Expertise provided by Kevin Matthews from buildingbread.com

Financial sector stocks include banks, insurers, and investment and service firms. They can be an addition to your investment portfolio.

This is especially important for new investors. They must understand why they might want financial stocks. They should be in their portfolio. These stocks play a role in creating a rounded investment portfolio. In the stock market finance is one of the 11 sectors. Ignoring this sector entirely could lead investors to miss out on gains that may occur across market cycles. Diversification is key. Predicting which sectors will outperform is hard to do. For example, while technology may dominate one year finance might take the lead next.

To delve deeper into this topic, let's discuss the benefits of investing in financial sector stocks. We'll compare them to stocks in other sectors. First, every company has a finance division. Finance is integral to business. So, investing in a company means investing in a basic, long-lasting business. Consider Visa as an illustration. Despite circumstances, people still need payment solutions. They are needed to meet a demand for Visa's services.

During market volatility, an investment can anchor you. It helps you weather financial uncertainties.

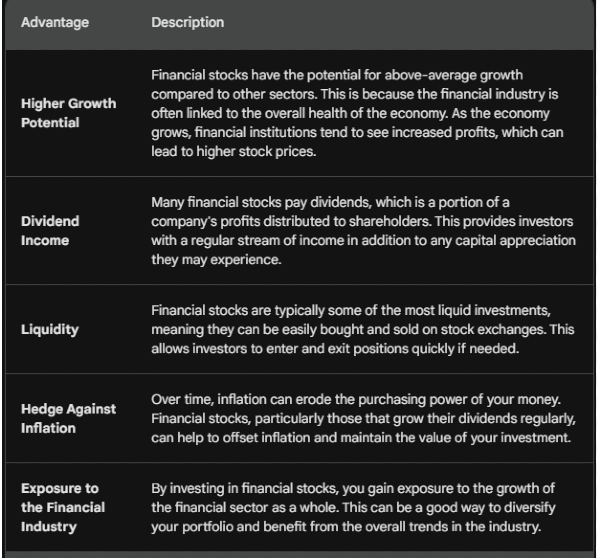

Advantages of Financial Stocks

Let’s delve deeper into the benefits that make them appealing:

Potential for High Returns: When you look at asset types such, as bonds and cash financial stocks have a history of delivering returns. This is because financial institutions are naturally profitable. They typically use capital to make profits. As time goes by their earnings generally increase consistently.

Dividend Income: Several financial companies are popular, for providing dividends which are profits given to shareholders. This results in an income flow for investors boosting the returns, on your investment.

Stability in Earnings: Financial institutions reap the rewards of earnings even when faced with challenges. They are stable. This is because they offer services like banking, insurance, and investment. These services are always in demand, no matter the conditions. These services are an enduring need. They ensure that financial companies keep an income.

Growth Potential: The world of finance is always. It is evolving. Sectors like fintech and wealth management offer growth opportunities. Businesses that can take advantage of these developments are poised to see expansion, in the future.

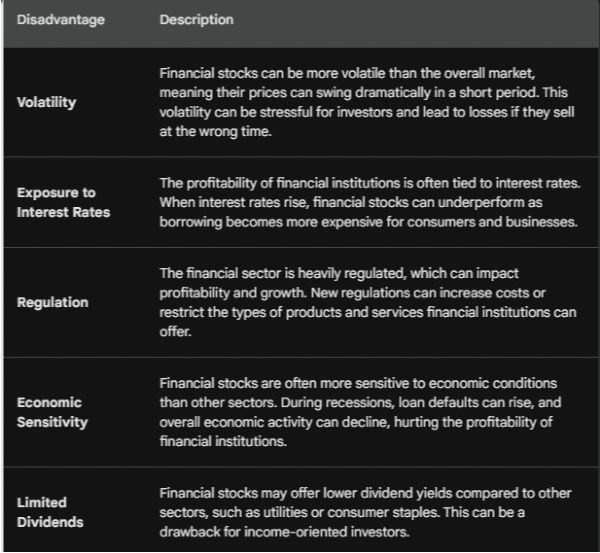

Disadvantages of Financial Stocks

Financial stocks offer many benefits. But, it's important to acknowledge their potential drawbacks:

Risk of Recession: During downturns financial stocks can be quite unstable. May lose value due, to the risky borrowing practices of various financial firms. If the economy falters there's a risk of borrowers failing to repay their loans, which could affect how profitable financial institutions are.

