Is WAL a Buy?

Western Alliance Bank (WAL) is rated a BUY. The stock tumbled hard with the rest of the regional banks in early 2023, but since then the stock has started to rebound back to its natural intrinsic value. The bank has proven its resilience by:

- Keeping appropriate reserves.

- Maintaining and growing earnings.

- Maintained its dividend after the shock to regional banks.

As Western Alliance has dropped from the headlines, the company’s stock has begun to rebound. The stock received a bump after each earnings announcement by reporting “business as usual”. As we will see, if Western Alliance can continue “business as usual”, the bank may be a fantastic investment opportunity.

Western Alliance’s Stock Price Target

As of the time of writing, WAL sat at $48 per share. Our price target is an ambitious $121 per share. This is the current intrinsic value we estimate the bank is worth. This value comes from clearly stellar financial metrics.

The company’s book value per share has been maintained at $50.21 per share. The company didn’t see an erosion of cash and assets due to the shock that occurred in regional banks.

The same cannot be said for other banks. Silicon Bank took a big hit thanks to losses in the bond market. The bank was tied up in long-term bonds that were priced as a loss in the market. When money in the venture capital sector dried up, Silicon Valley Bank didn’t have the liquid capital to pay out the withdrawals.

First Republic saw an outflow of $100 Billion in uninsured deposits.

Western Alliance bank also maintained a strong earnings per share of $7.88 diluted EPS (TTM). Though lower than their 2022 earnings, the bank has shown resilience. Signs point towards stronger earnings into 2024 as deposit growth stabilizes and the bank continues their business of carefully giving loans to a diversified set of clients.

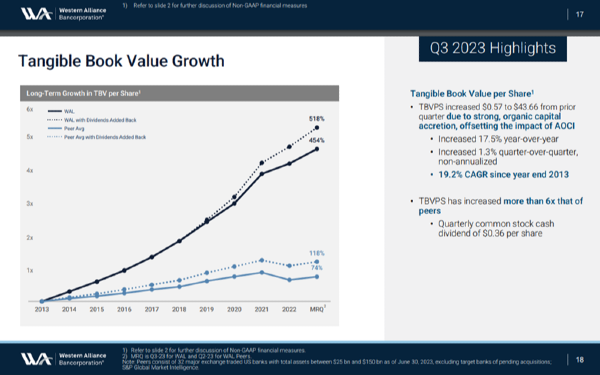

Impressively, the company’s tangible book value continues to grow this year. The company showcased their exceptional performance versus their peers:

Why is Western Alliance’s Stock Down?

Western Alliance Bancorporation is a “regional bank”. In early 2023, regional banks all fell due to the collapse of First Republic Bank and Silicon Valley Bank.

Western Alliance Bank nearly doubled in price after touching $11 per share and triggering a circuit breaker to stop trading on May 2nd, 2023. The stock then jumped again after Western Alliance reported that they were seeing increases in deposits.

Will Western Alliance’s Stock Recover?

Western Alliance is on track to recover. The stock has jumped since it fell to a 52-week low of $7.46. It’s now teasing $50 as of Q4 2023. Based on historical precedence, there is reason to believe that if the company can continue “business as usual”, their stock price will shoot back up to its current intrinsic value of $120.

However, as Joel Greenblatt, writer of The Little Book that Beats the Market notes in his book on investing, the key to reaping the benefits of investing is to understand and believe in your analysis.

This is very important when investing in Western Alliance. The bank’s volatility is very high. Daily movements in 2023 have ranged from over 10% to the positive and 10% to the negative. It’s important to understand why we’re estimating a price target of $120. These significant price movements up or down will cause investors to be spooked and sell their position in Western Alliance early.

