Key Takeaways

While the Metaverse megatrend is looking promising in 2024, the collapse in metaverse investments prices in 2021 and 2022 caused at least three metaverse themed ETFs to liquidate.

First Trust Indxx Metaverse ETF (ARVR) has the most relevance to the metaverse based on their top holdings.

Amplify Video Game Tech ETF (GAMR) has the best performance track record, mostly due to the ETF having a near decade long track record to smooth out the recent collapse in metaverse connected stocks.

Metaverse ETFs

The metaverse is a megatrend sector that will continue to grow in the next decade, even after interest in the metaverse waned in 2022. Sometimes, instead of trying to choose individual platforms that will succeed, it’s best to invest in a basket of stocks who will benefit from a general megatrend like the metaverse.

Exchange traded funds (ETFs) are an investment tool that allows you to invest in different “themes” like the metaverse. The ETF buys a basket of stocks based on a criterion for you. The fund will readjust their holdings periodically (typically quarterly or annually) so that they continue to buy relevant companies in the given theme.

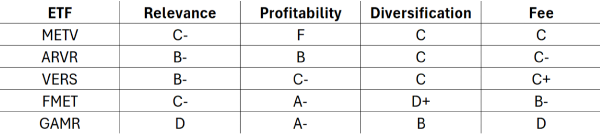

We’ve listed and ranked the top metaverse ETFs by the following criteria.

How relevant are the stocks in the ETF to the actual growth of the metaverse megatrend?

How is the historical performance? Is the fund choosing these metaverse stocks correctly? Or are they putting capital into failing metaverse projects?

Are they diversified? Are they seeking different opportunities within the metaverse megatrend versus their counterparts?

Are they cost reasonably? Are they taking too high of a fee?

Roundhill Ball Metaverse ETF (METV)

METV is an ETF with about $400 Million in assets. They invest in a wide range of companies with ties to the metaverse. The ETF is growth focused with investments that do hedge from a pure play metaverse strategy.

Many of the companies METV invests in have products disconnected from the metaverse. These include mega caps stocks like Apple, Google and Microsoft.

Methodology of METV

The Roundhill Ball Metaverse ETF is quite bullish on metaverse growth. According to Roundhill investments, the economic impact of the metaverse is, at the low end, expected to be $10.7 trillion by 2033. The bullish case estimates up to $43.0 trillion!

The fund notes that even Morgan Stanley estimates that in the long-term, the Metaverse in just the U.S. and China will be a $16.3 trillion market segment!

The fund references three reasons to invest in METV ETF and hence metaverse stocks:

Market Growth - Referencing the Morgan Stanley estimate, the metaverse is looking to grow significantly into 2033.

User Engagement - Referencing the user engagement seen with Roblox, the opportunity is there for growth. With Roblox looking to build an ad platform for their metaverse, there looks to be further avenues to profit from the user engagement growth in the metaverse.

Exponential Adoption - Referencing the new VR headset to be released by Apple (AAPL), the fund feels bullish in headset adoption. The fund expects Virtual Reality and Augmented Reality headsets to reach 31.1 million shipments by 2026.

The fund tracks the performance of the Ball Metaverse Index.

A committee comprised of representatives from Ball Metaverse Research Partners LLC and external subject matter experts (the “Index Committee”) analyze companies for their potential to experience profits from their activities in the Metaverse. The Metaverse Companies selected for inclusion in the Index are companies engaged in activities that fall into one or more categories identified by the Index Committee and described below.

Fees of METV

The fund fee is 0.59%.

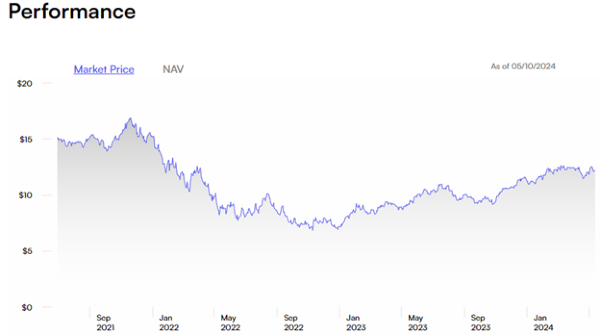

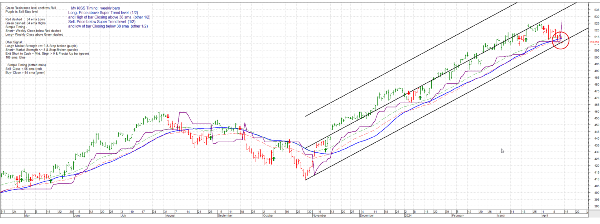

Performance of METV

Top Holdings of METV

The funds top holdings as of May 13th, 2024, are as follows:

