What is Astra Space Inc?

Astra Space Inc. is a publicly traded rocket technology company. Their main service is space delivery, but recently Astra has diversified into other space services. These include satellite constellation services and rocket component sales.

Astra is a small-cap stock that runs their company, appropriately, like a start-up. They are positioning themselves long term to be a formable player in space delivery. Every rocket launch is critical to their success, and they are rapidly iterating their technology as they learn from each mission.

Credit: Astra SpaceTech Day presentation screenshot

What was SpaceTech Day?

SpaceTech day was an opportunity for Astra Space Inc to showcase their new production facility in Alameda, California. Alameda mayor Marilyn Ezzy Ashcraft was the first speaker. She described how the cities old naval district was transforming with new manufacturing. She thanked Astra for being one of these new factories reinvigorating the district.

After the mayor spoke, the executive leadership discussed Astra's business plan in detail. Afterwards, those in attendance toured the ITAR facility.

Astra and the "Theory of Constraints"

SpaceTech Day highlighted Astra's use of the "Theory of Constraints". Referred to as "ToC", this theory identifies the limiting factor that keeps a company from its goal. This goal is typically cash generation or earnings.

Astra, with limited resources, can be modeled under this framework. ToC wants to optimize a critical path, which is a process constraint limiting the goal. Once you identify this constraint, you prioritize your business around this constraint.

The process works like this:

Astra's SpaceTech day hit home these fundamental constraints in their business. ToC will help give context to Astra's opportunities, struggles, and leadership. Astra is fighting against the clock to prove their company can be successful before capital runs out. Let's discuss their battle plans through a ToC lens.

Launch Delivery - The Critical Path

When I first analyzed Astra's stock, I thought that bookings were their critical path. But after SpaceTech day I believe their immediate critical path is launch delivery.

I was happy to hear Chris Kemp, CEO of Astra, discuss launch delivery in detail. Most analyst would glaze over this discussion because it's not about bookings. But, optimizing launch is crucial in 2022 to battle Astra's critical path.

The team discussed plans to improve launch delivery and remove it as a bottle neck.

One day recycle time of launch System

The Astra team has designed a launch system that can be disassembled and reused in one day. This side note in the presentation is absolutely critical. The team needs to be agile in the coming months to get launches out as fast as possible. Each launch has to contend with:

- Weather

- Licensing

- Space Address

Once a rocket payload is launched, the team will need to reuse and even ship out launch systems to prepare for the next rocket. Right now, they have 3 mobile launch systems.

As we will discuss later in this article, Astra may find themselves battling an over-saturation of rocket inventory. This inventory will destroy their cash holdings if they cannot keep up with launches.

Lean Mission Control

Astra has reduced their mission control from 21 team members to 8 team members per launch. This incredible efficiency reduces the possibility of human error or delay. It also frees more team members to conduct other rocket launches.

Smaller teams add to their launch nimbleness. This is another good sign that the Astra team is focusing on their launch constraint.

Credit: Astra SpaceTech Day presentation screenshot

Multiple Space Ports

Astra is working out of two space ports currently. The first space port is in Kodiak, Alaska, while the second port is Cape Canaveral. The team was excited to announce that they were licensing a space port in the United Kingdom.

Importantly, the team has focused on a robust shipping process for the rockets. U.S. rockets are regulated by the International Traffic in Arms Regulations (ITAR). Why is this important? The team needs multiple space ports to effectively launch regularly. And ideal launch locations are independent of the sovereign nation the port is in.

Shipping Rockets

Shipping rockets with an easy, clandestine, and ITAR process is critical to getting more launches. The fact that the executive leadership team recognizes this was very important. It's fun building rockets, it's what investors like. But I have more trust in the executive team because they realize that their business has constraints outside of rocket building.

Astra is building rockets that meet specifications beyond just launching cargo into space:

- Rockets are being built for containerized and clandestine shipments with ITAR in mind

- Rockets are built for ease of transport

- Rockets are built for their recycled launch system

Failure Rate

Its impressive that after 18 months of starting the company they received a license to launch. Since then they have rapidly iterated rocket technology. I am on board with their rapid rocket iterations but...

