Expertise provided by Kevin Matthews from buildingbread.com

Financial stocks refer to a group of stocks that cover companies offering services. This category is diverse. It includes banks, investment banks, insurance firms, credit card companies, and brokerages. Financial stocks play a role, in the economy and can be a profitable investment for those with market knowledge.

Investing in stocks can be beneficial. It's essential to choose wisely. The financial sector has growth and earnings opportunities. But not all companies are at the same level. Big banks like JPMorgan Chase and Bank of America have a record of stability. However, smaller regional banks had setbacks in 2023. Therefore, making informed decisions is crucial when investing in financials. Research companies. Understand why you want to invest. Define your investment objectives.

Benefits of Financial Stocks

There are several reasons why financial stocks can be a good investment:

Growth: The finance industry has a heritage of growth. Financial firms put much of their earnings back into their operations. This practice can increase stock values, over the years.

Dividend: Investors often look to stocks for dividends. Dividends are a share of a company's earnings distributed to shareholders. This arrangement can offer investors an income stream.

Stability: Financial firms are usually standing and lucrative. They offer investors a sense of security for their investment portfolios.

Financial sector stocks are an economic indicator. They can provide insights into the state of the economy. In times of prosperity financial stocks often demonstrate performance.

Risks of financial stocks

While financial stocks can be a good investment, there are also some risks to consider:

Economic Sensitivity: Stocks related to finance are impacted by the state of the economy. During times of downturn, financial stocks may not perform well.

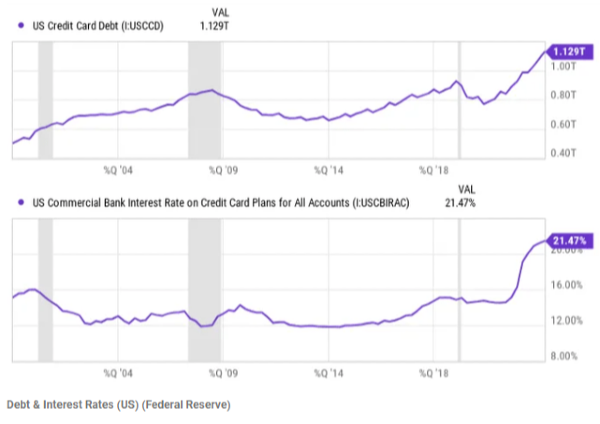

Interest Rates: Financial companies are also impacted by changes, in interest rates. When interest rates go up it can affect their profits negatively.

Regulation: The finance industry faces regulations and any alterations, to these regulations can have an effect, on the performance of financial stocks.

Competition: In the realm of finance the market is highly competitive leading to a strain, on profit margins.

Other Risks: Geopolitical occurrences and advancements, in technology are elements that can influence the performance of stocks.

How Do Bank Stocks Do During Inflation?

Dealing with inflation can pose challenges, for banks. While it may result in increased interest rates that can boost profits from loans it could also lead to a rise, in loan defaults when borrowers struggle to meet their repayment obligations.

Here's a more detailed breakdown of how inflation can impact bank stocks:

Increased Interest Rates: Previously discussed inflation may result in interest rates. This situation can be advantageous, for banks in a couple of ways. Initially, banks have the opportunity to impose interest fees on loans thereby boosting their earnings. Secondly, heightened interest rates can also contribute to an expansion of the interest margin (NIM) for banks. The NIM represents the variance between the interest rate applied by banks on loans and the interest rate received on deposits. An augmentation, in the NIM has the potential to enhance the profitability of banks.

Loan Defaults: However, inflation can also lead to an increase in loan defaults. Inflation can diminish the purchasing power of borrowers' earnings making it challenging for them to settle their debts. A rise, in loan defaults, can impact bank earnings negatively.

Bond Prices: Inflation could also result in a drop, in bond values. This happens because inflation diminishes the buying power of a bond's coupon payment. The decline in bond prices can negatively affect banks given that many banks own collections of bonds. In conclusion, the influence of inflation on bank shares is intricate. Hinges on elements. Nonetheless typically speaking inflation might have an impact on bank shares unless it triggers a rise, in loan defaults.

Should You Buy Bank Stocks Now?

Deciding whether or not to invest in bank stocks is a choice that hinges on factors, such, as your investment objectives and comfort level, with risk. Here are some things to consider before you invest in bank stocks:

The Current Economic Environment: When thinking about the economy it's important to take into account its condition. If the economy is doing well investing in bank stocks could be a choice. On the other hand, if the economy is struggling bank stocks might carry risk.

Interest Rates: When looking at the interest rates and their potential future trajectory it's important to note how changes, in interest rates can impact bank stocks. An increase in interest rates may affect bank stocks whereas a decrease in interest rates could pose challenges, for them.

The Health of the Banking Industry: Looking at the well-being of the banking sector is crucial. When the banking industry is, in shape investing in bank stocks could be a choice. On the other hand, if the banking industry is struggling, investing in bank stocks might pose risks.