Rating METV

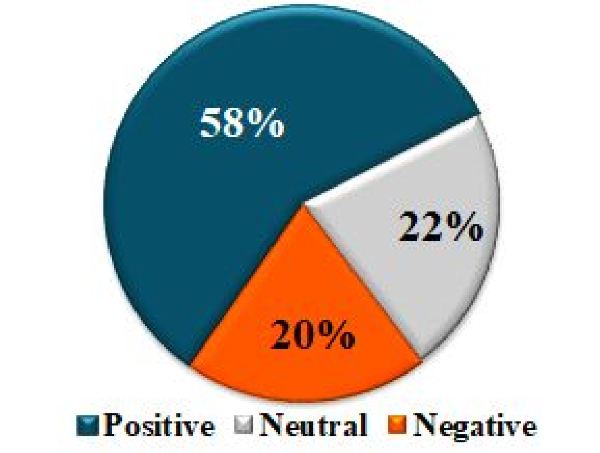

Overall, the ETF gets the following ratings:

Relevance to metaverse: C-

Profitability: F

Diversification: C

Fee: C

The fund has some relevance to the metaverse, but you are still investing in a multitude of other kinds of products and technologies. The fund has lost money since its inception, which leaves it at an F for profitability. The fund is highly diversified, and its fee is average.

First Trust Indxx Metaverse ETF (ARVR)

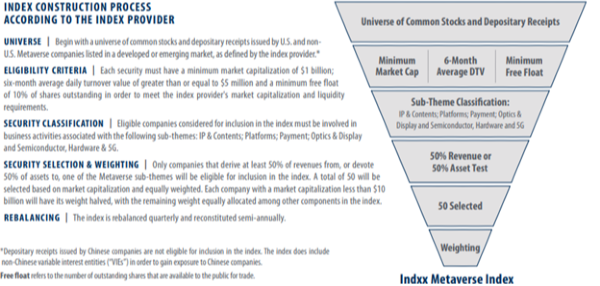

The First Trust Indxx Metaverse ETF follows the Indxx Metaverse Index.

All eligible companies considered for inclusion in the index must be involved in business activities associated with the following sub-themes:

Methodology of ARVR

The ETF gives broad definitions of metaverse themed stocks. The ETF shouldn’t be considered a pure play metaverse ETF, but that it also invests in companies that will support the development and distribution of the metaverse.

Based on the other ETFs in this list, these simple criteria may be the closest to metaverse themed investing.

Top Holdings of ARVR

Top Holdings as of May 13th, 2024

Performance of ARVR

The fund is compared to the MSCI ACWI index for its potential alpha. Since the fund’s inception, the fund has made 7.08% while MSCI ACWI Index has made 6.18%, an alpha of 0.90%.

Fees of ARVR

As of February 1st 2024, the fund’s expense ratio was 0.70%

Final Rating of ARVR

Overall, the ETF gets the following ratings:

Relevance to metaverse: B-

Profitability: B

Diversification: C

Fee: C-

The fact that the fund has made a profit since its inception gives it a leg up versus other metaverse ETFs. Its strong relevance to the metaverse is also strong thanks to its index construction process.

ProShares Metaverse ETF (VERS)

Methodology of VERS

Per the Metaverse ETF (VERS) prospectus:

VERS offers access to the metaverse ecosystem in a single ETF. The fund tracks a forward-looking index designed to capture the metaverse opportunity as it evolves.

The Index is constructed and maintained by Solactive AG. Each time the index chooses the stocks to buy, this Index Provider uses an automated scan of company filings and other public information searching for terms and phrases that will identify companies with large exposure to the metaverse.

Once the potential companies are found, Solactive AG reviews each company and manual removes any with minimal metaverse exposure. The remaining companies are then ranked based on their metaverse exposure.

