All right, so we’re in the middle of this massive AI gold rush, and everyone is scrambling to pick the one winning AI company. It feels like buying a lottery ticket—totally random and wildly risky. But what if there’s a smarter way to play? Instead of wagering on singular winners, you invest in the entire revolution. Welcome to the picks and shovels approach, and at the center of this strategy is CoreWeave.

During historical gold rushes, the greatest fortunes weren’t made by the few who discovered gold. They were made by those selling the tools—picks, shovels, pans—to every miner. In today’s AI boom, the essential tool is massive computational power. CoreWeave is the modern-day equivalent of the shovel seller. They build enormous data centers, load them with the most powerful GPUs on earth, and rent that raw compute to anyone designing the future of AI.

What Is CoreWeave?

CoreWeave isn’t a traditional cloud provider. They specialize in GPU-based infrastructure for AI training, inference, and high-performance computing. Their data centers are optimized end-to-end for workloads that require immense parallel processing power. By focusing exclusively on GPU acceleration, CoreWeave offers performance and pricing that general-purpose clouds can’t match.

Their customers range from AI startups to research labs to Fortune 500 companies building next-generation models. Instead of buying and managing expensive hardware, these organizations tap into CoreWeave’s massive compute pool on demand. It’s a capital-efficient model for both sides: CoreWeave scales capacity, and clients pay only for what they use.

The Bull Case: Explosive Growth

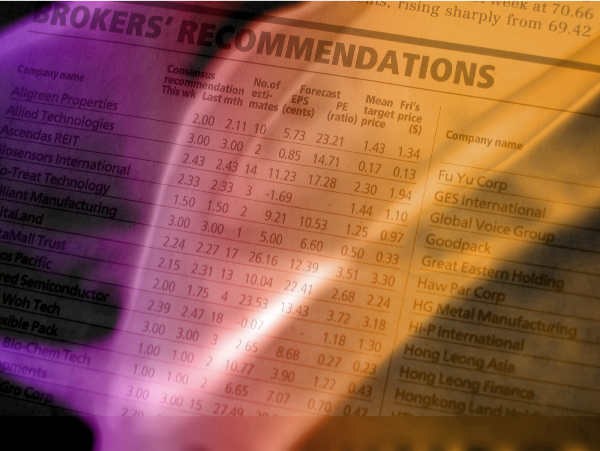

The bull case for CoreWeave boils down to two words: explosive growth. In 2024 alone, CoreWeave’s year-over-year revenue surged by an astonishing 736%, signaling hypergrowth that has Wall Street tooling up its expectations. This wasn’t a one-off spike. The company projects roughly $5.2 billion in revenue for 2025, representing an additional 170% jump.

Even more compelling is their secured backlog. CoreWeave has locked in over $30 billion in multi-year contracts. That’s not a guess or hypothetical pipeline—it’s a concrete, signed agreement guaranteeing future demand. Put it all together, and you get an unmatched combination of growth rates and committed revenue. Among standalone providers in the AI infrastructure space, no one matches their scale or momentum.

The Bear Case: Financial Red Flags

As thrilling as those numbers are, there are serious dangers lurking beneath the hood. CoreWeave boasts an impressive gross margin of nearly 74%, reflecting tremendous pricing power. Yet the bottom line remains deeply negative, and the cash burn is substantial. When you dig into their financial health check, the grades read like a warning siren: a D for profitability, a C- for liquidity, and a D+ for solvency.

That poor report card stems directly from a mountain of debt. Over the past year, CoreWeave’s total liabilities exploded from $1.5 billion to more than $8 billion. That’s not just rapid expansion—that’s a massive financial gamble. If demand slows or compute prices fall, servicing that debt could become a drag on growth, or worse, trigger liquidity concerns.

The Three-Year Forecast: Scenarios for CoreWeave

So how do analysts reconcile jaw-dropping growth with sky-high leverage? They model three potential futures:

- Conservative Case

In this scenario, growth stalls and margins tighten. Compute demand plateaus, debt service eats into cash flow, and the stock ends up trading in a narrow range. Essentially, you’d see little to no upside over the next three years, making this the low‐return outcome if AI spending cools off.

