Expertise provided by Kevin Matthews from buildingbread.com

Investing in stocks can enhance an investment portfolio. They provide opportunities, for growing capital earning dividends, and maintaining stability in challenging times. Nevertheless, the financial industry is intricate and ever-changing. Therefore, it's crucial to assess aspects before adding financial stocks to your investment mix.

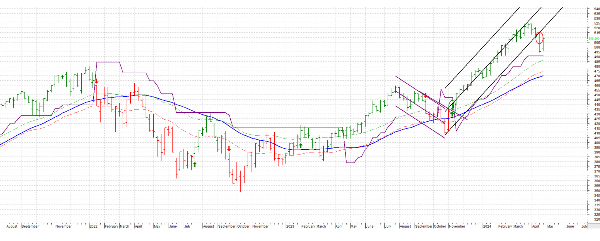

When I analyze a stock, I like to look at it from an angle. Firstly, I check how well the stock is doing; has it outperformed others in its finance category, and is it, among the 10% in the finance sector or part of the S&P 500? I want to see if it shines in the stock market and its specific finance niche. If it doesn't stand out, I tend to move on as I prefer focusing on achievers. Secondly, I review how consistent the company's free cash flow is – this is the cash after covering all expenses. Such a company is appealing. It shows strength and efficiency. It is like having ample cash reserves in a business. Lastly, I take into account the market scenario and trends. If consumer spending rises or interest rates drop, I look for companies that will benefit.

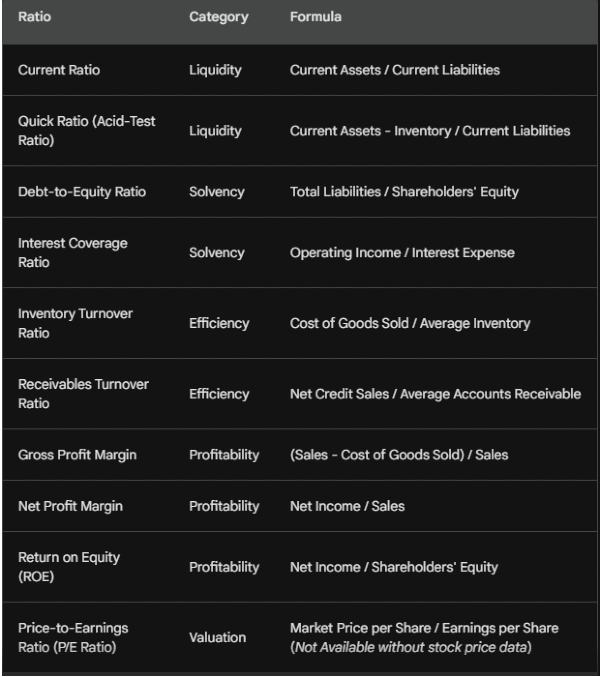

Financial Ratios

Financial ratios play a role, in assessing the well-being and success of a company. When examining investments, it's essential to take into account key ratios. Some of the ratios to keep in mind are;

Price-to-earnings (P/E) ratio:

When you're assessing a company’s stock the price, to earnings (P/E) ratio is a factor. It compares the stock price to its earnings per share (EPS). A low P/E ratio could indicate a stock while a high one might suggest it is overvalued. It's important to consider a company’s P/E ratio in comparison to its industry average and past ratios.

Return on equity (ROE):

Return on equity (ROE) measures how efficiently a company uses shareholder's equity to generate profits. A higher ROE is generally viewed positively. It's essential to analyze it relative to industry standards.

Debt-to-equity (D/E) ratio:

The debt to equity (D/E) ratio assesses a company’s leverage. A higher D/E ratio signifies reliance on debt for operations, which can pose risks during downturns.

Dividend yield:

Dividend yield is calculated by dividing the dividend payment, per share by the stock price. Financial stocks are often recognized for their dividend yields. It's crucial to consider the company's dividend payout ratio. This ratio represents the portion of earnings paid as dividends. A high payout ratio may suggest that the company lacks funds for reinvestment, in its expansion.

Financial Strength

Besides examining ratios it's essential to evaluate a company’s financial stability. This encompasses aspects, like profitability, liquidity, and capital adequacy.

