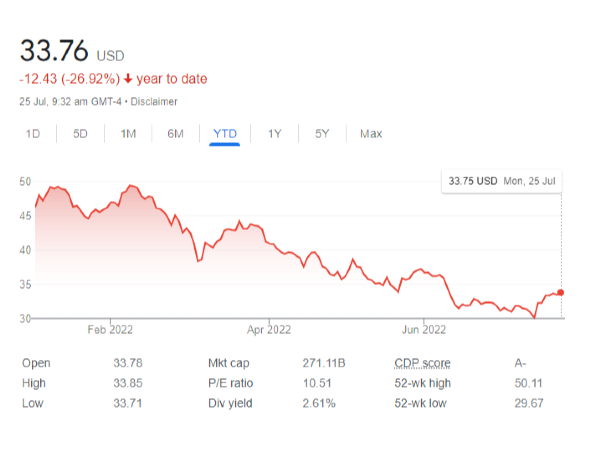

Why is the Netflix stock drop on a binge in 2022 and what has happened to Netflix? Is Netflix losing revenues after the world came out of its pandemic-led isolations and quarantines? The Netflix honeymoon with the shut-down of the world is over.

Many people are worried about the current pessimist economic situation and the Netflix stock drop. Is it worth buying, selling or holding this stock in a panic-led condition?

Let's explore these questions and other sentiments of the investors in this article and shed light on the future outlook of this entertainment stock. Are you struggling to find an answer to this question? Continue reading and you will find the answers to all these questions.

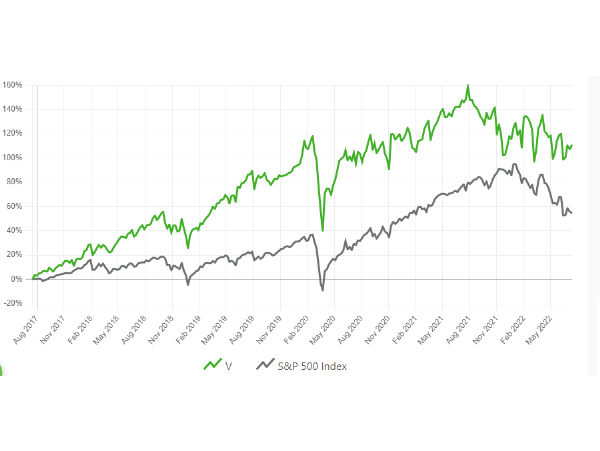

Read Also an Analysis on the FinTech stock of Visa (V) & Large-Cap Stock of Bank of America (BAC)

Netflix - Streaming Media Company

Netflix is an entertainment streaming service provider worldwide with over 222 million subscribers. The number of people watching Netflix series, movies, documentaries and mobile games goes beyond this number if we consider the shared number of accounts.

Founded in 1998, Netflix sustained competition for a long time and witnessed impressive growth. However, the picture changed dramatically after the Covid period ended in 2021. Similarly, the cutting-edge competition from Walt Disney, Prime Video and Comcast also took a significant market share.

