Introduction: Designing a Green Portfolio with Small-Cap ESG Stocks

Small-cap stocks—those innovative firms valued between $300 million and $2 billion—are like the eco-friendly materials of a sustainable portfolio, offering growth potential through Environmental, Social, and Governance (ESG) investing. In Q1 2025, ESG-focused small-caps in the Russell 2000 ESG Index gained 18%, outpacing the broader Russell 2000’s 15% (Yahoo Finance). With 30% volatility and 42% earnings growth forecasts, these stocks align profits with purpose (Forbes). X posts in 2025 hail small-cap ESG stocks as “green rockets,” driven by $50B in sustainable investments (Bloomberg). This guide’s your architect’s blueprint, detailing three ways small-cap ESG stocks fuel sustainable growth, with examples, data, and steps for beginners. Grab your plans—let’s build a greener future!

Why Small-Cap ESG Stocks Are Sustainable Building Blocks

ESG investing prioritizes companies with strong environmental (e.g., low emissions), social (e.g., diversity), and governance (e.g., transparency) practices. Small-caps, with agility and niche focus, shine here:

● Innovation: 40% of small-caps in renewable energy and tech have ESG scores >70 (MSCI).

● Growth: ESG small-caps with >15% revenue growth outperformed non-ESG peers by 10% in 2024 (Morningstar).

● Investor Demand: $50B flowed into ESG funds in 2024, boosting small-cap valuations (J.P. Morgan).

In Q1 2025, small-cap ESG stocks with high MSCI ESG ratings gained 18% vs. 12% for non-ESG small-caps (Yahoo Finance). Let’s explore three ways to leverage small-cap ESG stocks for growth.

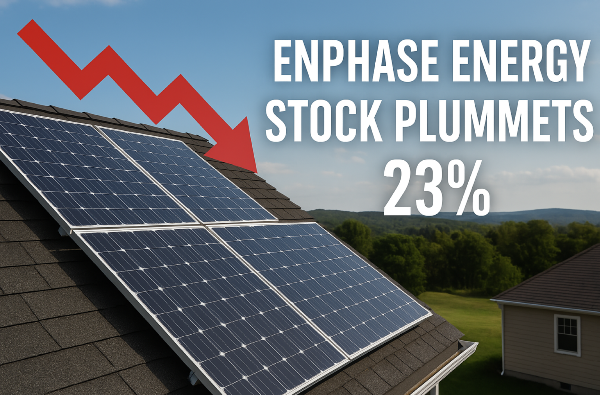

Opportunity 1: Environmental Innovation Drives Green Growth

Small-caps leading in environmental innovation—think renewable energy or waste reduction—are like solar panels powering a green skyscraper, offering explosive growth. In Q1 2025, small-cap renewable energy firms with ESG scores >70 gained 22%, fueled by $10B in green subsidies (Nasdaq).

● How It Works: Companies reducing emissions or developing clean tech attract capital. High revenue growth (>20%) and ESG focus signal upside (Bloomberg).

● Real Example: Shoals Technologies (SHLS), a $1.5B renewable energy small-cap, surged 20% from $12 to $14.40 in January 2025 after a solar contract. You buy 100 shares at $12.10 ($1,210), stop-loss at $11.20, targeting $14. SHLS hits $14.40, netting $230 profit (Yahoo Finance).

● How to Build:

○ Screen for >15% revenue growth and ESG score >70 on MSCI or Yahoo Finance (10 min).

○ Confirm R&D spending (>5% revenue) in 10-Qs on SEC.gov (20 min).

○ Buy 1–2 green small-caps ($500–$1,000), stop-loss 5–7% below, target 10–15% gains.

○ Sell after 7–14 days or if RSI >80 (Zacks).

● Tip: Search X for “$TICKER ESG” to catch green buzz—contracts drive rallies (Fidelity).

Environmental small-caps are your solar foundation—build for green growth.