Regulatory Landscape: The finance industry faces regulations that may limit the growth opportunities, for firms. These regulations are crucial for stability. But, they can also hinder innovation and company growth.

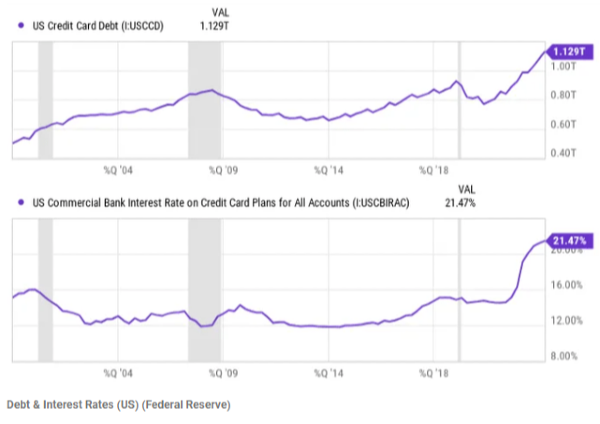

Interest Rate Sensitivity: Financial companies are influenced by changes, in interest rates. If interest rates go up the worth of stocks might drop. This happens because higher interest rates raise borrowing costs. This could affect the demand for loans and their profitability.

Making an Informed Decision

In the end, if financial stocks are a fit for your portfolio depends on your objectives and how much risk you will take. You have a long-term investment strategy and are okay with some risk. Financial stocks could be an investment option. They offer the chance for returns and stable income.

Investing Wisely

Before diving into financial stocks, consider these additional factors:

Economic Health: The well-being of the economy has an influence, on how financial stocks perform. When the economy is robust it creates a setting for institutions to succeed.

Interest Rate Environment: Be sure to watch out for changes, in interest rates as they can impact the performance of stocks.

Company Specifics: Make sure to investigate the firms that catch your eye. Look for companies that have a history of making money sound financial health and competent leaders. Consider these aspects. Do your homework. Then, you'll be able to decide if investing in financial stocks fits your approach and risk level.

Are Financial Stocks Right for You?

Deciding if financial stocks are right for you depends on your investment goals and how much risk you can handle. If you seek a lasting investment with the possibility of gains delving into stocks could be a wise choice. But if you prefer to play it safe when it comes to investing, then assets like bonds or cash might be more in line with your preferences.

Are bank stocks worth buying?

Financial stocks that focus on banks have their appeal, for reasons. They also carry inherent risks. Let’s delve into the details to assist you in making a decision;

Pros:

Potential for High Returns: Financial institutions, like companies, in the financial sector have a track record of outperforming bonds and cash when it comes to generating returns. Banks focus on lending and investments. They can use these to gradually increase profits by using capital effectively.

Dividends: Banks are often recognized for providing dividends which are a share of their earnings distributed to shareholders. This offers a source of income in addition, to any increase, in stock value.

Stable Earnings: Banks typically experience profits in contrast, to other industries. This is because they offer services such as checking accounts, loans, and money transfers. These services are in high demand.

Growth Potential: Fintech is changing the financial industry. It is creating opportunities for banks that use these services to manage wealth.

Cons:

Recession Risk: During downturns bank stocks are, at risk. If recessions occur there is a possibility of loan defaults which can impact bank profits and lead to a decrease, in stock prices.

Regulation: The banking industry is heavily regulated, which can limit banks' ability to grow and innovate. Regulations are needed for stability. But, they can stifle growth.

Interest Rates: The profitability of banks depends on interest rates. If rates go up borrowing costs increase, which could lead to loan requests and affect the earnings of banks.

So, are they worth buying?

It depends on your investment goals and risk tolerance. Here's what to consider:

Investment Horizon: If you're looking to invest for the long term and don't mind some risk, bank stocks could be a good choice. They offer attractive returns and steady dividend payouts over time.

Economic Outlook: A robust economy typically has effects, on banks. It's wise to check the conditions. Also, check the upcoming predictions before investing.

