Oracle stock has been on a wild ride this year. It’s up 36% year-to-date, trading at $226, but it also dropped nearly 10% in just the past month. That leaves investors asking the big question: is Oracle about to crash harder, or is this dip the perfect buying opportunity?

On the surface, Oracle looks unstoppable. Sales jumped 11% year-over-year to $15.9 billion. Cloud revenue exploded 27%, with infrastructure soaring 52%. And that’s before we even talk about the Stargate project—a multi-hundred-billion-dollar AI buildout backed by OpenAI and SoftBank.

But here’s the catch: Oracle’s capital expenditures ballooned 209% to $21.2 billion. Next year, they’re planning to spend even more. That could either be rocket fuel that launches the stock toward Wall Street’s $325 price target—or the anchor that drags it down.

Let’s break down the real numbers, the upside Wall Street sees, and the one risk investors might be ignoring.

Oracle’s Business and Why It Matters

Oracle isn’t just another legacy tech giant. It’s a leader in enterprise software and cloud computing, serving businesses, governments, and institutions with databases, middleware, ERP, HCM, NetSuite, and more.

The company created the world’s first autonomous database and facilitated the largest electronic health record implementation, serving over 9.5 million people worldwide. That’s not just history—it’s proof of Oracle’s ability to scale mission-critical systems.

And now, Oracle is positioning itself as a serious contender in the future of AI and cloud. The Stargate initiative, in partnership with OpenAI and SoftBank, could scale into the hundreds of billions. If successful, it could make Oracle a backbone of enterprise AI infrastructure.

Stock Performance: Long-Term Strength, Short-Term Volatility

Oracle’s stock has been resilient over the long term, steadily climbing for two decades. In 2025 alone, it’s up 36% year-to-date. But in the short term, profit-taking has pushed the stock down nearly 10% in a month.

That volatility raises the question: is this just a temporary dip, or the start of something bigger? Wall Street analysts currently rate Oracle a “moderate buy” with a high price target of $325—suggesting up to 44% upside.

Here’s a quick look at the numbers:

| Metric |

Current Value |

Change |

| Stock Price (2025 YTD) |

$226 |

+36% |

| 1-Month Performance |

$226 → ~$203 |

-10% |

| Wall Street Target |

$325 |

+44% potential |

Financials: Solid Growth Under the Hood

Oracle’s most recent quarterly financials show steady growth. Sales hit $15.9 billion, up 11.3% year-over-year. Net income rose 9% to $3.4 billion.

The real story is in the cloud business. Oracle’s cloud revenue reached $6.7 billion, up 27%. Infrastructure led the way with a 52% surge, while applications delivered steady double-digit growth.

Why does that matter? When infrastructure outpaces applications, it signals long-term scalability. That’s the kind of growth engine investors chase.

| Segment |

Revenue |

Growth |

| Total Sales |

$15.9B |

+11% |

| Net Income |

$3.4B |

+9% |

| Cloud Revenue |

$6.7B |

+27% |

| Cloud Infrastructure |

N/A (subset) |

+52% |

Overall, the financials look solid. Nothing jaw-dropping, but steady and reliable. That’s why many see the recent dip as a buying opportunity rather than a red flag.

The Two Catalysts That Could Define Oracle’s Future

Wall Street is watching two catalysts closely. Miss these, and the bull case could collapse. Nail them, and Oracle could become a growth powerhouse.

Cloud Infrastructure Growth

Oracle’s CEO projects cloud infrastructure growth accelerating from 50% in fiscal 2025 to over 70% in fiscal 2026. Total cloud revenue is expected to rise from 24% to more than 40%. If those numbers hit, Oracle proves it can scale alongside Amazon and Microsoft—while carving out its own lane.

The Stargate Project

This AI infrastructure initiative, backed by OpenAI and SoftBank, is tied to a $100–$500 billion buildout. If executed well, it could massively expand Oracle’s cloud footprint and position the company as a leader in enterprise AI.

| Catalyst |

2025 Growth |

2026 Projection |

| Cloud Infrastructure |

+50% |

+70% |

| Total Cloud Revenue |

+24% |

+40%+ |

| Stargate Buildout |

Early stage |

$100–$500B potential |

These are the growth engines Wall Street is betting on. But they also come with risks.

The Risk: Capex Explosion

Behind the strong revenue growth lies a potential problem: ballooning capital expenditures. Oracle’s capex rose 209% to $21.2 billion and is projected to hit $25 billion in 2026.