Profitability:

A company’s ability to make money can be gauged by its income or earnings, per share (EPS). Companies that turn a profit are usually in a position to pay out dividends and see their stock prices rise over time.

Liquidity:

A company’s cash flow indicates how easily it can handle its term commitments. Companies with cash flow are less likely to default on their debts.

Capital adequacy:

Financial strength reflects a company’s capacity to withstand setbacks. Companies with foundations are more resilient during tough economic times.

What makes for a Price-to-earnings (P/E) ratio?

The Price to Earnings (P/E) ratio is used to measure for evaluating companies in the financial industry. It is determined by dividing a stock's market price by its earnings per share (EPS). When assessing what qualifies as a "P/E ratio, for stocks one must take into account industry standards, economic circumstances, and unique company characteristics.

Industry Norms

In the sector are banks, insurance firms, and investment companies. P/E ratios often vary there, compared to other industries. Historically financial stocks tend to have P/E ratios than technology or consumer stocks. This is partly because financial firms are more stable. They also have more growth potential than tech companies. An accepted range for a P/E ratio for financial stocks is 10 to 15. But this can vary by the sub-sector and market.

Economic Conditions

The P/E ratios of stocks are significantly influenced by conditions. During growth, financial companies tend to see higher earnings. This is due to more lending, investments, and lower defaults. This can result in P/E ratios. Conversely in times of downturns earnings may decrease due, to default rates and reduced loan demand leading to lower P/E ratios.

Company-Specific Attributes

1. Earnings Rate:

Companies that anticipate earnings growth usually have P/E ratios. For stocks steady and reliable earnings growth can support a higher P/E ratio. A financial institution may want to grow its market presence or launch new offerings. In these cases, a higher P/E ratio could be seen as reasonable.

2. Risk Profile:

The level of risk linked to a company’s activities impacts its P/E ratio. Financial organizations face risk. They are heavily involved in markets or have substantial bad debt. They typically exhibit lower P/E ratios. On the other hand, funded firms, with varied income sources and robust risk mitigation strategies may support higher P/E ratios.

3. Dividend Yield:

Many financial companies, like banks and insurance firms, pay out dividends. A higher dividend yield can make a stock more appealing potentially resulting in a P/E ratio. Investors might be willing to accept a P/E ratio in return for dividend income.

Comparative Analysis

It's important to compare the P/E ratio of a stock with that of its peers and the overall market. A financial stock has a P/E ratio higher than its peers. It could be seen as overvalued unless strong growth prospects or lower risk factors are supporting it. On the other hand, a lower P/E ratio could indicate undervaluation or underlying concerns.

Limitations of P/E Ratio

Although helpful the P/E ratio does have its limitations. It doesn't consider growth rates. The PEG ratio handles those. It also ignores changes in accounting practices or one-time earnings events. So, use the P/E ratio. But, also use metrics like the price-to-book (P/B) ratio and return on equity (ROE). Also, consider the company's overall financial health.

A "good" P/E ratio range, for stocks typically falls between 10 to 15 depending on the circumstances.

When making investments in the sector, consider industry practices and economics. Also, look at the company's unique traits and compare it to similar businesses. Investors shouldn't base their decisions on the P/E ratio. Should incorporate it into a more comprehensive analysis to make well-informed choices.

Team Management:

The composition team plays a role, in the decision-making process when investing in stocks. A competent management team with a proven track record is more likely to steer the company towards success. Here are some key aspects to consider in evaluating a management team;

Experience:

The management team needs to possess experience within the financial services sector.

Track record:

A successful history of managing institutions is crucial for the management team.

Compensation:

The compensation structure of the management team should align with the interests of shareholders.

Growth Potential

Apart from stability and a reliable management team assessing a company’s growth potential is equally significant. Financial companies can expand through avenues, including growth, acquisitions, and introducing new products.

Organic growth

This term refers to a company's ability to increase its earnings without relying on acquisitions.

Acquisitions

Growing by buying companies is good. But we must fully evaluate each chance to buy before investing.

New product offerings

Expansion can come from making new and better products and services. This is true at financial companies.

Industry Trend

Keeping up with industry trends is vital. The financial services sector's landscape is evolving.

Fintech

Before you decide to invest in stocks make sure you stay updated on the trends, in the industry. One significant trend is the rise of fintech, where technology is being used to provide services. Fintech companies are changing the landscape of finance offering fresh possibilities for investors.