As I noted in my last analysis of Astra, I can understand rockets failing. But I'm very critical of a 66% failure rate. A high failure rate accentuates the launch problem and could be disastrous because of the following:

- Astra operations will be forced to increase rocket inventory. As we will discuss later, this destroys cash flow

- A failed rocket launch may destroy the customer's product. I do not believe a customer will continue to accept this no matter how sympathetic they are now. One shoe box size satellite may not be too expensive, but the production line for these satellites are likely custom batches. This means replacements will be more expensive since they can't be built in lots.

- You now force your launch teams to do more launches. If launches are your constraint, you exacerbate the problem with more launches to make up for failed attempts.

To be blunt, a 66% failure rate of paying launches will be unacceptable. (Test launches can fail that much). If they cannot get to a 95% success rate minimum by the end of 2022, I would change my outlook of Astra to "Strong Sell".

Bookings - The Future Constraint

As of Q2 2022, it looks like bookings is not the company's current constraint. That does not mean that they can ignore bookings, it is absolutely critical to grow sales. Yet, no amount of sales can offset inefficient and constrained launches.

Astra is benefiting from new companies creating products for space. But these new applications are gated by access to space. Astra has a real potential to be the truck company to space if they convince these new companies they are the best launch option.

The company is building on some key opportunities and advantages to grow bookings

- Constellation Missions

- Operating an Astra satellite constellation

- Allowing customers to choose their orbital address

- Rapid book to orbit

- Affordable launches

- Rocket component sales

Constellation Missions

Astra is banking on constellation missions to fuel its back log for the next decade. Constellations are a group of satellites that work to complete a mission. For example, the Tropics mission will orbit satellites in succession over hurricanes to get a time series of data. Constellations will have the following requirements:

- Deployment

- Spares and replacement

- replenishment

Astra will generate revenue from satellite constellation through launch and then after-deployment services.

Astra Satellite Constellation

New companies need satellite constellations, but may not be able to afford the capital expenditure. Astra is looking to setup their own constellation to meet this demand.

Astra relates this to cloud servers. In the past, companies had their own servers for their technology. Now, many companies rely on cloud services for their IT. Astra is looking to make a similar play with their own constellation.

This will have another effect of smoothing demand for rocket launches. Astra can fit in building and launching their own rockets to offset lulls in demand. This reduces disruption to their production teams by level loading production demand.

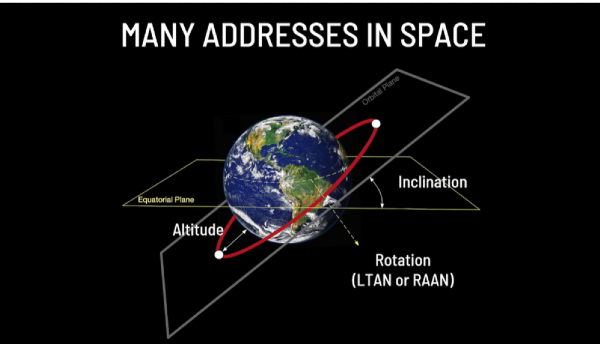

Credit: Astra SpaceTech Day presentation screenshot

Getting to the Right Orbital Address - NASA's Tropics Mission

Orbital addresses are 6 unique variables that define the space a satellite will orbit. These variables include:

- Altitude

- Inclination

- Rotation

During the NASA tropics mission, Astra needs to get three satellites into three different orbital planes. NASA awarded Astra $8 Million to get into these orbital planes. These rapidly deployed satellites will conduct thermal imaging of hurricanes. This progresses their mission to "Improve Life on Earth from Space".

Per Dr. Will McCarty, a program Scientist at NASA, the satellites used to be the size of school buses, but now are the size of shoe boxes. The satellites create a vertical profile of temperatures, water vapor and imaging of the hurricane.

In the past, satellites could get two pictures a day as they passed by the hurricane during their orbit around Earth. The Tropics Mission can have multiple satellites passing by in their orbit throughout the day. This creates a time evolution of the hurricane. The more launches, the higher the revisit rate.

This new paradigm is a satellite constellation. This increases the data capture received per day. Before constellations, only geosynchronous orbit could get you more data, but this is at a much further elevation. With Astra, NASA scientists can pick the orbit they want to be at. The scientists are not constrained by the orbit of the International Space Station, where these missions get a ride to.

Its hard to change addresses once in space. So Astra is working to get the constellation into the right orbit the first time.

