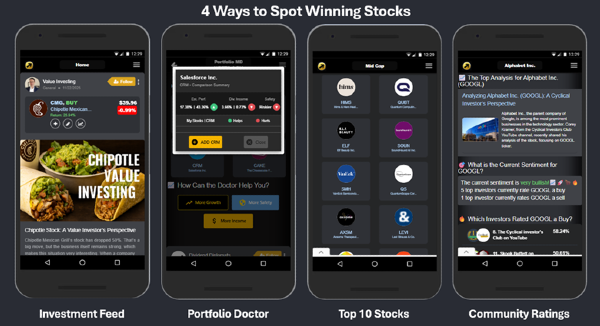

StockBossUp is built on a simple mission: elevate honest, data‑driven investment insight. One of the most powerful ways we do that is through the StockBossUp Investor Achievements system — a performance‑based ranking designed to surface the strongest stock ideas in the community.

We track how well each member’s stock ratings perform over time, then calculate an annualized score to rank every investor on the platform. The better your calls, the higher you rise.

And as you climb, something big happens: your stock ideas get amplified. Higher‑ranked investors earn more visibility, more views, and more influence across the platform. Strong ideas deserve a bigger spotlight — and StockBossUp makes sure they get it.

Qualifying for Ranking

Earning a spot in the StockBossUp rankings is easier than you might think. You only need to meet three simple requirements:

- Complete your profile

- Rate at least 10 stocks, with one rating updated within the last year

- Avoid being flagged as “too volatile”

If you’re new, our Getting Started Guide walks you through filling out your profile and rating your first 10 stocks step‑by‑step. It’s the fastest way to get ranking‑ready.

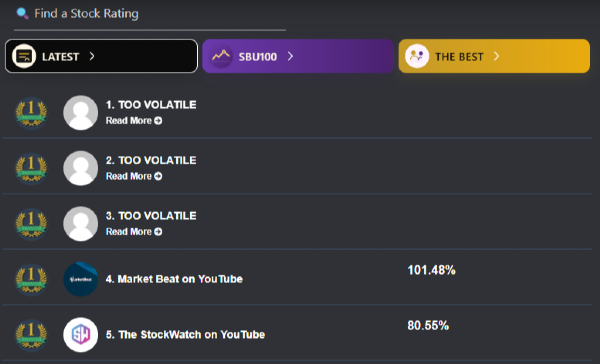

What Does “Too Volatile” Mean?

To keep our rankings fair and trustworthy, we run a statistical volatility check on all your stock ratings. This helps us filter out results that look more like luck than skill.

Think of it this way:

If someone rates nine stocks as buys and they all drop 90%, but one stock shoots up 1,000%, that single outlier shouldn’t catapult them to the top. Our system flags situations like this to protect the integrity of the rankings and highlight investors who show consistent, repeatable performance.

How to Fix a “Too Volatile” Flag

Getting flagged isn’t the end of the road — and it’s often easy to fix.

You have a few options:

- Set your most volatile rating to Neutral.

This removes that rating from your volatility calculation and can immediately bring your ranking back into good standing.

- Give it time.

New ratings can appear volatile because short‑term price swings get extrapolated into an estimated APR. As the stock stabilizes, your volatility score often settles naturally.

Just keep in mind: if the system detects extreme volatility for too long, it may automatically set one of your ratings to Neutral to keep the rankings fair for everyone.

An investor that is too volatile will be hidden. Their content will not be amplified until they fix their volatility.

Active Member

The first Investor achievement you’ll unlock is the Active Member badge — and it’s the easiest one to earn. As soon as you qualify for the rankings, you get it automatically, no matter where you place.

Once you’re an Active Member, your stock analysis starts appearing in other members’ feeds, giving your ideas more visibility and helping you build your reputation across the community.