- Moderate Case

Here, CoreWeave continues its momentum—revenue climbs, backlog turns into booked revenue, and the debt load gradually becomes more manageable. By 2028, the model forecasts a share price around $250. From today’s levels, that implies roughly a 170% total return, driven by a combination of multiple expansion and healthy earnings growth.

- Optimistic Case

In the bull‐bull outcome, AI workloads explode, pricing power remains intact, and CoreWeave effortlessly scales capacity without having to slash prices. Under these perfect‐storm conditions, the price target shoots up near $400 a share—a potential home run gain for anyone with conviction.

Balancing Upside and Risk

When you stack a potential 170% return or even higher against the reality of negative profitability and an $8 billion debt burden, the decision isn’t black and white. This isn’t a one‐off momentum trade—you’re betting on a multi‐year transformation of global compute infrastructure. If CoreWeave delivers on its backlog, optimizes its cost of capital, and sustains those mammoth gross margins, the upside remains compelling. But slip-ups in execution, a downturn in AI spending, or higher interest rates could magnify financial strain.

That delicate balance is why the final verdict lands on a cautious buy. You’re not swinging for the fences with a full allocation, nor are you sitting on the sidelines. Instead, you’re taking a calculated stake in what could be the essential picks and shovels play of the AI era—while actively managing the downside.

Actionable Guidance

To translate this analysis into concrete steps, here’s the playbook:

Ideal Buy Zone:

Look to initiate positions in the $80–$90 range. That price band offers a buffer if growth disappoints and positions you for maximum upside if the moderate scenario unfolds.

Position Sizing:

Keep CoreWeave under 10% of your total equity allocation. This is a high‐volatility holding; small sizing preserves capital if things go south.

Time Horizon:

Treat this as a 3–5 year commitment. You’re buying into a multi-year infrastructure build and need to give the story time to play out.

Downside Protection:

Implement a stop‐loss or similar risk‐management trigger. For example, you might exit if shares fall below $70—signaling that the growth narrative has broken down.

The Multi-Billion-Dollar Question

So, is CoreWeave a wildly risky gamble on an uncertain future or the absolutely essential “picks and shovels” play that every AI company needs? The answer hinges on your view of AI’s trajectory, your appetite for debt-fuelled growth stories, and your conviction that compute will remain the scarce, mission-critical resource of tomorrow.

At its core, this is a high-risk, high-reward proposition. If you believe AI is just getting started and that CoreWeave’s scale and locked-in contracts insulate it from competition, the upside could justify the financial strain. If you doubt prolonged hypergrowth or worry about cost of capital pressures, it might be one to admire from afar.

Ultimately, you must decide whether the next decade’s computing gold rush will crown CoreWeave as the shovel seller king—or whether the debt mountain proves too steep to climb.

All right, so we’re in the middle of this massive AI gold rush, and everyone is scrambling to pick the one winning AI company. It feels like buying a lottery ticket—totally random and wildly risky. But what if there’s a smarter way to play? Instead of wagering on singular winners, you invest in the entire revolution. Welcome to the picks and shovels approach, and at the center of this strategy is CoreWeave.

During historical gold rushes, the greatest fortunes weren’t made by the few who discovered gold. They were made by those selling the tools—picks, shovels, pans—to every miner. In today’s AI boom, the essential tool is massive computational power. CoreWeave is the modern-day equivalent of the shovel seller. They build enormous data centers, load them with the most powerful GPUs on earth, and rent that raw compute to anyone designing the future of AI.

What Is CoreWeave?

CoreWeave isn’t a traditional cloud provider. They specialize in GPU-based infrastructure for AI training, inference, and high-performance computing. Their data centers are optimized end-to-end for workloads that require immense parallel processing power. By focusing exclusively on GPU acceleration, CoreWeave offers performance and pricing that general-purpose clouds can’t match.

Their customers range from AI startups to research labs to Fortune 500 companies building next-generation models. Instead of buying and managing expensive hardware, these organizations tap into CoreWeave’s massive compute pool on demand. It’s a capital-efficient model for both sides: CoreWeave scales capacity, and clients pay only for what they use.

The Bull Case: Explosive Growth

The bull case for CoreWeave boils down to two words: explosive growth. In 2024 alone, CoreWeave’s year-over-year revenue surged by an astonishing 736%, signaling hypergrowth that has Wall Street tooling up its expectations. This wasn’t a one-off spike. The company projects roughly $5.2 billion in revenue for 2025, representing an additional 170% jump.