The tropics Mission has a complex system of orbital addresses including:

- 3 Planes

- 2 Orbits per plane

- Same altitude and inclination

- Evenly distributed around Earth

Rapid Book to Orbit

Astra's executive team wants to launch rockets just months after a sale is booked, if not days. This turnaround of raw material into cash would be unprecedented in the industry and help to stabilize the companies cash on hand.

This rapid launch schedule also allows customers to have more flexibility. Customers will be able to launch their products quicker, which in turn gives them revenue faster. This looks to be a real demand from the market as more space start-ups need satellites.

Credit: Astra SpaceTech Day presentation screenshot

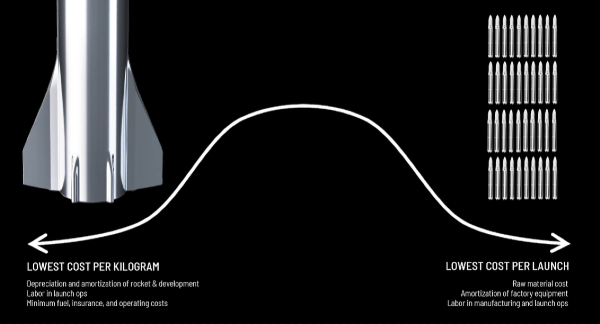

Affordable Launches

As of SpaceTech Day, Astra's launch price was $3.95 million. As of April 2022, NBC reported that:

- SpaceLab can launch a rocket for $5 million

- SpaceX charges $62 million (for a larger payload)

- Russia’s workhorse Soyuz rockets cost anywhere from $53 million to $225 million per launch

To make launches affordable, Astra is on a mission to lower the cost to manufacture rockets. Astra's CEO notes that like a Cessna, a basic rocket doesn't need much raw material to be made. So just like a Cessna, Astra is looking to keep the rocket cost down to only hundreds of thousands of dollars.

Rocket Component Sales

Astra has now booked 82 rockets engines to be sold to other rocket companies. This looks to be a good way to diversify revenue and level production at their factory. Astra says they have made investments to manufacture other space products they will sell to competitors.

Factory - Optimized Capital Project

Astra's goal is "daily space delivery" and is building their plant to scale the number of launches. Nearly all components are made within the building. Raw materials come in, rockets come out.

Astra plans to amortize cost across their factory instead of one big rocket. Astra is amortizing a factory using simplified, low cost rockets for launch.

If everything goes to plan, their factory should become the drumbeat of their operations. Astra can license more space ports. They can book more sales and obtain more customers. But a new plant will require significant capital and become their capital constraint. Hence, the factory must become the critical path in the future.

Right now its not the priority. Though it makes sense to optimize the plant for a rocket built a week, the team must prioritize successful launches. If Astra's inventory of rockets gets too big, this would be a symptom of the factory over working when the launch team can't get rockets into space.

Credit: Astra SpaceTech Day presentation screenshot

Why not Reuse Rockets?

Astra's financial models predict that a rocket needs to be reused 20 to 50 times to amortize the cost of the rocket. Astra is making simple rockets to scale. Making rockets simple is hard enough.

I agree with their direction. A customer doesn't care how their cargo gets to space. So if the cost is low then this is the direction to go.

Is Astra a Long Term Buy?

I rate Astra as a long term buy with a 5 year outlook. However, these events in 2022 would immediately change my position:

- If their failure rate with paid cargo doesn't get below 5%, Astra may not be able to succeed long term

- A symptom of this failure rate would be a large inventory of rockets. If rocket inventory gets too high, its likely they have not optimized launch as they should have

References

Cover Image from Nasa.gov

Images are screen shots from Astra's 2022 SpaceTech Day online presentation

I/we have a position in an asset mentioned

What is Astra Space Inc?

Astra Space Inc. is a publicly traded rocket technology company. Their main service is space delivery, but recently Astra has diversified into other space services. These include satellite constellation services and rocket component sales.

Astra is a small-cap stock that runs their company, appropriately, like a start-up. They are positioning themselves long term to be a formable player in space delivery. Every rocket launch is critical to their success, and they are rapidly iterating their technology as they learn from each mission.

Credit: Astra SpaceTech Day presentation screenshot

What was SpaceTech Day?

SpaceTech day was an opportunity for Astra Space Inc to showcase their new production facility in Alameda, California. Alameda mayor Marilyn Ezzy Ashcraft was the first speaker. She described how the cities old naval district was transforming with new manufacturing. She thanked Astra for being one of these new factories reinvigorating the district.