Making Money

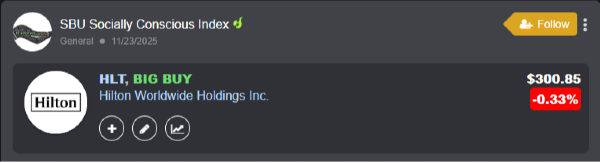

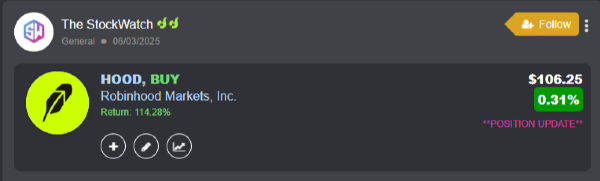

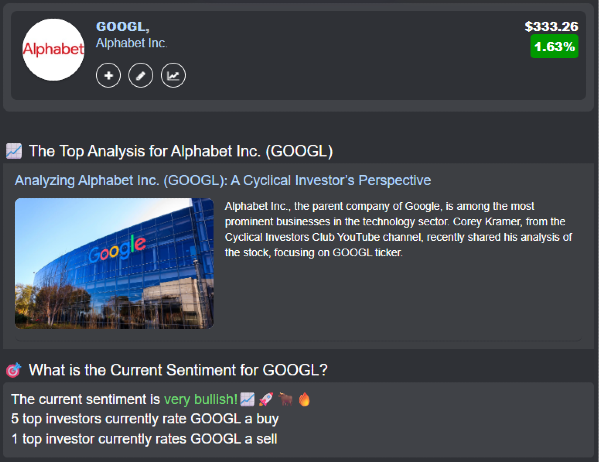

When your APR turns positive, it means your stock ratings are officially making money — a huge milestone worth celebrating. Hitting this level unlocks a powerful investor achievement.

Once you earn it, your stock articles start appearing in the Latest feed, giving your insights instant visibility. Even better, your top‑performing content becomes eligible for our Top Stock lists, putting your best ideas in front of the entire community and attracting even more readers to your analysis.

Top Stock Lists

Feeling Bullish

Feeling Bearish

Dividend Stocks

Large Companies

Midsize Companies

Small Companies

Industrials

Financials

Technology

Healthcare

Telecommunications

Energy

Utilities

Materials

Consumer Staples

Consumer Discretionary

Real Estate

ETFs and Miscellaneous

Earning 5% APR

When your stock ratings hit a 5% APR, you unlock the 500 Club achievement — a major milestone that proves your investment insights are delivering real, measurable returns. Earning 500 basis points means that, on average, the stocks you rated as “Buy” would generate about $500 a year on a $10,000 investment. That’s the kind of performance the community pays attention to.

Reaching the 500 Club doesn’t just feel good — it boosts your visibility across StockBossUp. Your stock ideas are more likely to appear in the Portfolio Doctor tool, in member feeds, and in our Top Stock Lists. If you publish stock analysis articles, your work may even become the showcase article for under‑followed stocks, giving your insights a powerful spotlight.

For example, check out AMD and its showcase article.

Keep in mind: for large‑cap and mega‑cap stocks with heavy trading volume, competition is tougher. Earning showcase placement often requires even higher Investor achievements — but the 500 Club is a strong step toward getting there.

Top 25 Percentile Investor

Reaching the top 25% of all investors on StockBossUp is a major accomplishment — and it doesn’t happen by accident. It takes real investing skill, consistent performance, and a track record strong enough to stand out in a competitive community.

When you break into the top 25%, everything changes. Your stock analysis gets priority visibility across StockBossUp, appearing more frequently in member feeds and stock discovery tools. But the amplification doesn’t stop there — your insights also gain increased exposure across search engines, social media, and AI‑driven results.

Our platform is designed to elevate the best investors across multiple channels, helping you grow your audience simply by being great at what you do.

A green flame next to a user’s name means they’re ranked in the top 25% of all investors.

Top 10 Percentile Investor

Reaching the top 10% of all investors on StockBossUp is a rare achievement — one that demands real skill, deep analysis, and consistent performance. This isn’t just another badge; it’s proof that your investment insights rank among the best in the entire community.

