Understanding how to classify a stock is a key skill for any investor. Sector classification helps you compare companies, study trends, and build a balanced portfolio. One of the most misunderstood sectors is consumer discretionary. Many companies sell products people enjoy, but not all of them fall into this category. This guide breaks down how to identify a true consumer discretionary stock in a simple and clear way.

Consumer discretionary stocks rise and fall with changes in the economy. When people feel confident, they spend more on non‑essential items. When times are tough, they cut back. Knowing this pattern helps you understand why these stocks behave the way they do.

The Global Industry Classification Standard (GICS) is the most common system used to group companies. It organizes businesses into sectors, industries, and sub‑industries. This system makes it easier to compare companies and understand how they fit into the market.

What Makes a Company “Consumer Discretionary”?

Consumer discretionary companies sell goods or services that people want but do not need. These purchases can be delayed when money is tight. Examples include clothing, cars, entertainment, and luxury items. These companies often depend on strong consumer confidence.

Demand for discretionary products is elastic. When prices rise or incomes fall, people buy less. This makes the sector more sensitive to economic cycles.

Consumer discretionary companies also rely heavily on branding and trends. A strong brand can help a company stand out, but trends can shift quickly. This adds another layer of risk and opportunity.

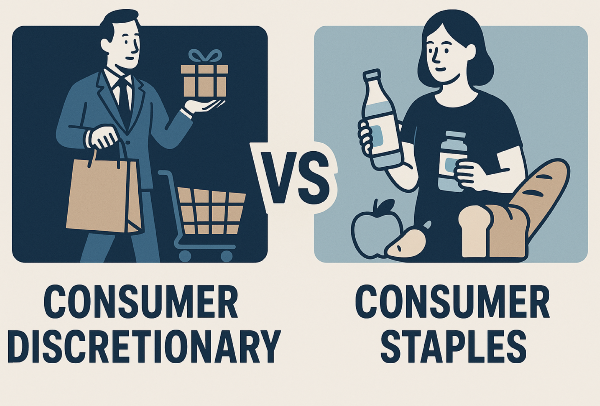

Consumer Discretionary vs. Consumer Staples

It is easy to confuse discretionary and staple companies. Both sell to consumers, but the nature of the products is different. Staples include items people buy no matter what. Discretionary items are optional.

Misclassification often happens with large retailers. Some sell both essential and non‑essential goods. For example, a big‑box store may sell groceries and electronics. In these cases, analysts look at the main source of revenue.

Subscription services can also be tricky. A streaming service may feel essential to some people, but it is still considered discretionary. The key question is whether the service is required for daily living.

Examples of Consumer Discretionary vs. Consumer Staples

| Category |

Consumer Discretionary |

Consumer Staples |

| Type of Spending |

Wants |

Needs |

| Demand |

Elastic |

Inelastic |

| Examples |

Apparel, autos, hotels |

Groceries, cleaning supplies |

Read More: Consumer Discretionary vs. Consumer Staples

The GICS Breakdown of Consumer Discretionary

GICS divides the consumer discretionary sector into several groups. These include automobiles, apparel, consumer services, and retailing. Each group contains industries and sub‑industries.

For example, auto manufacturers build vehicles people choose to buy. Apparel companies sell clothing and accessories. Hotels and restaurants fall under consumer services. Specialty retail includes stores focused on specific product types.

Companies like Tesla TSLA, NKE, and MCD fit into different parts of the sector. Each one sells products or services that people can delay buying.

Major GICS Consumer Discretionary Groups

| Group |

Examples of Sub‑Industries |

| Automobiles & Components |

Auto manufacturers, auto parts |

| Consumer Durables & Apparel |

Homebuilding, luxury goods |

| Consumer Services |

Hotels, restaurants |

| Retailing |

Internet retail, specialty retail |

A Step‑by‑Step Framework for Classifying a Stock

A simple process can help you classify any company. Start by looking at the company’s main source of revenue. Most companies list this in their annual report. Focus on the product or service that brings in the most money.

Next, decide whether the product is essential. Ask if consumers can delay the purchase. If the answer is yes, it is likely discretionary. Look at how demand changes during recessions. If sales drop sharply, that is another sign.

Then study price sensitivity. If customers buy less when prices rise, the product is elastic. Elastic demand is common in discretionary categories.

Compare the company to GICS definitions. These descriptions help you match the business to the right sub‑industry. You can also look at competitors. If similar companies are classified as discretionary, that is a strong clue.

Special Cases and Edge Scenarios

Some companies do not fit neatly into one category. Hybrid retailers sell both essential and non‑essential goods. A company like Amazon AMZN sells groceries, electronics, and clothing. Analysts classify it based on its dominant revenue source.

Luxury brands behave differently from basic discretionary companies. They may hold up better during downturns because wealthy customers continue to spend. Still, they are considered discretionary because their products are not essential.

Technology products can also fall into this sector. Gaming consoles, smart home devices, and high‑end electronics are optional purchases. Their demand rises when consumers have extra income.