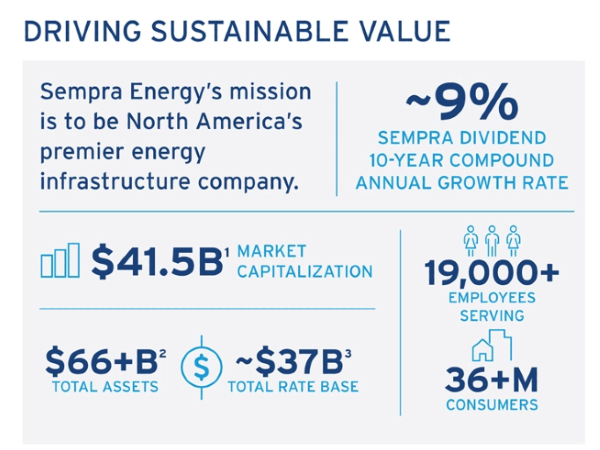

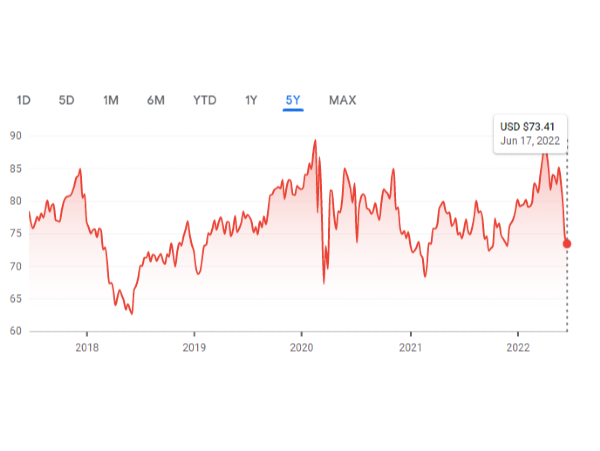

Read Utility Stocks Analysis on Sempra Energy Stock (SRE), SRE Stock Forecast, Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D)

Comcast and Netflix are both large-cap consumer-discretionary stocks listed on NASDAQ. Every internet retail company is vying for more subscribers by adopting different marketing strategies.

Netflix stock drop in 2022 is attributed to the higher inflation and the cost of living, compelling the consumers to reduce their expenditures. On the other hand, Netflix is going through fierce and relentless competition from other corporations. But the overall picture is not as gloomy as it appears to be. Why? Let's explore!

Read Also the Tech Stock analysis on Tesla (TSLA), Will Meta Stock Go Up? and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

What Happened to Netflix Stock?

During the first quarter of Netflix, ending in April, the Internet television network anticipated a loss of over 2 million subscribers in the second quarter. However, last week, the second-quarter earnings and financial reports surprised many investors.

Netflix managed to retain paid subscribers due to the advanced marketing strategy, exciting shows like Stranger Things and the shared accounts. Only 970 0000 subscribers were lost during the second quarter, the largest ever loss in the history of Netflix in a decade.

The reason behind the loss of subscribers is the elimination of streaming services from Russia and Ukraine combined with the higher subscription fees for the US and Canada. Besides, the media company is providing content below the par as it was used to be known for.

Moreover, other media companies are also competing for high-quality content and are succeeding in taking away the content from the industry. These competitors are providing a tough time for Netflix, which is why this largest-cap media company is planning to cope with this situation.

By opting for a partnership with Microsoft for the ad-supported tier by the end of this year, this stock is probably optimistic about a better outlook by providing its audience with a broad spectrum of choice and premium content.

Additionally, Netflix management has decided to crack down on the subscribers' password-sharing habits by introducing the 'Add a Home' feature for its Latin American Subscribers. It will help this entertainment stock to raise revenues.

The sharing of accounts will be provided at an additional rate of $3. Let's look at the reports for the second-quarter ending on June 30, 2022. We will see that the financial position is not as gloomy as it was forecasted in the first quarter.

Another major challenge for Netflix is the production of cash flow. It does not have enough cash flow, as indicated in the first quarterly report. Netflix spends a lot of cash on the in-house production of content every year.

Read about Why is Apple Dividend So Low? and Alphabet (GOOG) Earnings Sightly Hit By Current Economic Slow Down.

Free cash flow has always remained a dilemma for the company, and they are trying to produce the cash by creating high-quality content like Stranger Things which brought in $200 000. This quarter, the company 103 million dollars out of operating activities. The free cash flow was reported at a surplus of 13 million dollars.

Subsequently, the cash declined due to the Foreign Exchange impact of USD on cash and the Next Games Acquisition. However, they have resolved to keep the Free Cash Flow around $ 1 billion this year. The company is striving to produce their content and is optimistic about the positive cash flow during the following year.

