What is a Dividend Policy

A dividend policy is set by a company’s board of directors that gives guidance on how they determine the dividend payout. The dividend policy balances the needs of two critical stakeholders: the investors and the executive team.

Income investors invest in utility stocks because they are looking for a stable income from dividends. Utility companies know this and have special sections of their investor relations pages dedicated to income investors. The dividend policy is a guide for investors to know how future dividends will be paid. The board of directors can alienate income investors by setting a dividend policy that pays out a very low dividend. The board can also alienate investors by not following their dividend policy. Finally, investors may avoid a utility stock that has no dividend policy. A dividend policy attracts investors by giving them a guide to future dividends.

The other stakeholder that relies on a dividend policy is the executive team. A utility needs to use generated cash to complete capital projects, maintain the utility’s infrastructure, and payoff company debt. If the dividend policy pays out all the company’s earnings as a dividend, then the company will not be able to maintain future earnings and growth. When this occurs, the company’s stock price may fall as investors will get fearful when earnings fall. No matter how good an executive team is, if they do not have capital resources, they will be unable to grow the business.

The board of directors ultimately balance the needs of the company’s stakeholders by creating a dividend policy. By letting stakeholders know how the board is deciding dividends, it helps both investors and management make their own respective plans. Ultimately, this predictability is welcomed by all company stakeholders.

Types of Dividend Policies

A board of directors may settle on different policies based on the health and stage of the utility. A utility that is growing its business operations may forego a dividend policy as it manages the risk of new markets. The board may also set a dividend policy that best fits the needs of its stakeholders.

Dividend Payout Ratio – Earnings Based

The top utility stocks use a dividend payout ratio as their key metric of a dividend policy. The dividend payout ratio is the percentage of earning used for paying out a dividend. For example, if a company earns $2.00 per share a quarter and has a dividend payout ratio of 40%, then the dividend for the quarter will be $0.80 per share.

This approach is used by the top utility stocks because it helps the executive team prepare for its future growth while giving income investors clear guidance to dividend policy. This method also incentivizes investors to want to keep the dividend payout ratio low. Long term investors realize that if they can help the executive team grow earnings, their dividend payout will be higher in the future even if the payout ratio is lower.

Dividend Payout Ratio – Cashflow Based

Some companies will set a dividend policy based on the cash received by the company. A cashflow payout ratio is used when cash is needed in the company. Sometimes, earnings and cash do not go up together. Reported earnings consider multiple facets of the company like amortization, depreciation, accrued expenses, and other accounting practices to help give a full picture of the company. However, cash doesn’t take a lot of these accounting practices into account and if cash reserves are low, the company may need to manage cash reserves first. This means that dividends are paid as a percentage of cash intake instead of earning. If a utility’s cash position is low, it may want to create a dividend policy based on cash instead of earnings.

Dividend Growth

Some utilities have been growing their dividend for decades. It is a part of their culture and an expectation by their investors. Hence, a board of directors may set a dividend growth policy that will continue to grow the dividend regardless of business outcome.

This policy leans heavily towards the investor stakeholder. The risk of a policy like this is when unexpected business disruptions occur. A board may be forced to abruptly change their dividend policy, which will cause investor panic. Though a dividend growth policy may have its issues, it still drives the executive team to grow earnings to provide for the dividend.

No Policy

Some utilities do not have a dividend policy. These companies may be in a growth stage and feel that capital can be better utilized by the company for a better investor return. This is true when new markets are being targeted. Some utilities do not have a dividend policy simply because the board wants the flexibility to direct capital as needed without answering for why a dividend policy abruptly changed.

The Dividend Policy of the Top Utility Stocks

We assessed the top electric utilities and the top water utilities based on the stock’s price appreciation, dividend, volatility, and customer diversity. Below are the dividend policies of the top three electric and water utility stocks:

The top three electric utilities:

- American Electric Company (AEP) – 60% to 70%

- NextEra Energy (NEE) – 60% dividend payout ratio

- Duke Energy (DUK) – 65% to 75% dividend payout ratio

The top three water utility companies:

- American Water Works Company – 55% to 60% Dividend Payout Ratio

- Essential Utilities (WTRG) – 60% to 65% Dividend Payout Ratios

- Artesian Resource Corporation (ARTNA) - No Documented Dividend Policy

From researching these top utilities, a key pattern is that the top utilities clearly spell out a dividend policy. The dividend policy of the top utility stocks is around 60% to 65%. The dividend policy is clearly documented in either the company’s quarterly presentation or investor relations page.