Borderline Company Types

| Company Type |

Why Classification Is Hard |

| Big‑box retailers |

Mixed product categories |

| Luxury brands |

Wealthy buyers behave differently |

| Tech devices |

Optional but widely used |

Economic Indicators That Influence Discretionary Stocks

Consumer discretionary stocks move with the economy. When people feel confident, they spend more. The Consumer Confidence Index helps track this trend. High confidence often leads to higher sales.

Employment and wage growth also matter. When people earn more, they have more money for optional purchases. Interest rates affect big‑ticket items like cars and home improvement projects. Higher rates make loans more expensive.

Inflation can shift spending from discretionary to essential goods. When prices rise, people focus on needs first. Retail sales data gives clues about how consumers are spending across categories.

Read More: The Role of Consumer Sentiment in Discretionary Stock Performance, How Interest Rates Impact Consumer Discretionary Stocks

How Classification Impacts Investment Decisions

Knowing how to classify a stock helps you build a balanced portfolio. Consumer discretionary stocks add growth potential but also add risk. They tend to rise fast in strong economies and fall hard in weak ones.

Valuation is another factor. Discretionary companies often trade at higher multiples because investors expect growth. Understanding the sector helps you judge whether a stock is priced fairly.

Risk management is easier when you know how cyclical a company is. Sector rotation strategies rely on understanding when to shift into or out of discretionary stocks. Long‑term investors can also benefit from knowing how these companies behave over time.

Case Studies: Classifying Real Companies

A pure discretionary company is easy to classify. A clothing brand or auto manufacturer sells products people can delay buying. Their sales rise and fall with the economy.

A borderline retailer may sell both essentials and non‑essentials. Analysts look at revenue mix to decide the correct category. A luxury brand fits the discretionary sector because its products are optional, even if demand stays strong.

A mixed‑revenue company may have several business lines. In this case, the largest segment determines the classification. This keeps the system consistent across the market.

Common Mistakes When Classifying Stocks

Many investors focus on brand perception instead of revenue. A company may feel like a discretionary brand, but its main revenue source may be essential goods. Another mistake is ignoring cyclicality. A company that depends on strong economic conditions is usually discretionary.

Subscription models can also confuse investors. Even if a service feels essential, it may still be optional. Always look at how demand changes during downturns.

Tools and Resources for Accurate Classification

You can use several tools to classify a stock. GICS documentation provides clear definitions. Company annual reports show revenue breakdowns. Industry reports help you compare companies. ETF holdings lists also reveal how professionals classify stocks.

Financial data platforms make it easy to check sector labels. These tools help you confirm your classification and avoid mistakes.

Conclusion

Classifying a stock as consumer discretionary becomes easier when you follow a clear process. Look at the company’s main revenue source, study demand patterns, and compare it to GICS definitions. This approach helps you understand how the company fits into the market. It also helps you make better investment decisions and build a stronger portfolio.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

Understanding how to classify a stock is a key skill for any investor. Sector classification helps you compare companies, study trends, and build a balanced portfolio. One of the most misunderstood sectors is consumer discretionary. Many companies sell products people enjoy, but not all of them fall into this category. This guide breaks down how to identify a true consumer discretionary stock in a simple and clear way.

Consumer discretionary stocks rise and fall with changes in the economy. When people feel confident, they spend more on non‑essential items. When times are tough, they cut back. Knowing this pattern helps you understand why these stocks behave the way they do.

The Global Industry Classification Standard (GICS) is the most common system used to group companies. It organizes businesses into sectors, industries, and sub‑industries. This system makes it easier to compare companies and understand how they fit into the market.

What Makes a Company “Consumer Discretionary”?

Consumer discretionary companies sell goods or services that people want but do not need. These purchases can be delayed when money is tight. Examples include clothing, cars, entertainment, and luxury items. These companies often depend on strong consumer confidence.

Demand for discretionary products is elastic. When prices rise or incomes fall, people buy less. This makes the sector more sensitive to economic cycles.

Consumer discretionary companies also rely heavily on branding and trends. A strong brand can help a company stand out, but trends can shift quickly. This adds another layer of risk and opportunity.

Consumer Discretionary vs. Consumer Staples

It is easy to confuse discretionary and staple companies. Both sell to consumers, but the nature of the products is different. Staples include items people buy no matter what. Discretionary items are optional.

Misclassification often happens with large retailers. Some sell both essential and non‑essential goods. For example, a big‑box store may sell groceries and electronics. In these cases, analysts look at the main source of revenue.

Subscription services can also be tricky. A streaming service may feel essential to some people, but it is still considered discretionary. The key question is whether the service is required for daily living.

Examples of Consumer Discretionary vs. Consumer Staples

The GICS Breakdown of Consumer Discretionary

GICS divides the consumer discretionary sector into several groups. These include automobiles, apparel, consumer services, and retailing. Each group contains industries and sub‑industries.

For example, auto manufacturers build vehicles people choose to buy. Apparel companies sell clothing and accessories. Hotels and restaurants fall under consumer services. Specialty retail includes stores focused on specific product types.

Companies like Tesla TSLA, NKE, and MCD fit into different parts of the sector. Each one sells products or services that people can delay buying.

