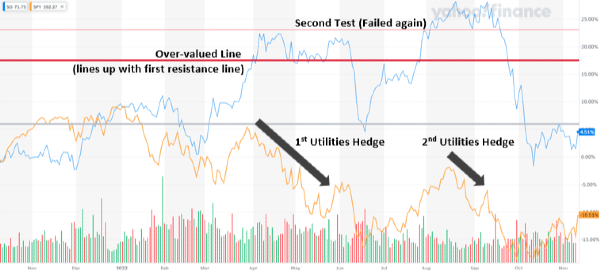

Recessions might ruin many businesses, but not those in the utility industry. Their stable nature makes them a haven as bedrock stocks for many investors. Nevertheless, firms in this sector are among the companies with the highest debt to equity ratio, and we will explain why.

The stable nature of the utility sector makes their bonds valuable, giving them access to easy and quick funding. They deliver consistent dividends to investors because they provide everyday necessities like electricity and gas to consumers regardless of demand. Hence, they can keep high debt even if it is not what is considered to be a good debt to equity ratio.

New investors may be unsure whether the debt to equity ratio higher or lower is better, especially in utilities. The answer is relatively simple once you understand the nature of the business. Hence, we will take time to expand on this subject.

Utility Debt Risk

Debt might not be good, but global statistics tell a different story. The debt for non-financial companies stood at $88 trillion, above the worldwide GDP. That paints a picture of how much funding businesses need to stay afloat.

The debt-to-equity ratio measures how much a company finances its operations through debt. It further shows how much the company can cover its debt with shareholder equity. Essentially, it is a simple calculation.

Companies with a high debt-to-equity ratio are significant risks for investors. However, it takes much more to understand what is considered to be a good debt to equity ratio.

As mentioned earlier, utility businesses are among the companies with a high debt to equity ratio. However, valuing utility stocks is much easier because of their predictability and stability.

So, what is considered a good debt to equity ratio? You should have a fair knowledge of this aspect as we dive deeper.

Although the figures differ depending on the industry, a debt-to-equity ratio of 2 to 2.5 is ideal. That shows that financiers or lenders contribute about twice what the company’s equity contributes.

However, a low debt-to-equity ratio is sometimes a good sign. The utility industry stays in a unique spot, giving it leverage over debt risks.

Utility Stocks are Meant to Be Safe. Debt Makes Them More Risky

High debt is a considerable risk; hence, people tend to avoid companies with a high debt-to-equity ratio. A minor economic downturn could send such businesses into a debt cycle, leaving them unable to meet customer demands. When that happens, it often spells the doom of such businesses.

Public utility companies may have stable and predictable stocks, but their extensive debt makes them risky. The neat thing is that they need the money to stay afloat. Hence, they will always accumulate debt for their business operations, especially when starting.

Getting the top utility stocks will place you in a safe spot. It is a brilliant way to diversify your portfolio, even though it does not bring all those exciting price jumps. The idea is to have something stable and predictable to invest in.

Utility stocks are also recession-proof, despite their high debt risk. They blur the lines covering whether the debt to equity ratio higher or lower is better. However, there are a couple of things you should know before making the dive for utility stocks.

You must consider the debt-risk factors.

Utility Debt Risk Factors

Before we look at the debt risk factors, let us get one thing out of the way: interest rates. The answer is yes if you wonder whether interest rates affect utility companies.

Interest rates always play a significant role during recessions or inflation. Central banks use interest rates to maintain their economies and overcome shortcomings.

Apart from making bonds look more attractive, they raise business costs. Utility companies pass on the extra cost to the consumers, but it is not a one-stop solution. Another way would be to pass it on to the investors and bondholders.

New investors would shy away because of the higher cost. Nevertheless, utility companies have a good chance of surviving a recession.

The “debt risk” factors are crucial in screening for utility stocks in different markets. They include the following:

Economic Factors: Despite being recession-proof, other economic factors can affect utility debt. A faulty product or new regulations could see a company need a significant capital expenditure. This alone could result in liquidity problems, further straining the company.

Obscured factors: These factors take time to be clear and sometimes escape predictions. A utility company could be on the brink of bankruptcy and still have a high valuation. It is similar to having a good credit rating, presenting a low risk of default while being one step away from collapse.