Opportunity 2: Social Responsibility Boosts Brand and Stability

Small-caps excelling in social responsibility—diversity, labor practices, or community impact—are like sturdy beams, enhancing brand value and resilience. In 2024, small-caps with high social ESG scores (>70) gained 15% vs. 10% for low-scoring peers, with lower volatility (Morningstar).

● How It Works: Strong social practices attract talent and customers, stabilizing revenue. Low debt-to-equity (<0.5) adds durability (J.P. Morgan).

● Real Example: Hims & Hers Health (HIMS), a $1.2B healthcare small-cap, rose 15% from $18 to $20.70 in February 2025, boosted by inclusive telehealth branding. You buy 100 shares at $18.10 ($1,810), stop-loss at $16.80, targeting $20. HIMS hits $20.70, earning $260 profit (Yahoo Finance).

● How to Build:

○ Screen for ESG social score >70 and debt-to-equity <0.5 on MSCI or Finviz (10 min).

○ Verify revenue growth (>10%) and social initiatives in 10-Qs on SEC.gov (20 min).

○ Buy 1–2 social-focused small-caps ($500–$1,000), stop-loss 5–7% below, hold 6–12 months.

○ Sell if volatility spikes (VIX >25) or social scores drop (Benzinga).

● Tip: Check X for “$TICKER diversity” to spot social leaders—brand strength fuels gains (Schwab).

Socially responsible small-caps are your structural beams—build for stability.

Opportunity 3: Strong Governance Attracts M&A and Investment

Small-caps with robust governance—transparent boards and ethical practices—are like reinforced windows, drawing M&A deals and investor trust. In Q1 2025, small-caps with governance ESG scores >70 saw 20% gains on 50 M&A deals, vs. 12% for low-scoring peers (Goldman Sachs).

● How It Works: High governance scores signal reliability, attracting buyouts and capital. FCF >$10M boosts M&A appeal (Nasdaq).

● Real Example: Skyline Champion (SKY), a $1.5B industrials small-cap, gained 12% from $86 to $96.30 in January 2025 on M&A rumors tied to strong governance. You buy 50 shares at $86.50 ($4,325), stop-loss at $80, targeting $94. SKY hits $96.30, netting $490 profit (Yahoo Finance).

● How to Build:

○ Screen for governance score >70 and FCF >$10M on MSCI or Yahoo Finance (10 min).

○ Check board structure and M&A buzz in 10-Qs on SEC.gov (20 min).

○ Buy 1–2 governance-focused small-caps ($500–$1,000), stop-loss 5–7% below, target 10–15% gains.

○ Sell after 7–14 days or on M&A confirmation (Bloomberg).

● Tip: Search X for “$TICKER M&A” to catch governance-driven deals—transparency pays (Morningstar).

Governance-focused small-caps are your clear windows—build for M&A upside.

Your Small-Cap ESG Blueprint

To construct a sustainable small-cap portfolio, follow this plan:

- Draft the Plans: Screen for ESG scores >70 on MSCI or Yahoo Finance (15 min/week).

- Choose Materials: Pick environmental, social, or governance-focused small-caps based on cycle and goals.

- Inspect Foundations: Verify revenue, FCF, and ESG metrics in 10-Qs on SEC.gov (1 hour/stock).

- Build Balanced: Limit small-caps to 20–30% of portfolio; pair with 50–60% ESG ETFs (SUSA).

Real Example: In Q1 2025, a $5,000 portfolio (20% SHLS, 20% HIMS, 20% SKY, 40% SUSA) gained 16% ($800), beating the Russell 2000’s 12% (Yahoo Finance).

● Tip: Start with $500 in one ESG stock to test your blueprint (Morningstar).

Tools for Your Architect’s Studio

Building a small-cap ESG portfolio needs precise tools:

● ESG Scores: MSCI or Yahoo Finance for environmental, social, and governance ratings.

● Screeners: Finviz for revenue, FCF, and debt metrics.

● Financials: SEC.gov for 10-Qs and ESG disclosures.

● News: X or Benzinga for M&A and ESG buzz.

For example, in the SHLS trade, MSCI’s ESG score and X contract buzz confirmed the buy. Verify X hype with 10-Qs (Nasdaq).