Regulation

When it comes to the financial services sector strict regulations are in place. Changes in regulations can greatly impact firms.

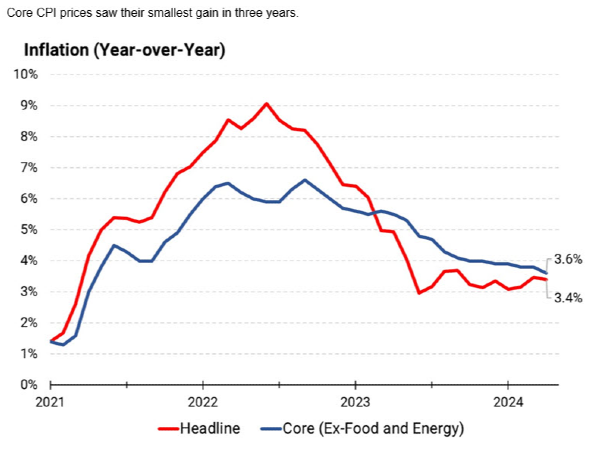

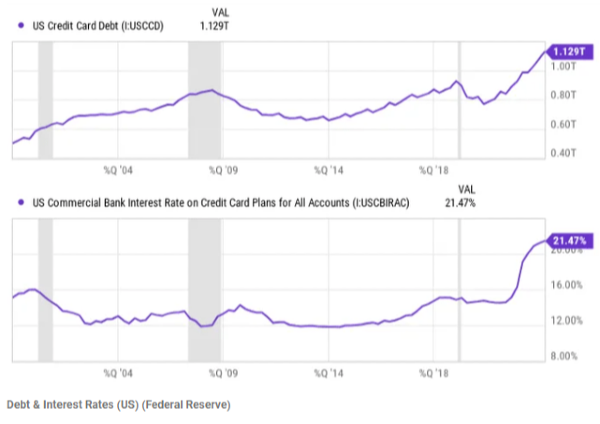

Interest Rate

Interest rates also play a role in determining the profitability of these companies. Investors should stay informed about how fluctuations in interest rates could influence their investments.

What financials to look at when buying a stock?

When buying stocks, consider indicators like revenue growth and net income margin. Also, consider metrics like earnings per share (EPS), debt-to-equity ratio, cash flow, and return on equity (ROE). Also, you must examine the company’s balance sheet. It shows their assets, debts, and shareholder equity. We can evaluate management efficiency with metrics like inventory turnover and operating margin. They provide insights into a company’s health and growth.

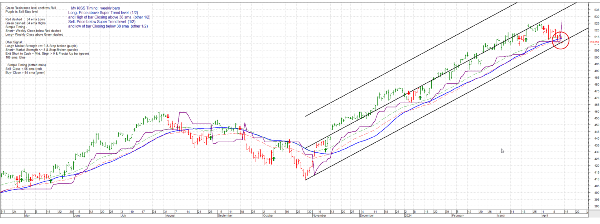

How do you know if a stock is overvalued?

Source: Investopedia

Source: Investopedia

Is a stock overvalued? To find out, look at metrics like P/E ratio, P/B ratio, and P/S ratio. Also, consider dividend yield, discounted cash flow (DCF) analysis, and industry comparisons. And, think about qualitative factors like growth potential and management quality. Technical analysis tools, like RSI and MACD, can also be utilized for assessment purposes.

Financial stock will trade below their intrinsic value. This phenonomen started right after the financial crisis. Expect to discount the intrinsic value you calculate by at least 20% to take into account the market's hesitation towards financial stocks.

Conclusion

When thinking about investing in stocks it's important to take into account a variety of factors. Assess how well the company is doing compared to others, in its industry and consider its cash flow stability and market trends. Key financial measures like P/E ratio, ROE, and D/E ratio offer insights into the company’s health. Industry standards and economic conditions help determine its worth. It is also important to look at the management team’s expertise and track record. Also, at the potential for growth and industry developments, such as advances, in fintech. By evaluating these aspects, investors can make decisions. They can navigate the complexities of the financial market with confidence.