When you hit the top 10%, your analysis gains unmatched priority. Your articles can become the showcase piece for any stock, even highly competitive mega-cap stocks. Your insights rise above all others on the platform, giving your ideas maximum visibility and influence.

But staying at the top takes work. Rankings are based on annualized APR, which levels the playing field for new members. That means even new investors can climb past you if their ratings outperform yours. To hold your position, it’s crucial to keep making strong stock ratings — and revisit older ratings to keep them accurate and up‑to‑date.

Two green flames next to a user’s name signifies they are a top 10 percentile investor

Power Investor

Earning the Power Investor achievement is one of the highest honors on StockBossUp — and for good reason. To unlock it, you must rank in the top 25% of all investors and publish 20 showcase‑worthy articles. Very few investors ever reach this level, and those who do have proven themselves to be elite analysts with consistently high‑quality insights.

The rewards are massive. As a Power Investor, your stock analysis receives the strongest amplification on the entire platform. Your ideas surface more often, reach more members, and carry more influence than any other tier. When you speak, the community pays attention — and StockBossUp makes sure your best work gets the spotlight it deserves.

A showcase article will be the first article you see when you navigate to a stock rating screen

Final Takeaway

StockBossUp’s Investor Achievements system is designed to elevate the voices that deserve to be heard. Top‑performing analysts and content creators gain powerful visibility, helping their best investment insights reach a wider audience across the platform.

At the same time, new investors benefit from a trusted network of proven performers. By highlighting consistent, data‑driven voices, StockBossUp makes it easier for beginners to discover reliable guidance and build confidence in their investing journey.

It’s a system that rewards skill, amplifies great ideas, and strengthens the entire community.

More Reads

Read our entire introduction series on StockBossUp to get started:

StockBossUp is built on a simple mission: elevate honest, data‑driven investment insight. One of the most powerful ways we do that is through the StockBossUp Investor Achievements system — a performance‑based ranking designed to surface the strongest stock ideas in the community.

We track how well each member’s stock ratings perform over time, then calculate an annualized score to rank every investor on the platform. The better your calls, the higher you rise.

And as you climb, something big happens: your stock ideas get amplified. Higher‑ranked investors earn more visibility, more views, and more influence across the platform. Strong ideas deserve a bigger spotlight — and StockBossUp makes sure they get it.

Qualifying for Ranking

Earning a spot in the StockBossUp rankings is easier than you might think. You only need to meet three simple requirements:

If you’re new, our Getting Started Guide walks you through filling out your profile and rating your first 10 stocks step‑by‑step. It’s the fastest way to get ranking‑ready.

What Does “Too Volatile” Mean?

To keep our rankings fair and trustworthy, we run a statistical volatility check on all your stock ratings. This helps us filter out results that look more like luck than skill.

Think of it this way:

If someone rates nine stocks as buys and they all drop 90%, but one stock shoots up 1,000%, that single outlier shouldn’t catapult them to the top. Our system flags situations like this to protect the integrity of the rankings and highlight investors who show consistent, repeatable performance.

How to Fix a “Too Volatile” Flag

Getting flagged isn’t the end of the road — and it’s often easy to fix.

You have a few options:

This removes that rating from your volatility calculation and can immediately bring your ranking back into good standing.

New ratings can appear volatile because short‑term price swings get extrapolated into an estimated APR. As the stock stabilizes, your volatility score often settles naturally.

Just keep in mind: if the system detects extreme volatility for too long, it may automatically set one of your ratings to Neutral to keep the rankings fair for everyone.

Active Member

The first Investor achievement you’ll unlock is the Active Member badge — and it’s the easiest one to earn. As soon as you qualify for the rankings, you get it automatically, no matter where you place.

Once you’re an Active Member, your stock analysis starts appearing in other members’ feeds, giving your ideas more visibility and helping you build your reputation across the community.