Surprisingly, the foreign exchange fluctuations have caused the revenue to drop in 2022. A stronger dollar does not benefit the company as the expenses are made in dollars and the revenues. It causes a reduction in revenues. As a result, the company forecast a 29% decline in the operating profits year-on-year in the third quarter.

The Bottom Line

While working on different strategies like a low-cost Ad-Supported tier powered by Microsoft to crack down on account sharing, Netflix is hopeful about the future outlook. It expects 1 million new subscribers under its paid membership streaming.

Moreover, there's good news for Netflix lovers as the corporation has decided to provide all the big-budget films on the Netflix platform instead of playing them in theatres. Moreover, it has agreed to offer a binge-watching service for the new shows; the subscribers can watch all the episodes at once.

Lastly, a strong US dollar could be a significant challenge for this stock and they have to incur higher costs and lower revenues due to the fluctuations in currency rates. Netflix earns most of its revenue from streaming outside the USA. So, exchange rate fluctuations significantly threaten the next quarter's earnings.

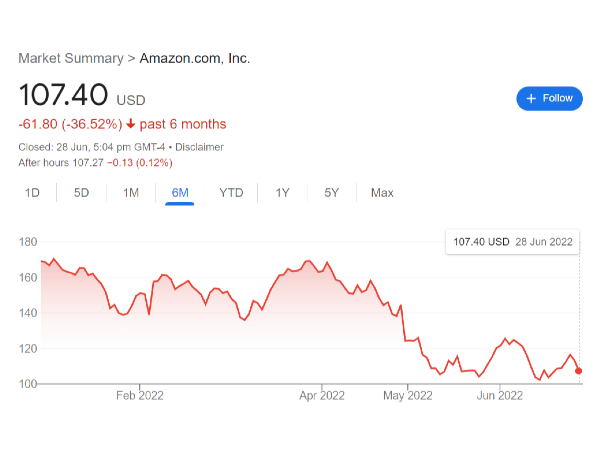

Read Also: Amazon Stock Price Prediction and NextEra Energy Stock (NEE)

Currency fluctuations are likely to raise investors' eyebrows, and they might want to sell the stock in this economic slowdown and competitive industrial environment. So, Netflix is definitely not a buy right now.

However, the investors showed positive sentiments after the earnings call of the second quarter and the shares increased by 6% after the announcement. In other words, investors have confidence in Netflix stock and they seemed a little worried about what happened to Netflix Stock in the short run only.

Why is the Netflix stock drop on a binge in 2022 and what has happened to Netflix? Is Netflix losing revenues after the world came out of its pandemic-led isolations and quarantines? The Netflix honeymoon with the shut-down of the world is over.

Many people are worried about the current pessimist economic situation and the Netflix stock drop. Is it worth buying, selling or holding this stock in a panic-led condition?

Let's explore these questions and other sentiments of the investors in this article and shed light on the future outlook of this entertainment stock. Are you struggling to find an answer to this question? Continue reading and you will find the answers to all these questions.

Read Also an Analysis on the FinTech stock of Visa (V) & Large-Cap Stock of Bank of America (BAC)

Netflix - Streaming Media Company

Netflix is an entertainment streaming service provider worldwide with over 222 million subscribers. The number of people watching Netflix series, movies, documentaries and mobile games goes beyond this number if we consider the shared number of accounts.

Founded in 1998, Netflix sustained competition for a long time and witnessed impressive growth. However, the picture changed dramatically after the Covid period ended in 2021. Similarly, the cutting-edge competition from Walt Disney, Prime Video and Comcast also took a significant market share.

Read Utility Stocks Analysis on Sempra Energy Stock (SRE), SRE Stock Forecast, Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D)

Comcast and Netflix are both large-cap consumer-discretionary stocks listed on NASDAQ. Every internet retail company is vying for more subscribers by adopting different marketing strategies.

Netflix stock drop in 2022 is attributed to the higher inflation and the cost of living, compelling the consumers to reduce their expenditures. On the other hand, Netflix is going through fierce and relentless competition from other corporations. But the overall picture is not as gloomy as it appears to be. Why? Let's explore!