For more information watch this video:

https://youtu.be/_sKPA2KcIlE

Expertise provided by Kevin Matthews from buildingbread.com

Investing in stocks can enhance an investment portfolio. They provide opportunities, for growing capital earning dividends, and maintaining stability in challenging times. Nevertheless, the financial industry is intricate and ever-changing. Therefore, it's crucial to assess aspects before adding financial stocks to your investment mix.

When I analyze a stock, I like to look at it from an angle. Firstly, I check how well the stock is doing; has it outperformed others in its finance category, and is it, among the 10% in the finance sector or part of the S&P 500? I want to see if it shines in the stock market and its specific finance niche. If it doesn't stand out, I tend to move on as I prefer focusing on achievers. Secondly, I review how consistent the company's free cash flow is – this is the cash after covering all expenses. Such a company is appealing. It shows strength and efficiency. It is like having ample cash reserves in a business. Lastly, I take into account the market scenario and trends. If consumer spending rises or interest rates drop, I look for companies that will benefit.

Financial Ratios

Financial ratios play a role, in assessing the well-being and success of a company. When examining investments, it's essential to take into account key ratios. Some of the ratios to keep in mind are;

Price-to-earnings (P/E) ratio:

When you're assessing a company’s stock the price, to earnings (P/E) ratio is a factor. It compares the stock price to its earnings per share (EPS). A low P/E ratio could indicate a stock while a high one might suggest it is overvalued. It's important to consider a company’s P/E ratio in comparison to its industry average and past ratios.

Return on equity (ROE):

Return on equity (ROE) measures how efficiently a company uses shareholder's equity to generate profits. A higher ROE is generally viewed positively. It's essential to analyze it relative to industry standards.

Debt-to-equity (D/E) ratio:

The debt to equity (D/E) ratio assesses a company’s leverage. A higher D/E ratio signifies reliance on debt for operations, which can pose risks during downturns.

Dividend yield:

Dividend yield is calculated by dividing the dividend payment, per share by the stock price. Financial stocks are often recognized for their dividend yields. It's crucial to consider the company's dividend payout ratio. This ratio represents the portion of earnings paid as dividends. A high payout ratio may suggest that the company lacks funds for reinvestment, in its expansion.

Financial Strength

Besides examining ratios it's essential to evaluate a company’s financial stability. This encompasses aspects, like profitability, liquidity, and capital adequacy.

Profitability:

A company’s ability to make money can be gauged by its income or earnings, per share (EPS). Companies that turn a profit are usually in a position to pay out dividends and see their stock prices rise over time.

Liquidity:

A company’s cash flow indicates how easily it can handle its term commitments. Companies with cash flow are less likely to default on their debts.

Capital adequacy:

Financial strength reflects a company’s capacity to withstand setbacks. Companies with foundations are more resilient during tough economic times.

What makes for a Price-to-earnings (P/E) ratio?

The Price to Earnings (P/E) ratio is used to measure for evaluating companies in the financial industry. It is determined by dividing a stock's market price by its earnings per share (EPS). When assessing what qualifies as a "P/E ratio, for stocks one must take into account industry standards, economic circumstances, and unique company characteristics.

Industry Norms

In the sector are banks, insurance firms, and investment companies. P/E ratios often vary there, compared to other industries. Historically financial stocks tend to have P/E ratios than technology or consumer stocks. This is partly because financial firms are more stable. They also have more growth potential than tech companies. An accepted range for a P/E ratio for financial stocks is 10 to 15. But this can vary by the sub-sector and market.

Economic Conditions

The P/E ratios of stocks are significantly influenced by conditions. During growth, financial companies tend to see higher earnings. This is due to more lending, investments, and lower defaults. This can result in P/E ratios. Conversely in times of downturns earnings may decrease due, to default rates and reduced loan demand leading to lower P/E ratios.

Company-Specific Attributes

1. Earnings Rate:

Companies that anticipate earnings growth usually have P/E ratios. For stocks steady and reliable earnings growth can support a higher P/E ratio. A financial institution may want to grow its market presence or launch new offerings. In these cases, a higher P/E ratio could be seen as reasonable.

2. Risk Profile:

The level of risk linked to a company’s activities impacts its P/E ratio. Financial organizations face risk. They are heavily involved in markets or have substantial bad debt. They typically exhibit lower P/E ratios. On the other hand, funded firms, with varied income sources and robust risk mitigation strategies may support higher P/E ratios.