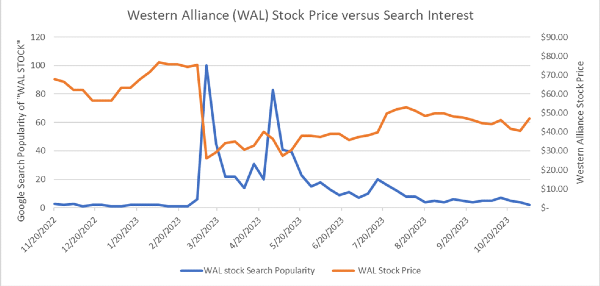

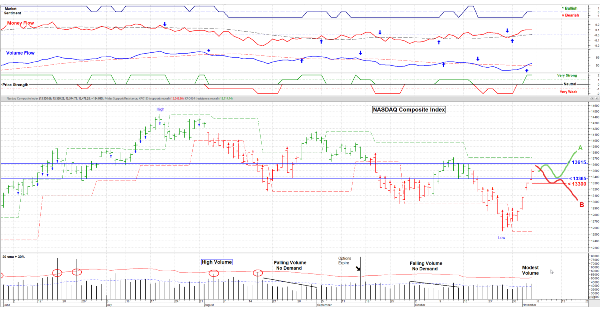

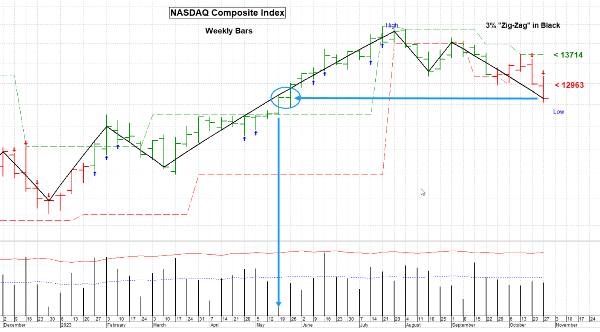

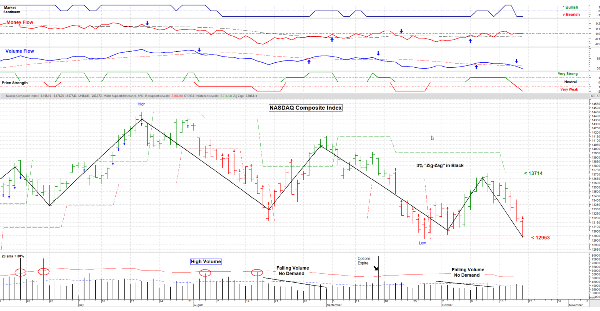

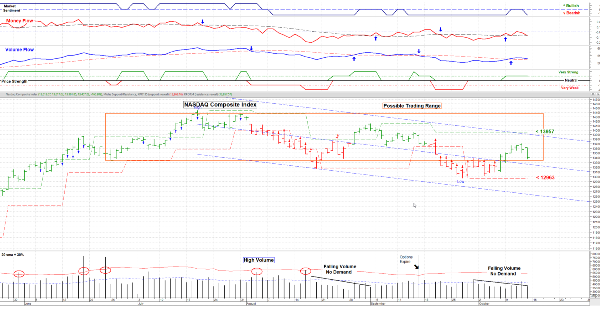

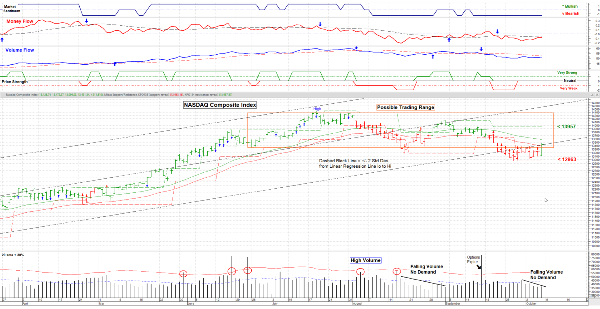

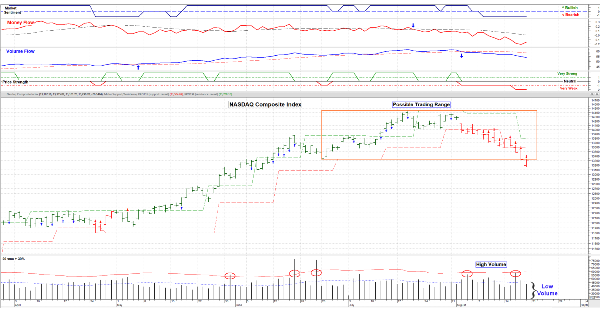

Long term, Western Alliance may continue to revert back to its intrinsic value of around $120 so long as it remains out of the news. In the chart above, the bank’s stock plummeted each time they made headlines, which caused a spike in search results. So long as Western Alliance stays out of the news, the bank should comfortably recover in the next two years.

Why is Western Alliance a Good Buy?

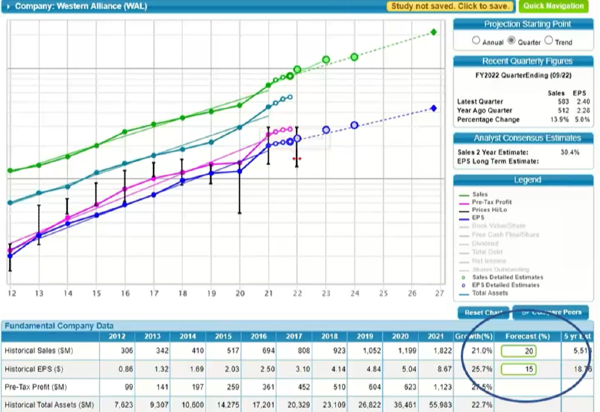

Prior to the regional bank crisis, Western Alliance maintained solid fundamentals. The bank’s fundamentals were solid when analyzed with a stock selection guide (SSG).

Western Alliance showed a classical up, straight, and parallel SSG. This means that revenue was growing, earnings was growing in line with revenue, and this growth was very straight. One note: on an SSG, a straight line is a simplified way of showing logarithmic growth.

