Key Takeaways

| Company |

Ticker |

Market Capitalization |

Industry Position |

| Weyerhaeuser Company |

NYSE: WY |

$18.55B Market Cap |

Largest private timberland owner, REIT structure |

| West Fraser Timber Co. Ltd. |

NYSE: WFG |

$5.89B Market Cap |

Diversified wood products, cross-border operations |

| Rayonier Inc. |

NYSE: RYN |

$3.89B Market Cap |

Timberland REIT, sustainable forestry management |

| Boise Cascade Company |

NYSE: BCC |

$3.63B Market Cap |

Engineered wood products, strong distribution network |

| PotlatchDeltic Corporation |

NASDAQ: PCH |

$3.02B Market Cap |

Timberland REIT, integrated real estate and manufacturing |

The U.S. lumber industry plays a crucial role in construction, housing, and infrastructure, making publicly traded lumber companies key players in the market. As demand for sustainable building materials and residential developments rises, these companies drive innovation and shape industry trends. Understanding their financial performance, market influence, and sustainability initiatives can help investors navigate opportunities in this essential sector.

2. Market Overview of the Lumber Industry

The U.S. lumber industry remains a critical component of the economy, with annual softwood production reaching approximately 292.1 million cubic meters. The country is also the largest consumer of industrial wood, accounting for nearly 20% of global consumption. This demand is driven by housing construction, infrastructure projects, and the growing preference for sustainable building materials.

Several key trends are shaping the lumber market, including the rising adoption of engineered wood products and smart forestry technologies. Sustainability initiatives, such as FSC and PEFC certifications, are influencing consumer preferences and corporate strategies. Additionally, automation in sawmills is improving efficiency, with nearly 50% of global sawmills now utilizing advanced processing technologies.

3. Criteria for Ranking the Largest Publicly Traded Lumber Companies

Market capitalization and financial strength are key indicators of a lumber company's stability and growth potential. Leading publicly traded firms like Weyerhaeuser and Rayonier maintain multi-billion-dollar valuations, reflecting investor confidence and industry dominance. Strong financial performance, including consistent revenue growth and profitability, ensures these companies can weather economic fluctuations and capitalize on emerging market opportunities.

Annual revenue and timber output further define a company's industry standing, with top firms generating billions in sales while managing extensive timberland assets. Companies like PotlatchDeltic and Boise Cascade leverage their large-scale operations to supply construction and manufacturing sectors. High timber output not only supports revenue streams but also positions these firms as essential suppliers in the global wood products market.

Geographic presence and sustainability initiatives play a crucial role in ranking lumber companies. Firms with diversified operations across North America benefit from regional demand variations and supply chain efficiencies. Additionally, ESG commitments, such as FSC-certified forestry practices and carbon reduction strategies, enhance corporate reputation and investor appeal. Companies prioritizing sustainability are better positioned to meet regulatory requirements and shifting consumer preferences.

4. Top Publicly Traded Lumber Companies in the U.S.

Several publicly traded lumber companies dominate the U.S. market, offering investors exposure to the construction and forestry sectors. Industry leaders like Weyerhaeuser (NYSE: WY), Boise Cascade (NYSE: BCC), and Rayonier (NYSE: RYN) maintain strong financial positions and extensive timberland assets. With increasing demand for sustainable building materials and infrastructure growth, these companies continue to shape the future of the lumber industry.

Weyerhaeuser Company (NYSE: WY)

Weyerhaeuser Company (NYSE: WY) is one of the largest private owners of timberlands in the U.S., managing approximately 11 million acres. As a real estate investment trust (REIT), the company focuses on sustainable forestry and wood products manufacturing. With a market capitalization of around $18.89 billion and annual revenue exceeding $7.09 billion, Weyerhaeuser remains a dominant force in the lumber industry.

The company operates across two primary segments: timberlands and wood products. Its timberland division oversees sustainable forest management, ensuring long-term resource availability. Meanwhile, its wood products segment supplies essential materials for construction, including lumber, plywood, and engineered wood, catering to residential and commercial markets.