Major GICS Consumer Discretionary Groups

A Step‑by‑Step Framework for Classifying a Stock

A simple process can help you classify any company. Start by looking at the company’s main source of revenue. Most companies list this in their annual report. Focus on the product or service that brings in the most money.

Next, decide whether the product is essential. Ask if consumers can delay the purchase. If the answer is yes, it is likely discretionary. Look at how demand changes during recessions. If sales drop sharply, that is another sign.

Then study price sensitivity. If customers buy less when prices rise, the product is elastic. Elastic demand is common in discretionary categories.

Compare the company to GICS definitions. These descriptions help you match the business to the right sub‑industry. You can also look at competitors. If similar companies are classified as discretionary, that is a strong clue.

Special Cases and Edge Scenarios

Some companies do not fit neatly into one category. Hybrid retailers sell both essential and non‑essential goods. A company like Amazon AMZN sells groceries, electronics, and clothing. Analysts classify it based on its dominant revenue source.

Luxury brands behave differently from basic discretionary companies. They may hold up better during downturns because wealthy customers continue to spend. Still, they are considered discretionary because their products are not essential.

Technology products can also fall into this sector. Gaming consoles, smart home devices, and high‑end electronics are optional purchases. Their demand rises when consumers have extra income.

Borderline Company Types

Economic Indicators That Influence Discretionary Stocks

Consumer discretionary stocks move with the economy. When people feel confident, they spend more. The Consumer Confidence Index helps track this trend. High confidence often leads to higher sales.

Employment and wage growth also matter. When people earn more, they have more money for optional purchases. Interest rates affect big‑ticket items like cars and home improvement projects. Higher rates make loans more expensive.

Inflation can shift spending from discretionary to essential goods. When prices rise, people focus on needs first. Retail sales data gives clues about how consumers are spending across categories.

How Classification Impacts Investment Decisions

Knowing how to classify a stock helps you build a balanced portfolio. Consumer discretionary stocks add growth potential but also add risk. They tend to rise fast in strong economies and fall hard in weak ones.

Valuation is another factor. Discretionary companies often trade at higher multiples because investors expect growth. Understanding the sector helps you judge whether a stock is priced fairly.

Risk management is easier when you know how cyclical a company is. Sector rotation strategies rely on understanding when to shift into or out of discretionary stocks. Long‑term investors can also benefit from knowing how these companies behave over time.

Case Studies: Classifying Real Companies

A pure discretionary company is easy to classify. A clothing brand or auto manufacturer sells products people can delay buying. Their sales rise and fall with the economy.

A borderline retailer may sell both essentials and non‑essentials. Analysts look at revenue mix to decide the correct category. A luxury brand fits the discretionary sector because its products are optional, even if demand stays strong.

A mixed‑revenue company may have several business lines. In this case, the largest segment determines the classification. This keeps the system consistent across the market.

Common Mistakes When Classifying Stocks

Many investors focus on brand perception instead of revenue. A company may feel like a discretionary brand, but its main revenue source may be essential goods. Another mistake is ignoring cyclicality. A company that depends on strong economic conditions is usually discretionary.

Subscription models can also confuse investors. Even if a service feels essential, it may still be optional. Always look at how demand changes during downturns.

Tools and Resources for Accurate Classification

You can use several tools to classify a stock. GICS documentation provides clear definitions. Company annual reports show revenue breakdowns. Industry reports help you compare companies. ETF holdings lists also reveal how professionals classify stocks.

Financial data platforms make it easy to check sector labels. These tools help you confirm your classification and avoid mistakes.

Conclusion

Classifying a stock as consumer discretionary becomes easier when you follow a clear process. Look at the company’s main revenue source, study demand patterns, and compare it to GICS definitions. This approach helps you understand how the company fits into the market. It also helps you make better investment decisions and build a stronger portfolio.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

The Top Consumer Discretionary Stocks

A dynamic list of leading companies within the sector, highlighting notable performers and long‑term growth drivers. A majority of top investors on StockBossUp rated each company on this list a buy.

What Are Consumer Discretionary Stocks?

An introduction to the sector’s core characteristics and market role.

How Consumer Discretionary Stocks Perform in Different Market Cycles

A review of how economic conditions influence sector performance.

Consumer Discretionary vs Consumer Staples: Key Differences

A comparison of spending patterns, risk profiles, and investment considerations.

How to Analyze Consumer Discretionary Companies

A structured approach to evaluating business models and financial strength.

The Role of Consumer Sentiment in Discretionary Stock Performance

Insight into how consumer confidence and behavioral trends shape demand.

How Interest Rates Impact Consumer Discretionary Stocks

An examination of rate sensitivity and macroeconomic pressures.

Are Consumer Discretionary Stocks Good for Long Term Investors?

A long term perspective on growth potential and sector volatility.

How to Build a Portfolio of Consumer Discretionary Stocks

Practical guidance for constructing and managing sector exposure.

Best ETFs for Consumer Discretionary Exposure

A review of leading ETFs offering diversified access to the sector.

How to Classify a Stock as Consumer Discretionary

A clear explanation of classification standards and sector placement.