The Utility and Energy Sector Provide Electricity

So you’re a new investor jumping into the stock market. Because your monthly electric bill has been hurting your budget, you think it’s a good time to invest in your local electric company because they are definitely making a profit off you.

So as a new investor, you look up energy stocks. But all you can see are oil and gas stocks in the energy sector? When you finally look up your electric company, you find that its not in the energy sector, but the utility sector.

For the uninitiated, this seems odd. My electric company is providing me electric energy, doesn’t that make it an energy stock? Well you see, the entire process of delivering energy to your home and all the buildings in your community, can be broken down into two steps in a process. And the businesses that cater to those two steps in the process, as we will see, are vastly different investments with vastly different risks and opportunities.

The First Step - Oil, Gas and Coal

The first step in delivering energy to your home is to dig and drill for materials out of the Earth that we can efficiently burn to create steam, yes steam, that turns a turbine and creates electricity. This is the traditional energy sector. And what materials do we need to dig and drill for? Oil, gas, and coal.

Even today with all our talk about renewable energy, the majority of all electric power made is through this archaic process. Burn it and turn it.

The Second Step - Producing and Delivering Electricity

Utilities provide the second half of the process. Utilities run the plants that burn fossil fuels. They run the transmission and distribution lines that provide that electricity to your home from that plant. And they ultimately bill you for the amount of electricity they provide you.

So that is fundamentally the difference between the energy and utility sector. But that is not the reason why Wall Street broke up the energy process this way. The reason why Wall Street categorized oil and gas stocks separately from utility stocks is that the two investments have vastly different return opportunities and vastly different risks.

Utilities and Energy Stock are Vastly Different Investments

You see, the oil and gas industry provide oil to a world-wide market with multiple other companies and even entire countries competing to provide oil and gas to the highest bidder. And because oil and gas are in constant demand, if supplies get limited, the price of oil and gas can skyrocket, as you’ve probably seen at the pumps.

And supplies can get limited, very limited. With whole nation-states nationalizing their own internal oil industry, the very supply of oil can make or break a nation. Hence then the supply of oil is as erratic as politics because a lot of time it is controlled by politics.

So, from an investor’s perspective, since the price of oil can change so rapidly, there are opportunities to enjoy the windfall of such high prices. Conversely, you could risk significant losses if the price of oil plummets. And though I must emphasize that there is nothing morally wrong with an investment with oil, it does feel at times that you’re making a deal with the devil because when the world is going through hardships and uncertainty, energy stocks will likely rise.

Due to the speculative nature of the energy sector, the industry is influenced heavily by the futures market. The futures market is where people buy and sell contracts to take in commodities in the future. And oh boy, not to go down a rabbit’s hole, but the futures market is where fortunes are made and lost every day. Volatility comes standard in the futures market.

The Utility Sector is Less Volatile

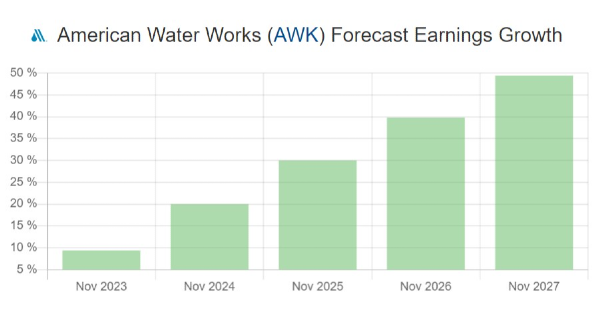

But while the energy sector, made up of oil, gas, and coal prospecting, is volatile and potential lucrative, the utility sector is the complete opposite. An investment in a utility has historically been stable, boring, and growing at a snail’s pace. While the energy sector could see a doubling or tripling of wins…. Or losses, a 15% increase in a utility in one year can be an exciting occasion for the utility investor… maybe even too exciting.

Utilities are really boring for many reasons, but the ultimate reason is that they pass all the volatility of the oil, gas, and coal industry onto businesses and consumers. For consumers, you simply get a higher utility bill when the price of energy goes up. The utility is going to make the same return regardless of the price of oil.

On top of this, utilities in the United States are also heavily regulated as many of them get to be a complete monopoly in their region. Utilities are regulated by “rate of return regulation” meaning that the utility can make only a fixed return.

Hence, when energy prices fall, the utility has to pass that savings to the consumer. By following these regulations, utilities are allowed to maintain their monopolies in a region [1].