Weyerhaeuser prioritizes sustainability through responsible forestry practices and ESG commitments. The company adheres to internationally recognized standards, such as FSC certification, to promote environmental stewardship. Investors view Weyerhaeuser as a stable long-term asset, benefiting from housing market growth and increasing demand for sustainable building materials Market Cap Analysis.

Rayonier Inc. (NYSE: RYN)

Rayonier Inc. (NYSE: RYN) operates as a timberland real estate investment trust (REIT), focusing on sustainable forest management and land optimization. The company generates revenue through timber sales, land leasing, and real estate development, ensuring long-term value creation for investors. As one of the largest timber REITs, Rayonier strategically manages its assets to balance environmental stewardship with profitability.

With approximately 2.5 million acres of timberland across the U.S. and New Zealand, Rayonier benefits from geographic diversification and access to high-demand markets. Its forest asset management strategy prioritizes sustainable harvesting practices, ensuring consistent timber supply while maintaining ecological integrity. The company’s presence in key softwood-growing regions strengthens its competitive position in the global lumber industry.

Rayonier’s recent financial performance reflects both market challenges and strategic adjustments. In Q1 2025, the company reported revenues of $82.9 million, with a net loss of $3.4 million due to restructuring and discontinued operations in New Zealand. Despite short-term setbacks, Rayonier maintains a strong long-term outlook, with projected full-year net income ranging from $424 to $458 million. Investors continue to monitor its shareholder returns, particularly as the company refines its portfolio and expands sustainable forestry initiatives.

Read More: Rayonier Investor Relations

Rayonier Q1 2025 Financial Report

Boise Cascade Company (NYSE: BCC)

Boise Cascade Company (NYSE: BCC) is a leading manufacturer of engineered wood products, supplying high-performance materials for residential and commercial construction. The company specializes in laminated veneer lumber (LVL), I-joists, and glulam beams, offering durable and sustainable alternatives to traditional lumber. With over 60 years of industry experience, Boise Cascade continues to innovate, providing builders with reliable solutions that enhance structural integrity and efficiency.

Boise Cascade operates an extensive network of manufacturing facilities and distribution centers across North America. Its strategically located plants ensure consistent production of engineered wood products, while its wholesale distribution business supplies a broad mix of building materials, including metal, cement, and decking. The company’s ability to integrate manufacturing with distribution allows it to serve dealers, home improvement centers, and industrial customers efficiently.

A key competitive advantage for Boise Cascade lies in its streamlined supply chain operations. The company leverages advanced software tools to optimize design, estimating, and material take-offs, improving project efficiency for builders. Additionally, its nationwide distribution network ensures timely delivery, reducing delays and enhancing customer satisfaction. By combining strong product innovation with logistical expertise, Boise Cascade maintains a dominant position in the engineered wood market.

PotlatchDeltic Corporation (NASDAQ: PCH)

PotlatchDeltic Corporation (NASDAQ: PCH) is a leading timberland REIT, owning approximately 2.1 million acres across the U.S. The company generates revenue through sustainable timber harvesting, land sales, and real estate development. Its diversified revenue streams ensure long-term stability, making it a key player in the forestry and wood products industry.

PotlatchDeltic integrates timberland management with manufacturing operations, operating seven facilities that produce lumber and plywood. This vertical integration allows the company to optimize resource utilization while maintaining efficiency in production and distribution. Additionally, its real estate division unlocks value by repurposing land for commercial and residential development.

The company’s growth strategy focuses on expanding its timber base and enhancing operational efficiency. Recent investments in sawmill modernization, such as the Waldo, Arkansas facility upgrade, have improved production capacity and competitiveness. With a strong balance sheet and disciplined capital allocation, PotlatchDeltic remains well-positioned for long-term shareholder returns.