Read Also the Tech Stock analysis on Tesla (TSLA), Will Meta Stock Go Up? and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

What Happened to Netflix Stock?

During the first quarter of Netflix, ending in April, the Internet television network anticipated a loss of over 2 million subscribers in the second quarter. However, last week, the second-quarter earnings and financial reports surprised many investors.

Netflix managed to retain paid subscribers due to the advanced marketing strategy, exciting shows like Stranger Things and the shared accounts. Only 970 0000 subscribers were lost during the second quarter, the largest ever loss in the history of Netflix in a decade.

The reason behind the loss of subscribers is the elimination of streaming services from Russia and Ukraine combined with the higher subscription fees for the US and Canada. Besides, the media company is providing content below the par as it was used to be known for.

Moreover, other media companies are also competing for high-quality content and are succeeding in taking away the content from the industry. These competitors are providing a tough time for Netflix, which is why this largest-cap media company is planning to cope with this situation.

By opting for a partnership with Microsoft for the ad-supported tier by the end of this year, this stock is probably optimistic about a better outlook by providing its audience with a broad spectrum of choice and premium content.

Additionally, Netflix management has decided to crack down on the subscribers' password-sharing habits by introducing the 'Add a Home' feature for its Latin American Subscribers. It will help this entertainment stock to raise revenues.

The sharing of accounts will be provided at an additional rate of $3. Let's look at the reports for the second-quarter ending on June 30, 2022. We will see that the financial position is not as gloomy as it was forecasted in the first quarter.

Another major challenge for Netflix is the production of cash flow. It does not have enough cash flow, as indicated in the first quarterly report. Netflix spends a lot of cash on the in-house production of content every year.

Read about Why is Apple Dividend So Low? and Alphabet (GOOG) Earnings Sightly Hit By Current Economic Slow Down.

Free cash flow has always remained a dilemma for the company, and they are trying to produce the cash by creating high-quality content like Stranger Things which brought in $200 000. This quarter, the company 103 million dollars out of operating activities. The free cash flow was reported at a surplus of 13 million dollars.

Subsequently, the cash declined due to the Foreign Exchange impact of USD on cash and the Next Games Acquisition. However, they have resolved to keep the Free Cash Flow around $ 1 billion this year. The company is striving to produce their content and is optimistic about the positive cash flow during the following year.

Surprisingly, the foreign exchange fluctuations have caused the revenue to drop in 2022. A stronger dollar does not benefit the company as the expenses are made in dollars and the revenues. It causes a reduction in revenues. As a result, the company forecast a 29% decline in the operating profits year-on-year in the third quarter.

The Bottom Line

While working on different strategies like a low-cost Ad-Supported tier powered by Microsoft to crack down on account sharing, Netflix is hopeful about the future outlook. It expects 1 million new subscribers under its paid membership streaming.

Moreover, there's good news for Netflix lovers as the corporation has decided to provide all the big-budget films on the Netflix platform instead of playing them in theatres. Moreover, it has agreed to offer a binge-watching service for the new shows; the subscribers can watch all the episodes at once.

Lastly, a strong US dollar could be a significant challenge for this stock and they have to incur higher costs and lower revenues due to the fluctuations in currency rates. Netflix earns most of its revenue from streaming outside the USA. So, exchange rate fluctuations significantly threaten the next quarter's earnings.

Read Also: Amazon Stock Price Prediction and NextEra Energy Stock (NEE)

Currency fluctuations are likely to raise investors' eyebrows, and they might want to sell the stock in this economic slowdown and competitive industrial environment. So, Netflix is definitely not a buy right now.

However, the investors showed positive sentiments after the earnings call of the second quarter and the shares increased by 6% after the announcement. In other words, investors have confidence in Netflix stock and they seemed a little worried about what happened to Netflix Stock in the short run only.