Introduction

Costco Wholesale Corporation (NASDAQ: COST) has recently experienced a notable decline in its stock price, dropping over 8% in the last five days. This downturn comes amid market uncertainty and tariff concerns, leading to Costco underperforming compared to the broader S&P 500. With Costco trading at $951.9 per share, investors are questioning whether this dip presents a buying opportunity.

Costco's Key Financial Metrics

A deeper dive into Costco's financials reveals crucial insights:

- Market Cap: $430 billion

- PE Ratio: 55 (Above market average)

- Earnings Per Share (EPS): $7.13

- Beta: 0.82 (Indicating lower volatility)

- Dividend Yield: 0.4% ($4.59 per share)

- Free Cash Flow Payout Ratio: 40%

Despite recent volatility, analysts continue to recommend Costco as a buy, setting a target price of $1,062—a price Costco previously reached just weeks ago.

Revenue and Profitability Trends

Costco’s trailing twelve-month revenue stands at $258 billion, marking consistent year-over-year growth. Despite external economic pressures, Costco has demonstrated robust profitability, achieving $7.58 billion in net income with a 15% compound annual growth rate (CAGR).

However, free cash flow has dipped to $5 billion, largely due to increased capital expenditures, a trend reflected in the company’s operating cash flow. Costco has also maintained flat outstanding shares since 2013, opting against stock buybacks or additional issuances.

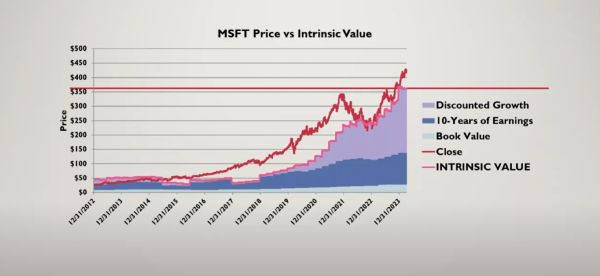

Stock Valuation: Discounted Cash Flow Model

Using a discounted free cash flow (DCF) model, Costco’s intrinsic value is calculated at $366 per share, significantly lower than the current stock price. The dividend discount model similarly suggests that Costco may be overvalued, given its relatively low dividend yield and a high bond yield environment.

Comparable Company Analysis

Comparing Costco with competitors like Walmart (NYSE: WMT), Target (NYSE: TGT), and BJ’s Wholesale (NYSE: BJ) offers further perspective:

| Company |

Revenue |

Net Income |

PE Ratio |

Revenue Growth Rate |

| Costco |

$258B |

$7.58B |

55 |

Highest Among Peers |

| Walmart |

$620B |

$23B |

30 |

Moderate |

| Target |

$107B |

$3.3B |

25 |

Lower than Costco |

| BJ’s |

$22B |

$0.9B |

22 |

Lower than Costco |

Costco maintains the highest revenue growth rate among its peers, justifying its premium valuation. However, its price-to-earnings-growth (PEG) ratio of 5 suggests it may be expensive compared to historic norms.

Conclusion: Should You Buy Costco Stock?

Historically, Costco has outperformed the S&P 500, gaining over 200% in the past five years. Even with the current pullback, its long-term growth trajectory remains strong.

However, given the high valuation, investors may want to wait for a more attractive entry point before adding Costco to their portfolios. For long-term investors, Costco’s revenue growth, profitability, and stability make it a strong contender for sustained performance.

What do you think? Is Costco a buy at current levels, or should investors wait for further discounts? Let’s discuss!

https://youtu.be/O20qGawpDFw?si=eDHwZInwH4ksSYOX

Introduction

Costco Wholesale Corporation (NASDAQ: COST) has recently experienced a notable decline in its stock price, dropping over 8% in the last five days. This downturn comes amid market uncertainty and tariff concerns, leading to Costco underperforming compared to the broader S&P 500. With Costco trading at $951.9 per share, investors are questioning whether this dip presents a buying opportunity.

Costco's Key Financial Metrics

A deeper dive into Costco's financials reveals crucial insights:

Despite recent volatility, analysts continue to recommend Costco as a buy, setting a target price of $1,062—a price Costco previously reached just weeks ago.

Revenue and Profitability Trends

Costco’s trailing twelve-month revenue stands at $258 billion, marking consistent year-over-year growth. Despite external economic pressures, Costco has demonstrated robust profitability, achieving $7.58 billion in net income with a 15% compound annual growth rate (CAGR).

However, free cash flow has dipped to $5 billion, largely due to increased capital expenditures, a trend reflected in the company’s operating cash flow. Costco has also maintained flat outstanding shares since 2013, opting against stock buybacks or additional issuances.

Stock Valuation: Discounted Cash Flow Model

Using a discounted free cash flow (DCF) model, Costco’s intrinsic value is calculated at $366 per share, significantly lower than the current stock price. The dividend discount model similarly suggests that Costco may be overvalued, given its relatively low dividend yield and a high bond yield environment.

Comparable Company Analysis

Comparing Costco with competitors like Walmart (NYSE: WMT), Target (NYSE: TGT), and BJ’s Wholesale (NYSE: BJ) offers further perspective:

Costco maintains the highest revenue growth rate among its peers, justifying its premium valuation. However, its price-to-earnings-growth (PEG) ratio of 5 suggests it may be expensive compared to historic norms.

Conclusion: Should You Buy Costco Stock?

Historically, Costco has outperformed the S&P 500, gaining over 200% in the past five years. Even with the current pullback, its long-term growth trajectory remains strong.

However, given the high valuation, investors may want to wait for a more attractive entry point before adding Costco to their portfolios. For long-term investors, Costco’s revenue growth, profitability, and stability make it a strong contender for sustained performance.

What do you think? Is Costco a buy at current levels, or should investors wait for further discounts? Let’s discuss!

https://youtu.be/O20qGawpDFw?si=eDHwZInwH4ksSYOX