Reviewed by Chaster Johnson

Utility stocks might seem unattractive for their average growth and moderate dividends. However, if your portfolio doesn't contain a utility stock, your portfolio is neither diversified nor risk-adjusted. This is why every investor must try to prepare for every economic situation.

When the market is booming, other growth stocks become more attractive. However, these stocks might perform poorly during a recession and bring negative results. As a result, the average return on your portfolio will be affected adversely.

Suppose you have utility stocks in your portfolio. In that case, your portfolio will perform impressively in the period when the market returns are declining after adjusting for the risks. Risk adjustment is the most crucial factor while diversifying your portfolio.

Let’s learn about the recession-proof industries and the utility stocks in the recession, which may help a portfolio's Annualized Percentage Return (APR) stay positive during a downturn.

What happens in a Recession?

Recessions are a curse for businesses. However, some businesses perform pretty well and produce impressive revenues and earnings when the other industries' revenues are falling. Other companies are on the verge of shutting down.

Generally, Gross Domestic Product (GDP) falls due to the fall in demand for consumer products. As a result, the business cut back its costs. The business will lay off workers, reduce production levels or close down the plants.

On the other hand, consumers reduce their demand for the products due to lower income and higher unemployment. To combat this situation and boost consumer demand, the Federal Reserve (FED) reduces the interest rates to encourage people to spend more and invest more.

Similarly, the government reduces taxes and increases expenditures to encourage people to spend more. However, the current recession of 2022 was a combination of higher demand and lower production. FED adopted a hawkish policy of interest rates to curb inflation. In addition, the businesses were affected by the disruption in the supply chain due to the Russia-Ukraine war.

When Do Utility Stocks Perform well?

Utility stocks perform well when the market slips into recession or when the inflation rate is higher. Due to these factors, interest rates increase and, thus, the cost of financing and borrowing.

Utility sector have an advantage of passing on the higher costs to the customers. This is why these utility companies can bear their operating costs conveniently and continue to pay higher dividend yield to the investors.

Recession proof industries

There are some businesses and industries which perform well during a recession. This is because these industries are less affected by the repercussions of declining GDP. This is because these industries have a steady demand even when consumer sentiment is negative.

- Utility Industries

- HealthCare Industries

- Education

- Food & Beverages

The reason behind these recession-resistant industries is their essential nature. Consumers need to cut back their expenditures on these products considerably.

Sectors that tend to perform well during recessions

Sectors that tend to perform well are as follows:

- Communication services

- Consumer staples

- Energy

- Health care

- Materials

- Real estate

- Utilities

Want to invest in tech stocks? Read also: Tesla (TSLA), Alphabet (GOOG), NetFlix (NFLX), Facebook (META), Microsoft (MSFT) and Apple (APPL)

Three top utility stocks to buy

Currently, the top three growth utility stocks to buy are the ones with impressive growth in revenues and earnings. Moreover, dividend stocks become more attractive for investors. So, you can invest in the following three stocks to lessen the risk and multiply your returns during a recession.

For a list of the top utility stocks on StockBossUp, see The Top Utility Stocks to Buy Now

On the other hand, you can also check the three top Utility Stocks here. These stocks are performing really well, and you will get an idea about the analyst's consensus on these utility stocks.

Investing in Utility Stocks

Investing in utility stocks is essential to get impressive returns and to make your portfolio less risky and more diversified. So how do utility stocks help investors? First, utility stocks are attractive for investors who love dividends and have a long-term outlook on their investments.

This is why if you have invested in utility stocks, you will earn regular income in the form of dividends and save yourself from the adverse effects of recessions or economic cycles.

Do you want to invest in Fintech Stocks? Read Visa (V) and Bank of America (BAC)

Frequently Asked Questions

What are the best utility stocks to buy?

The best utility stocks to buy right now are as follows:

See Also: The Best Utility Stocks To Buy Right Now

Are utility stocks good during a recession?

Utility stocks are the best investment during a recession due to the lower prices and higher dividend yields. They are the best buy-and-hold stocks when investing with a long-term perspective. Defensive shareholders invest heavily in growth utility stocks aiming to minimize the risk.

Are utility stocks safe?

Utility Stocks are safe to invest in during an economic downturn. They are performing well during a recession and yield dividends regularly and steadily to the shareholders.

See also: The Top Safe Stocks to Buy Now

How much of my portfolio should be in utilities?

The general rule is to dedicate 5% of your portfolio to the utility sector. And, each stock company you invest in must be at most 5% of the industry.

See also: How to Screen for Utilities

How do rising interest rates affect utility stocks?

Rising interest rate negatively impacts utility stocks because investors find government-backed bonds more attractive than utilities' steady yet low dividend yield.

Utility industry relies heavily on the debt financing. When the interest rates are higher, debt financing becomes more expensive. Ultimately, the rising cost of borrowing becomes a hurdle for the utility sector.

This is the reason many utility industries find it difficult to pay higher dividends. As a result, the bonds look more attractive as compared to utility bonds.

Are Utility Stocks A Good Buy Now?

Utility Stocks are the best buy now as their share prices are lower at a time when market is experiencing mixed sentiments and there's a situation of uncertainty about the recovery of stock market from recession to boom again.

The Bottom Line

Finally, utility stocks are the best options for investors in a recession. As a result, defensive investors want to make their portfolio risk-adjusted and earn a yield when other stocks are performing poorly.

Reviewed by Chaster Johnson

Utility stocks might seem unattractive for their average growth and moderate dividends. However, if your portfolio doesn't contain a utility stock, your portfolio is neither diversified nor risk-adjusted. This is why every investor must try to prepare for every economic situation.

When the market is booming, other growth stocks become more attractive. However, these stocks might perform poorly during a recession and bring negative results. As a result, the average return on your portfolio will be affected adversely.