Western Alliance SSG in February 2023

Revenue growth was at 21% and earnings growth was at 25%. The bank was doing quite well prior to the crisis. The crisis itself was tech related. As investments dried up for startups, banks associated with tech startups got affected by a run on the bank.

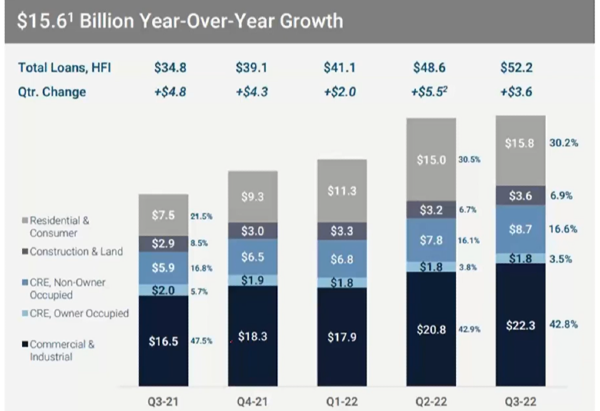

Western Alliance didn’t have significant exposure to technology companies. They provide loans to construction projects, industrial projects, and residential projects. Their customers and their depositors weren’t concentrated in technology companies.

Western Alliance did not have significant exposure to the tech sector

Finally, Western Alliance has a superb return on average assets. Their return of 1.86% is a positive outlier in the banking industry.

Altogether, the bank was a great buy before the regional bank crisis, and once the smoke faded, WAL continued to be a great opportunity.

Stock Forecast for WAL

Western Alliance is a great opportunity for long-term investors for the next few years. We estimate that Western Alliance has a great intrinsic value, and the bank has proven that they can continue growing this value quarter over quarter.