Read More: The Top Utility Stocks Suggested by the top members on StockBossUp

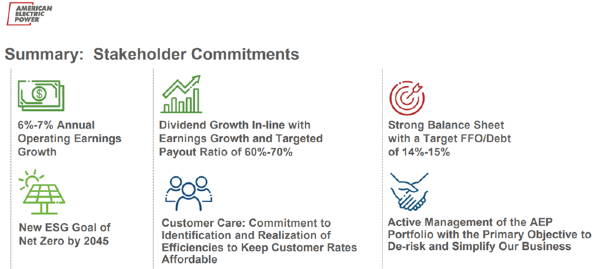

American Electric Power Company (AEP) – 60% to 70% dividend payout ratio

AEP is ranked as our best electric utility stock.

The company’s 5-year stock appreciation was 3.45% APR. Their max drawdown and volatility were the lowest of 14 companies we ranked. Due to this stability, AEP holds a dividend yield of 3.71% as of November 2022.

AEP is focused on business stability and steady growth. The company recognizes not only the importance of dividend investors, but also their bond investors. Per their “fixed income investors page:

“Fixed income investors are vital to our investment strategy. Our goal to provide stable and reliable income to bond investors is an integral component of our capital expenditure activity.”

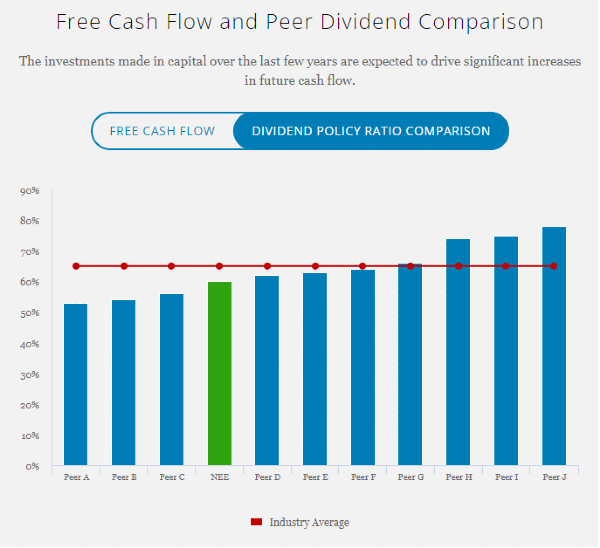

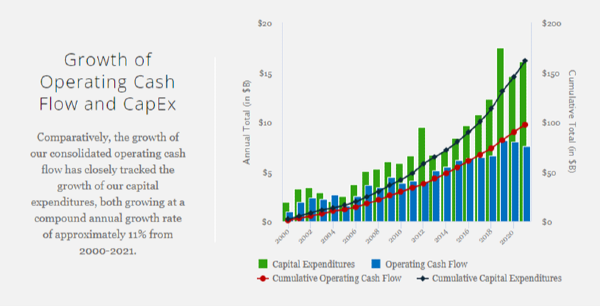

NextEra Energy (NEE) – 60% dividend payout ratio

NextEra provides a dividend payout ratio of 60%. NextEra shows on their cash flow quality and leverage page that they are efficiently using the operation cash flow they keep in house to continue growing earnings through their capital expenditure ventures:

Duke Energy – 65% to 75% dividend payout ratio

Duke Energy’s goal is to increase shareholder return by roughly 10% through two means. The first is by growing earnings, which in theory should translate into the growth of the company’s stock price. Second, the company’s dividend yield will give an attractive 4.3% return on investment.

This is in line with their dividend policy that they declare on the Duke Energy investor FAQ page of a 65% to 75% dividend payout ratio.