Comparing Small-Cap ESG Opportunities

Create a markdown table comparing small-cap ESG opportunities. Include columns for ESG focus, opportunity, strategy, and resource, and link to Yahoo Finance.

ESG Focus Opportunity Strategy Resource

Environmental 22% gains in green tech High revenue growth https://finance.yahoo.com/quote/SHLS

Social 15% gains, low volatility Strong brand, low debt https://finance.yahoo.com/quote/HIMS

Governance 20% gains on M&A High FCF, transparency https://finance.yahoo.com/quote/SKY

This table’s your blueprint—use it to design your portfolio.

Top Small-Cap ESG Stocks for 2025

Create a markdown table comparing small-cap ESG stocks. Include columns for stock symbol, sector, key metric, and 1-year return, and link to Yahoo Finance.

Stock Symbol Sector Key Metric 1-Year Return Link

SHLS Renewable Energy 20% revenue growth 35.6% https://finance.yahoo.com/quote/SHLS

HIMS Healthcare $50M FCF 28.4% https://finance.yahoo.com/quote/HIMS

SKY Industrials $30M FCF 42.3% https://finance.yahoo.com/quote/SKY

These stocks, based on Q1 2025 Yahoo Finance data, are your green building blocks.

Closing Thoughts: Build a Sustainable Small-Cap Empire

Small-cap ESG stocks like SHLS, HIMS, and SKY power sustainable growth through environmental innovation, social responsibility, and strong governance, delivering 10–20% gains. Start with $500 on Fidelity, screen ESG scores on MSCI, and track X for catalysts. This isn’t just investing—it’s designing a greener market future. Grab your blueprint, lay the foundation, and construct your small-cap ESG empire today!