Companies are only eligible if they generate at least 50% of their revenues from Metaverse-related business operations.

Top VERS Holdings

The top holdings for VERS are mostly mega-cap technology companies. The holdings therefore will have large swings based on the tech sector.

VERS Fees

An operating expense of 0.58%

VERS Profitability

VERS is up 4% since inception roughly 2 years ago. This growth is considerably underwhelming, but fortunately positive compared to its peers.

Final Rating of VERS

Overall, VERS is a “meh” ETF for the metaverse. It has some interesting choices lower in its holdings, but its top holdings are a typical mix of stocks an investor could easily find on their own. The fee is reasonable and the diversification is okay.

Relevance to metaverse: B-

Profitability: C-

Diversification: C

Fee: C+

Fidelity Metaverse ETF (FMET)

Methodology

The manager for this ETF is the standard Fidelity Management & Research Company LLC with Geode Capital Management, LLC serving as a sub-adviser for the fund.

The Fidelity Metaverse Index is created using Fidelity's rules-based proprietary index methodology. The index methodology identifies and ranks stocks for inclusion in the index based on company revenues and proprietary natural language processing (NLP) scores. This is a very fascinating methodology that is tapping into AI for its assessment of a stocks theme.

Fees of FMET

The Fidelity Metaverse ETF has a reasonable management fee of 0.39%.

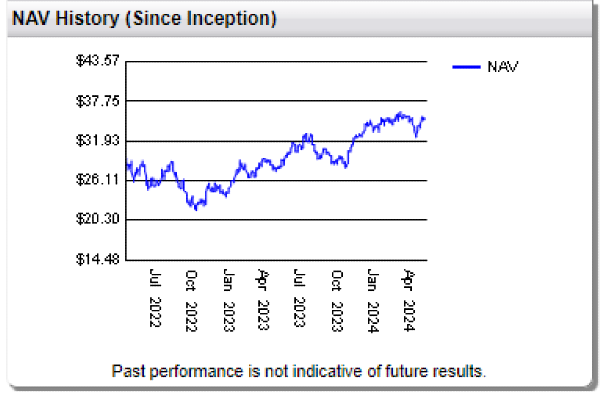

Performance of FMET

The NAV of FMET is up 10.5% since inception

Top Holdings

FMET holds 53 assets in the fund. The top 10 stocks held by FMET are the typical mega cap technology stocks.

Final Rating of FMET

Again, you’re essentially investing in the tech sector mega cap stocks. 80% of its holdings are large cap stocks. The profitability is the best in class, but its metaverse relevance is lacking.

Relevance to metaverse: C-

Profitability: A-

Diversification: D+

Fee: B-

Amplify Video Game Tech ETF (GAMR)

Prior to 1/29/24, the Amplify Video Game Tech ETF was formerly the ETFMG Wedbush ETFMG Video Game Tech ETF. A unique entry to our metaverse ETF list with its pure gaming focus, the fund has some compelling reasons to invest:

Methodology

The fund uses indices created by ee Fund Management

The fund’s methodology is executed by a committee of experts, which is different from some of the other ETFs on this list that are using AI to find metaverse stock candidates.

The candidate companies should be actively engaged in a business activity supporting or utilizing the video gaming industry. The companies should fit the following categories:

Primary Participants: software or hardware developers for the video game, education, virtual/augmented reality, or simulation markets. An example of this would be Roblox.

Secondary Participants: Companies with segments of their business in video or provide distribution or intellectual properties. Or companies that deliver goods and services to these segments. An example would be GameStop.

Diversified Participants: Large broad-based companies whose business models support gaming.

Small Capitalization Companies: These are companies with market capitalizations less than $1 billion.

Fees of FMET

The expense ratio for FMET is 0.75%, which is higher than the other ETFs on this list.