Read More: PotlatchDeltic Corporation Investor Relations

PotlatchDeltic Merger Announcement

West Fraser Timber Co. Ltd. (NYSE: WFG)

West Fraser Timber Co. Ltd. (NYSE: WFG) operates as a leading diversified wood products company with a strong cross-border presence in the U.S. and Canada. The company manages a vast network of sawmills, plywood plants, and engineered wood facilities, ensuring a steady supply of lumber and panel products to North American markets. Its strategic positioning allows it to mitigate trade uncertainties while capitalizing on regional demand fluctuations.

Specializing in a wide range of wood products, West Fraser produces softwood lumber, oriented strand board (OSB), plywood, and laminated veneer lumber (LVL). The company continues to expand its engineered wood segment, leveraging advanced manufacturing techniques to enhance product durability and efficiency. Recent investments in mill modernization and automation have strengthened its competitive edge, improving production capacity and cost efficiency.

Financially, West Fraser maintains a stable outlook despite market fluctuations. In Q4 2024, the company reported sales of $1.405 billion, with an adjusted EBITDA of $140 million, reflecting resilience in its engineered wood segment. While challenges such as high mortgage rates and potential U.S. tariffs on Canadian exports pose risks, West Fraser remains focused on optimizing its mill portfolio and returning capital to shareholders. Its long-term strategy prioritizes cost efficiency, modernization, and sustainable growth.

Read More: West Fraser Q4 2024 Financial Report

Industry Challenges and Opportunities in the Lumber Sector

Impact of Fluctuating Lumber Prices and Market Volatility

Lumber prices have experienced extreme volatility in recent years, driven by factors such as supply chain disruptions, inflation, and shifting trade policies. Natural disasters, including wildfires and pest infestations, have further impacted timber supply, leading to unpredictable price swings. Businesses that adapt to these fluctuations through strategic planning and diversified sourcing are better positioned to maintain profitability.

Competition from International Suppliers

The U.S. lumber industry faces stiff competition from international suppliers, particularly Canadian producers who benefit from lower production costs and favorable exchange rates. Trade disputes and tariffs have historically influenced pricing, with recent increases in anti-dumping duties on Canadian lumber adding further complexity. Despite these challenges, domestic companies are investing in efficiency improvements to remain competitive.

Rising Interest in Sustainable Forestry Investments

Sustainability has become a key focus in the lumber industry, with investors increasingly prioritizing companies that adhere to responsible forestry practices. Certifications such as FSC and PEFC help companies demonstrate their commitment to environmental stewardship. As demand for eco-friendly building materials grows, firms that integrate sustainability into their operations are likely to see long-term benefits.

Innovations in Engineered Wood and Alternative Materials

Advancements in engineered wood products, such as cross-laminated timber (CLT) and laminated veneer lumber (LVL), are reshaping the construction industry. These materials offer enhanced durability and sustainability, making them attractive alternatives to traditional lumber. Companies investing in research and development for innovative wood products are well-positioned for future growth.

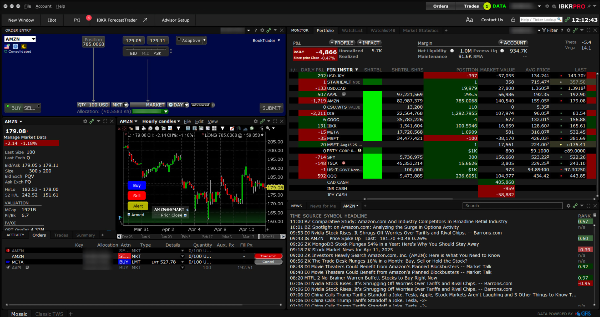

Investment Considerations for Lumber Stocks

How to Evaluate Publicly Traded Lumber Companies

Investors assessing lumber stocks should consider key financial metrics such as market capitalization, revenue growth, and timberland assets. Companies with diversified revenue streams, including timber harvesting, real estate development, and engineered wood production, tend to offer greater stability. Additionally, ESG commitments and sustainability initiatives can enhance long-term investment appeal.

Risks and Rewards of Investing in Timber Stocks

While timber stocks provide exposure to essential industries like construction and infrastructure, they are subject to cyclical market fluctuations. Factors such as housing demand, interest rates, and trade policies can significantly impact stock performance. However, companies with strong balance sheets and efficient operations can mitigate risks and deliver consistent returns.