That’s aggressive investment, signaling ambition in cloud and AI. But it also raises concerns about margins and free cash flow. If growth doesn’t keep pace with spending, Oracle could face serious pressure.

High capex is a double-edged sword. It can either be the rocket booster that launches Oracle into the stratosphere—or the anchor that drags it down.

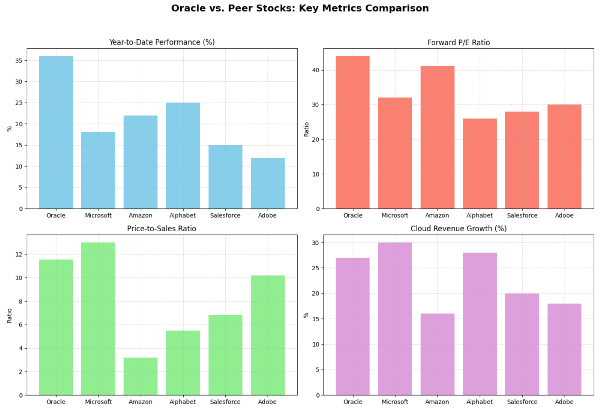

Valuation: Priced for Perfection

Oracle currently trades at 44 times forward earnings. Its price-to-sales ratio is 11.54, second only to Microsoft. That means Oracle is priced like a superstar.

And when expectations are that high, even small disappointments can trigger big price drops.

| Valuation Metric |

Oracle |

Peer Comparison |

| Forward P/E |

44x |

Higher than most peers |

| Price-to-Sales |

11.54 |

Only Microsoft higher |

| Dividend Yield |

<1% ($2 payout) |

Low for income investors |

Oracle does pay a dividend, but at less than 1%, it’s not exactly attractive for income-focused investors. Still, it’s a small bonus for long-term holders.

Final Takeaway: Buy, Hold, or Sell?

Oracle is priced for greatness. If you buy in, you’re betting on execution, not hope. The company has strong financials, ambitious growth plans, and massive AI potential through Stargate. But it also carries high risk with ballooning capex and lofty valuations.

For low-risk investors, Oracle may not be the best fit. But for those with a long-term horizon who believe in cloud and AI, Oracle could be a very interesting play.

Verdict: Oracle is a BUY for long-term growth investors willing to stomach volatility.

For cautious investors, it’s closer to a HOLD until execution on cloud and Stargate becomes clearer.

If you’re looking beyond Oracle, here are five stocks worth checking out 🚀. Each of these companies operates in similar spaces—cloud, enterprise software, or AI infrastructure—but with growth profiles or advantages that some analysts argue make them stronger bets than Oracle right now.

| Company |

Symbol |

Why It May Be Better Than Oracle |

| Microsoft |

MSFT |

Dominates cloud with Azure, growing faster than Oracle’s cloud segment, and has a more diversified revenue base across productivity software, gaming, and AI. |

| Amazon |

AMZN |

AWS remains the global leader in cloud infrastructure, with scale and profitability that Oracle’s cloud business is still chasing. |

| Alphabet |

GOOGL |

Google Cloud is expanding rapidly, and Alphabet’s AI leadership (DeepMind, Gemini) gives it a stronger innovation edge than Oracle. |

| Salesforce |

CRM |

The leader in customer relationship management software, with sticky enterprise clients and consistent double-digit growth, compared to Oracle’s slower legacy segments. |

| Adobe |

ADBE |

Stronger margins and higher analyst upside potential, with dominance in creative software and growing cloud-based subscription revenue. |

https://youtu.be/IEok9wZdqSo?si=IlkxH-MIlcUOfzvt

Oracle stock has been on a wild ride this year. It’s up 36% year-to-date, trading at $226, but it also dropped nearly 10% in just the past month. That leaves investors asking the big question: is Oracle about to crash harder, or is this dip the perfect buying opportunity?

On the surface, Oracle looks unstoppable. Sales jumped 11% year-over-year to $15.9 billion. Cloud revenue exploded 27%, with infrastructure soaring 52%. And that’s before we even talk about the Stargate project—a multi-hundred-billion-dollar AI buildout backed by OpenAI and SoftBank.

But here’s the catch: Oracle’s capital expenditures ballooned 209% to $21.2 billion. Next year, they’re planning to spend even more. That could either be rocket fuel that launches the stock toward Wall Street’s $325 price target—or the anchor that drags it down.

Let’s break down the real numbers, the upside Wall Street sees, and the one risk investors might be ignoring.