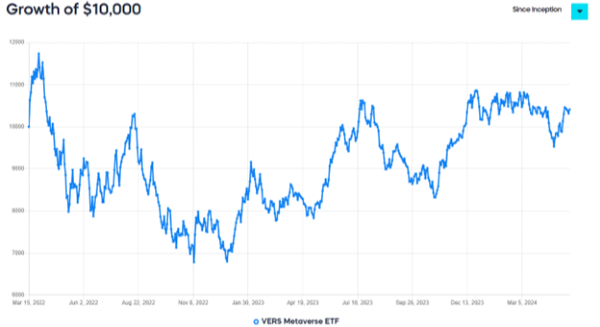

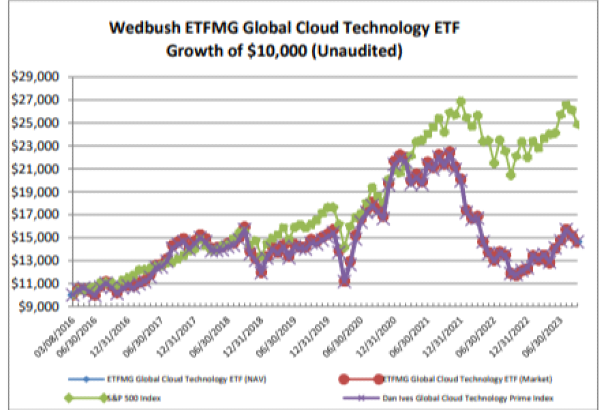

Performance of GAMR

As of Q2 2024, GAMR has an annualized return of 11.48%, which is admirable for an ETF in this segment. Other ETFs on this list haven’t performed nearly as well as GAMR, which would make sense that this ETF has a longer history of performance to smooth out the very volatile times in 2021 and 2022.

Top Holdings

The fund has 89 total holdings within the gaming theme.

These are the top 10 holdings of GAMR as of

May 13th 2024:

Rating GAMR

Overall, the ETF gets the following ratings:

Relevance to metaverse: D

Profitability: A-

Diversification: B

Fee: D

This ETF is very diversified with many of its holding’s smaller international companies. The fund also has reasonable profitability compared to its peers. However, its relevance to the metaverse is mixed with its stocks being in the video game industry, but not fully in the metaverse realm.

Defunk Metaverse ETFs

Fount Metaverse ETF (MTVR)

The Fount Metaverse ETF (MTVR) ceased operations on July 28th 2023 and liquidated.

The fund looks to possibly be a victim of the sudden loss of interest in the metaverse. Though it may have been reformed under stock symbol MTVR-DE, it’s best to look for other ETF opportunities in the metaverse.

Submersive Metaverse ETF (PUNK)

PUNK closed down on May 31st 2023.

The company was skeptical of Facebook’s visions of the metaverse and was looking for alternative companies for the PUNK brand ETF. However, the fund is now closed with the investment advisor looking towards AI as a better innovation space.

Global X Metaverse ETF (VR)

Another ETF that fell after forming in the wake of the Metaverse explosion, Global X Metaverse ETF was unceremoniously cut along with 18 other Global X ETFs on January 19th, 2024.

Final Thoughts

Finding the right metaverse ETF is a difficult pursuit due to many metaverse ETFs recently liquidating, a lack of performance, and difficulty finding relevant metaverse investments within the surviving ETFs. Many of the ETFs feel like generic tech stock funds.

The metaverse megatrend is looking promising for the next decade; however, using a metaverse ETF to profit from the trend may have mixed results. Be sure to do your own research when looking for metaverse stocks to invest in.

Below are the final ratings we gave to each active metaverse stock.

Read More

Investments in Metaverse Stocks

How the Metaverse Makes Money

Metaverse Investment Analysis

Key Takeaways

While the Metaverse megatrend is looking promising in 2024, the collapse in metaverse investments prices in 2021 and 2022 caused at least three metaverse themed ETFs to liquidate.

First Trust Indxx Metaverse ETF (ARVR) has the most relevance to the metaverse based on their top holdings.

Amplify Video Game Tech ETF (GAMR) has the best performance track record, mostly due to the ETF having a near decade long track record to smooth out the recent collapse in metaverse connected stocks.

Metaverse ETFs

The metaverse is a megatrend sector that will continue to grow in the next decade, even after interest in the metaverse waned in 2022. Sometimes, instead of trying to choose individual platforms that will succeed, it’s best to invest in a basket of stocks who will benefit from a general megatrend like the metaverse.

