Unpack the composition of the S&P 500, its large-cap focus, and what it means for diversification, ETF exposure, and portfolio strategy.

Is the S&P 500 Really Just a Large-Cap Index?

The S&P 500 is widely regarded as the gold standard for tracking the performance of U.S. equities. Comprising approximately 500 of the most prominent publicly traded companies, it serves as a barometer for the overall health of the American stock market. Investors, analysts, and fund managers often use it as a benchmark to evaluate portfolio performance and market trends. While the index is commonly referred to as a large-cap index, this classification isn’t as clear-cut as it seems.

Although most of its constituents meet the large-cap threshold—typically defined as companies with a market capitalization between $10 billion and $200 billion—some exceptions exist due to market fluctuations and index committee discretion. In this article, we’ll explore what qualifies a company for inclusion in the S&P 500, how market cap thresholds are applied, and whether all its components truly fit the large-cap mold. We’ll also examine how these nuances impact ETF strategies, diversification, and investor decision-making in 2025.

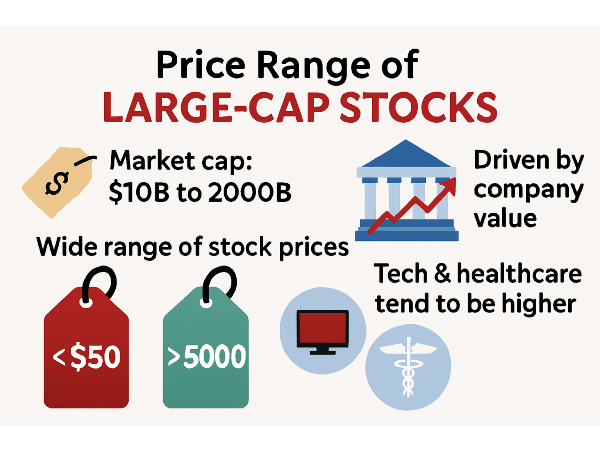

What Is a Large-Cap Stock and Why Market Cap Matters More Than Price

Large-cap stocks are typically defined as companies with a market capitalization between $10 billion and $200 billion. Companies that exceed $200 billion in market cap are considered mega-cap, such as Apple AAPL and Microsoft MSFT. Market capitalization is calculated by multiplying a company’s stock price by its total number of outstanding shares. For example, Verizon Communications VZ trades under $50 per share but qualifies as a large-cap due to its substantial market value. Conversely, Booking Holdings BKNG trades above $5,000 per share but has a similar market cap.

In The Investor’s Podcast Network, analysts noted, “Market cap—not price—is what defines a company’s weight in the market” (🎧 08:20), emphasizing the importance of understanding valuation beyond surface-level figures. Meanwhile, Morningstar’s Investing Insights highlighted, “Investors often confuse high price with high value, but they’re not the same” (🎧 09:45), reinforcing the need to look deeper into fundamentals.

Sources:

Stock Analysis – List of Large-Cap Stocks

MarketBeat – What Are Large-Cap Stocks?

Forbes Advisor – What Are Large-Cap Stocks?

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – What is the Price Range for Large-Cap Stocks?

Yahoo Finance – Sector Performance

ETF.com – Sector Exposure in Large-Cap ETFs

SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

S&P 500 Eligibility Criteria: How Companies Qualify for the Index

To be included in the S&P 500, a company must meet several stringent criteria that go beyond just market capitalization. As of 2025, the minimum market cap requirement is approximately $15 billion. Companies must also demonstrate adequate liquidity, with a minimum monthly trading volume and at least 50% of shares publicly available. Additionally, they must be headquartered in the United States, file 10-K annual reports, and report positive earnings in the most recent quarter and over the trailing four quarters combined.

The S&P Index Committee, a group of analysts and economists at S&P Dow Jones Indices, plays a pivotal role in maintaining the index. Their discretionary oversight means that not all large-cap stocks are automatically included, and some mid-cap companies may remain in the index due to legacy status or strategic balance.