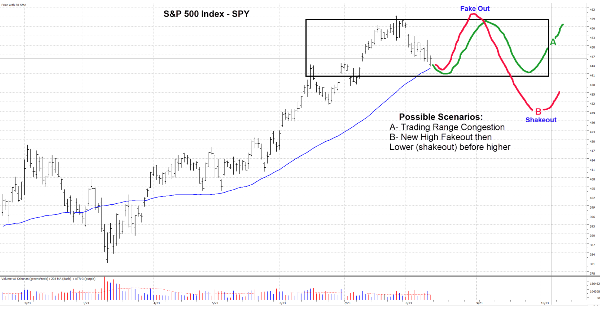

The negative is that the market is very skittish when it comes to Western Alliance Bank. The stock will easily fall 50% below intrinsic value during a crisis. This happened during the Covid-19 pandemic and again during the regional bank crisis.

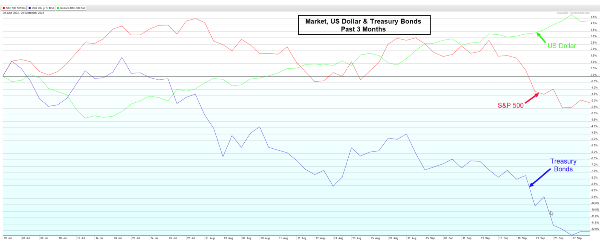

Investors interested in holding Western Alliance Bank must contend with a five-year beta of 1.41. The stock will collapse if the market gets fearful. This means you may have to hold a loss for years before the bank recovers as the bank is not insulated from shocks to the overall market.

However, when its quiet and the economy is acting normally, investors will reward Western Alliance’s growth. The market will revert the stock price of WAL back to its intrinsic value so long as there is no turbulence in the financial sector or the economy.

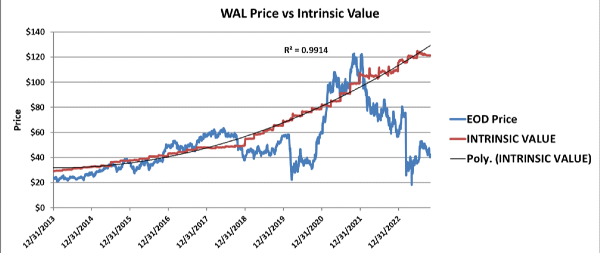

Western Alliance price versus intrinsic value

Western Alliance has proven they have a disciplined approach to investing. Their estimated intrinsic value has a near perfect polynomial growth trajectory with an unprecedented 0.9914 correlation coefficient.

What’s fascinating are the dips away from its intrinsic value. The first big dip was Covid-19, while the second big dip was the regional bank crisis. The gap between intrinsic value and price is unprecedented.

Now, while WAL intrinsic value halted its growth slightly in 2023, the company is maintaining its core business fundamentals. It’s possible that it will be back to business as usual by mid-2024.

2025 Price Forecast for WAL

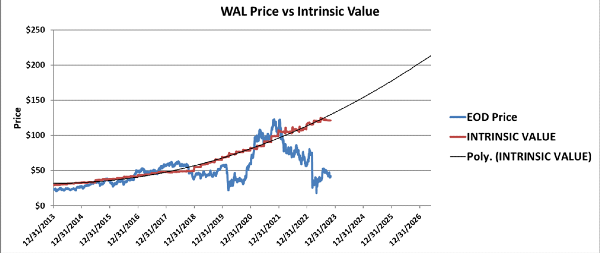

Western Alliance Intrinsic Value extrapolated thru 2026

We are setting a price target of $175 for Western Alliance Bank in 2025. The company has proven for the last decade that they have a disciplined approach to investing. The bank stays focused on building regional relationships and acquiring businesses that complement its core business while improving profitability. Some examples include the banks acquisition of AmeriHome to complement its B2B mortgage business and Digital Disbursements to expand their presence in legal banking services.

Again, it must be warned that Western Alliance is susceptible to significant market volatility. Any financial or economic crisis may propel WAL stock down to the $90 range during this period.

2028 Price Forecast for WAL

Western Alliance Bank has a proven track record to continue its growth and hit a price of $250 by 2028. This would be an astonishing accomplishment and would value the company at a market capitalization of $25 Billion.