3. Dividend Yield:

Many financial companies, like banks and insurance firms, pay out dividends. A higher dividend yield can make a stock more appealing potentially resulting in a P/E ratio. Investors might be willing to accept a P/E ratio in return for dividend income.

Comparative Analysis

It's important to compare the P/E ratio of a stock with that of its peers and the overall market. A financial stock has a P/E ratio higher than its peers. It could be seen as overvalued unless strong growth prospects or lower risk factors are supporting it. On the other hand, a lower P/E ratio could indicate undervaluation or underlying concerns.

Limitations of P/E Ratio

Although helpful the P/E ratio does have its limitations. It doesn't consider growth rates. The PEG ratio handles those. It also ignores changes in accounting practices or one-time earnings events. So, use the P/E ratio. But, also use metrics like the price-to-book (P/B) ratio and return on equity (ROE). Also, consider the company's overall financial health. A "good" P/E ratio range, for stocks typically falls between 10 to 15 depending on the circumstances.

When making investments in the sector, consider industry practices and economics. Also, look at the company's unique traits and compare it to similar businesses. Investors shouldn't base their decisions on the P/E ratio. Should incorporate it into a more comprehensive analysis to make well-informed choices.

Team Management:

The composition team plays a role, in the decision-making process when investing in stocks. A competent management team with a proven track record is more likely to steer the company towards success. Here are some key aspects to consider in evaluating a management team;

Experience:

The management team needs to possess experience within the financial services sector.

Track record:

A successful history of managing institutions is crucial for the management team.

Compensation:

The compensation structure of the management team should align with the interests of shareholders.

Growth Potential

Apart from stability and a reliable management team assessing a company’s growth potential is equally significant. Financial companies can expand through avenues, including growth, acquisitions, and introducing new products.

Organic growth

This term refers to a company's ability to increase its earnings without relying on acquisitions.

Acquisitions

Growing by buying companies is good. But we must fully evaluate each chance to buy before investing.

New product offerings

Expansion can come from making new and better products and services. This is true at financial companies.

Industry Trend

Keeping up with industry trends is vital. The financial services sector's landscape is evolving.

Fintech

Before you decide to invest in stocks make sure you stay updated on the trends, in the industry. One significant trend is the rise of fintech, where technology is being used to provide services. Fintech companies are changing the landscape of finance offering fresh possibilities for investors.

Regulation

When it comes to the financial services sector strict regulations are in place. Changes in regulations can greatly impact firms.

Interest Rate

Interest rates also play a role in determining the profitability of these companies. Investors should stay informed about how fluctuations in interest rates could influence their investments.

What financials to look at when buying a stock?

When buying stocks, consider indicators like revenue growth and net income margin. Also, consider metrics like earnings per share (EPS), debt-to-equity ratio, cash flow, and return on equity (ROE). Also, you must examine the company’s balance sheet. It shows their assets, debts, and shareholder equity. We can evaluate management efficiency with metrics like inventory turnover and operating margin. They provide insights into a company’s health and growth.

How do you know if a stock is overvalued?

Is a stock overvalued? To find out, look at metrics like P/E ratio, P/B ratio, and P/S ratio. Also, consider dividend yield, discounted cash flow (DCF) analysis, and industry comparisons. And, think about qualitative factors like growth potential and management quality. Technical analysis tools, like RSI and MACD, can also be utilized for assessment purposes.

Financial stock will trade below their intrinsic value. This phenonomen started right after the financial crisis. Expect to discount the intrinsic value you calculate by at least 20% to take into account the market's hesitation towards financial stocks.

Conclusion

When thinking about investing in stocks it's important to take into account a variety of factors. Assess how well the company is doing compared to others, in its industry and consider its cash flow stability and market trends. Key financial measures like P/E ratio, ROE, and D/E ratio offer insights into the company’s health. Industry standards and economic conditions help determine its worth. It is also important to look at the management team’s expertise and track record. Also, at the potential for growth and industry developments, such as advances, in fintech. By evaluating these aspects, investors can make decisions. They can navigate the complexities of the financial market with confidence.

For more information watch this video:

https://youtu.be/_sKPA2KcIlE