Large Scale Solar Power

Major Utilities have integrated solar energy into their power generation portfolio. The largest power generating utilities in the U.S. have significant amounts of power coming from solar array farms across the country.

Nearly every major utility company plans to grow their position in renewable energy for the next decade, and solar energy is a major part of each plan. solar energy has become a viable power source thanks to favorable government incentives, cheaper installation, and improved energy storage.

“Energy storage is actually the true bridge to a clean-energy future” – Bernadette Del Chiaro, executive director of the California Solar and Storage Association

Energy storage allows electricity to be used “smoothly” by customers by holding electrical energy while demand is low. This smoothing allows solar panels to accumulate energy during the day while customers use the energy at night when solar energy cannot be harvested.

The U.S Energy Information Administration found that the cost to store a unit of energy (a kilowatt-hour) fell 70% from 2015 to 2018.

Utility-scale solar farms have been adopted by the utility industry and will likely continue to grow in the foreseeable future. While most utilities have focused on solar farms, other utilities like NRG Energy is looking to build solar arrays for individual customers and organizations. Both business models look to be viable and will have the overall effect of pushing innovation in the solar power generation.

What is the Best Solar Stock to Invest in?

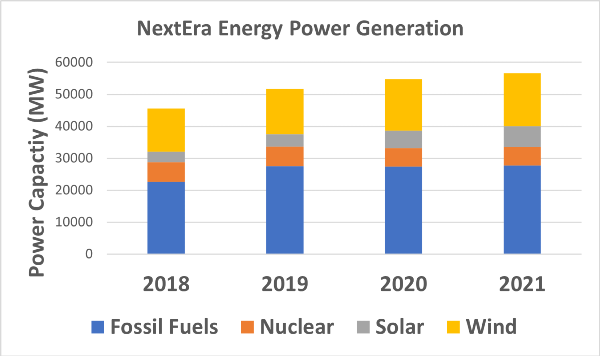

By far, the best stock to get exposure to utility-scale solar power generation and invest in a company that provides a strong investment opportunity is NextEra Energy. When it comes to solar power, NextEra Energy sits in its own tier. NextEra Energy has 56,581 MW of power generation capacity. Of that capacity, 11.59% consists of solar power.

NextEra Energy is likely the top power generation public utility in the U.S. based on the mega-watts of power generation capacity it has. And its incredible that a company this large is dedicated to incorporating renewable energy heavily into its power generation portfolio.

The company’s growth in solar makes sense. The company is primarily located in Florida, which gets more sunlight than other parts of the U.S. This makes solar farms more viable in their region. NextEra Energy is also committed to zero carbon emissions by 2045, making solar a vital part of their core values.

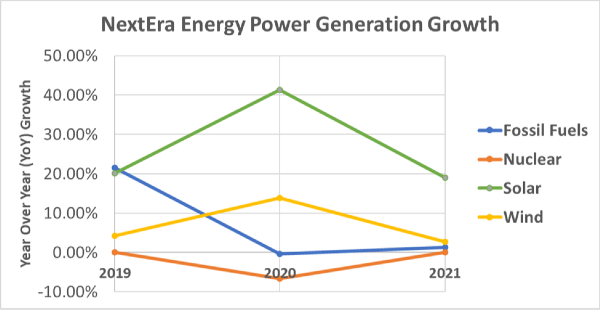

NextEra Energy year over year growth of their energy sources

NextEra Energy isn’t just a great solar farm investment. NextEra Energy is a proven strong investment for income investors and retail investors.

What Companies Invest in Solar Energy?

Besides NextEra Energy, the other utilities that significantly invest in solar energy are Dominion Energy (D), The Southern Company (SRE), and Exelon (EXC). Dominion Energy has a healthy 8.15% of its power generation capacity in solar power, with The Southern Company coming up next at 5.44% and Exelon at 4.63%.