After the mayor spoke, the executive leadership discussed Astra's business plan in detail. Afterwards, those in attendance toured the ITAR facility.

Astra and the "Theory of Constraints"

SpaceTech Day highlighted Astra's use of the "Theory of Constraints". Referred to as "ToC", this theory identifies the limiting factor that keeps a company from its goal. This goal is typically cash generation or earnings.

Astra, with limited resources, can be modeled under this framework. ToC wants to optimize a critical path, which is a process constraint limiting the goal. Once you identify this constraint, you prioritize your business around this constraint.

The process works like this:

Credit: LeanProduction.com

Astra's SpaceTech day hit home these fundamental constraints in their business. ToC will help give context to Astra's opportunities, struggles, and leadership. Astra is fighting against the clock to prove their company can be successful before capital runs out. Let's discuss their battle plans through a ToC lens.

Launch Delivery - The Critical Path

When I first analyzed Astra's stock, I thought that bookings were their critical path. But after SpaceTech day I believe their immediate critical path is launch delivery.

I was happy to hear Chris Kemp, CEO of Astra, discuss launch delivery in detail. Most analyst would glaze over this discussion because it's not about bookings. But, optimizing launch is crucial in 2022 to battle Astra's critical path.

The team discussed plans to improve launch delivery and remove it as a bottle neck.

One day recycle time of launch System

The Astra team has designed a launch system that can be disassembled and reused in one day. This side note in the presentation is absolutely critical. The team needs to be agile in the coming months to get launches out as fast as possible. Each launch has to contend with:

Once a rocket payload is launched, the team will need to reuse and even ship out launch systems to prepare for the next rocket. Right now, they have 3 mobile launch systems.

As we will discuss later in this article, Astra may find themselves battling an over-saturation of rocket inventory. This inventory will destroy their cash holdings if they cannot keep up with launches.

Lean Mission Control

Astra has reduced their mission control from 21 team members to 8 team members per launch. This incredible efficiency reduces the possibility of human error or delay. It also frees more team members to conduct other rocket launches.

Smaller teams add to their launch nimbleness. This is another good sign that the Astra team is focusing on their launch constraint.

Credit: Astra SpaceTech Day presentation screenshot

Multiple Space Ports

Astra is working out of two space ports currently. The first space port is in Kodiak, Alaska, while the second port is Cape Canaveral. The team was excited to announce that they were licensing a space port in the United Kingdom.

Importantly, the team has focused on a robust shipping process for the rockets. U.S. rockets are regulated by the International Traffic in Arms Regulations (ITAR). Why is this important? The team needs multiple space ports to effectively launch regularly. And ideal launch locations are independent of the sovereign nation the port is in.

Shipping Rockets

Shipping rockets with an easy, clandestine, and ITAR process is critical to getting more launches. The fact that the executive leadership team recognizes this was very important. It's fun building rockets, it's what investors like. But I have more trust in the executive team because they realize that their business has constraints outside of rocket building.

Astra is building rockets that meet specifications beyond just launching cargo into space:

Failure Rate

Its impressive that after 18 months of starting the company they received a license to launch. Since then they have rapidly iterated rocket technology. I am on board with their rapid rocket iterations but...

As I noted in my last analysis of Astra, I can understand rockets failing. But I'm very critical of a 66% failure rate. A high failure rate accentuates the launch problem and could be disastrous because of the following:

To be blunt, a 66% failure rate of paying launches will be unacceptable. (Test launches can fail that much). If they cannot get to a 95% success rate minimum by the end of 2022, I would change my outlook of Astra to "Strong Sell".

Bookings - The Future Constraint

As of Q2 2022, it looks like bookings is not the company's current constraint. That does not mean that they can ignore bookings, it is absolutely critical to grow sales. Yet, no amount of sales can offset inefficient and constrained launches.

Astra is benefiting from new companies creating products for space. But these new applications are gated by access to space. Astra has a real potential to be the truck company to space if they convince these new companies they are the best launch option.

The company is building on some key opportunities and advantages to grow bookings

Constellation Missions

Astra is banking on constellation missions to fuel its back log for the next decade. Constellations are a group of satellites that work to complete a mission. For example, the Tropics mission will orbit satellites in succession over hurricanes to get a time series of data. Constellations will have the following requirements:

Astra will generate revenue from satellite constellation through launch and then after-deployment services.