Individual Bank Strength: Check out the banks that catch your eye. Seek out banks that have a history, financial standing, and a capable leadership team.

Why are bank stocks so cheap?

There are a couple of reasons why bank stocks might be trading at a lower price point than you might expect:

Economic Uncertainty: There is a worry, about the possibility of a downturn. During recessions, loan defaults rise. This hurts bank profits a lot. Investors typically foresee this danger. Might choose to sell bank stocks in advance of a recession causing their prices to decrease.

Interest Rate Sensitivity: Banks earn profits by gathering interest, from loans. When interest rates go up it presents a situation. Banks can earn more on loans. But current borrowers might struggle to renegotiate at rates. This could result in defaults. Also, higher rates may make other investments more appealing. People are diverting funds from the banking industry.

Regulation: The banking industry faces regulations that restrict their capacity to expand and explore opportunities that could lead to increased profits. Regulations are crucial for stability. But, they may hinder creativity and growth, hurting the value of banks.

Here are some additional things to consider before investing in financial stocks:

The overall health of the economy: The strength of the economy greatly influences how financial stocks perform. When the economy is robust financial stocks tend to thrive. During downturns, financial stocks may drop in value.

The interest rate environment: When interest rates go up it can impact how well financial stocks perform. If interest rates increase the value of stocks may drop as a result.

The specific company: When thinking about investing make sure to do your homework on the firms you're interested, in. Look for companies that have a history of making money. They have solid finances and competent leaders.

Consider all these aspects. Then, you can confidently decide if stocks align with your goals.

Watch this video for more information.

https://youtu.be/sMgkWmw4ZLo

Expertise provided by Kevin Matthews from buildingbread.com

Financial sector stocks include banks, insurers, and investment and service firms. They can be an addition to your investment portfolio.

This is especially important for new investors. They must understand why they might want financial stocks. They should be in their portfolio. These stocks play a role in creating a rounded investment portfolio. In the stock market finance is one of the 11 sectors. Ignoring this sector entirely could lead investors to miss out on gains that may occur across market cycles. Diversification is key. Predicting which sectors will outperform is hard to do. For example, while technology may dominate one year finance might take the lead next.

To delve deeper into this topic, let's discuss the benefits of investing in financial sector stocks. We'll compare them to stocks in other sectors. First, every company has a finance division. Finance is integral to business. So, investing in a company means investing in a basic, long-lasting business. Consider Visa as an illustration. Despite circumstances, people still need payment solutions. They are needed to meet a demand for Visa's services.

During market volatility, an investment can anchor you. It helps you weather financial uncertainties.

Advantages of Financial Stocks

Let’s delve deeper into the benefits that make them appealing:

Potential for High Returns: When you look at asset types such, as bonds and cash financial stocks have a history of delivering returns. This is because financial institutions are naturally profitable. They typically use capital to make profits. As time goes by their earnings generally increase consistently.

Dividend Income: Several financial companies are popular, for providing dividends which are profits given to shareholders. This results in an income flow for investors boosting the returns, on your investment.

Stability in Earnings: Financial institutions reap the rewards of earnings even when faced with challenges. They are stable. This is because they offer services like banking, insurance, and investment. These services are always in demand, no matter the conditions. These services are an enduring need. They ensure that financial companies keep an income.

Growth Potential: The world of finance is always. It is evolving. Sectors like fintech and wealth management offer growth opportunities. Businesses that can take advantage of these developments are poised to see expansion, in the future.

Disadvantages of Financial Stocks

Financial stocks offer many benefits. But, it's important to acknowledge their potential drawbacks:

Risk of Recession: During downturns financial stocks can be quite unstable. May lose value due, to the risky borrowing practices of various financial firms. If the economy falters there's a risk of borrowers failing to repay their loans, which could affect how profitable financial institutions are.

Regulatory Landscape: The finance industry faces regulations that may limit the growth opportunities, for firms. These regulations are crucial for stability. But, they can also hinder innovation and company growth.

Interest Rate Sensitivity: Financial companies are influenced by changes, in interest rates. If interest rates go up the worth of stocks might drop. This happens because higher interest rates raise borrowing costs. This could affect the demand for loans and their profitability.