Potential for Long-Term Gains Amid Housing and Infrastructure Growth

The ongoing expansion of residential and commercial construction, coupled with government infrastructure investments, supports long-term demand for lumber. As urbanization and sustainability trends drive the adoption of engineered wood products, leading lumber companies stand to benefit. Investors seeking stable, asset-backed investments may find timber stocks an attractive option for portfolio diversification.

7. Conclusion

The largest publicly traded lumber companies in the U.S. play a crucial role in construction, sustainability, and investment opportunities. Understanding market dynamics, financial metrics, and industry challenges helps investors make informed decisions about timber stocks. As housing demand and infrastructure growth continue, companies prioritizing efficiency and responsible forestry practices are well-positioned for long-term success.

The U.S. lumber industry plays a crucial role in construction, housing, and infrastructure, making publicly traded lumber companies key players in the market. As demand for sustainable building materials and residential developments rises, these companies drive innovation and shape industry trends. Understanding their financial performance, market influence, and sustainability initiatives can help investors navigate opportunities in this essential sector.

2. Market Overview of the Lumber Industry

The U.S. lumber industry remains a critical component of the economy, with annual softwood production reaching approximately 292.1 million cubic meters. The country is also the largest consumer of industrial wood, accounting for nearly 20% of global consumption. This demand is driven by housing construction, infrastructure projects, and the growing preference for sustainable building materials.

Several key trends are shaping the lumber market, including the rising adoption of engineered wood products and smart forestry technologies. Sustainability initiatives, such as FSC and PEFC certifications, are influencing consumer preferences and corporate strategies. Additionally, automation in sawmills is improving efficiency, with nearly 50% of global sawmills now utilizing advanced processing technologies.

3. Criteria for Ranking the Largest Publicly Traded Lumber Companies

Market capitalization and financial strength are key indicators of a lumber company's stability and growth potential. Leading publicly traded firms like Weyerhaeuser and Rayonier maintain multi-billion-dollar valuations, reflecting investor confidence and industry dominance. Strong financial performance, including consistent revenue growth and profitability, ensures these companies can weather economic fluctuations and capitalize on emerging market opportunities.

Annual revenue and timber output further define a company's industry standing, with top firms generating billions in sales while managing extensive timberland assets. Companies like PotlatchDeltic and Boise Cascade leverage their large-scale operations to supply construction and manufacturing sectors. High timber output not only supports revenue streams but also positions these firms as essential suppliers in the global wood products market.

Geographic presence and sustainability initiatives play a crucial role in ranking lumber companies. Firms with diversified operations across North America benefit from regional demand variations and supply chain efficiencies. Additionally, ESG commitments, such as FSC-certified forestry practices and carbon reduction strategies, enhance corporate reputation and investor appeal. Companies prioritizing sustainability are better positioned to meet regulatory requirements and shifting consumer preferences.

4. Top Publicly Traded Lumber Companies in the U.S.

Several publicly traded lumber companies dominate the U.S. market, offering investors exposure to the construction and forestry sectors. Industry leaders like Weyerhaeuser (NYSE: WY), Boise Cascade (NYSE: BCC), and Rayonier (NYSE: RYN) maintain strong financial positions and extensive timberland assets. With increasing demand for sustainable building materials and infrastructure growth, these companies continue to shape the future of the lumber industry.

Weyerhaeuser Company (NYSE: WY)

Weyerhaeuser Company (NYSE: WY) is one of the largest private owners of timberlands in the U.S., managing approximately 11 million acres. As a real estate investment trust (REIT), the company focuses on sustainable forestry and wood products manufacturing. With a market capitalization of around $18.89 billion and annual revenue exceeding $7.09 billion, Weyerhaeuser remains a dominant force in the lumber industry.

The company operates across two primary segments: timberlands and wood products. Its timberland division oversees sustainable forest management, ensuring long-term resource availability. Meanwhile, its wood products segment supplies essential materials for construction, including lumber, plywood, and engineered wood, catering to residential and commercial markets.