Even more compelling is their secured backlog. CoreWeave has locked in over $30 billion in multi-year contracts. That’s not a guess or hypothetical pipeline—it’s a concrete, signed agreement guaranteeing future demand. Put it all together, and you get an unmatched combination of growth rates and committed revenue. Among standalone providers in the AI infrastructure space, no one matches their scale or momentum.

The Bear Case: Financial Red Flags

As thrilling as those numbers are, there are serious dangers lurking beneath the hood. CoreWeave boasts an impressive gross margin of nearly 74%, reflecting tremendous pricing power. Yet the bottom line remains deeply negative, and the cash burn is substantial. When you dig into their financial health check, the grades read like a warning siren: a D for profitability, a C- for liquidity, and a D+ for solvency.

That poor report card stems directly from a mountain of debt. Over the past year, CoreWeave’s total liabilities exploded from $1.5 billion to more than $8 billion. That’s not just rapid expansion—that’s a massive financial gamble. If demand slows or compute prices fall, servicing that debt could become a drag on growth, or worse, trigger liquidity concerns.

The Three-Year Forecast: Scenarios for CoreWeave

So how do analysts reconcile jaw-dropping growth with sky-high leverage? They model three potential futures:

In this scenario, growth stalls and margins tighten. Compute demand plateaus, debt service eats into cash flow, and the stock ends up trading in a narrow range. Essentially, you’d see little to no upside over the next three years, making this the low‐return outcome if AI spending cools off.

Here, CoreWeave continues its momentum—revenue climbs, backlog turns into booked revenue, and the debt load gradually becomes more manageable. By 2028, the model forecasts a share price around $250. From today’s levels, that implies roughly a 170% total return, driven by a combination of multiple expansion and healthy earnings growth.

In the bull‐bull outcome, AI workloads explode, pricing power remains intact, and CoreWeave effortlessly scales capacity without having to slash prices. Under these perfect‐storm conditions, the price target shoots up near $400 a share—a potential home run gain for anyone with conviction.

Balancing Upside and Risk

When you stack a potential 170% return or even higher against the reality of negative profitability and an $8 billion debt burden, the decision isn’t black and white. This isn’t a one‐off momentum trade—you’re betting on a multi‐year transformation of global compute infrastructure. If CoreWeave delivers on its backlog, optimizes its cost of capital, and sustains those mammoth gross margins, the upside remains compelling. But slip-ups in execution, a downturn in AI spending, or higher interest rates could magnify financial strain.

That delicate balance is why the final verdict lands on a cautious buy. You’re not swinging for the fences with a full allocation, nor are you sitting on the sidelines. Instead, you’re taking a calculated stake in what could be the essential picks and shovels play of the AI era—while actively managing the downside.

Actionable Guidance

To translate this analysis into concrete steps, here’s the playbook:

Ideal Buy Zone:

Look to initiate positions in the $80–$90 range. That price band offers a buffer if growth disappoints and positions you for maximum upside if the moderate scenario unfolds.

Position Sizing:

Keep CoreWeave under 10% of your total equity allocation. This is a high‐volatility holding; small sizing preserves capital if things go south.

Time Horizon:

Treat this as a 3–5 year commitment. You’re buying into a multi-year infrastructure build and need to give the story time to play out.

Downside Protection:

Implement a stop‐loss or similar risk‐management trigger. For example, you might exit if shares fall below $70—signaling that the growth narrative has broken down.

The Multi-Billion-Dollar Question

So, is CoreWeave a wildly risky gamble on an uncertain future or the absolutely essential “picks and shovels” play that every AI company needs? The answer hinges on your view of AI’s trajectory, your appetite for debt-fuelled growth stories, and your conviction that compute will remain the scarce, mission-critical resource of tomorrow.

At its core, this is a high-risk, high-reward proposition. If you believe AI is just getting started and that CoreWeave’s scale and locked-in contracts insulate it from competition, the upside could justify the financial strain. If you doubt prolonged hypergrowth or worry about cost of capital pressures, it might be one to admire from afar.

Ultimately, you must decide whether the next decade’s computing gold rush will crown CoreWeave as the shovel seller king—or whether the debt mountain proves too steep to climb.