Exchange traded funds (ETFs) are an investment tool that allows you to invest in different “themes” like the metaverse. The ETF buys a basket of stocks based on a criterion for you. The fund will readjust their holdings periodically (typically quarterly or annually) so that they continue to buy relevant companies in the given theme. We’ve listed and ranked the top metaverse ETFs by the following criteria.

How relevant are the stocks in the ETF to the actual growth of the metaverse megatrend?

How is the historical performance? Is the fund choosing these metaverse stocks correctly? Or are they putting capital into failing metaverse projects?

Are they diversified? Are they seeking different opportunities within the metaverse megatrend versus their counterparts?

Are they cost reasonably? Are they taking too high of a fee?

Roundhill Ball Metaverse ETF (METV)

METV is an ETF with about $400 Million in assets. They invest in a wide range of companies with ties to the metaverse. The ETF is growth focused with investments that do hedge from a pure play metaverse strategy.

Many of the companies METV invests in have products disconnected from the metaverse. These include mega caps stocks like Apple, Google and Microsoft.

Methodology of METV

The Roundhill Ball Metaverse ETF is quite bullish on metaverse growth. According to Roundhill investments, the economic impact of the metaverse is, at the low end, expected to be $10.7 trillion by 2033. The bullish case estimates up to $43.0 trillion!

The fund notes that even Morgan Stanley estimates that in the long-term, the Metaverse in just the U.S. and China will be a $16.3 trillion market segment! The fund references three reasons to invest in METV ETF and hence metaverse stocks:

Market Growth - Referencing the Morgan Stanley estimate, the metaverse is looking to grow significantly into 2033.

User Engagement - Referencing the user engagement seen with Roblox, the opportunity is there for growth. With Roblox looking to build an ad platform for their metaverse, there looks to be further avenues to profit from the user engagement growth in the metaverse.

Exponential Adoption - Referencing the new VR headset to be released by Apple (AAPL), the fund feels bullish in headset adoption. The fund expects Virtual Reality and Augmented Reality headsets to reach 31.1 million shipments by 2026.

The fund tracks the performance of the Ball Metaverse Index.

A committee comprised of representatives from Ball Metaverse Research Partners LLC and external subject matter experts (the “Index Committee”) analyze companies for their potential to experience profits from their activities in the Metaverse. The Metaverse Companies selected for inclusion in the Index are companies engaged in activities that fall into one or more categories identified by the Index Committee and described below.

Hardware

Compute

Networking

Virtual Platform

Interchange Standards

Payments

Content, assets, and Identity Services

Fees of METV

The fund fee is 0.59%.

Performance of METV

Source: Roundhillinvestments.com

Top Holdings of METV

The funds top holdings as of May 13th, 2024, are as follows:

Apple Inc (AAPL) - 8.79%

ROBLOX Corp (RBLX) - 6.00%

Meta Platforms Inc (META) - 5.76%

NVIDIA Corp (NVDA) - 5.60%

Alphabet Inc (GOOGL) - 4.19%

Microsoft Corp (MSFT) - 4.14%

QUALCOMM Inc (QCOM) - 4.04%

Unity Software Inc (U) - 4.03%

Tencent Holdings Ltd (TCEHY) - 3.98%

Snap Inc (SNAP) - 3.42%

Rating METV

Overall, the ETF gets the following ratings:

Relevance to metaverse: C-

Profitability: F

Diversification: C

Fee: C

The fund has some relevance to the metaverse, but you are still investing in a multitude of other kinds of products and technologies. The fund has lost money since its inception, which leaves it at an F for profitability. The fund is highly diversified, and its fee is average.

First Trust Indxx Metaverse ETF (ARVR)

The First Trust Indxx Metaverse ETF follows the Indxx Metaverse Index. All eligible companies considered for inclusion in the index must be involved in business activities associated with the following sub-themes:

Internet Protocol (IP) and Contents

Platforms

Payment

Optics & Display

Semiconductor, Hardware and 5G

Methodology of ARVR

The ETF gives broad definitions of metaverse themed stocks. The ETF shouldn’t be considered a pure play metaverse ETF, but that it also invests in companies that will support the development and distribution of the metaverse.

Based on the other ETFs in this list, these simple criteria may be the closest to metaverse themed investing.