In Morningstar’s Investing Insights, analysts noted, “The S&P 500 isn’t just a math formula—it’s a curated list shaped by committee judgment” (🎧 10:35). Meanwhile, The Investor’s Podcast Network emphasized, “Legacy constituents can linger even after slipping below the cap threshold” (🎧 09:50), highlighting the index’s nuanced structure. This blend of rules and discretion makes the S&P 500 both a reliable benchmark and a dynamic reflection of the U.S. economy.

Sources:

Stock Analysis – List of Large-Cap Stocks

MarketBeat – What Are Large-Cap Stocks?

Forbes Advisor – What Are Large-Cap Stocks?

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – What is the Price Range for Large-Cap Stocks?

Yahoo Finance – Sector Performance

ETF.com – Sector Exposure in Large-Cap ETFs

SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

Are All S&P 500 Stocks Truly Large-Cap?

Most constituents do fall within the $10 billion to $200 billion market cap range, but market fluctuations can cause some to temporarily dip below this level. Importantly, companies are not automatically removed from the index. For example, companies like News Corp or Dish Network have, at times, hovered near or below the large-cap threshold yet remained in the index due to legacy inclusion and broader representation goals.

This flexibility ensures that the index reflects the evolving nature of the market without excessive turnover. In Morningstar’s Investing Insights, analysts noted, “The S&P 500 isn’t a rigid formula—it’s a curated snapshot of the U.S. economy” (🎧 11:10), emphasizing the committee’s role in maintaining balance. Meanwhile, The Investor’s Podcast Network highlighted, “Some mid-cap stocks remain in the index longer than expected, especially if they serve a strategic sector role” (🎧 09:35).

Sources:

S&P Global – S&P 500 Brochure

Stock Analysis – S&P 500 Stocks List

MarketBeat – S&P 500 Stocks Overview

SlickCharts – S&P 500 by Market Cap

Morningstar – Index Fund Composition

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

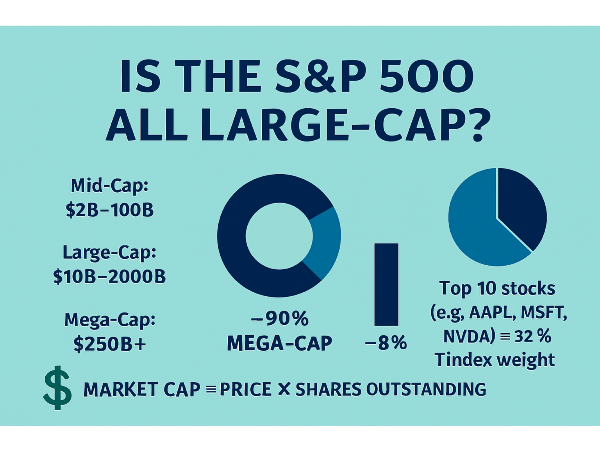

Market Cap Distribution in the S&P 500: Why a Few Giants Drive the Index

The S&P 500 may include 500 companies, but its performance is heavily influenced by a handful of mega-cap stocks. As of mid-2025, Apple AAPL, Microsoft MSFT, and Nvidia NVDA collectively account for nearly 18% of the index’s total weight. This concentration means that movements in just a few stocks can significantly sway the index, even if the majority of constituents remain stable.

In contrast, the S&P 500’s long tail of smaller constituents—many with weights under 0.5%—have limited influence on index performance. Companies like News Corp or Dish Network may be included, but their impact is minimal compared to the top 10 holdings. In Morningstar’s Investing Insights, analysts observed, “The S&P 500 is top-heavy by design, and that skews diversification” (🎧 12:10). Meanwhile, The Investor’s Podcast Network noted, “Sector exposure is often a byproduct of mega-cap dominance, not deliberate allocation” (🎧 11:25).

Sources:

SlickCharts – S&P 500 by Market Cap

Advisor Channel – Complete Breakdown of S&P 500 Companies

Yahoo Finance – Apple, Nvidia, Microsoft Drive S&P 500 Market Concentration

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – S&P 500 ETF Overview

SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

Investor Takeaways: How S&P 500 ETFs Shape Portfolio Exposure

S&P 500 ETFs like SPDR S&P 500 ETF Trust (SPY) and Vanguard S&P 500 ETF (VOO) are among the most popular vehicles for gaining large-cap exposure. These funds track the S&P 500 index, offering investors access to 500 of the largest U.S. companies in a single, low-cost investment. SPY is known for its high liquidity and is often favored by institutional traders, while VOO appeals to long-term investors with its lower expense ratio and tax efficiency.

Despite their broad appeal, these ETFs come with limitations. Because the S&P 500 is market-cap weighted, a small number of mega-cap stocks—like Apple AAPL, Microsoft MSFT, and Nvidia NVDA—dominate the index’s performance. This concentration can skew diversification, especially during sector-specific downturns. In Morningstar’s Investing Insights, analysts noted, “Investors may think they’re diversified, but they’re often overexposed to tech” (🎧 11:50). Meanwhile, The Investor’s Podcast Network emphasized, “Cap-weighted ETFs can silently amplify risk if you’re not watching sector weights” (🎧 10:10).

Sources:

ETF.com – VOO vs SPY Comparison

Forbes – SPY vs VOO for Retirement Investing

Wall Street Simplified – SPY vs VOO vs QQQ ETF Comparison

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

To Conclude

While the S&P 500 is widely viewed as a large-cap index, its composition reveals a more nuanced reality. The majority of its constituents meet the large-cap threshold, but market fluctuations and committee discretion allow for the inclusion of some mid-cap companies as well. With mega-cap giants like Apple AAPL, Microsoft MSFT, and Nvidia NVDA dominating index weight, the S&P 500’s performance is often driven by a concentrated few.

This top-heavy structure impacts diversification and sector exposure, making it essential for investors to understand what they’re actually holding when investing in S&P 500-linked ETFs. By examining eligibility criteria, market cap distribution, and the index’s evolving composition, investors can make more informed decisions and consider complementary strategies to achieve balanced exposure. The S&P 500 remains a powerful benchmark—but not a one-size-fits-all solution.

Podcast Transcripts 🎧

Motley Fool Money – Dividend Stocks for a Volatile Market

This episode explores how dividend-paying companies offer stability in turbulent markets. The hosts highlight sectors like consumer staples and utilities, and discuss how dividend consistency can anchor long-term portfolios.

“Dividends are the ballast in your portfolio” (🎧 12:45)

Transcript available here

We Study Billionaires – How Billionaires Use Dividends

This episode examines how legendary investors like Warren Buffett and Charlie Munger use dividend-paying stocks to build wealth, emphasizing the power of compounding and long-term holding.

“Steady growth from broad market exposure anchors long-term wealth” (🎧 10:15)

“Dividend reinvestment compounds returns over decades” (🎧 16:20)

Morningstar’s Investing Insights – Dividend Investing in 2025

Analysts discuss undervalued sectors like healthcare and energy, and how dividend growth stocks are positioned for the year ahead.

“Low fees and market efficiency are key to building wealth” (🎧 12:30)

“Diversification supports sustainable income” (🎧 14:20)

Transcript available here

Dividend Talk – From Dividend Cuts to Recovery

This episode explores companies that have cut dividends—like Shell, General Electric, and 3M—and how some rebounded while others struggled.

“When a dividend seems too high, it’s a cue to investigate further” (🎧 11:36)

“Dividend cuts can lead to long-term resilience” (🎧 27:50)

The Long View – How to Build a Dividend Portfolio

This episode offers a deep dive into constructing a dividend-focused portfolio, balancing yield with growth, and avoiding overconcentration.

“A diversified dividend portfolio shields against market shocks” (🎧 13:55)

“Align dividend strategies with long-term wealth goals” (🎧 21:18)

The Meb Faber Show – Avoiding Dividend Traps

Meb Faber discusses the risks of high-yield dividend stocks in taxable accounts and advocates for a total return approach.

“A blind allegiance to dividends could be a very, very bad idea” (🎧 09:10)

“Stripping out top dividend payers can improve after-tax returns” (🎧 12:40)

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39045/understanding-large-us-cap-stocks-and-their-market-influence

Should I Invest in a Small, Mid, or Large-Cap?- https://stockbossup.com/pages/post/39158/small-cap-vs-mid-cap-vs-large-cap-choosing-the-right-investment-strategy

Which Large Cap Fund is Best Now?- https://stockbossup.com/pages/post/39144/best-large-cap-funds-for-maximum-returns-in-2025

Top Sectors in Large Cap Stocks: A Complete Breakdown for Smart Investors- https://stockbossup.com/pages/post/39244/top-sectors-in-large-cap-stocks-a-complete-breakdown-for-smart-investors

Unpack the composition of the S&P 500, its large-cap focus, and what it means for diversification, ETF exposure, and portfolio strategy.

Is the S&P 500 Really Just a Large-Cap Index?

The S&P 500 is widely regarded as the gold standard for tracking the performance of U.S. equities. Comprising approximately 500 of the most prominent publicly traded companies, it serves as a barometer for the overall health of the American stock market. Investors, analysts, and fund managers often use it as a benchmark to evaluate portfolio performance and market trends. While the index is commonly referred to as a large-cap index, this classification isn’t as clear-cut as it seems.

Although most of its constituents meet the large-cap threshold—typically defined as companies with a market capitalization between $10 billion and $200 billion—some exceptions exist due to market fluctuations and index committee discretion. In this article, we’ll explore what qualifies a company for inclusion in the S&P 500, how market cap thresholds are applied, and whether all its components truly fit the large-cap mold. We’ll also examine how these nuances impact ETF strategies, diversification, and investor decision-making in 2025.

What Is a Large-Cap Stock and Why Market Cap Matters More Than Price

Large-cap stocks are typically defined as companies with a market capitalization between $10 billion and $200 billion. Companies that exceed $200 billion in market cap are considered mega-cap, such as Apple AAPL and Microsoft MSFT. Market capitalization is calculated by multiplying a company’s stock price by its total number of outstanding shares. For example, Verizon Communications VZ trades under $50 per share but qualifies as a large-cap due to its substantial market value. Conversely, Booking Holdings BKNG trades above $5,000 per share but has a similar market cap.

In The Investor’s Podcast Network, analysts noted, “Market cap—not price—is what defines a company’s weight in the market” (🎧 08:20), emphasizing the importance of understanding valuation beyond surface-level figures. Meanwhile, Morningstar’s Investing Insights highlighted, “Investors often confuse high price with high value, but they’re not the same” (🎧 09:45), reinforcing the need to look deeper into fundamentals.

Sources:

Stock Analysis – List of Large-Cap Stocks

MarketBeat – What Are Large-Cap Stocks?

Forbes Advisor – What Are Large-Cap Stocks?

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – What is the Price Range for Large-Cap Stocks?

Yahoo Finance – Sector Performance

ETF.com – Sector Exposure in Large-Cap ETFs SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

S&P 500 Eligibility Criteria: How Companies Qualify for the Index

To be included in the S&P 500, a company must meet several stringent criteria that go beyond just market capitalization. As of 2025, the minimum market cap requirement is approximately $15 billion. Companies must also demonstrate adequate liquidity, with a minimum monthly trading volume and at least 50% of shares publicly available. Additionally, they must be headquartered in the United States, file 10-K annual reports, and report positive earnings in the most recent quarter and over the trailing four quarters combined.

The S&P Index Committee, a group of analysts and economists at S&P Dow Jones Indices, plays a pivotal role in maintaining the index. Their discretionary oversight means that not all large-cap stocks are automatically included, and some mid-cap companies may remain in the index due to legacy status or strategic balance.

In Morningstar’s Investing Insights, analysts noted, “The S&P 500 isn’t just a math formula—it’s a curated list shaped by committee judgment” (🎧 10:35). Meanwhile, The Investor’s Podcast Network emphasized, “Legacy constituents can linger even after slipping below the cap threshold” (🎧 09:50), highlighting the index’s nuanced structure. This blend of rules and discretion makes the S&P 500 both a reliable benchmark and a dynamic reflection of the U.S. economy.

Sources:

Stock Analysis – List of Large-Cap Stocks

MarketBeat – What Are Large-Cap Stocks?

Forbes Advisor – What Are Large-Cap Stocks?

The Investor’s Podcast Network

Morningstar’s Investing Insights

StockBossUp – What is the Price Range for Large-Cap Stocks?

Yahoo Finance – Sector Performance

ETF.com – Sector Exposure in Large-Cap ETFs SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

Are All S&P 500 Stocks Truly Large-Cap?

Most constituents do fall within the $10 billion to $200 billion market cap range, but market fluctuations can cause some to temporarily dip below this level. Importantly, companies are not automatically removed from the index. For example, companies like News Corp or Dish Network have, at times, hovered near or below the large-cap threshold yet remained in the index due to legacy inclusion and broader representation goals.

This flexibility ensures that the index reflects the evolving nature of the market without excessive turnover. In Morningstar’s Investing Insights, analysts noted, “The S&P 500 isn’t a rigid formula—it’s a curated snapshot of the U.S. economy” (🎧 11:10), emphasizing the committee’s role in maintaining balance. Meanwhile, The Investor’s Podcast Network highlighted, “Some mid-cap stocks remain in the index longer than expected, especially if they serve a strategic sector role” (🎧 09:35).

Sources:

S&P Global – S&P 500 Brochure

Stock Analysis – S&P 500 Stocks List

MarketBeat – S&P 500 Stocks Overview

SlickCharts – S&P 500 by Market Cap

Morningstar – Index Fund Composition The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

Market Cap Distribution in the S&P 500: Why a Few Giants Drive the Index

The S&P 500 may include 500 companies, but its performance is heavily influenced by a handful of mega-cap stocks. As of mid-2025, Apple AAPL, Microsoft MSFT, and Nvidia NVDA collectively account for nearly 18% of the index’s total weight. This concentration means that movements in just a few stocks can significantly sway the index, even if the majority of constituents remain stable.

In contrast, the S&P 500’s long tail of smaller constituents—many with weights under 0.5%—have limited influence on index performance. Companies like News Corp or Dish Network may be included, but their impact is minimal compared to the top 10 holdings. In Morningstar’s Investing Insights, analysts observed, “The S&P 500 is top-heavy by design, and that skews diversification” (🎧 12:10). Meanwhile, The Investor’s Podcast Network noted, “Sector exposure is often a byproduct of mega-cap dominance, not deliberate allocation” (🎧 11:25).

Sources:

SlickCharts – S&P 500 by Market Cap

Advisor Channel – Complete Breakdown of S&P 500 Companies

Yahoo Finance – Apple, Nvidia, Microsoft Drive S&P 500 Market Concentration

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – S&P 500 ETF Overview

SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

Investor Takeaways: How S&P 500 ETFs Shape Portfolio Exposure

S&P 500 ETFs like SPDR S&P 500 ETF Trust (SPY) and Vanguard S&P 500 ETF (VOO) are among the most popular vehicles for gaining large-cap exposure. These funds track the S&P 500 index, offering investors access to 500 of the largest U.S. companies in a single, low-cost investment. SPY is known for its high liquidity and is often favored by institutional traders, while VOO appeals to long-term investors with its lower expense ratio and tax efficiency.

Despite their broad appeal, these ETFs come with limitations. Because the S&P 500 is market-cap weighted, a small number of mega-cap stocks—like Apple AAPL, Microsoft MSFT, and Nvidia NVDA—dominate the index’s performance. This concentration can skew diversification, especially during sector-specific downturns. In Morningstar’s Investing Insights, analysts noted, “Investors may think they’re diversified, but they’re often overexposed to tech” (🎧 11:50). Meanwhile, The Investor’s Podcast Network emphasized, “Cap-weighted ETFs can silently amplify risk if you’re not watching sector weights” (🎧 10:10).

Sources:

ETF.com – VOO vs SPY Comparison

Forbes – SPY vs VOO for Retirement Investing

Wall Street Simplified – SPY vs VOO vs QQQ ETF Comparison

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

SoFi – S&P 500 Sector Weights

World P/E Ratio – Sector P/E and Valuation

FTSE Russell – Russell 1000 Index Methodology

CGAA – Publicly Traded Companies by Sector

To Conclude

While the S&P 500 is widely viewed as a large-cap index, its composition reveals a more nuanced reality. The majority of its constituents meet the large-cap threshold, but market fluctuations and committee discretion allow for the inclusion of some mid-cap companies as well. With mega-cap giants like Apple AAPL, Microsoft MSFT, and Nvidia NVDA dominating index weight, the S&P 500’s performance is often driven by a concentrated few.

This top-heavy structure impacts diversification and sector exposure, making it essential for investors to understand what they’re actually holding when investing in S&P 500-linked ETFs. By examining eligibility criteria, market cap distribution, and the index’s evolving composition, investors can make more informed decisions and consider complementary strategies to achieve balanced exposure. The S&P 500 remains a powerful benchmark—but not a one-size-fits-all solution.

Podcast Transcripts 🎧

Motley Fool Money – Dividend Stocks for a Volatile Market

This episode explores how dividend-paying companies offer stability in turbulent markets. The hosts highlight sectors like consumer staples and utilities, and discuss how dividend consistency can anchor long-term portfolios.

“Dividends are the ballast in your portfolio” (🎧 12:45)

Transcript available here

We Study Billionaires – How Billionaires Use Dividends

This episode examines how legendary investors like Warren Buffett and Charlie Munger use dividend-paying stocks to build wealth, emphasizing the power of compounding and long-term holding.

“Steady growth from broad market exposure anchors long-term wealth” (🎧 10:15)

“Dividend reinvestment compounds returns over decades” (🎧 16:20)

Morningstar’s Investing Insights – Dividend Investing in 2025

Analysts discuss undervalued sectors like healthcare and energy, and how dividend growth stocks are positioned for the year ahead.

“Low fees and market efficiency are key to building wealth” (🎧 12:30) “Diversification supports sustainable income” (🎧 14:20)

Transcript available here

Dividend Talk – From Dividend Cuts to Recovery

This episode explores companies that have cut dividends—like Shell, General Electric, and 3M—and how some rebounded while others struggled.

“When a dividend seems too high, it’s a cue to investigate further” (🎧 11:36)

“Dividend cuts can lead to long-term resilience” (🎧 27:50)

The Long View – How to Build a Dividend Portfolio

This episode offers a deep dive into constructing a dividend-focused portfolio, balancing yield with growth, and avoiding overconcentration. “A diversified dividend portfolio shields against market shocks” (🎧 13:55)

“Align dividend strategies with long-term wealth goals” (🎧 21:18)

The Meb Faber Show – Avoiding Dividend Traps

Meb Faber discusses the risks of high-yield dividend stocks in taxable accounts and advocates for a total return approach.

“A blind allegiance to dividends could be a very, very bad idea” (🎧 09:10)

“Stripping out top dividend payers can improve after-tax returns” (🎧 12:40)

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39045/understanding-large-us-cap-stocks-and-their-market-influence

Should I Invest in a Small, Mid, or Large-Cap?- https://stockbossup.com/pages/post/39158/small-cap-vs-mid-cap-vs-large-cap-choosing-the-right-investment-strategy

Which Large Cap Fund is Best Now?- https://stockbossup.com/pages/post/39144/best-large-cap-funds-for-maximum-returns-in-2025

Top Sectors in Large Cap Stocks: A Complete Breakdown for Smart Investors- https://stockbossup.com/pages/post/39244/top-sectors-in-large-cap-stocks-a-complete-breakdown-for-smart-investors