What is Metaverse Real Estate?

Metaverse Real Estate is virtual land within a 3-D simulated reality. These virtual properties are typically bought with cryptocurrency. Depending on the metaverse, you typically have CAD tools that you can use to build structures or experiences on your property.

Companies using metaverse real estate

Several companies have started investing in metaverse real estate.

Growing Issues in the Metaverse Real Estate Market

Right now, metaverse real estate numbers are still low. Estimates valued the metaverse real estate market to be $1.69 billion in 2023. Though, there looks to be some turmoil right now in the markets:

- The estimated value of virtual land in 2022 was $18,000 for a parcel of virtual land. That value crumbled to less than $2,000 by 2023

- Interest on Decentraland looks to be falling, with a drop in active audience and real estate purchases.

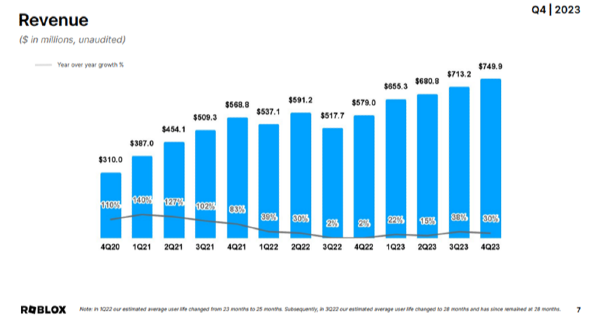

Overall, metaverses focused on Decentraland and Sandbox are having difficulties holding users, while metaverses like Roblox continue to grow.

From my own experience, the difference between the platforms is the fundamental difference of metaverse real estate platforms focused on the buying and selling of real estate and cryptocurrency versus Roblox which is focused on user experience and entertainment.

Ultimately, Roblox gives a simple reason for users to join - large scale social gaming.

Roblox by its very nature, can spool up thousands of “real estate metaverse experiences” with ease and let the Roblox market decide which experience their user base likes.

Ro’ estate Simulator easily garnered 1.4 million visits since its creation in 2022. This one experience alone overshadows traditional real estate metaverses.

Roblox has a major advantage as its decentralized groups of developers will find ways to incorporate advertising in creative ways into their games. These creative advertising campaigns can easily manifest in giving corporations “virtual real estate” in their worlds.

Multiple Roblox simulations have “starting points” where user’s spawn and are in queue to play the next game.

Spawn area for Roblox simulation “Cube Defense”. Source: cube-defense.fandom.com

There is no reason why corporations couldn’t place virtual showrooms in these areas. With some ingenuity, they can make these showrooms a fun part of the experience instead of a friction point.

Which Metaverse Real Estate Companies

The space has multiple real estate platforms vying for supremacy. These four platforms are:

Sandbox

The Sandbox Metaverse is a vibrant, user-driven virtual world where creativity and social interaction thrive. In 2024, it’s a bustling hub with over 5 million user wallets, a significant increase from the previous year.

The Sandbox is a digital playground where users can build, explore, and interact. It’s a place where you can create your own games, design unique digital assets, and even own virtual land. The platform has seen a surge in user-generated experiences, with over 1,000 experiences available on its map.

Users on Sand Box spend an average of 62 minutes per day in the metaverse, exploring user-generated content, attending events, and interacting with others. The platform also hosts various events and seasons, such as the popular 'Dr Bomkus Trials’.

The Sandbox’s economy is powered by its native cryptocurrency, the SAND token. SAND is used for transactions within the metaverse, including buying virtual land, purchasing assets, and accessing games. In 2024, the SAND token is predicted to have an average price of $0.45, with a potential high of $1.403.

Decentraland

A virtual social world that is also a user governed DAO. The platform requires the use of the cryptocurrency MANA. In 2024, Decentraland’s theme is “Forging Foundations for the Future”.

Cryptovoxels

Cryptovoxels is a user-owned virtual world, powered by the Ethereum blockchain. In 2024, its user base seems low based on blockchain information.