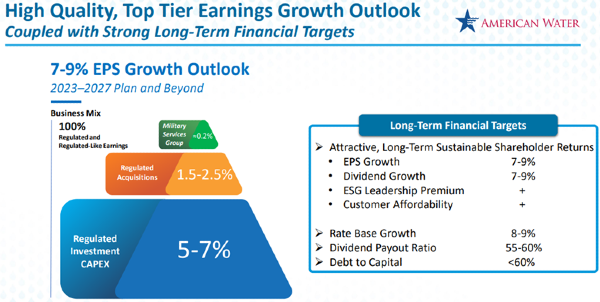

American Water Works Company – 55% to 60% Dividend Payout Ratio

The top water utility company, American Water Works, is our top income water utility stock. Its stock price volatility is low, it’s price appreciation is high, and its dividend is healthy. The company is growing due to a focus on acquiring regulated customers in multiple states.

Their dividend policy reflects a balanced approach between growth and investor needs at 55% to 60%.

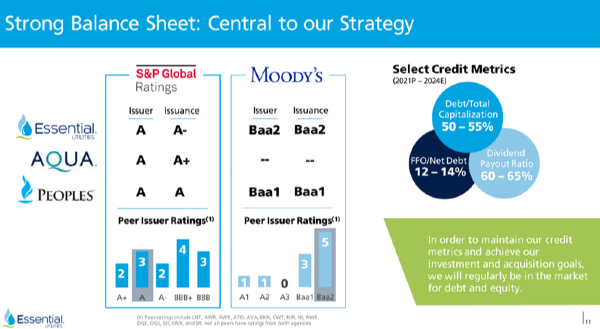

Essential Utilities (WTRG) – 60% to 65% Dividend Payout Ratios

Essential Utilities has a strong dividend thanks to strong earnings. Their company footprint extends across Illinois all the way to Virginia and includes Texas as well. The company was hurt in our analysis by poor price volatility. This is likely due to their exposure to natural gas in West Virginia and Kentucky.

Artesian Resource Corporation (ARTNA) - No Documented Dividend Policy

Artesian Resource Corporation is our third ranked water company. The stock price has one of the lowest volatilities but also one of the lowest customer bases. Artesian Resources doesn’t look to have a concrete dividend policy. Per their 2021 annual report

“Our strategy is to increase customer growth, revenues, earnings and dividends by expanding our water, wastewater and SLP Plan services across the Delmarva Peninsula.”

Their goal is to grow dividends, but they do not compare it to their earnings using a dividend payout ratio.

What Shouldn’t be Influencing a Dividend Policy

Based on researching the top utility stocks, it’s clear that the dividend policy is influenced by:

- Earnings growth and return on capital

- Debt Management

- Income for investors

The dividend policies of the top utilities are not influenced by artificial dividend growth goals. The dividend growth must be aligned with earnings growth. The dividend policy really strikes a balanced between a company’s capital needs and the investors’ income needs. It’s likely not a coincidence that the top utilities split their earnings nearly in half between their business growth and their investors.

Why Should a Company Have a Dividend Policy

Nearly every top utility company on our list has a dividend policy. The utilities use these policies to:

- Give income investors guidance on how dividends are determined

- Gives the executive team guidance on the capital they will be able to redeploy back into the company

- Gives both stakeholders, the executive team and the income investors, incentives to grow company earnings by aligning dividend growth with earnings and capital deployment.

Arguments Against a Dividend Policy

Based on our analysis on the top utilities, a dividend policy is really the right choice for companies who generate income for their investors. A dividend policy is not useful for companies focused on company growth like technology companies and small-cap companies. However, if a board of directors has to manage the needs of their income investors and their company growth, a dividend policy helps to set guidelines for both stakeholders.

Conclusion

The Board of Directors of the top utility companies use a dividend policy to give clear guidance to their stakeholders. The top utilities maintain a dividend payout ratio of about 60% to 65% as their dividend policy.

For income investors, a utility really should have a dividend policy if you are serious about investing in the company. The top utility companies have better dividends, price growth, and price volatility and almost all of them have a dividend policy.