During this period, expect more acquisitions and potential mergers as the regional bank continues to extend its presence across the country. Keep an eye on revenue growth in the coming years. Western Alliance will need to continue to grow into different regions to maintain earnings growth and its own survivability. However, this growth has been proven possible by the company as they have grown the intrinsic value of the bank 100% between 2018 and 2022, regardless of what was happening in the economy.

Final Thoughts on Buying Western Alliance Bank (WAL)

Western Alliance may be poised for a big jump in the coming years. The bank has already proven to be resilient. However, conservative investors must be cautious as the bank’s stock price is very volatile with a beta of 1.41. The bank is a great long-term investment but be ready for a bumpy ride.

I/we have a position in an asset mentioned

https://youtu.be/_beeBWeCWaM

Is WAL a Buy?

Western Alliance Bank (WAL) is rated a BUY. The stock tumbled hard with the rest of the regional banks in early 2023, but since then the stock has started to rebound back to its natural intrinsic value. The bank has proven its resilience by:

As Western Alliance has dropped from the headlines, the company’s stock has begun to rebound. The stock received a bump after each earnings announcement by reporting “business as usual”. As we will see, if Western Alliance can continue “business as usual”, the bank may be a fantastic investment opportunity.

Western Alliance’s Stock Price Target

As of the time of writing, WAL sat at $48 per share. Our price target is an ambitious $121 per share. This is the current intrinsic value we estimate the bank is worth. This value comes from clearly stellar financial metrics.

The company’s book value per share has been maintained at $50.21 per share. The company didn’t see an erosion of cash and assets due to the shock that occurred in regional banks.

The same cannot be said for other banks. Silicon Bank took a big hit thanks to losses in the bond market. The bank was tied up in long-term bonds that were priced as a loss in the market. When money in the venture capital sector dried up, Silicon Valley Bank didn’t have the liquid capital to pay out the withdrawals.

First Republic saw an outflow of $100 Billion in uninsured deposits.

Western Alliance bank also maintained a strong earnings per share of $7.88 diluted EPS (TTM). Though lower than their 2022 earnings, the bank has shown resilience. Signs point towards stronger earnings into 2024 as deposit growth stabilizes and the bank continues their business of carefully giving loans to a diversified set of clients.

Impressively, the company’s tangible book value continues to grow this year. The company showcased their exceptional performance versus their peers:

Source: WAL investor relations

Why is Western Alliance’s Stock Down?

Western Alliance Bancorporation is a “regional bank”. In early 2023, regional banks all fell due to the collapse of First Republic Bank and Silicon Valley Bank.

Western Alliance Bank nearly doubled in price after touching $11 per share and triggering a circuit breaker to stop trading on May 2nd, 2023. The stock then jumped again after Western Alliance reported that they were seeing increases in deposits.

Will Western Alliance’s Stock Recover?

Western Alliance is on track to recover. The stock has jumped since it fell to a 52-week low of $7.46. It’s now teasing $50 as of Q4 2023. Based on historical precedence, there is reason to believe that if the company can continue “business as usual”, their stock price will shoot back up to its current intrinsic value of $120.

However, as Joel Greenblatt, writer of The Little Book that Beats the Market notes in his book on investing, the key to reaping the benefits of investing is to understand and believe in your analysis.

This is very important when investing in Western Alliance. The bank’s volatility is very high. Daily movements in 2023 have ranged from over 10% to the positive and 10% to the negative. It’s important to understand why we’re estimating a price target of $120. These significant price movements up or down will cause investors to be spooked and sell their position in Western Alliance early.

Long term, Western Alliance may continue to revert back to its intrinsic value of around $120 so long as it remains out of the news. In the chart above, the bank’s stock plummeted each time they made headlines, which caused a spike in search results. So long as Western Alliance stays out of the news, the bank should comfortably recover in the next two years.

Why is Western Alliance a Good Buy?