Oracle’s Business and Why It Matters

Oracle isn’t just another legacy tech giant. It’s a leader in enterprise software and cloud computing, serving businesses, governments, and institutions with databases, middleware, ERP, HCM, NetSuite, and more.

The company created the world’s first autonomous database and facilitated the largest electronic health record implementation, serving over 9.5 million people worldwide. That’s not just history—it’s proof of Oracle’s ability to scale mission-critical systems.

And now, Oracle is positioning itself as a serious contender in the future of AI and cloud. The Stargate initiative, in partnership with OpenAI and SoftBank, could scale into the hundreds of billions. If successful, it could make Oracle a backbone of enterprise AI infrastructure.

Stock Performance: Long-Term Strength, Short-Term Volatility

Oracle’s stock has been resilient over the long term, steadily climbing for two decades. In 2025 alone, it’s up 36% year-to-date. But in the short term, profit-taking has pushed the stock down nearly 10% in a month.

That volatility raises the question: is this just a temporary dip, or the start of something bigger? Wall Street analysts currently rate Oracle a “moderate buy” with a high price target of $325—suggesting up to 44% upside.

Here’s a quick look at the numbers:

Financials: Solid Growth Under the Hood

Oracle’s most recent quarterly financials show steady growth. Sales hit $15.9 billion, up 11.3% year-over-year. Net income rose 9% to $3.4 billion.

The real story is in the cloud business. Oracle’s cloud revenue reached $6.7 billion, up 27%. Infrastructure led the way with a 52% surge, while applications delivered steady double-digit growth.

Why does that matter? When infrastructure outpaces applications, it signals long-term scalability. That’s the kind of growth engine investors chase.

Overall, the financials look solid. Nothing jaw-dropping, but steady and reliable. That’s why many see the recent dip as a buying opportunity rather than a red flag.

The Two Catalysts That Could Define Oracle’s Future

Wall Street is watching two catalysts closely. Miss these, and the bull case could collapse. Nail them, and Oracle could become a growth powerhouse.

Cloud Infrastructure Growth

Oracle’s CEO projects cloud infrastructure growth accelerating from 50% in fiscal 2025 to over 70% in fiscal 2026. Total cloud revenue is expected to rise from 24% to more than 40%. If those numbers hit, Oracle proves it can scale alongside Amazon and Microsoft—while carving out its own lane.

The Stargate Project

This AI infrastructure initiative, backed by OpenAI and SoftBank, is tied to a $100–$500 billion buildout. If executed well, it could massively expand Oracle’s cloud footprint and position the company as a leader in enterprise AI.

These are the growth engines Wall Street is betting on. But they also come with risks.

The Risk: Capex Explosion

Behind the strong revenue growth lies a potential problem: ballooning capital expenditures. Oracle’s capex rose 209% to $21.2 billion and is projected to hit $25 billion in 2026.

That’s aggressive investment, signaling ambition in cloud and AI. But it also raises concerns about margins and free cash flow. If growth doesn’t keep pace with spending, Oracle could face serious pressure.

High capex is a double-edged sword. It can either be the rocket booster that launches Oracle into the stratosphere—or the anchor that drags it down.

Valuation: Priced for Perfection

Oracle currently trades at 44 times forward earnings. Its price-to-sales ratio is 11.54, second only to Microsoft. That means Oracle is priced like a superstar.

And when expectations are that high, even small disappointments can trigger big price drops.

Oracle does pay a dividend, but at less than 1%, it’s not exactly attractive for income-focused investors. Still, it’s a small bonus for long-term holders.

Final Takeaway: Buy, Hold, or Sell?

Oracle is priced for greatness. If you buy in, you’re betting on execution, not hope. The company has strong financials, ambitious growth plans, and massive AI potential through Stargate. But it also carries high risk with ballooning capex and lofty valuations.

For low-risk investors, Oracle may not be the best fit. But for those with a long-term horizon who believe in cloud and AI, Oracle could be a very interesting play.

Verdict: Oracle is a BUY for long-term growth investors willing to stomach volatility.

For cautious investors, it’s closer to a HOLD until execution on cloud and Stargate becomes clearer.

If you’re looking beyond Oracle, here are five stocks worth checking out 🚀. Each of these companies operates in similar spaces—cloud, enterprise software, or AI infrastructure—but with growth profiles or advantages that some analysts argue make them stronger bets than Oracle right now.

https://youtu.be/IEok9wZdqSo?si=IlkxH-MIlcUOfzvt