These four public utilities are the major utilities that are making serious investments in solar farms.

| Company |

Total Capacity (MW) |

Solar Capacity (%) |

| Dominion Energy (D) |

27,000 |

8.15% |

| The Southern Company (SO) |

44,000 |

5.44% |

| Exelon (EXC) |

33,300 |

4.63% |

Dominion Energy

Dominion Energy, Inc runs multiple solar energy services in five states. They are also looking to expand in Virginia, with 16,100 MW planned to go online by 2035.

Dominion Energy has a total capacity of 27.1 GW as of 2019.

Dominion Energy has installed 2,200 megawatts (MW) of solar into operation in 10 states. That is enough energy to power about 550,000 homes at peak output.

Southern Company

Southern Power currently owns or operates more than 2,395 megawatts of solar generating capacity at 28 facilities operating in California, Georgia, Nevada, New Mexico, North Carolina and Texas. Twenty-six of these facilities are co-owned by third parties, with Southern Power having the majority ownership. Southern Company Total Generating Capacity is 44,000 MW

Which is the Best Stock to Invest in Solar Energy for the Long Term?

NextEra Energy has both the proven track record and the documented commitment to continue building out utility-scale solar farms over the next decade. NextEra has committed to build 28,000 to 37,000 Megawatts of capacity thru 2025. That growth is roughly 50% of the capacity the company currently holds. This unprecedented growth matches their proven growth they’ve already accomplished since 2018.

Dominion Energy is also looking to expand their solar power. Dominion is in the works of building a 1,000 MW utility-scale solar project in Virginia. This project alone will nearly double their solar capacity. The company estimates they will invest $20 Billion into solar development through 2035.

Which Public Utilities are not Investing in Solar Power?

| Company |

Total Capacity (MW) |

Solar Capacity (%) |

| American Electric Power Inc (AEP) |

26,000 |

0.45% |

| Duke Energy Corporation (DUK) |

50,000 |

1.00% |

| Entergy (ETR) |

24,000 |

2.14% |

AEP

AEP renewables has 3 utility scale solar sites in California, Nevada, and Utah. The sites together create 116 MW of energy. AEP generates about 26,000 MW of energy in the United States. Solar makes up 0.446% of AEPs generation capacity.

AEP has a bigger portfolio of wind energy, with 1,260 MW of capacity, which is roughly 4.85% of their total portfolio. Renewables are planned to become ~50% of their total capacity by 2030

Duke Energy

Over 500 MW of solar capacity of its 2800 MW of renewable energy generation. Duke Energy’s total capacity is 50,000 MW.

Similar to AEP, Duke Energy has a larger focus on wind energy in their renewables portfolio. The company has 2,300 MW of wind power capacity, which amounts to 4.6% of their total energy generation portfolio.

The Bottom Line

If you're looking for a really strong company to invest in that is committed to solar energy, start researching NextEra Energy. Solar and wind power has credibly grown in the last 10 years. Based on the plans of the top public utilities, this trend will accelerate during this decade.

Large Scale Solar Power

Major Utilities have integrated solar energy into their power generation portfolio. The largest power generating utilities in the U.S. have significant amounts of power coming from solar array farms across the country.

Nearly every major utility company plans to grow their position in renewable energy for the next decade, and solar energy is a major part of each plan. solar energy has become a viable power source thanks to favorable government incentives, cheaper installation, and improved energy storage.

Energy storage allows electricity to be used “smoothly” by customers by holding electrical energy while demand is low. This smoothing allows solar panels to accumulate energy during the day while customers use the energy at night when solar energy cannot be harvested. The U.S Energy Information Administration found that the cost to store a unit of energy (a kilowatt-hour) fell 70% from 2015 to 2018.

Source: eia.gov

Utility-scale solar farms have been adopted by the utility industry and will likely continue to grow in the foreseeable future. While most utilities have focused on solar farms, other utilities like NRG Energy is looking to build solar arrays for individual customers and organizations. Both business models look to be viable and will have the overall effect of pushing innovation in the solar power generation.

What is the Best Solar Stock to Invest in?