Read More: The Safest Utilities to Buy Now

Utilities Rely on Debt

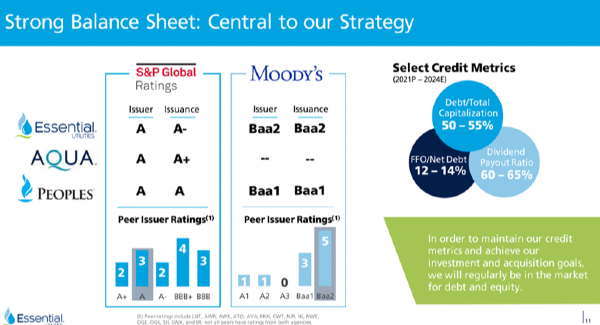

And finally, there is the real need for capital. Utilities are capital intensive. They own large plants and infrastructure and maintenance obligations. Debt is not just a tool use by the Utility, debt is an instrumental part of a utilities business. So instrumental in fact that many utilities have whole slides on their quarterly presentations dedicated to their credit rating. And how do they keep a high credit rating? They have run a consistent operation with steady, but growing, earnings coming in every quarter.

Because large bond investors aren’t just looking repayment every month. Large bond investors will intrude into the business by asking questions to ensure their very large debt doesn’t go into default. That means the utilities want their whole business, from dividends, to earnings, to growth, and costs, to all be stable.

This in turn translates into a vastly different investment from the energy sector.

To make things even more confusing, Exxon-Mobil, the largest stock in the energy sector, not only produces oil, but they use this natural resource to make plastics.

Hence, from a business standpoint, Exxon-Mobil could be categorized as an industrial stock as well.

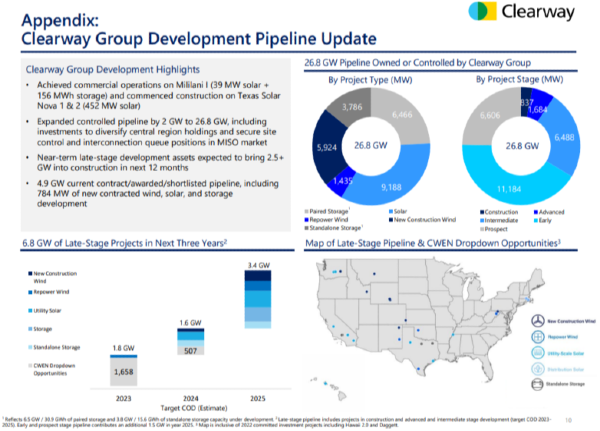

As for utilities, with more investments in renewable energy, they are slowly cutting out the oil and gas portion of the electric production process as they are getting the energy from solar, wind and nuclear energy.

The Bottom Line

So the next time you come across the utility and energy sector, remember, the reason that they are in different categories is that they are completely different investment options for your portfolio. While the energy sector is volatile, speculative, and dominated by the futures market, the utility sector is stable, income focused, and dominated by bond investors.

Check out our companion video:

https://youtu.be/M6RfFWNdbV4

References

1). https://indianaenergy.org/energy-overview-public-utility/

Further Readings - Stock Ideas

Further Readings - A Guide to Investing in Utilities

The Utility and Energy Sector Provide Electricity

So you’re a new investor jumping into the stock market. Because your monthly electric bill has been hurting your budget, you think it’s a good time to invest in your local electric company because they are definitely making a profit off you.

So as a new investor, you look up energy stocks. But all you can see are oil and gas stocks in the energy sector? When you finally look up your electric company, you find that its not in the energy sector, but the utility sector.

For the uninitiated, this seems odd. My electric company is providing me electric energy, doesn’t that make it an energy stock? Well you see, the entire process of delivering energy to your home and all the buildings in your community, can be broken down into two steps in a process. And the businesses that cater to those two steps in the process, as we will see, are vastly different investments with vastly different risks and opportunities.

The First Step - Oil, Gas and Coal

The first step in delivering energy to your home is to dig and drill for materials out of the Earth that we can efficiently burn to create steam, yes steam, that turns a turbine and creates electricity. This is the traditional energy sector. And what materials do we need to dig and drill for? Oil, gas, and coal.

Image by Анатолий Стафичук from Pixabay

The Second Step - Producing and Delivering Electricity

Image by cwizner from Pixabay

Utilities provide the second half of the process. Utilities run the plants that burn fossil fuels. They run the transmission and distribution lines that provide that electricity to your home from that plant. And they ultimately bill you for the amount of electricity they provide you.

So that is fundamentally the difference between the energy and utility sector. But that is not the reason why Wall Street broke up the energy process this way. The reason why Wall Street categorized oil and gas stocks separately from utility stocks is that the two investments have vastly different return opportunities and vastly different risks.

Utilities and Energy Stock are Vastly Different Investments

You see, the oil and gas industry provide oil to a world-wide market with multiple other companies and even entire countries competing to provide oil and gas to the highest bidder. And because oil and gas are in constant demand, if supplies get limited, the price of oil and gas can skyrocket, as you’ve probably seen at the pumps. And supplies can get limited, very limited. With whole nation-states nationalizing their own internal oil industry, the very supply of oil can make or break a nation. Hence then the supply of oil is as erratic as politics because a lot of time it is controlled by politics.

One revolution can roil markets. Image by PublicDomainPictures from Pixabay

So, from an investor’s perspective, since the price of oil can change so rapidly, there are opportunities to enjoy the windfall of such high prices. Conversely, you could risk significant losses if the price of oil plummets. And though I must emphasize that there is nothing morally wrong with an investment with oil, it does feel at times that you’re making a deal with the devil because when the world is going through hardships and uncertainty, energy stocks will likely rise.

Due to the speculative nature of the energy sector, the industry is influenced heavily by the futures market. The futures market is where people buy and sell contracts to take in commodities in the future. And oh boy, not to go down a rabbit’s hole, but the futures market is where fortunes are made and lost every day. Volatility comes standard in the futures market.

The Utility Sector is Less Volatile

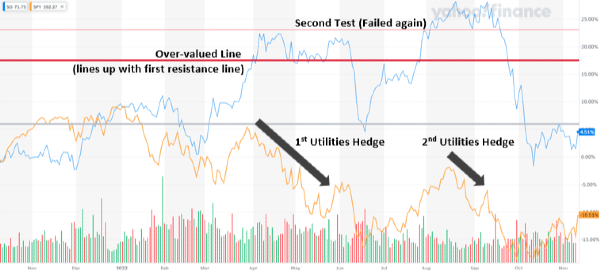

But while the energy sector, made up of oil, gas, and coal prospecting, is volatile and potential lucrative, the utility sector is the complete opposite. An investment in a utility has historically been stable, boring, and growing at a snail’s pace. While the energy sector could see a doubling or tripling of wins…. Or losses, a 15% increase in a utility in one year can be an exciting occasion for the utility investor… maybe even too exciting.

Utilities are really boring for many reasons, but the ultimate reason is that they pass all the volatility of the oil, gas, and coal industry onto businesses and consumers. For consumers, you simply get a higher utility bill when the price of energy goes up. The utility is going to make the same return regardless of the price of oil.

On top of this, utilities in the United States are also heavily regulated as many of them get to be a complete monopoly in their region. Utilities are regulated by “rate of return regulation” meaning that the utility can make only a fixed return.

Hence, when energy prices fall, the utility has to pass that savings to the consumer. By following these regulations, utilities are allowed to maintain their monopolies in a region [1].

Utilities Rely on Debt

And finally, there is the real need for capital. Utilities are capital intensive. They own large plants and infrastructure and maintenance obligations. Debt is not just a tool use by the Utility, debt is an instrumental part of a utilities business. So instrumental in fact that many utilities have whole slides on their quarterly presentations dedicated to their credit rating. And how do they keep a high credit rating? They have run a consistent operation with steady, but growing, earnings coming in every quarter.

Because large bond investors aren’t just looking repayment every month. Large bond investors will intrude into the business by asking questions to ensure their very large debt doesn’t go into default. That means the utilities want their whole business, from dividends, to earnings, to growth, and costs, to all be stable.

This in turn translates into a vastly different investment from the energy sector.

To make things even more confusing, Exxon-Mobil, the largest stock in the energy sector, not only produces oil, but they use this natural resource to make plastics.

Hence, from a business standpoint, Exxon-Mobil could be categorized as an industrial stock as well.

As for utilities, with more investments in renewable energy, they are slowly cutting out the oil and gas portion of the electric production process as they are getting the energy from solar, wind and nuclear energy.

The Bottom Line

So the next time you come across the utility and energy sector, remember, the reason that they are in different categories is that they are completely different investment options for your portfolio. While the energy sector is volatile, speculative, and dominated by the futures market, the utility sector is stable, income focused, and dominated by bond investors.

Check out our companion video:

https://youtu.be/M6RfFWNdbV4

References

1). https://indianaenergy.org/energy-overview-public-utility/

Further Readings - Stock Ideas

Further Readings - A Guide to Investing in Utilities