Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

March 10, 2023 – It was a rough week, especially on Friday. Bonds were up (interest rates down), the US Dollar Up, but dramatically down on Friday, all on economic news & bank failure concerns. Yes, when the banks sneeze, the markets catch a cold. I sound like a broken record but this (remains) a news driven market. Up on poor economic news (the FED will stop raising rates) and FOMO and then down when the economic news is really pretty strong (back to inflation fears).

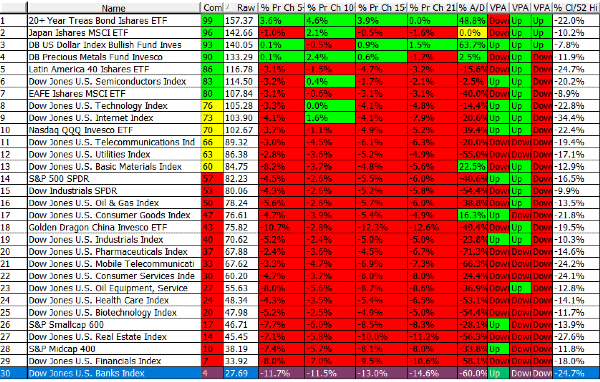

We’re back within my trading range and the open question is how much lower. IF the Last Point of Support (LPS) is to hold and return to higher highs it’s got to happen PDQ (pretty dam quick). Else we’re headed lower to at least the 10805 level or back to the old January lows. We have now returned to the late December, 2022 levels and all we have to show for it is volatility. This is a market for short term trading at best and not quite ready for ‘investing’ (IMHO). But that time will come and it will likely not be very obvious. I’m not convinced that we’ve seen a climatic sell off yet when everyone throws in the towel and gives up. The Short Term Sector Strength table is shown above –

More economic news on Tuesday next week and it will be interesting to see how the market reacts. I remain heavy in Cash with only a few small positions and I’m standing close to the exit door on those too. Have a good week & Take Care. …………….. Tom …………….. Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission. Price chart at: www.Special-Risk.net