The platform is also a digital playground like Decentraland and The Sand box where users can own and build on virtual land. The platform has seen a surge in user-generated experiences, with daily activities including exploring user-created spaces, attending events, and interacting with others. These areas are explored using portals and womps.

Cryptovoxels' economy is powered by Ethereum's native asset, Ether (ETH). Ether is used for transactions within the metaverse, including buying virtual land and accessing various features.

In 2024, the use of Ether has made Cryptovoxels more accessible, as users don't need to swap tokens around to get a unique in-game currency. Blockchain data from bitdegree.org show that user activity is dwindling.

Somnium

Though once touted as one of the big four metaverse real estate plays, Somnium looks to be in a steady decline.

Axie Infinity

The metaverse cryptocurrency game once popular as a “grinding career” for some southeast Asians, the game took a sharp downturn in 2022. The price of AXS, the platform’s core cryptocurreny, collapsed 99% from its peak.

The platform is making changes to bring interest back to its platform:

Expanding the IP-based gaming ecosystem

Providing direct support for game development

Created open source tools for the community

Building more e-sports-friendly games

There are still many issues, but the metaverse platform is looking to bring back its audience.

The company’s cryptocurrency, AXS, has been stable around $7.00 in 2024.

Republic Realm – Metaverse Real Estate Development

Republic Realm is a metaverse real estate investment and development firm. Now called Every Realm, they focus on the acquisition, management, development, and sale of virtual land across various metaverses. They invest in, manage, and develop assets including non-fungible tokens (NFTs), virtual real estate, metaverse platforms, gaming, and infrastructure.

Unfortunately, the development company has had some troubles recently. In 2023, Republic canceled a $75 million metaverse fund following volatility in the cryptocurrency markets and SEC guidance.

Now, Every Realm is still focused on the metaverse, but their portfolio looks to be evolving in 2024.

Final Thoughts on Metaverse Real Estate

Clearly the metaverse real estate sector had a “correction” in 2022. Many companies and DAOs have struggled since the peak in the early 2020s. What is clear is that Roblox is shaping the direction these companies are going.

The platforms that look to still be going strong, like Sandbox, seem to be focusing more on the community's experience and making their code more accessible with open source code. By focusing on the developers and the community experience instead of the economics of the ecosystem, some of these platforms could be reforged as the foundation of the metaverse of the future.

Read More

Investments in Metaverse Stocks

How the Metaverse Makes Money

Metaverse Investment Analysis

What is Metaverse Real Estate?

Metaverse Real Estate is virtual land within a 3-D simulated reality. These virtual properties are typically bought with cryptocurrency. Depending on the metaverse, you typically have CAD tools that you can use to build structures or experiences on your property.

Companies using metaverse real estate

Several companies have started investing in metaverse real estate.

Source: techradar.com

Growing Issues in the Metaverse Real Estate Market

Right now, metaverse real estate numbers are still low. Estimates valued the metaverse real estate market to be $1.69 billion in 2023. Though, there looks to be some turmoil right now in the markets:

source: tradedog.io

Overall, metaverses focused on Decentraland and Sandbox are having difficulties holding users, while metaverses like Roblox continue to grow.

Roblox continues to grow revenue, source: Roblox Q4 2023 investor presentation

From my own experience, the difference between the platforms is the fundamental difference of metaverse real estate platforms focused on the buying and selling of real estate and cryptocurrency versus Roblox which is focused on user experience and entertainment.

Roblox by its very nature, can spool up thousands of “real estate metaverse experiences” with ease and let the Roblox market decide which experience their user base likes. Ro’ estate Simulator easily garnered 1.4 million visits since its creation in 2022. This one experience alone overshadows traditional real estate metaverses.

Roblox has a major advantage as its decentralized groups of developers will find ways to incorporate advertising in creative ways into their games. These creative advertising campaigns can easily manifest in giving corporations “virtual real estate” in their worlds.

Multiple Roblox simulations have “starting points” where user’s spawn and are in queue to play the next game.