What Makes Utility Debt Unique

Having established that utilities are among companies with a high debt ratio, it is time to see why they are unique. These businesses can take on large amounts of debt because of the sensitivity of their products or services. You would agree that electricity and gas are essential components for everyday living.

Utility companies go beyond what is considered a good debt-to-equity ratio. However, one must be cautious, especially during periods of high interest rates.

Companies with the Highest Debt to Equity Ratio

Utility companies get a large amount of debt to finance their business. Other industries with high debt include:

- Oil and Gas

- Telecommunications

- Banking

- Manufacturing

Utility companies have a lot of debt as they often require large amounts of cash to fund their business expenses. They must produce consumer goods or services consistently to meet basic human needs in society and across the globe. Nonetheless, the demand for their products or services makes their valuation remains stable, relatively unaffected, and predictable.

Is Debt to Equity Ratio Higher or Lower Better?

Having a low ratio is better. That often shows that the company or business has reached maturity and funds most of its operations with equity. However, it is company-dependent.

Utility companies have a high figure that may not correspond to what is considered a good debt-to-equity ratio. That is because they often need large capital expenditures to drive production. Anything short of that, and we will have unmet consumer demands.

Having a high debt-to-equity ratio is partially right. In other industries, it is necessary to drive growth and innovation. For utilities, it is one way of maintaining stable and predictable stocks.

So, to answer the question, is debt to equity ratio higher or lower better? The best approach is to know the industry you want to invest in. A high figure is not bad for utilities and most often signifies stability.

Frequently Asked Questions

Do utility companies have a lot of debt?

Utility companies have a lot of debt as they often require large amounts of cash to fund their business expenses. They must produce consumer goods or services consistently to meet basic human needs in society and across the globe. Nonetheless, the demand for their products or services makes their valuation remains stable, relatively unaffected, and predictable.

Are utility companies affected by interest rates?

Interest rates affect utility companies, raising business costs and making bonds look attractive. Utility companies pass on the extra cost to the consumers, but it is not a one-stop solution. Another way would be to pass it on to the investors and bondholders.

Why do utilities have high debt to equity ratios?

Utility companies produce consumer goods that are always in demand to meet basic needs in the society and globe. Doing that calls for a high inflow of funds to keep manufacturing processes and services going at optimal speed. As a result, these companies can borrow large amounts of money while relying on their stable stocks for equity.

Recessions might ruin many businesses, but not those in the utility industry. Their stable nature makes them a haven as bedrock stocks for many investors. Nevertheless, firms in this sector are among the companies with the highest debt to equity ratio, and we will explain why.

The stable nature of the utility sector makes their bonds valuable, giving them access to easy and quick funding. They deliver consistent dividends to investors because they provide everyday necessities like electricity and gas to consumers regardless of demand. Hence, they can keep high debt even if it is not what is considered to be a good debt to equity ratio.

New investors may be unsure whether the debt to equity ratio higher or lower is better, especially in utilities. The answer is relatively simple once you understand the nature of the business. Hence, we will take time to expand on this subject.

Utility Debt Risk

Debt might not be good, but global statistics tell a different story. The debt for non-financial companies stood at $88 trillion, above the worldwide GDP. That paints a picture of how much funding businesses need to stay afloat.

The debt-to-equity ratio measures how much a company finances its operations through debt. It further shows how much the company can cover its debt with shareholder equity. Essentially, it is a simple calculation.

Companies with a high debt-to-equity ratio are significant risks for investors. However, it takes much more to understand what is considered to be a good debt to equity ratio. As mentioned earlier, utility businesses are among the companies with a high debt to equity ratio. However, valuing utility stocks is much easier because of their predictability and stability.

So, what is considered a good debt to equity ratio? You should have a fair knowledge of this aspect as we dive deeper. Although the figures differ depending on the industry, a debt-to-equity ratio of 2 to 2.5 is ideal. That shows that financiers or lenders contribute about twice what the company’s equity contributes.

However, a low debt-to-equity ratio is sometimes a good sign. The utility industry stays in a unique spot, giving it leverage over debt risks.