Further Readings - Stock Ideas

Further Readings - A Guide to Investing in Utilities

A Series for Beginner Investors

What is a Dividend Policy

A dividend policy is set by a company’s board of directors that gives guidance on how they determine the dividend payout. The dividend policy balances the needs of two critical stakeholders: the investors and the executive team.

Income investors invest in utility stocks because they are looking for a stable income from dividends. Utility companies know this and have special sections of their investor relations pages dedicated to income investors. The dividend policy is a guide for investors to know how future dividends will be paid. The board of directors can alienate income investors by setting a dividend policy that pays out a very low dividend. The board can also alienate investors by not following their dividend policy. Finally, investors may avoid a utility stock that has no dividend policy. A dividend policy attracts investors by giving them a guide to future dividends.

The other stakeholder that relies on a dividend policy is the executive team. A utility needs to use generated cash to complete capital projects, maintain the utility’s infrastructure, and payoff company debt. If the dividend policy pays out all the company’s earnings as a dividend, then the company will not be able to maintain future earnings and growth. When this occurs, the company’s stock price may fall as investors will get fearful when earnings fall. No matter how good an executive team is, if they do not have capital resources, they will be unable to grow the business. The board of directors ultimately balance the needs of the company’s stakeholders by creating a dividend policy. By letting stakeholders know how the board is deciding dividends, it helps both investors and management make their own respective plans. Ultimately, this predictability is welcomed by all company stakeholders.

Types of Dividend Policies

A board of directors may settle on different policies based on the health and stage of the utility. A utility that is growing its business operations may forego a dividend policy as it manages the risk of new markets. The board may also set a dividend policy that best fits the needs of its stakeholders.

Dividend Payout Ratio – Earnings Based

The top utility stocks use a dividend payout ratio as their key metric of a dividend policy. The dividend payout ratio is the percentage of earning used for paying out a dividend. For example, if a company earns $2.00 per share a quarter and has a dividend payout ratio of 40%, then the dividend for the quarter will be $0.80 per share.

This approach is used by the top utility stocks because it helps the executive team prepare for its future growth while giving income investors clear guidance to dividend policy. This method also incentivizes investors to want to keep the dividend payout ratio low. Long term investors realize that if they can help the executive team grow earnings, their dividend payout will be higher in the future even if the payout ratio is lower.

Dividend Payout Ratio – Cashflow Based

Some companies will set a dividend policy based on the cash received by the company. A cashflow payout ratio is used when cash is needed in the company. Sometimes, earnings and cash do not go up together. Reported earnings consider multiple facets of the company like amortization, depreciation, accrued expenses, and other accounting practices to help give a full picture of the company. However, cash doesn’t take a lot of these accounting practices into account and if cash reserves are low, the company may need to manage cash reserves first. This means that dividends are paid as a percentage of cash intake instead of earning. If a utility’s cash position is low, it may want to create a dividend policy based on cash instead of earnings.

Dividend Growth

Some utilities have been growing their dividend for decades. It is a part of their culture and an expectation by their investors. Hence, a board of directors may set a dividend growth policy that will continue to grow the dividend regardless of business outcome.

This policy leans heavily towards the investor stakeholder. The risk of a policy like this is when unexpected business disruptions occur. A board may be forced to abruptly change their dividend policy, which will cause investor panic. Though a dividend growth policy may have its issues, it still drives the executive team to grow earnings to provide for the dividend.

No Policy

Some utilities do not have a dividend policy. These companies may be in a growth stage and feel that capital can be better utilized by the company for a better investor return. This is true when new markets are being targeted. Some utilities do not have a dividend policy simply because the board wants the flexibility to direct capital as needed without answering for why a dividend policy abruptly changed.

The Dividend Policy of the Top Utility Stocks

We assessed the top electric utilities and the top water utilities based on the stock’s price appreciation, dividend, volatility, and customer diversity. Below are the dividend policies of the top three electric and water utility stocks: The top three electric utilities:

The top three water utility companies:

From researching these top utilities, a key pattern is that the top utilities clearly spell out a dividend policy. The dividend policy of the top utility stocks is around 60% to 65%. The dividend policy is clearly documented in either the company’s quarterly presentation or investor relations page.