Suppose you have utility stocks in your portfolio. In that case, your portfolio will perform impressively in the period when the market returns are declining after adjusting for the risks. Risk adjustment is the most crucial factor while diversifying your portfolio.

Let’s learn about the recession-proof industries and the utility stocks in the recession, which may help a portfolio's Annualized Percentage Return (APR) stay positive during a downturn.

What happens in a Recession?

Recessions are a curse for businesses. However, some businesses perform pretty well and produce impressive revenues and earnings when the other industries' revenues are falling. Other companies are on the verge of shutting down.

Generally, Gross Domestic Product (GDP) falls due to the fall in demand for consumer products. As a result, the business cut back its costs. The business will lay off workers, reduce production levels or close down the plants. On the other hand, consumers reduce their demand for the products due to lower income and higher unemployment. To combat this situation and boost consumer demand, the Federal Reserve (FED) reduces the interest rates to encourage people to spend more and invest more.

Similarly, the government reduces taxes and increases expenditures to encourage people to spend more. However, the current recession of 2022 was a combination of higher demand and lower production. FED adopted a hawkish policy of interest rates to curb inflation. In addition, the businesses were affected by the disruption in the supply chain due to the Russia-Ukraine war.

When Do Utility Stocks Perform well?

Utility stocks perform well when the market slips into recession or when the inflation rate is higher. Due to these factors, interest rates increase and, thus, the cost of financing and borrowing.

Utility sector have an advantage of passing on the higher costs to the customers. This is why these utility companies can bear their operating costs conveniently and continue to pay higher dividend yield to the investors.

Recession proof industries

There are some businesses and industries which perform well during a recession. This is because these industries are less affected by the repercussions of declining GDP. This is because these industries have a steady demand even when consumer sentiment is negative.

The reason behind these recession-resistant industries is their essential nature. Consumers need to cut back their expenditures on these products considerably.

Sectors that tend to perform well during recessions

Sectors that tend to perform well are as follows:

Want to invest in tech stocks? Read also: Tesla (TSLA), Alphabet (GOOG), NetFlix (NFLX), Facebook (META), Microsoft (MSFT) and Apple (APPL)

Three top utility stocks to buy

Currently, the top three growth utility stocks to buy are the ones with impressive growth in revenues and earnings. Moreover, dividend stocks become more attractive for investors. So, you can invest in the following three stocks to lessen the risk and multiply your returns during a recession.

For a list of the top utility stocks on StockBossUp, see The Top Utility Stocks to Buy Now

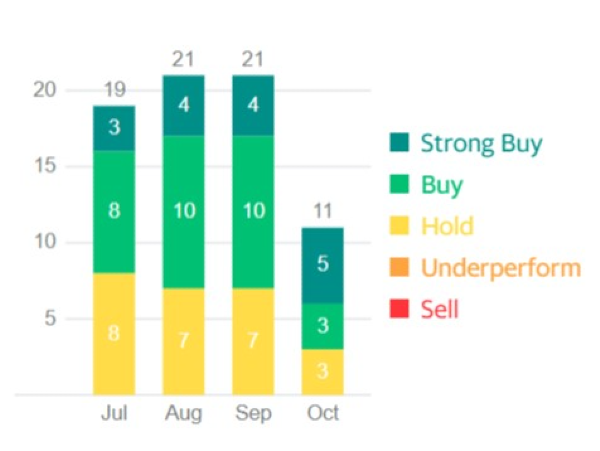

On the other hand, you can also check the three top Utility Stocks here. These stocks are performing really well, and you will get an idea about the analyst's consensus on these utility stocks.

Investing in Utility Stocks

Investing in utility stocks is essential to get impressive returns and to make your portfolio less risky and more diversified. So how do utility stocks help investors? First, utility stocks are attractive for investors who love dividends and have a long-term outlook on their investments.

This is why if you have invested in utility stocks, you will earn regular income in the form of dividends and save yourself from the adverse effects of recessions or economic cycles.

Do you want to invest in Fintech Stocks? Read Visa (V) and Bank of America (BAC)

Frequently Asked Questions

What are the best utility stocks to buy?

The best utility stocks to buy right now are as follows:

See Also: The Best Utility Stocks To Buy Right Now

Are utility stocks good during a recession?

Utility stocks are the best investment during a recession due to the lower prices and higher dividend yields. They are the best buy-and-hold stocks when investing with a long-term perspective. Defensive shareholders invest heavily in growth utility stocks aiming to minimize the risk.

Are utility stocks safe?

Utility Stocks are safe to invest in during an economic downturn. They are performing well during a recession and yield dividends regularly and steadily to the shareholders.

See also: The Top Safe Stocks to Buy Now

How much of my portfolio should be in utilities?

The general rule is to dedicate 5% of your portfolio to the utility sector. And, each stock company you invest in must be at most 5% of the industry.

See also: How to Screen for Utilities

How do rising interest rates affect utility stocks?

Rising interest rate negatively impacts utility stocks because investors find government-backed bonds more attractive than utilities' steady yet low dividend yield.

Utility industry relies heavily on the debt financing. When the interest rates are higher, debt financing becomes more expensive. Ultimately, the rising cost of borrowing becomes a hurdle for the utility sector.

This is the reason many utility industries find it difficult to pay higher dividends. As a result, the bonds look more attractive as compared to utility bonds.

Are Utility Stocks A Good Buy Now?

Utility Stocks are the best buy now as their share prices are lower at a time when market is experiencing mixed sentiments and there's a situation of uncertainty about the recovery of stock market from recession to boom again.

The Bottom Line

Finally, utility stocks are the best options for investors in a recession. As a result, defensive investors want to make their portfolio risk-adjusted and earn a yield when other stocks are performing poorly.