Making Money

When your APR turns positive, it means your stock ratings are officially making money — a huge milestone worth celebrating. Hitting this level unlocks a powerful investor achievement.

Once you earn it, your stock articles start appearing in the Latest feed, giving your insights instant visibility. Even better, your top‑performing content becomes eligible for our Top Stock lists, putting your best ideas in front of the entire community and attracting even more readers to your analysis.

Top Stock Lists

Feeling Bullish

Feeling Bearish

Dividend Stocks

Large Companies

Midsize Companies

Small Companies

Industrials

Financials

Technology

Healthcare

Telecommunications

Energy

Utilities

Materials

Consumer Staples

Consumer Discretionary

Real Estate

ETFs and Miscellaneous

Earning 5% APR

When your stock ratings hit a 5% APR, you unlock the 500 Club achievement — a major milestone that proves your investment insights are delivering real, measurable returns. Earning 500 basis points means that, on average, the stocks you rated as “Buy” would generate about $500 a year on a $10,000 investment. That’s the kind of performance the community pays attention to.

Reaching the 500 Club doesn’t just feel good — it boosts your visibility across StockBossUp. Your stock ideas are more likely to appear in the Portfolio Doctor tool, in member feeds, and in our Top Stock Lists. If you publish stock analysis articles, your work may even become the showcase article for under‑followed stocks, giving your insights a powerful spotlight.

Keep in mind: for large‑cap and mega‑cap stocks with heavy trading volume, competition is tougher. Earning showcase placement often requires even higher Investor achievements — but the 500 Club is a strong step toward getting there.

Top 25 Percentile Investor

Reaching the top 25% of all investors on StockBossUp is a major accomplishment — and it doesn’t happen by accident. It takes real investing skill, consistent performance, and a track record strong enough to stand out in a competitive community.

When you break into the top 25%, everything changes. Your stock analysis gets priority visibility across StockBossUp, appearing more frequently in member feeds and stock discovery tools. But the amplification doesn’t stop there — your insights also gain increased exposure across search engines, social media, and AI‑driven results.

Our platform is designed to elevate the best investors across multiple channels, helping you grow your audience simply by being great at what you do.

Top 10 Percentile Investor

Reaching the top 10% of all investors on StockBossUp is a rare achievement — one that demands real skill, deep analysis, and consistent performance. This isn’t just another badge; it’s proof that your investment insights rank among the best in the entire community.

When you hit the top 10%, your analysis gains unmatched priority. Your articles can become the showcase piece for any stock, even highly competitive mega-cap stocks. Your insights rise above all others on the platform, giving your ideas maximum visibility and influence.

But staying at the top takes work. Rankings are based on annualized APR, which levels the playing field for new members. That means even new investors can climb past you if their ratings outperform yours. To hold your position, it’s crucial to keep making strong stock ratings — and revisit older ratings to keep them accurate and up‑to‑date.

Power Investor

Earning the Power Investor achievement is one of the highest honors on StockBossUp — and for good reason. To unlock it, you must rank in the top 25% of all investors and publish 20 showcase‑worthy articles. Very few investors ever reach this level, and those who do have proven themselves to be elite analysts with consistently high‑quality insights.

The rewards are massive. As a Power Investor, your stock analysis receives the strongest amplification on the entire platform. Your ideas surface more often, reach more members, and carry more influence than any other tier. When you speak, the community pays attention — and StockBossUp makes sure your best work gets the spotlight it deserves.

Final Takeaway

StockBossUp’s Investor Achievements system is designed to elevate the voices that deserve to be heard. Top‑performing analysts and content creators gain powerful visibility, helping their best investment insights reach a wider audience across the platform.

At the same time, new investors benefit from a trusted network of proven performers. By highlighting consistent, data‑driven voices, StockBossUp makes it easier for beginners to discover reliable guidance and build confidence in their investing journey.

It’s a system that rewards skill, amplifies great ideas, and strengthens the entire community.

More Reads

Read our entire introduction series on StockBossUp to get started: