Key Takeaways

The top European Material Stocks are below. These companies can be purchased on U.S. stock exchanges.

| Company |

Symbol |

U.S. Exchange |

Description |

| ArcelorMittal |

MT |

NYSE |

Europe's largest steel manufacturer, supplying materials for construction, automotive, and industrial applications. |

| Rio Tinto |

RIO |

NYSE |

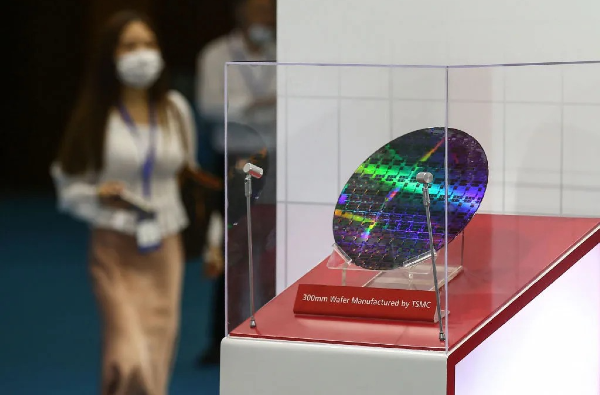

A global mining giant involved in aluminum, copper, iron ore, and other metals critical for industrial and tech sectors. |

| BASF SE |

BASFY |

OTC |

Leading chemical producer, specializing in industrial materials, agriculture solutions, and high-performance coatings. |

| Linde plc |

LIN |

NYSE |

A major supplier of industrial gases and engineered chemicals used across healthcare, manufacturing, and energy industries. |

| CRH plc |

CRH |

NYSE |

A top construction materials provider, producing cement, aggregates, and infrastructure solutions for global projects. |

| Holcim Ltd |

HCMLY |

OTC |

Swiss-based leader in sustainable construction materials, focusing on eco-friendly cement and innovative building solutions. |

| Umicore |

UMICY |

OTC |

Specializes in battery materials, recycling technology, and sustainable metal refining for clean energy applications. |

| Stora Enso |

SEOAY |

OTC |

A pioneer in sustainable timber and packaging, providing renewable materials for industrial and consumer markets. |

All right, 2025 is here, and the stock market is riding waves of uncertainty, bouncing between optimism and skepticism like a trader trying to time the next big move. But if there’s one sector quietly powering through volatility, it's Europe's material industry. Think of steel, chemicals, cement, and eco-friendly materials—pillars of infrastructure and manufacturing that aren't going anywhere, no matter how much the market mood swings. For U.S. investors, European material stocks offer exposure to global demand, industry-leading sustainability initiatives, and companies with decades of market resilience. The best part? You don’t need an offshore brokerage to get in on the action.

Investing in European material stocks is easier than ever with American Depositary Receipts (ADRs), select exchange-traded funds (ETFs), and direct listings on U.S. exchanges. Heavyweights like ArcelorMittal (MT), BASF SE (BASFY), and CRH plc (CRH) trade right alongside familiar U.S. giants, giving investors easy access to Europe's top industrial players. Whether you’re betting on growth, stability, or sustainability-driven innovation, these stocks bring a fresh angle to portfolio diversification. So, if you’re tired of watching the same old tickers, European materials might just be the hidden gems you’ve been looking for.

Understanding European Material Stocks

Europe’s material sector isn’t just about steel and concrete—it’s a powerhouse of industrial innovation, sustainability, and global infrastructure development. From the massive steel operations of ArcelorMittal (MT) to the cutting-edge chemical advancements of BASF SE (BASFY), these companies shape entire economies. The region’s construction materials industry, led by CRH plc (CRH) and Holcim Ltd (HCMLY), continues to dominate with eco-conscious solutions that address both regulatory pressure and investor demand. Whether it’s metals fueling tech and manufacturing, chemicals driving industrial processes, or construction materials laying the foundation for urban expansion, European firms remain essential players on the world stage.

Macroeconomic trends heavily influence European material stocks, making them dynamic investment opportunities. Currency fluctuations, geopolitical developments, and shifting trade policies can create waves across these sectors. Meanwhile, EU regulations and carbon-reduction initiatives push companies toward greener, more efficient production methods. As climate concerns grow, firms with strong ESG commitments are reaping the benefits of both government incentives and investor confidence. Companies like Umicore (UMICY) and Stora Enso (SEOAY) — leaders in sustainable battery materials and eco-friendly packaging—exemplify the shift toward responsible innovation.

How U.S. Investors Can Buy European Stocks

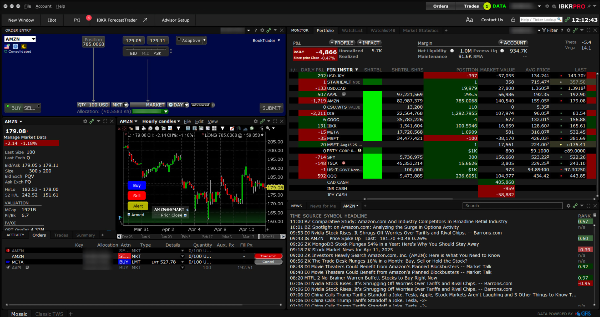

For U.S. investors, gaining exposure to European material stocks isn’t as complicated as it sounds. American Depositary Receipts (ADRs) allow direct investment in top European companies without navigating foreign exchanges. Major players such as Rio Tinto (RIO) and Linde plc (LIN) are readily available on U.S. markets, simplifying access to global industry leaders. Exchange-traded funds (ETFs) like the iShares MSCI Europe Materials ETF further streamline investment, bundling multiple European material stocks into one diversified asset.

Beyond ADRs and ETFs, direct brokerage accounts open another door to European investments. Many major platforms now offer international trading, allowing investors to purchase stocks straight from European exchanges. This method provides direct exposure to market movements without relying on secondary instruments. Whether through ADRs, sector-focused ETFs, or direct trading strategies, there’s no shortage of ways for U.S. investors to tap into Europe’s thriving materials sector. If you're serious about diversifying globally, these stocks offer a strong foundation—literally.

Top European Material Stocks on U.S. Exchanges

If you're scanning U.S. exchanges for hidden gems in the European materials sector, look no further than ArcelorMittal (MT), BASF SE (BASFY), CRH plc (CRH), and Linde plc (LIN) — industry titans shaping global infrastructure, chemical production, and sustainable materials. These stocks bring a mix of stability and innovation, giving investors exposure to European markets without the headache of international trading. Whether you're bullish on raw materials fueling industrial expansion or seeking ESG-focused leaders redefining sustainability, these companies stand out as high-potential picks that continue to drive economic growth worldwide.

Leading Metal Producers

If you're looking for powerhouse metal producers with European roots, ArcelorMittal (MT) and Rio Tinto (RIO) are top contenders on U.S. exchanges. ArcelorMittal dominates steel manufacturing across Europe and beyond, supplying critical infrastructure and automotive industries. Meanwhile, Rio Tinto, with its vast mining operations, plays a crucial role in global metals production, from aluminum to copper. Both companies stand strong in the materials sector, offering growth potential, dividend stability, and strategic positioning amid global demand shifts and sustainability transitions.

Chemical Industry Giants

Europe’s chemical sector boasts major players like BASF SE (BASFY) and Linde plc (LIN), both of which trade on U.S. exchanges, offering investors exposure to industrial materials and advanced chemical solutions. BASF dominates in specialty chemicals, fueling industries from agriculture to automotive, while Linde specializes in gases and engineered materials critical for manufacturing and medical applications. These companies continue to lead in innovation, sustainability, and market expansion, making them solid contenders for investors seeking stability and long-term growth in the materials sector.

Construction & Building Materials Leaders

When it comes to construction and building materials, CRH plc (CRH) and Holcim Ltd (HCMLY) are two European heavyweights accessible on U.S. exchanges. CRH dominates in cement and construction aggregates, supplying essential materials for infrastructure projects worldwide. Holcim, on the other hand, has carved out a strong position in sustainable building solutions, pushing eco-friendly innovations like carbon-neutral cement and advanced recycling technologies. Both companies benefit from global urbanization trends, government infrastructure spending, and ESG-driven demand, making them compelling investments in the materials sector.

Sustainable & Eco-Friendly Material Innovators

Sustainability isn't just a buzzword—it's a multi-billion-dollar movement reshaping industries, and Umicore (UMICY) and Stora Enso (SEOAY) are leading the charge. Umicore dominates in battery recycling and clean-energy materials, fueling the electric vehicle boom while tackling environmental waste head-on. Meanwhile, Stora Enso is revolutionizing timber and packaging with eco-friendly solutions, proving that profitability and sustainability can go hand in hand. With strong ESG scores and government-backed incentives driving demand for cleaner production, both companies are positioned as long-term winners in the global push toward greener industries.

Risk Factors & Market Considerations

Investing in European material stocks isn’t just about picking winners—it’s about navigating risks like a pro. Currency fluctuations can impact returns, with exchange rates swinging based on economic shifts and central bank policies. Then there’s the regulatory maze—European governments are big on ESG mandates, and shifting compliance rules can reshape industries overnight. Geopolitical influences, from trade agreements to unexpected tensions, add another layer of complexity, making global diversification crucial. And let’s not forget supply chain hurdles—raw materials aren’t immune to global logistics disruptions, creating challenges for production and distribution. The key? Understanding these risks and structuring a portfolio that adapts to market waves instead of sinking under them.

Investment Strategies & Portfolio Integration

Stacking your portfolio with European material stocks isn’t just about picking winners—it’s about strategy. Long-term investors can ride out volatility by targeting industry giants with strong fundamentals, while short-term traders might capitalize on cyclical price swings in steel, chemicals, and construction materials. Diversification is key, blending metals, industrial chemicals, and ESG-focused companies to hedge against macroeconomic shifts. Keep an eye on financial metrics like P/E ratios, dividend yields, and cash flow stability to separate long-term outperformers from fleeting hype. Whether you're in it for growth, income, or sustainability-driven upside, structuring your portfolio with European materials can add global resilience to your investment game.

Conclusion

All right, we just stacked this conversation with European material stocks, investment strategies, and ESG leaders—so if your portfolio needs some industrial muscle, you’ve got the roadmap. Whether you’re hunting for steel giants, chemical innovators, or sustainable disruptors, these picks are built for long-term gains. The market may be unpredictable, but strong fundamentals and global positioning make these stocks prime candidates for stability and growth. Now, time to put the research to work—because hidden gems don’t stay hidden forever.

All right, 2025 is here, and the stock market is riding waves of uncertainty, bouncing between optimism and skepticism like a trader trying to time the next big move. But if there’s one sector quietly powering through volatility, it's Europe's material industry. Think of steel, chemicals, cement, and eco-friendly materials—pillars of infrastructure and manufacturing that aren't going anywhere, no matter how much the market mood swings. For U.S. investors, European material stocks offer exposure to global demand, industry-leading sustainability initiatives, and companies with decades of market resilience. The best part? You don’t need an offshore brokerage to get in on the action.

Investing in European material stocks is easier than ever with American Depositary Receipts (ADRs), select exchange-traded funds (ETFs), and direct listings on U.S. exchanges. Heavyweights like ArcelorMittal (MT), BASF SE (BASFY), and CRH plc (CRH) trade right alongside familiar U.S. giants, giving investors easy access to Europe's top industrial players. Whether you’re betting on growth, stability, or sustainability-driven innovation, these stocks bring a fresh angle to portfolio diversification. So, if you’re tired of watching the same old tickers, European materials might just be the hidden gems you’ve been looking for.

Understanding European Material Stocks

Europe’s material sector isn’t just about steel and concrete—it’s a powerhouse of industrial innovation, sustainability, and global infrastructure development. From the massive steel operations of ArcelorMittal (MT) to the cutting-edge chemical advancements of BASF SE (BASFY), these companies shape entire economies. The region’s construction materials industry, led by CRH plc (CRH) and Holcim Ltd (HCMLY), continues to dominate with eco-conscious solutions that address both regulatory pressure and investor demand. Whether it’s metals fueling tech and manufacturing, chemicals driving industrial processes, or construction materials laying the foundation for urban expansion, European firms remain essential players on the world stage.

Macroeconomic trends heavily influence European material stocks, making them dynamic investment opportunities. Currency fluctuations, geopolitical developments, and shifting trade policies can create waves across these sectors. Meanwhile, EU regulations and carbon-reduction initiatives push companies toward greener, more efficient production methods. As climate concerns grow, firms with strong ESG commitments are reaping the benefits of both government incentives and investor confidence. Companies like Umicore (UMICY) and Stora Enso (SEOAY) — leaders in sustainable battery materials and eco-friendly packaging—exemplify the shift toward responsible innovation.

How U.S. Investors Can Buy European Stocks

For U.S. investors, gaining exposure to European material stocks isn’t as complicated as it sounds. American Depositary Receipts (ADRs) allow direct investment in top European companies without navigating foreign exchanges. Major players such as Rio Tinto (RIO) and Linde plc (LIN) are readily available on U.S. markets, simplifying access to global industry leaders. Exchange-traded funds (ETFs) like the iShares MSCI Europe Materials ETF further streamline investment, bundling multiple European material stocks into one diversified asset.

Beyond ADRs and ETFs, direct brokerage accounts open another door to European investments. Many major platforms now offer international trading, allowing investors to purchase stocks straight from European exchanges. This method provides direct exposure to market movements without relying on secondary instruments. Whether through ADRs, sector-focused ETFs, or direct trading strategies, there’s no shortage of ways for U.S. investors to tap into Europe’s thriving materials sector. If you're serious about diversifying globally, these stocks offer a strong foundation—literally.

Top European Material Stocks on U.S. Exchanges

If you're scanning U.S. exchanges for hidden gems in the European materials sector, look no further than ArcelorMittal (MT), BASF SE (BASFY), CRH plc (CRH), and Linde plc (LIN) — industry titans shaping global infrastructure, chemical production, and sustainable materials. These stocks bring a mix of stability and innovation, giving investors exposure to European markets without the headache of international trading. Whether you're bullish on raw materials fueling industrial expansion or seeking ESG-focused leaders redefining sustainability, these companies stand out as high-potential picks that continue to drive economic growth worldwide.

Leading Metal Producers

If you're looking for powerhouse metal producers with European roots, ArcelorMittal (MT) and Rio Tinto (RIO) are top contenders on U.S. exchanges. ArcelorMittal dominates steel manufacturing across Europe and beyond, supplying critical infrastructure and automotive industries. Meanwhile, Rio Tinto, with its vast mining operations, plays a crucial role in global metals production, from aluminum to copper. Both companies stand strong in the materials sector, offering growth potential, dividend stability, and strategic positioning amid global demand shifts and sustainability transitions.

Chemical Industry Giants

Europe’s chemical sector boasts major players like BASF SE (BASFY) and Linde plc (LIN), both of which trade on U.S. exchanges, offering investors exposure to industrial materials and advanced chemical solutions. BASF dominates in specialty chemicals, fueling industries from agriculture to automotive, while Linde specializes in gases and engineered materials critical for manufacturing and medical applications. These companies continue to lead in innovation, sustainability, and market expansion, making them solid contenders for investors seeking stability and long-term growth in the materials sector.

Construction & Building Materials Leaders

When it comes to construction and building materials, CRH plc (CRH) and Holcim Ltd (HCMLY) are two European heavyweights accessible on U.S. exchanges. CRH dominates in cement and construction aggregates, supplying essential materials for infrastructure projects worldwide. Holcim, on the other hand, has carved out a strong position in sustainable building solutions, pushing eco-friendly innovations like carbon-neutral cement and advanced recycling technologies. Both companies benefit from global urbanization trends, government infrastructure spending, and ESG-driven demand, making them compelling investments in the materials sector.

Sustainable & Eco-Friendly Material Innovators

Sustainability isn't just a buzzword—it's a multi-billion-dollar movement reshaping industries, and Umicore (UMICY) and Stora Enso (SEOAY) are leading the charge. Umicore dominates in battery recycling and clean-energy materials, fueling the electric vehicle boom while tackling environmental waste head-on. Meanwhile, Stora Enso is revolutionizing timber and packaging with eco-friendly solutions, proving that profitability and sustainability can go hand in hand. With strong ESG scores and government-backed incentives driving demand for cleaner production, both companies are positioned as long-term winners in the global push toward greener industries.

Risk Factors & Market Considerations

Investing in European material stocks isn’t just about picking winners—it’s about navigating risks like a pro. Currency fluctuations can impact returns, with exchange rates swinging based on economic shifts and central bank policies. Then there’s the regulatory maze—European governments are big on ESG mandates, and shifting compliance rules can reshape industries overnight. Geopolitical influences, from trade agreements to unexpected tensions, add another layer of complexity, making global diversification crucial. And let’s not forget supply chain hurdles—raw materials aren’t immune to global logistics disruptions, creating challenges for production and distribution. The key? Understanding these risks and structuring a portfolio that adapts to market waves instead of sinking under them.

Investment Strategies & Portfolio Integration

Stacking your portfolio with European material stocks isn’t just about picking winners—it’s about strategy. Long-term investors can ride out volatility by targeting industry giants with strong fundamentals, while short-term traders might capitalize on cyclical price swings in steel, chemicals, and construction materials. Diversification is key, blending metals, industrial chemicals, and ESG-focused companies to hedge against macroeconomic shifts. Keep an eye on financial metrics like P/E ratios, dividend yields, and cash flow stability to separate long-term outperformers from fleeting hype. Whether you're in it for growth, income, or sustainability-driven upside, structuring your portfolio with European materials can add global resilience to your investment game.

Conclusion

All right, we just stacked this conversation with European material stocks, investment strategies, and ESG leaders—so if your portfolio needs some industrial muscle, you’ve got the roadmap. Whether you’re hunting for steel giants, chemical innovators, or sustainable disruptors, these picks are built for long-term gains. The market may be unpredictable, but strong fundamentals and global positioning make these stocks prime candidates for stability and growth. Now, time to put the research to work—because hidden gems don’t stay hidden forever.