Your Investment Goals: When thinking about your investment objectives it's important to consider what you're aiming for. If you're seeking a lasting investment that offers both growth and income potential bank stocks could be a choice.

10 best bank stocks to buy in 2024

JPMorgan Chase & Co. (JPM)

- Market Cap: $573 billion (as of April 14, 2024)

- Dividend Yield: 3.21% (as of April 14, 2024)

JPMorgan Chase stands as the bank, in the United States in terms of assets. Holds a prominent position globally. JPMorgan Chase provides many services. These include investment banking, commercial banking, consumer banking, and wealth management. It has a reputation for being profitable and having strong management. Notably, the bank marked its year of raising dividends in 2023.

Bank of America Corporation (BAC)

- Market Cap: $294 billion (as of April 14, 2024)

- Dividend Yield: 2.62% (as of April 14, 2024)

Bank of America ranks as the bank, in the United States based on its assets. The institution provides a range of services, such as banking, consumer banking, and wealth management. With a footprint, in the U.S. Bank of America is also making strides in expansion. Following the crisis of 2008, the bank's stock value has shown a recovery.

Wells Fargo & Co. (WFC)

- Market Cap: $203 billion (as of April 14, 2024)

- Dividend Yield: 1.90% (as of April 14, 2024)

Wells Fargo ranks as the bank, in the United States based on its assets. This financial institution provides a range of services such as banking, consumer banking, and wealth management. Wells Fargo has shown performance in the stock market over the past few years. Nevertheless, the bank has faced scrutiny due, to scandals leading to increased oversight.

Citigroup Inc. (C)

- Market Cap: $107 billion (as of April 14, 2024)

- Dividend Yield: 4.21% (as of April 14, 2024)

Citigroup is a well-known bank. It provides a range of financial services, such as investment banking, commercial banking, consumer banking, and wealth management. While Citigroup is prominently established in the United States it also maintains a footprint. Citigroup's stock value has fluctuated over the years. However, the bank is actively working to improve its finances.

The Goldman Sachs Group, Inc. (GS)

- Market Cap: $154 billion (as of April 14, 2024)

- Dividend Yield: 1.81% (as of April 14, 2024)

Goldman Sachs is an investment bank. It offers a range of services, such as investment banking, trading securities, and managing wealth. Known for its reputation the bank's stock value may fluctuate yet it has consistently maintained profitability, over the years.

Morgan Stanley (MS)

- Market Cap: $178 billion (as of April 14, 2024)

- Dividend Yield: 1.78% (as of April 14, 2024)

Morgan Stanley is an investment bank. It offers services such as investment banking, securities trading, and wealth management. Known for its reputation Morgan Stanley stands among the top-tier investment banks globally. While the bank's stock value may fluctuate it boasts a legacy of profitability, over time.

Bank of Montreal (BMO)

- Market Cap: $92 billion (as of April 14, 2024)

- Dividend Yield: 4.02% (as of April 14, 2024)

The Bank of Montreal stands as the established bank, in Canada. Ranks among the largest banks in North America. It provides many services. These include banking, consumer banking, and wealth management. It is strong in both Canada and the United States. It is also growing in other global regions. Renowned for its robustness and reliability the bank maintains a reputation, in the industry.

HSBC Holdings plc (HSBC)

- Market Cap: $182 billion (as of April 14, 2024)

- Dividend Yield: 3.37% (as of April 14, 2024)

HSBC Holdings is an investment bank and financial services company based in Britain. It holds the title of being the biggest bank in Europe by total assets. HSBC provides a range of services, such as banking, consumer banking, and wealth management. It operates globally in more than 60 countries and territories. Renowned for its standing and reliability the bank has established itself as a key player, in the industry.

Industrial and Commercial Bank of China (ICBC)

- Market Cap: $246 billion (as of April 14, 2024)

- Dividend Yield: 3.88% (as of April 14, 2024)

The Industrial and Commercial Bank of China stands as the world's bank in terms of assets. This state-owned commercial bank provides a range of services covering banking, consumer banking, and investment banking. ICBC has a footprint in China and is expanding globally. Its stock price may fluctuate, but investing in it lets you tap into the thriving Chinese economy.

Banco Santander, S.A. (SAN)

- Market Cap: $120 billion (as of April 14, 2024)

- Dividend Yield: 4.87% (as of April 14, 2024)

Banco Santander, a financial services corporation based in Spain holds the position, as the largest bank in Spain in terms of total assets. Banco Santander offers many services. These include banking, consumer banking, and investment banking. The bank operates globally in over 10 countries and territories. While the stock price of Banco Santander may fluctuate at times investors are attracted to its high dividend yield.

For more information watch this video:

https://youtu.be/mXPoLxLYP70

Expertise provided by Kevin Matthews from buildingbread.com

Financial stocks refer to a group of stocks that cover companies offering services. This category is diverse. It includes banks, investment banks, insurance firms, credit card companies, and brokerages. Financial stocks play a role, in the economy and can be a profitable investment for those with market knowledge.