Prior to the regional bank crisis, Western Alliance maintained solid fundamentals. The bank’s fundamentals were solid when analyzed with a stock selection guide (SSG).

Western Alliance showed a classical up, straight, and parallel SSG. This means that revenue was growing, earnings was growing in line with revenue, and this growth was very straight. One note: on an SSG, a straight line is a simplified way of showing logarithmic growth.

Western Alliance SSG in February 2023

Revenue growth was at 21% and earnings growth was at 25%. The bank was doing quite well prior to the crisis. The crisis itself was tech related. As investments dried up for startups, banks associated with tech startups got affected by a run on the bank. Western Alliance didn’t have significant exposure to technology companies. They provide loans to construction projects, industrial projects, and residential projects. Their customers and their depositors weren’t concentrated in technology companies.

Western Alliance did not have significant exposure to the tech sector

Finally, Western Alliance has a superb return on average assets. Their return of 1.86% is a positive outlier in the banking industry. Altogether, the bank was a great buy before the regional bank crisis, and once the smoke faded, WAL continued to be a great opportunity.

Stock Forecast for WAL

Western Alliance is a great opportunity for long-term investors for the next few years. We estimate that Western Alliance has a great intrinsic value, and the bank has proven that they can continue growing this value quarter over quarter.

The negative is that the market is very skittish when it comes to Western Alliance Bank. The stock will easily fall 50% below intrinsic value during a crisis. This happened during the Covid-19 pandemic and again during the regional bank crisis.

Investors interested in holding Western Alliance Bank must contend with a five-year beta of 1.41. The stock will collapse if the market gets fearful. This means you may have to hold a loss for years before the bank recovers as the bank is not insulated from shocks to the overall market.

However, when its quiet and the economy is acting normally, investors will reward Western Alliance’s growth. The market will revert the stock price of WAL back to its intrinsic value so long as there is no turbulence in the financial sector or the economy.

Western Alliance price versus intrinsic value

Western Alliance has proven they have a disciplined approach to investing. Their estimated intrinsic value has a near perfect polynomial growth trajectory with an unprecedented 0.9914 correlation coefficient.

What’s fascinating are the dips away from its intrinsic value. The first big dip was Covid-19, while the second big dip was the regional bank crisis. The gap between intrinsic value and price is unprecedented.

Now, while WAL intrinsic value halted its growth slightly in 2023, the company is maintaining its core business fundamentals. It’s possible that it will be back to business as usual by mid-2024.

2025 Price Forecast for WAL

Western Alliance Intrinsic Value extrapolated thru 2026

We are setting a price target of $175 for Western Alliance Bank in 2025. The company has proven for the last decade that they have a disciplined approach to investing. The bank stays focused on building regional relationships and acquiring businesses that complement its core business while improving profitability. Some examples include the banks acquisition of AmeriHome to complement its B2B mortgage business and Digital Disbursements to expand their presence in legal banking services.

Again, it must be warned that Western Alliance is susceptible to significant market volatility. Any financial or economic crisis may propel WAL stock down to the $90 range during this period.

2028 Price Forecast for WAL

Western Alliance Bank has a proven track record to continue its growth and hit a price of $250 by 2028. This would be an astonishing accomplishment and would value the company at a market capitalization of $25 Billion.

During this period, expect more acquisitions and potential mergers as the regional bank continues to extend its presence across the country. Keep an eye on revenue growth in the coming years. Western Alliance will need to continue to grow into different regions to maintain earnings growth and its own survivability. However, this growth has been proven possible by the company as they have grown the intrinsic value of the bank 100% between 2018 and 2022, regardless of what was happening in the economy.

Final Thoughts on Buying Western Alliance Bank (WAL)

Western Alliance may be poised for a big jump in the coming years. The bank has already proven to be resilient. However, conservative investors must be cautious as the bank’s stock price is very volatile with a beta of 1.41. The bank is a great long-term investment but be ready for a bumpy ride.

I/we have a position in an asset mentioned

https://youtu.be/_beeBWeCWaM