Making an Informed Decision

In the end, if financial stocks are a fit for your portfolio depends on your objectives and how much risk you will take. You have a long-term investment strategy and are okay with some risk. Financial stocks could be an investment option. They offer the chance for returns and stable income.

Investing Wisely

Before diving into financial stocks, consider these additional factors:

Economic Health: The well-being of the economy has an influence, on how financial stocks perform. When the economy is robust it creates a setting for institutions to succeed.

Interest Rate Environment: Be sure to watch out for changes, in interest rates as they can impact the performance of stocks.

Company Specifics: Make sure to investigate the firms that catch your eye. Look for companies that have a history of making money sound financial health and competent leaders. Consider these aspects. Do your homework. Then, you'll be able to decide if investing in financial stocks fits your approach and risk level.

Are Financial Stocks Right for You?

Deciding if financial stocks are right for you depends on your investment goals and how much risk you can handle. If you seek a lasting investment with the possibility of gains delving into stocks could be a wise choice. But if you prefer to play it safe when it comes to investing, then assets like bonds or cash might be more in line with your preferences.

Are bank stocks worth buying?

Financial stocks that focus on banks have their appeal, for reasons. They also carry inherent risks. Let’s delve into the details to assist you in making a decision;

Pros:

Potential for High Returns: Financial institutions, like companies, in the financial sector have a track record of outperforming bonds and cash when it comes to generating returns. Banks focus on lending and investments. They can use these to gradually increase profits by using capital effectively.

Dividends: Banks are often recognized for providing dividends which are a share of their earnings distributed to shareholders. This offers a source of income in addition, to any increase, in stock value.

Stable Earnings: Banks typically experience profits in contrast, to other industries. This is because they offer services such as checking accounts, loans, and money transfers. These services are in high demand.

Growth Potential: Fintech is changing the financial industry. It is creating opportunities for banks that use these services to manage wealth.

Cons:

Recession Risk: During downturns bank stocks are, at risk. If recessions occur there is a possibility of loan defaults which can impact bank profits and lead to a decrease, in stock prices.

Regulation: The banking industry is heavily regulated, which can limit banks' ability to grow and innovate. Regulations are needed for stability. But, they can stifle growth.

Interest Rates: The profitability of banks depends on interest rates. If rates go up borrowing costs increase, which could lead to loan requests and affect the earnings of banks.

So, are they worth buying?

It depends on your investment goals and risk tolerance. Here's what to consider:

Investment Horizon: If you're looking to invest for the long term and don't mind some risk, bank stocks could be a good choice. They offer attractive returns and steady dividend payouts over time.

Economic Outlook: A robust economy typically has effects, on banks. It's wise to check the conditions. Also, check the upcoming predictions before investing.

Individual Bank Strength: Check out the banks that catch your eye. Seek out banks that have a history, financial standing, and a capable leadership team.

Why are bank stocks so cheap?

There are a couple of reasons why bank stocks might be trading at a lower price point than you might expect:

Economic Uncertainty: There is a worry, about the possibility of a downturn. During recessions, loan defaults rise. This hurts bank profits a lot. Investors typically foresee this danger. Might choose to sell bank stocks in advance of a recession causing their prices to decrease.

Interest Rate Sensitivity: Banks earn profits by gathering interest, from loans. When interest rates go up it presents a situation. Banks can earn more on loans. But current borrowers might struggle to renegotiate at rates. This could result in defaults. Also, higher rates may make other investments more appealing. People are diverting funds from the banking industry.

Regulation: The banking industry faces regulations that restrict their capacity to expand and explore opportunities that could lead to increased profits. Regulations are crucial for stability. But, they may hinder creativity and growth, hurting the value of banks.

Here are some additional things to consider before investing in financial stocks:

The overall health of the economy: The strength of the economy greatly influences how financial stocks perform. When the economy is robust financial stocks tend to thrive. During downturns, financial stocks may drop in value.

The interest rate environment: When interest rates go up it can impact how well financial stocks perform. If interest rates increase the value of stocks may drop as a result.

The specific company: When thinking about investing make sure to do your homework on the firms you're interested, in. Look for companies that have a history of making money. They have solid finances and competent leaders.

Consider all these aspects. Then, you can confidently decide if stocks align with your goals.

Watch this video for more information.

https://youtu.be/sMgkWmw4ZLo