Utility Stocks are Meant to Be Safe. Debt Makes Them More Risky

High debt is a considerable risk; hence, people tend to avoid companies with a high debt-to-equity ratio. A minor economic downturn could send such businesses into a debt cycle, leaving them unable to meet customer demands. When that happens, it often spells the doom of such businesses. Public utility companies may have stable and predictable stocks, but their extensive debt makes them risky. The neat thing is that they need the money to stay afloat. Hence, they will always accumulate debt for their business operations, especially when starting. Getting the top utility stocks will place you in a safe spot. It is a brilliant way to diversify your portfolio, even though it does not bring all those exciting price jumps. The idea is to have something stable and predictable to invest in. Utility stocks are also recession-proof, despite their high debt risk. They blur the lines covering whether the debt to equity ratio higher or lower is better. However, there are a couple of things you should know before making the dive for utility stocks. You must consider the debt-risk factors.

Utility Debt Risk Factors

Before we look at the debt risk factors, let us get one thing out of the way: interest rates. The answer is yes if you wonder whether interest rates affect utility companies. Interest rates always play a significant role during recessions or inflation. Central banks use interest rates to maintain their economies and overcome shortcomings. Apart from making bonds look more attractive, they raise business costs. Utility companies pass on the extra cost to the consumers, but it is not a one-stop solution. Another way would be to pass it on to the investors and bondholders. New investors would shy away because of the higher cost. Nevertheless, utility companies have a good chance of surviving a recession. The “debt risk” factors are crucial in screening for utility stocks in different markets. They include the following:

Economic Factors: Despite being recession-proof, other economic factors can affect utility debt. A faulty product or new regulations could see a company need a significant capital expenditure. This alone could result in liquidity problems, further straining the company.

Obscured factors: These factors take time to be clear and sometimes escape predictions. A utility company could be on the brink of bankruptcy and still have a high valuation. It is similar to having a good credit rating, presenting a low risk of default while being one step away from collapse.

What Makes Utility Debt Unique

Having established that utilities are among companies with a high debt ratio, it is time to see why they are unique. These businesses can take on large amounts of debt because of the sensitivity of their products or services. You would agree that electricity and gas are essential components for everyday living. Utility companies go beyond what is considered a good debt-to-equity ratio. However, one must be cautious, especially during periods of high interest rates.

Companies with the Highest Debt to Equity Ratio

Utility companies get a large amount of debt to finance their business. Other industries with high debt include:

Utility companies have a lot of debt as they often require large amounts of cash to fund their business expenses. They must produce consumer goods or services consistently to meet basic human needs in society and across the globe. Nonetheless, the demand for their products or services makes their valuation remains stable, relatively unaffected, and predictable.

Is Debt to Equity Ratio Higher or Lower Better?

Having a low ratio is better. That often shows that the company or business has reached maturity and funds most of its operations with equity. However, it is company-dependent. Utility companies have a high figure that may not correspond to what is considered a good debt-to-equity ratio. That is because they often need large capital expenditures to drive production. Anything short of that, and we will have unmet consumer demands. Having a high debt-to-equity ratio is partially right. In other industries, it is necessary to drive growth and innovation. For utilities, it is one way of maintaining stable and predictable stocks. So, to answer the question, is debt to equity ratio higher or lower better? The best approach is to know the industry you want to invest in. A high figure is not bad for utilities and most often signifies stability.

Frequently Asked Questions

Do utility companies have a lot of debt?

Utility companies have a lot of debt as they often require large amounts of cash to fund their business expenses. They must produce consumer goods or services consistently to meet basic human needs in society and across the globe. Nonetheless, the demand for their products or services makes their valuation remains stable, relatively unaffected, and predictable.

Are utility companies affected by interest rates?

Interest rates affect utility companies, raising business costs and making bonds look attractive. Utility companies pass on the extra cost to the consumers, but it is not a one-stop solution. Another way would be to pass it on to the investors and bondholders.

Why do utilities have high debt to equity ratios?

Utility companies produce consumer goods that are always in demand to meet basic needs in the society and globe. Doing that calls for a high inflow of funds to keep manufacturing processes and services going at optimal speed. As a result, these companies can borrow large amounts of money while relying on their stable stocks for equity.