By far, the best stock to get exposure to utility-scale solar power generation and invest in a company that provides a strong investment opportunity is NextEra Energy. When it comes to solar power, NextEra Energy sits in its own tier. NextEra Energy has 56,581 MW of power generation capacity. Of that capacity, 11.59% consists of solar power.

NextEra Energy power capacity by source. Fossil fuels includes oil, gas, and coal. See their excel sheet for 2022 for more information. This can be found in their ESG Resources Page

NextEra Energy is likely the top power generation public utility in the U.S. based on the mega-watts of power generation capacity it has. And its incredible that a company this large is dedicated to incorporating renewable energy heavily into its power generation portfolio. The company’s growth in solar makes sense. The company is primarily located in Florida, which gets more sunlight than other parts of the U.S. This makes solar farms more viable in their region. NextEra Energy is also committed to zero carbon emissions by 2045, making solar a vital part of their core values.

NextEra Energy year over year growth of their energy sources

NextEra Energy isn’t just a great solar farm investment. NextEra Energy is a proven strong investment for income investors and retail investors.

What Companies Invest in Solar Energy?

Besides NextEra Energy, the other utilities that significantly invest in solar energy are Dominion Energy (D), The Southern Company (SRE), and Exelon (EXC). Dominion Energy has a healthy 8.15% of its power generation capacity in solar power, with The Southern Company coming up next at 5.44% and Exelon at 4.63%. These four public utilities are the major utilities that are making serious investments in solar farms.

Dominion Energy

Dominion Energy, Inc runs multiple solar energy services in five states. They are also looking to expand in Virginia, with 16,100 MW planned to go online by 2035.

Dominion Energy Solar Farm

Dominion Energy has a total capacity of 27.1 GW as of 2019. Dominion Energy has installed 2,200 megawatts (MW) of solar into operation in 10 states. That is enough energy to power about 550,000 homes at peak output.

Southern Company

Southern Power currently owns or operates more than 2,395 megawatts of solar generating capacity at 28 facilities operating in California, Georgia, Nevada, New Mexico, North Carolina and Texas. Twenty-six of these facilities are co-owned by third parties, with Southern Power having the majority ownership. Southern Company Total Generating Capacity is 44,000 MW

Which is the Best Stock to Invest in Solar Energy for the Long Term?

NextEra Energy has both the proven track record and the documented commitment to continue building out utility-scale solar farms over the next decade. NextEra has committed to build 28,000 to 37,000 Megawatts of capacity thru 2025. That growth is roughly 50% of the capacity the company currently holds. This unprecedented growth matches their proven growth they’ve already accomplished since 2018.

Dominion Energy is also looking to expand their solar power. Dominion is in the works of building a 1,000 MW utility-scale solar project in Virginia. This project alone will nearly double their solar capacity. The company estimates they will invest $20 Billion into solar development through 2035.

Which Public Utilities are not Investing in Solar Power?

Entergy Total Capacity and solar capacity

AEP

AEP renewables has 3 utility scale solar sites in California, Nevada, and Utah. The sites together create 116 MW of energy. AEP generates about 26,000 MW of energy in the United States. Solar makes up 0.446% of AEPs generation capacity.

AEP has a bigger portfolio of wind energy, with 1,260 MW of capacity, which is roughly 4.85% of their total portfolio. Renewables are planned to become ~50% of their total capacity by 2030

Duke Energy

Over 500 MW of solar capacity of its 2800 MW of renewable energy generation. Duke Energy’s total capacity is 50,000 MW. Similar to AEP, Duke Energy has a larger focus on wind energy in their renewables portfolio. The company has 2,300 MW of wind power capacity, which amounts to 4.6% of their total energy generation portfolio.

The Bottom Line

If you're looking for a really strong company to invest in that is committed to solar energy, start researching NextEra Energy. Solar and wind power has credibly grown in the last 10 years. Based on the plans of the top public utilities, this trend will accelerate during this decade.