Spawn area for Roblox simulation “Cube Defense”. Source: cube-defense.fandom.com

There is no reason why corporations couldn’t place virtual showrooms in these areas. With some ingenuity, they can make these showrooms a fun part of the experience instead of a friction point.

Which Metaverse Real Estate Companies

The space has multiple real estate platforms vying for supremacy. These four platforms are:

Sandbox

The Sandbox Metaverse is a vibrant, user-driven virtual world where creativity and social interaction thrive. In 2024, it’s a bustling hub with over 5 million user wallets, a significant increase from the previous year.

The Sandbox is a digital playground where users can build, explore, and interact. It’s a place where you can create your own games, design unique digital assets, and even own virtual land. The platform has seen a surge in user-generated experiences, with over 1,000 experiences available on its map.

Users on Sand Box spend an average of 62 minutes per day in the metaverse, exploring user-generated content, attending events, and interacting with others. The platform also hosts various events and seasons, such as the popular 'Dr Bomkus Trials’.

The Sandbox’s economy is powered by its native cryptocurrency, the SAND token. SAND is used for transactions within the metaverse, including buying virtual land, purchasing assets, and accessing games. In 2024, the SAND token is predicted to have an average price of $0.45, with a potential high of $1.403.

Decentraland

A virtual social world that is also a user governed DAO. The platform requires the use of the cryptocurrency MANA. In 2024, Decentraland’s theme is “Forging Foundations for the Future”.

Cryptovoxels

Cryptovoxels is a user-owned virtual world, powered by the Ethereum blockchain. In 2024, its user base seems low based on blockchain information. The platform is also a digital playground like Decentraland and The Sand box where users can own and build on virtual land. The platform has seen a surge in user-generated experiences, with daily activities including exploring user-created spaces, attending events, and interacting with others. These areas are explored using portals and womps.

Cryptovoxels' economy is powered by Ethereum's native asset, Ether (ETH). Ether is used for transactions within the metaverse, including buying virtual land and accessing various features.

In 2024, the use of Ether has made Cryptovoxels more accessible, as users don't need to swap tokens around to get a unique in-game currency. Blockchain data from bitdegree.org show that user activity is dwindling.

Somnium

Though once touted as one of the big four metaverse real estate plays, Somnium looks to be in a steady decline.

Axie Infinity

The metaverse cryptocurrency game once popular as a “grinding career” for some southeast Asians, the game took a sharp downturn in 2022. The price of AXS, the platform’s core cryptocurreny, collapsed 99% from its peak.

Source: reports.tiger-research.com

The platform is making changes to bring interest back to its platform:

Expanding the IP-based gaming ecosystem

Providing direct support for game development

Created open source tools for the community

Building more e-sports-friendly games

There are still many issues, but the metaverse platform is looking to bring back its audience.

The company’s cryptocurrency, AXS, has been stable around $7.00 in 2024.

Republic Realm – Metaverse Real Estate Development

Republic Realm is a metaverse real estate investment and development firm. Now called Every Realm, they focus on the acquisition, management, development, and sale of virtual land across various metaverses. They invest in, manage, and develop assets including non-fungible tokens (NFTs), virtual real estate, metaverse platforms, gaming, and infrastructure. Unfortunately, the development company has had some troubles recently. In 2023, Republic canceled a $75 million metaverse fund following volatility in the cryptocurrency markets and SEC guidance. Now, Every Realm is still focused on the metaverse, but their portfolio looks to be evolving in 2024.

Final Thoughts on Metaverse Real Estate

Clearly the metaverse real estate sector had a “correction” in 2022. Many companies and DAOs have struggled since the peak in the early 2020s. What is clear is that Roblox is shaping the direction these companies are going.

The platforms that look to still be going strong, like Sandbox, seem to be focusing more on the community's experience and making their code more accessible with open source code. By focusing on the developers and the community experience instead of the economics of the ecosystem, some of these platforms could be reforged as the foundation of the metaverse of the future.

Read More

Investments in Metaverse Stocks

How the Metaverse Makes Money

Metaverse Investment Analysis