Investing in stocks can be beneficial. It's essential to choose wisely. The financial sector has growth and earnings opportunities. But not all companies are at the same level. Big banks like JPMorgan Chase and Bank of America have a record of stability. However, smaller regional banks had setbacks in 2023. Therefore, making informed decisions is crucial when investing in financials. Research companies. Understand why you want to invest. Define your investment objectives.

Benefits of Financial Stocks

There are several reasons why financial stocks can be a good investment:

Growth: The finance industry has a heritage of growth. Financial firms put much of their earnings back into their operations. This practice can increase stock values, over the years.

Dividend: Investors often look to stocks for dividends. Dividends are a share of a company's earnings distributed to shareholders. This arrangement can offer investors an income stream.

Stability: Financial firms are usually standing and lucrative. They offer investors a sense of security for their investment portfolios.

Financial sector stocks are an economic indicator. They can provide insights into the state of the economy. In times of prosperity financial stocks often demonstrate performance.

Risks of financial stocks

While financial stocks can be a good investment, there are also some risks to consider:

Economic Sensitivity: Stocks related to finance are impacted by the state of the economy. During times of downturn, financial stocks may not perform well.

Interest Rates: Financial companies are also impacted by changes, in interest rates. When interest rates go up it can affect their profits negatively.

Regulation: The finance industry faces regulations and any alterations, to these regulations can have an effect, on the performance of financial stocks.

Competition: In the realm of finance the market is highly competitive leading to a strain, on profit margins.

Other Risks: Geopolitical occurrences and advancements, in technology are elements that can influence the performance of stocks.

How Do Bank Stocks Do During Inflation?

Dealing with inflation can pose challenges, for banks. While it may result in increased interest rates that can boost profits from loans it could also lead to a rise, in loan defaults when borrowers struggle to meet their repayment obligations. Here's a more detailed breakdown of how inflation can impact bank stocks:

Increased Interest Rates: Previously discussed inflation may result in interest rates. This situation can be advantageous, for banks in a couple of ways. Initially, banks have the opportunity to impose interest fees on loans thereby boosting their earnings. Secondly, heightened interest rates can also contribute to an expansion of the interest margin (NIM) for banks. The NIM represents the variance between the interest rate applied by banks on loans and the interest rate received on deposits. An augmentation, in the NIM has the potential to enhance the profitability of banks.

Loan Defaults: However, inflation can also lead to an increase in loan defaults. Inflation can diminish the purchasing power of borrowers' earnings making it challenging for them to settle their debts. A rise, in loan defaults, can impact bank earnings negatively.

Bond Prices: Inflation could also result in a drop, in bond values. This happens because inflation diminishes the buying power of a bond's coupon payment. The decline in bond prices can negatively affect banks given that many banks own collections of bonds. In conclusion, the influence of inflation on bank shares is intricate. Hinges on elements. Nonetheless typically speaking inflation might have an impact on bank shares unless it triggers a rise, in loan defaults.

Should You Buy Bank Stocks Now?

Deciding whether or not to invest in bank stocks is a choice that hinges on factors, such, as your investment objectives and comfort level, with risk. Here are some things to consider before you invest in bank stocks:

The Current Economic Environment: When thinking about the economy it's important to take into account its condition. If the economy is doing well investing in bank stocks could be a choice. On the other hand, if the economy is struggling bank stocks might carry risk.

Interest Rates: When looking at the interest rates and their potential future trajectory it's important to note how changes, in interest rates can impact bank stocks. An increase in interest rates may affect bank stocks whereas a decrease in interest rates could pose challenges, for them.

The Health of the Banking Industry: Looking at the well-being of the banking sector is crucial. When the banking industry is, in shape investing in bank stocks could be a choice. On the other hand, if the banking industry is struggling, investing in bank stocks might pose risks.

Your Investment Goals: When thinking about your investment objectives it's important to consider what you're aiming for. If you're seeking a lasting investment that offers both growth and income potential bank stocks could be a choice.

10 best bank stocks to buy in 2024

JPMorgan Chase & Co. (JPM)

JPMorgan Chase stands as the bank, in the United States in terms of assets. Holds a prominent position globally. JPMorgan Chase provides many services. These include investment banking, commercial banking, consumer banking, and wealth management. It has a reputation for being profitable and having strong management. Notably, the bank marked its year of raising dividends in 2023.

Bank of America Corporation (BAC)

Wells Fargo & Co. (WFC)

Citigroup Inc. (C)

The Goldman Sachs Group, Inc. (GS)

Morgan Stanley (MS)

Bank of Montreal (BMO)

HSBC Holdings plc (HSBC)

Industrial and Commercial Bank of China (ICBC)

Banco Santander, S.A. (SAN)

For more information watch this video:

https://youtu.be/mXPoLxLYP70