Top Holdings of ARVR

Top Holdings as of May 13th, 2024

Snap Inc. - 4.21%

Xiaomi Corporation - 3.62%

Tencent Holdings Limited - 3.51%

Amphenol Corporation - 3.30%

Texas Instrument - 3.27%

Apple Inc. - 3.12%

QUALCOMM - 3.11%

Nexon Co. - 3.10%

Microchip Technology - 3.07%

Taiwan Semiconductor Manufacturing Company - 3.03%

Performance of ARVR

Source: ftportfolios.com

The fund is compared to the MSCI ACWI index for its potential alpha. Since the fund’s inception, the fund has made 7.08% while MSCI ACWI Index has made 6.18%, an alpha of 0.90%.

Fees of ARVR

As of February 1st 2024, the fund’s expense ratio was 0.70%

Final Rating of ARVR

Overall, the ETF gets the following ratings:

Relevance to metaverse: B-

Profitability: B

Diversification: C

Fee: C-

The fact that the fund has made a profit since its inception gives it a leg up versus other metaverse ETFs. Its strong relevance to the metaverse is also strong thanks to its index construction process.

ProShares Metaverse ETF (VERS)

Image Source: proshares.com

Methodology of VERS

Per the Metaverse ETF (VERS) prospectus:

The Index is constructed and maintained by Solactive AG. Each time the index chooses the stocks to buy, this Index Provider uses an automated scan of company filings and other public information searching for terms and phrases that will identify companies with large exposure to the metaverse.

Once the potential companies are found, Solactive AG reviews each company and manual removes any with minimal metaverse exposure. The remaining companies are then ranked based on their metaverse exposure.

Companies are only eligible if they generate at least 50% of their revenues from Metaverse-related business operations.

Top VERS Holdings

The top holdings for VERS are mostly mega-cap technology companies. The holdings therefore will have large swings based on the tech sector.

ALPHABET - 4.89%

NVIDIA CORP - 4.55%

APPLE INC - 4.54%

AMAZON.COM INC - 4.43%

MICROSOFT CORP - 4.29%

IMMERSION CORPORATION - 4.25%

HIMAX TECHNOLOGIES - 4.24%

SNAP INC - 4.07%

PTC INC - 3.98%

EXP WORLD HOLDINGS INC - 3.98%

VERS Fees

An operating expense of 0.58%

VERS Profitability

VERS is up 4% since inception roughly 2 years ago. This growth is considerably underwhelming, but fortunately positive compared to its peers.

Source: proshares.com

Final Rating of VERS

Overall, VERS is a “meh” ETF for the metaverse. It has some interesting choices lower in its holdings, but its top holdings are a typical mix of stocks an investor could easily find on their own. The fee is reasonable and the diversification is okay.

Relevance to metaverse: B-

Profitability: C-

Diversification: C

Fee: C+

Fidelity Metaverse ETF (FMET)

Methodology

The manager for this ETF is the standard Fidelity Management & Research Company LLC with Geode Capital Management, LLC serving as a sub-adviser for the fund.

The Fidelity Metaverse Index is created using Fidelity's rules-based proprietary index methodology. The index methodology identifies and ranks stocks for inclusion in the index based on company revenues and proprietary natural language processing (NLP) scores. This is a very fascinating methodology that is tapping into AI for its assessment of a stocks theme.

Fees of FMET

The Fidelity Metaverse ETF has a reasonable management fee of 0.39%.

Performance of FMET

The NAV of FMET is up 10.5% since inception

Top Holdings

FMET holds 53 assets in the fund. The top 10 stocks held by FMET are the typical mega cap technology stocks.

Alphabet Inc (GOOGL) - 5.51%

Tencent Holdings Limited - 5.38%

NVIDIA (NVDA) - 5.12%

Samsung Electronics Co - 4.76%

AAPLApple Inc (AAPL) - 4.42%

Microsoft Corp (MSFT) - 4.41%

Qualcomm Inc (QCOM) - 4.20%

Meta Platforms Inc (META) - 4.12%

Advanced Micro Devices Inc (AMD) - 3.97%

Adobe Inc (ADBE) - 3.73%

Final Rating of FMET

Again, you’re essentially investing in the tech sector mega cap stocks. 80% of its holdings are large cap stocks. The profitability is the best in class, but its metaverse relevance is lacking.