Astra Satellite Constellation

New companies need satellite constellations, but may not be able to afford the capital expenditure. Astra is looking to setup their own constellation to meet this demand.

Astra relates this to cloud servers. In the past, companies had their own servers for their technology. Now, many companies rely on cloud services for their IT. Astra is looking to make a similar play with their own constellation.

This will have another effect of smoothing demand for rocket launches. Astra can fit in building and launching their own rockets to offset lulls in demand. This reduces disruption to their production teams by level loading production demand.

Credit: Astra SpaceTech Day presentation screenshot

Getting to the Right Orbital Address - NASA's Tropics Mission

Orbital addresses are 6 unique variables that define the space a satellite will orbit. These variables include:

During the NASA tropics mission, Astra needs to get three satellites into three different orbital planes. NASA awarded Astra $8 Million to get into these orbital planes. These rapidly deployed satellites will conduct thermal imaging of hurricanes. This progresses their mission to "Improve Life on Earth from Space".

Per Dr. Will McCarty, a program Scientist at NASA, the satellites used to be the size of school buses, but now are the size of shoe boxes. The satellites create a vertical profile of temperatures, water vapor and imaging of the hurricane.

In the past, satellites could get two pictures a day as they passed by the hurricane during their orbit around Earth. The Tropics Mission can have multiple satellites passing by in their orbit throughout the day. This creates a time evolution of the hurricane. The more launches, the higher the revisit rate.

This new paradigm is a satellite constellation. This increases the data capture received per day. Before constellations, only geosynchronous orbit could get you more data, but this is at a much further elevation. With Astra, NASA scientists can pick the orbit they want to be at. The scientists are not constrained by the orbit of the International Space Station, where these missions get a ride to.

Its hard to change addresses once in space. So Astra is working to get the constellation into the right orbit the first time.

The tropics Mission has a complex system of orbital addresses including:

Rapid Book to Orbit

Astra's executive team wants to launch rockets just months after a sale is booked, if not days. This turnaround of raw material into cash would be unprecedented in the industry and help to stabilize the companies cash on hand.

This rapid launch schedule also allows customers to have more flexibility. Customers will be able to launch their products quicker, which in turn gives them revenue faster. This looks to be a real demand from the market as more space start-ups need satellites.

Credit: Astra SpaceTech Day presentation screenshot

Affordable Launches

As of SpaceTech Day, Astra's launch price was $3.95 million. As of April 2022, NBC reported that:

To make launches affordable, Astra is on a mission to lower the cost to manufacture rockets. Astra's CEO notes that like a Cessna, a basic rocket doesn't need much raw material to be made. So just like a Cessna, Astra is looking to keep the rocket cost down to only hundreds of thousands of dollars.

Rocket Component Sales

Astra has now booked 82 rockets engines to be sold to other rocket companies. This looks to be a good way to diversify revenue and level production at their factory. Astra says they have made investments to manufacture other space products they will sell to competitors.

Factory - Optimized Capital Project

Astra's goal is "daily space delivery" and is building their plant to scale the number of launches. Nearly all components are made within the building. Raw materials come in, rockets come out.

Astra plans to amortize cost across their factory instead of one big rocket. Astra is amortizing a factory using simplified, low cost rockets for launch.

If everything goes to plan, their factory should become the drumbeat of their operations. Astra can license more space ports. They can book more sales and obtain more customers. But a new plant will require significant capital and become their capital constraint. Hence, the factory must become the critical path in the future.

Right now its not the priority. Though it makes sense to optimize the plant for a rocket built a week, the team must prioritize successful launches. If Astra's inventory of rockets gets too big, this would be a symptom of the factory over working when the launch team can't get rockets into space.

Credit: Astra SpaceTech Day presentation screenshot

Why not Reuse Rockets?

Astra's financial models predict that a rocket needs to be reused 20 to 50 times to amortize the cost of the rocket. Astra is making simple rockets to scale. Making rockets simple is hard enough.

I agree with their direction. A customer doesn't care how their cargo gets to space. So if the cost is low then this is the direction to go.

Is Astra a Long Term Buy?

I rate Astra as a long term buy with a 5 year outlook. However, these events in 2022 would immediately change my position:

References

Cover Image from Nasa.gov

Images are screen shots from Astra's 2022 SpaceTech Day online presentation

I/we have a position in an asset mentioned