Google Revenue

| Breakdown |

Revenue |

| Google Search & Other |

$40.7 Billion |

| Google’s Cloud Business |

$6.2 billion |

| YouTube Advertising |

$7.3 Billion |

|

|

|

|

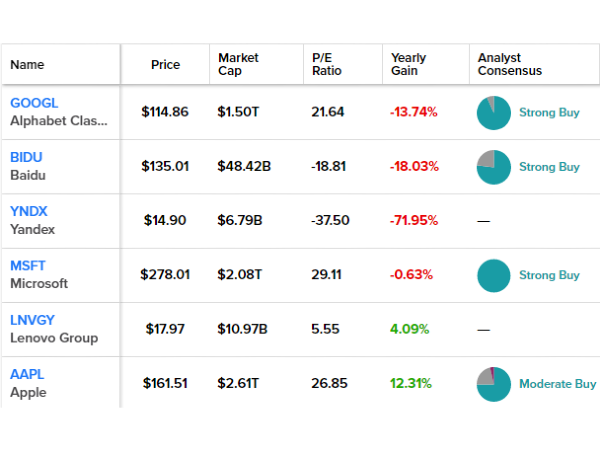

The current price of Goog stock is $115.48. The stock split on July 15 was paid in dividends to all its shareholders. The stock split of 20-for-1 was the most prominent stock split of 2022.

Many companies announced stock splits in the current year. For example, Amazon also announced a stock split of a 20-to-1 stock split. Shopify joined the stock splits with 10-to-1 in June 2022. Tesla will reveal a stock split of 6-for-1 in August.

If you are looking for recession-proof utility stocks, read my stock analysis on Sempra Energy Stock (SRE), SRE Stock Forecast, Dominion Energy Stock (D), NRG Energy Stock and Edison International Stock (EIX).

The Alphabet stock stopped hiring new employees due to the downward economic landscape. Alphabet has predicted a depressed yet steady growth over the third quarter.

The revenues slipped by the company due to the strength of the US Dollars as Google earns income denominated in other currencies while it makes payments in the USD. This fluctuation caused the revenues to drop in the second quarter.

The competitors of YouTube like TikTok are providing a challenging time for YouTube and google competitors like Amazon and Microsoft as the main rivals.

The Bottom Line

The Alphabet stock's second-quarter earnings have shown solid results, and it is a recession-proof stock as everybody uses Google services even during depressed times. The revenues and profits dropped by a few points, but steady growth in Google earnings is going on a slid trajectory.

So, if you want to buy this stock, you can buy Alphabet stocks to earn higher revenues for a long time. The fundamentals of the corporation are resilient and steady. The low price has attracted many investors who want to invest in the lowest-price yet solid stocks with a long-term investment outlook.

Goog earnings for the second quarter of 2022 were a near miss from achieving their target earnings. Nevertheless, the investors were seen as confident after a few hours of the announcement of the Alphabet stock.

The Alphabet stock activity climbed up by 4% after-hours trading, and the shares gained momentum since Alphabet shared the quarterly reports. The primary revenue was drawn from the Google advertisement, YouTube and the Google search.

Alphabet Inc.

Alphabet Inc is a parent company of both Goog and Googl. Established in 2015, this American multinational corporation was listed on New York Stock Exchange (NYSE) in 2015. Alphabet has categorized the stocks into Class A and Class C.

Read about why is Apple dividend so low? and Will Meta Stock Go Up?

Class A represents stocks with the highest value, and only more mature investors can invest in these stocks. These shares provide voting rights to the shareholders. On the other hand, class C stocks are those without the entitlement of any shareholder votes.

Which is better?

Well, an investor with a forever holding period in mind should buy Class A shares. Conversely, if you want to keep Alphabet shares for a shorter time, then Class C shares are the best for you.

Alphabet had shown solid growth and resilient earnings during the Covid-19 due to the digital advertising boom and YouTube Ads. People were googling everything from products to buy online to providing services virtually. After the Covid-19, the recovery phase ended with an overheated economy, causing inflation to rise; Alphabet stocks revenues also jumped up. However, the current economic slowdown has caused Alphabet stocks to dip in earnings and revenues.

Read my Analysis of the Visa (V), Netflix (NFLX) and Bank of America (BAC)

Goog Earnings Quarter 2 Report

The Quarter 2 report by the Alphabet stock has shown higher revenues yet slightly lower than expected ones. Still, the Alphabet stock showed solid results compared to other NASDAQ stocks.

The earnings-per-share (EPS) was reported at $1.21 lower than the expectations of $1.28

The revenues increased was only 13% this quarter against the 62% last year in the same quarter. The Goog CFO has shown optimism about the future resilient growth due to the heavy research & development investment into the Cloud services and the algorithms- the backbone of the Alphabet Corporation.

The Goog revenues reached $69.7 billion compared to $61.9 billion in 2021. The significant drag on profits was the higher spending on the latest projects and sales and marketing. A Breakdown of Google Revenue

The current price of Goog stock is $115.48. The stock split on July 15 was paid in dividends to all its shareholders. The stock split of 20-for-1 was the most prominent stock split of 2022.

Many companies announced stock splits in the current year. For example, Amazon also announced a stock split of a 20-to-1 stock split. Shopify joined the stock splits with 10-to-1 in June 2022. Tesla will reveal a stock split of 6-for-1 in August.

If you are looking for recession-proof utility stocks, read my stock analysis on Sempra Energy Stock (SRE), SRE Stock Forecast, Dominion Energy Stock (D), NRG Energy Stock and Edison International Stock (EIX).

The Alphabet stock stopped hiring new employees due to the downward economic landscape. Alphabet has predicted a depressed yet steady growth over the third quarter.

The revenues slipped by the company due to the strength of the US Dollars as Google earns income denominated in other currencies while it makes payments in the USD. This fluctuation caused the revenues to drop in the second quarter.

The competitors of YouTube like TikTok are providing a challenging time for YouTube and google competitors like Amazon and Microsoft as the main rivals.

The Bottom Line

The Alphabet stock's second-quarter earnings have shown solid results, and it is a recession-proof stock as everybody uses Google services even during depressed times. The revenues and profits dropped by a few points, but steady growth in Google earnings is going on a slid trajectory.

So, if you want to buy this stock, you can buy Alphabet stocks to earn higher revenues for a long time. The fundamentals of the corporation are resilient and steady. The low price has attracted many investors who want to invest in the lowest-price yet solid stocks with a long-term investment outlook.