Weyerhaeuser prioritizes sustainability through responsible forestry practices and ESG commitments. The company adheres to internationally recognized standards, such as FSC certification, to promote environmental stewardship. Investors view Weyerhaeuser as a stable long-term asset, benefiting from housing market growth and increasing demand for sustainable building materials Market Cap Analysis.

Rayonier Inc. (NYSE: RYN)

Rayonier Inc. (NYSE: RYN) operates as a timberland real estate investment trust (REIT), focusing on sustainable forest management and land optimization. The company generates revenue through timber sales, land leasing, and real estate development, ensuring long-term value creation for investors. As one of the largest timber REITs, Rayonier strategically manages its assets to balance environmental stewardship with profitability.

With approximately 2.5 million acres of timberland across the U.S. and New Zealand, Rayonier benefits from geographic diversification and access to high-demand markets. Its forest asset management strategy prioritizes sustainable harvesting practices, ensuring consistent timber supply while maintaining ecological integrity. The company’s presence in key softwood-growing regions strengthens its competitive position in the global lumber industry.

Rayonier’s recent financial performance reflects both market challenges and strategic adjustments. In Q1 2025, the company reported revenues of $82.9 million, with a net loss of $3.4 million due to restructuring and discontinued operations in New Zealand. Despite short-term setbacks, Rayonier maintains a strong long-term outlook, with projected full-year net income ranging from $424 to $458 million. Investors continue to monitor its shareholder returns, particularly as the company refines its portfolio and expands sustainable forestry initiatives.

Boise Cascade Company (NYSE: BCC)

Boise Cascade Company (NYSE: BCC) is a leading manufacturer of engineered wood products, supplying high-performance materials for residential and commercial construction. The company specializes in laminated veneer lumber (LVL), I-joists, and glulam beams, offering durable and sustainable alternatives to traditional lumber. With over 60 years of industry experience, Boise Cascade continues to innovate, providing builders with reliable solutions that enhance structural integrity and efficiency.

Boise Cascade operates an extensive network of manufacturing facilities and distribution centers across North America. Its strategically located plants ensure consistent production of engineered wood products, while its wholesale distribution business supplies a broad mix of building materials, including metal, cement, and decking. The company’s ability to integrate manufacturing with distribution allows it to serve dealers, home improvement centers, and industrial customers efficiently.

A key competitive advantage for Boise Cascade lies in its streamlined supply chain operations. The company leverages advanced software tools to optimize design, estimating, and material take-offs, improving project efficiency for builders. Additionally, its nationwide distribution network ensures timely delivery, reducing delays and enhancing customer satisfaction. By combining strong product innovation with logistical expertise, Boise Cascade maintains a dominant position in the engineered wood market.

PotlatchDeltic Corporation (NASDAQ: PCH)

PotlatchDeltic Corporation (NASDAQ: PCH) is a leading timberland REIT, owning approximately 2.1 million acres across the U.S. The company generates revenue through sustainable timber harvesting, land sales, and real estate development. Its diversified revenue streams ensure long-term stability, making it a key player in the forestry and wood products industry.

PotlatchDeltic integrates timberland management with manufacturing operations, operating seven facilities that produce lumber and plywood. This vertical integration allows the company to optimize resource utilization while maintaining efficiency in production and distribution. Additionally, its real estate division unlocks value by repurposing land for commercial and residential development.

The company’s growth strategy focuses on expanding its timber base and enhancing operational efficiency. Recent investments in sawmill modernization, such as the Waldo, Arkansas facility upgrade, have improved production capacity and competitiveness. With a strong balance sheet and disciplined capital allocation, PotlatchDeltic remains well-positioned for long-term shareholder returns.

West Fraser Timber Co. Ltd. (NYSE: WFG)

West Fraser Timber Co. Ltd. (NYSE: WFG) operates as a leading diversified wood products company with a strong cross-border presence in the U.S. and Canada. The company manages a vast network of sawmills, plywood plants, and engineered wood facilities, ensuring a steady supply of lumber and panel products to North American markets. Its strategic positioning allows it to mitigate trade uncertainties while capitalizing on regional demand fluctuations.