Read More: The Top Utility Stocks Suggested by the top members on StockBossUp

American Electric Power Company (AEP) – 60% to 70% dividend payout ratio

Source: AEP investor presentation, Q3 2022

AEP is ranked as our best electric utility stock.

The company’s 5-year stock appreciation was 3.45% APR. Their max drawdown and volatility were the lowest of 14 companies we ranked. Due to this stability, AEP holds a dividend yield of 3.71% as of November 2022.

AEP is focused on business stability and steady growth. The company recognizes not only the importance of dividend investors, but also their bond investors. Per their “fixed income investors page:

NextEra Energy (NEE) – 60% dividend payout ratio

Source: NextEra Energy Investor Relations – Cash Flow Quality and Leverage

NextEra provides a dividend payout ratio of 60%. NextEra shows on their cash flow quality and leverage page that they are efficiently using the operation cash flow they keep in house to continue growing earnings through their capital expenditure ventures:

Source: NextEra Energy Investor Relations – Cash Flow Quality and Leverage

Duke Energy – 65% to 75% dividend payout ratio

Source Duke Energy Q3 2022 Earnings Presentation

Duke Energy’s goal is to increase shareholder return by roughly 10% through two means. The first is by growing earnings, which in theory should translate into the growth of the company’s stock price. Second, the company’s dividend yield will give an attractive 4.3% return on investment.

This is in line with their dividend policy that they declare on the Duke Energy investor FAQ page of a 65% to 75% dividend payout ratio.

American Water Works Company – 55% to 60% Dividend Payout Ratio

Source: American Water Works Investor Presentation

The top water utility company, American Water Works, is our top income water utility stock. Its stock price volatility is low, it’s price appreciation is high, and its dividend is healthy. The company is growing due to a focus on acquiring regulated customers in multiple states. Their dividend policy reflects a balanced approach between growth and investor needs at 55% to 60%.

Essential Utilities (WTRG) – 60% to 65% Dividend Payout Ratios

Source: Essential Utilities Investor Presentation September 2022

Essential Utilities has a strong dividend thanks to strong earnings. Their company footprint extends across Illinois all the way to Virginia and includes Texas as well. The company was hurt in our analysis by poor price volatility. This is likely due to their exposure to natural gas in West Virginia and Kentucky.

Artesian Resource Corporation (ARTNA) - No Documented Dividend Policy

Artesian Resource Corporation is our third ranked water company. The stock price has one of the lowest volatilities but also one of the lowest customer bases. Artesian Resources doesn’t look to have a concrete dividend policy. Per their 2021 annual report “Our strategy is to increase customer growth, revenues, earnings and dividends by expanding our water, wastewater and SLP Plan services across the Delmarva Peninsula.” Their goal is to grow dividends, but they do not compare it to their earnings using a dividend payout ratio.

What Shouldn’t be Influencing a Dividend Policy

Based on researching the top utility stocks, it’s clear that the dividend policy is influenced by:

The dividend policies of the top utilities are not influenced by artificial dividend growth goals. The dividend growth must be aligned with earnings growth. The dividend policy really strikes a balanced between a company’s capital needs and the investors’ income needs. It’s likely not a coincidence that the top utilities split their earnings nearly in half between their business growth and their investors.

Why Should a Company Have a Dividend Policy

Nearly every top utility company on our list has a dividend policy. The utilities use these policies to:

Arguments Against a Dividend Policy

Based on our analysis on the top utilities, a dividend policy is really the right choice for companies who generate income for their investors. A dividend policy is not useful for companies focused on company growth like technology companies and small-cap companies. However, if a board of directors has to manage the needs of their income investors and their company growth, a dividend policy helps to set guidelines for both stakeholders.

Conclusion

The Board of Directors of the top utility companies use a dividend policy to give clear guidance to their stakeholders. The top utilities maintain a dividend payout ratio of about 60% to 65% as their dividend policy. For income investors, a utility really should have a dividend policy if you are serious about investing in the company. The top utility companies have better dividends, price growth, and price volatility and almost all of them have a dividend policy.

Further Readings - Stock Ideas

Further Readings - A Guide to Investing in Utilities

A Series for Beginner Investors