Relevance to metaverse: C-

Profitability: A-

Diversification: D+

Fee: B-

Amplify Video Game Tech ETF (GAMR)

Prior to 1/29/24, the Amplify Video Game Tech ETF was formerly the ETFMG Wedbush ETFMG Video Game Tech ETF. A unique entry to our metaverse ETF list with its pure gaming focus, the fund has some compelling reasons to invest:

GAMR looks to be the first ETF in the video game tech industry.

The video game industry is enjoyed by over 3 billion loyal users.

The video game industry is expected to grow at a CAGR of 13.4% from 2023 to 2030, reaching $583.69 billion by 2030.3

Methodology

The fund uses indices created by ee Fund Management The fund’s methodology is executed by a committee of experts, which is different from some of the other ETFs on this list that are using AI to find metaverse stock candidates. The candidate companies should be actively engaged in a business activity supporting or utilizing the video gaming industry. The companies should fit the following categories:

Primary Participants: software or hardware developers for the video game, education, virtual/augmented reality, or simulation markets. An example of this would be Roblox.

Secondary Participants: Companies with segments of their business in video or provide distribution or intellectual properties. Or companies that deliver goods and services to these segments. An example would be GameStop.

Diversified Participants: Large broad-based companies whose business models support gaming.

Small Capitalization Companies: These are companies with market capitalizations less than $1 billion.

Fees of FMET

The expense ratio for FMET is 0.75%, which is higher than the other ETFs on this list.

Performance of GAMR

Source: GAMR annual report

As of Q2 2024, GAMR has an annualized return of 11.48%, which is admirable for an ETF in this segment. Other ETFs on this list haven’t performed nearly as well as GAMR, which would make sense that this ETF has a longer history of performance to smooth out the very volatile times in 2021 and 2022.

Top Holdings

The fund has 89 total holdings within the gaming theme. These are the top 10 holdings of GAMR as of May 13th 2024:

GameStop Corp (GME - 5.29%

Bilibili Inc (BILI) - 4.05%

Embracer Group - 3.89%

CD Projekt SA - 3.21%

Pearl Abyss Corp - 3.10%

Playtika Holding Corp (PLTK) - 2.93%

International Games System Co - 2.90%

Krafton Inc - 2.77%

NCSoft Corp - 2.62%

Ubisoft Entertainment (UBSFF) - 2.62%

Rating GAMR

Overall, the ETF gets the following ratings: Relevance to metaverse: D

Profitability: A-

Diversification: B

Fee: D

This ETF is very diversified with many of its holding’s smaller international companies. The fund also has reasonable profitability compared to its peers. However, its relevance to the metaverse is mixed with its stocks being in the video game industry, but not fully in the metaverse realm.

Defunk Metaverse ETFs

Fount Metaverse ETF (MTVR)

The Fount Metaverse ETF (MTVR) ceased operations on July 28th 2023 and liquidated.

The fund looks to possibly be a victim of the sudden loss of interest in the metaverse. Though it may have been reformed under stock symbol MTVR-DE, it’s best to look for other ETF opportunities in the metaverse.

Submersive Metaverse ETF (PUNK)

PUNK closed down on May 31st 2023.

The company was skeptical of Facebook’s visions of the metaverse and was looking for alternative companies for the PUNK brand ETF. However, the fund is now closed with the investment advisor looking towards AI as a better innovation space.

Global X Metaverse ETF (VR)

Another ETF that fell after forming in the wake of the Metaverse explosion, Global X Metaverse ETF was unceremoniously cut along with 18 other Global X ETFs on January 19th, 2024.

Final Thoughts

Finding the right metaverse ETF is a difficult pursuit due to many metaverse ETFs recently liquidating, a lack of performance, and difficulty finding relevant metaverse investments within the surviving ETFs. Many of the ETFs feel like generic tech stock funds.

The metaverse megatrend is looking promising for the next decade; however, using a metaverse ETF to profit from the trend may have mixed results. Be sure to do your own research when looking for metaverse stocks to invest in. Below are the final ratings we gave to each active metaverse stock.

Read More

Investments in Metaverse Stocks

How the Metaverse Makes Money

Metaverse Investment Analysis