Specializing in a wide range of wood products, West Fraser produces softwood lumber, oriented strand board (OSB), plywood, and laminated veneer lumber (LVL). The company continues to expand its engineered wood segment, leveraging advanced manufacturing techniques to enhance product durability and efficiency. Recent investments in mill modernization and automation have strengthened its competitive edge, improving production capacity and cost efficiency.

Financially, West Fraser maintains a stable outlook despite market fluctuations. In Q4 2024, the company reported sales of $1.405 billion, with an adjusted EBITDA of $140 million, reflecting resilience in its engineered wood segment. While challenges such as high mortgage rates and potential U.S. tariffs on Canadian exports pose risks, West Fraser remains focused on optimizing its mill portfolio and returning capital to shareholders. Its long-term strategy prioritizes cost efficiency, modernization, and sustainable growth.

Industry Challenges and Opportunities in the Lumber Sector

Impact of Fluctuating Lumber Prices and Market Volatility

Lumber prices have experienced extreme volatility in recent years, driven by factors such as supply chain disruptions, inflation, and shifting trade policies. Natural disasters, including wildfires and pest infestations, have further impacted timber supply, leading to unpredictable price swings. Businesses that adapt to these fluctuations through strategic planning and diversified sourcing are better positioned to maintain profitability.

Competition from International Suppliers

The U.S. lumber industry faces stiff competition from international suppliers, particularly Canadian producers who benefit from lower production costs and favorable exchange rates. Trade disputes and tariffs have historically influenced pricing, with recent increases in anti-dumping duties on Canadian lumber adding further complexity. Despite these challenges, domestic companies are investing in efficiency improvements to remain competitive.

Rising Interest in Sustainable Forestry Investments

Sustainability has become a key focus in the lumber industry, with investors increasingly prioritizing companies that adhere to responsible forestry practices. Certifications such as FSC and PEFC help companies demonstrate their commitment to environmental stewardship. As demand for eco-friendly building materials grows, firms that integrate sustainability into their operations are likely to see long-term benefits.

Innovations in Engineered Wood and Alternative Materials

Advancements in engineered wood products, such as cross-laminated timber (CLT) and laminated veneer lumber (LVL), are reshaping the construction industry. These materials offer enhanced durability and sustainability, making them attractive alternatives to traditional lumber. Companies investing in research and development for innovative wood products are well-positioned for future growth.

Investment Considerations for Lumber Stocks

How to Evaluate Publicly Traded Lumber Companies

Investors assessing lumber stocks should consider key financial metrics such as market capitalization, revenue growth, and timberland assets. Companies with diversified revenue streams, including timber harvesting, real estate development, and engineered wood production, tend to offer greater stability. Additionally, ESG commitments and sustainability initiatives can enhance long-term investment appeal.

Risks and Rewards of Investing in Timber Stocks

While timber stocks provide exposure to essential industries like construction and infrastructure, they are subject to cyclical market fluctuations. Factors such as housing demand, interest rates, and trade policies can significantly impact stock performance. However, companies with strong balance sheets and efficient operations can mitigate risks and deliver consistent returns.

Potential for Long-Term Gains Amid Housing and Infrastructure Growth

The ongoing expansion of residential and commercial construction, coupled with government infrastructure investments, supports long-term demand for lumber. As urbanization and sustainability trends drive the adoption of engineered wood products, leading lumber companies stand to benefit. Investors seeking stable, asset-backed investments may find timber stocks an attractive option for portfolio diversification.

7. Conclusion

The largest publicly traded lumber companies in the U.S. play a crucial role in construction, sustainability, and investment opportunities. Understanding market dynamics, financial metrics, and industry challenges helps investors make informed decisions about timber stocks. As housing demand and infrastructure growth continue, companies prioritizing efficiency and responsible forestry practices are well-positioned for long-term success.