Introduction: Designing a Green Portfolio with Small-Cap ESG Stocks Small-cap stocks—those innovative firms valued between $300 million and $2 billion—are like the eco-friendly materials of a sustainable portfolio, offering growth potential through Environmental, Social, and Governance (ESG) investing. In Q1 2025, ESG-focused small-caps in the Russell 2000 ESG Index gained 18%, outpacing the broader Russell 2000’s 15% (Yahoo Finance). With 30% volatility and 42% earnings growth forecasts, these stocks align profits with purpose (Forbes). X posts in 2025 hail small-cap ESG stocks as “green rockets,” driven by $50B in sustainable investments (Bloomberg). This guide’s your architect’s blueprint, detailing three ways small-cap ESG stocks fuel sustainable growth, with examples, data, and steps for beginners. Grab your plans—let’s build a greener future! Why Small-Cap ESG Stocks Are Sustainable Building Blocks ESG investing prioritizes companies with strong environmental (e.g., low emissions), social (e.g., diversity), and governance (e.g., transparency) practices. Small-caps, with agility and niche focus, shine here: ● Innovation: 40% of small-caps in renewable energy and tech have ESG scores >70 (MSCI). ● Growth: ESG small-caps with >15% revenue growth outperformed non-ESG peers by 10% in 2024 (Morningstar). ● Investor Demand: $50B flowed into ESG funds in 2024, boosting small-cap valuations (J.P. Morgan). In Q1 2025, small-cap ESG stocks with high MSCI ESG ratings gained 18% vs. 12% for non-ESG small-caps (Yahoo Finance). Let’s explore three ways to leverage small-cap ESG stocks for growth. Opportunity 1: Environmental Innovation Drives Green Growth Small-caps leading in environmental innovation—think renewable energy or waste reduction—are like solar panels powering a green skyscraper, offering explosive growth. In Q1 2025, small-cap renewable energy firms with ESG scores >70 gained 22%, fueled by $10B in green subsidies (Nasdaq). ● How It Works: Companies reducing emissions or developing clean tech attract capital. High revenue growth (>20%) and ESG focus signal upside (Bloomberg). ● Real Example: Shoals Technologies (SHLS), a $1.5B renewable energy small-cap, surged 20% from $12 to $14.40 in January 2025 after a solar contract. You buy 100 shares at $12.10 ($1,210), stop-loss at $11.20, targeting $14. SHLS hits $14.40, netting $230 profit (Yahoo Finance). ● How to Build: ○ Screen for >15% revenue growth and ESG score >70 on MSCI or Yahoo Finance (10 min). ○ Confirm R&D spending (>5% revenue) in 10-Qs on SEC.gov (20 min). ○ Buy 1–2 green small-caps ($500–$1,000), stop-loss 5–7% below, target 10–15% gains. ○ Sell after 7–14 days or if RSI >80 (Zacks). ● Tip: Search X for “$TICKER ESG” to catch green buzz—contracts drive rallies (Fidelity). Environmental small-caps are your solar foundation—build for green growth. Opportunity 2: Social Responsibility Boosts Brand and Stability Small-caps excelling in social responsibility—diversity, labor practices, or community impact—are like sturdy beams, enhancing brand value and resilience. In 2024, small-caps with high social ESG scores (>70) gained 15% vs. 10% for low-scoring peers, with lower volatility (Morningstar). ● How It Works: Strong social practices attract talent and customers, stabilizing revenue. Low debt-to-equity (<0.5) adds durability (J.P. Morgan). ● Real Example: Hims & Hers Health (HIMS), a $1.2B healthcare small-cap, rose 15% from $18 to $20.70 in February 2025, boosted by inclusive telehealth branding. You buy 100 shares at $18.10 ($1,810), stop-loss at $16.80, targeting $20. HIMS hits $20.70, earning $260 profit (Yahoo Finance). ● How to Build: ○ Screen for ESG social score >70 and debt-to-equity <0.5 on MSCI or Finviz (10 min). ○ Verify revenue growth (>10%) and social initiatives in 10-Qs on SEC.gov (20 min). ○ Buy 1–2 social-focused small-caps ($500–$1,000), stop-loss 5–7% below, hold 6–12 months. ○ Sell if volatility spikes (VIX >25) or social scores drop (Benzinga). ● Tip: Check X for “$TICKER diversity” to spot social leaders—brand strength fuels gains (Schwab). Socially responsible small-caps are your structural beams—build for stability. Opportunity 3: Strong Governance Attracts M&A and Investment Small-caps with robust governance—transparent boards and ethical practices—are like reinforced windows, drawing M&A deals and investor trust. In Q1 2025, small-caps with governance ESG scores >70 saw 20% gains on 50 M&A deals, vs. 12% for low-scoring peers (Goldman Sachs). ● How It Works: High governance scores signal reliability, attracting buyouts and capital. FCF >$10M boosts M&A appeal (Nasdaq). ● Real Example: Skyline Champion (SKY), a $1.5B industrials small-cap, gained 12% from $86 to $96.30 in January 2025 on M&A rumors tied to strong governance. You buy 50 shares at $86.50 ($4,325), stop-loss at $80, targeting $94. SKY hits $96.30, netting $490 profit (Yahoo Finance). ● How to Build: ○ Screen for governance score >70 and FCF >$10M on MSCI or Yahoo Finance (10 min). ○ Check board structure and M&A buzz in 10-Qs on SEC.gov (20 min). ○ Buy 1–2 governance-focused small-caps ($500–$1,000), stop-loss 5–7% below, target 10–15% gains. ○ Sell after 7–14 days or on M&A confirmation (Bloomberg). ● Tip: Search X for “$TICKER M&A” to catch governance-driven deals—transparency pays (Morningstar). Governance-focused small-caps are your clear windows—build for M&A upside. Your Small-Cap ESG Blueprint To construct a sustainable small-cap portfolio, follow this plan:

Social 15% gains, low volatility Strong brand, low debt https://finance.yahoo.com/quote/HIMS

Governance 20% gains on M&A High FCF, transparency https://finance.yahoo.com/quote/SKY

This table’s your blueprint—use it to design your portfolio. Top Small-Cap ESG Stocks for 2025 Create a markdown table comparing small-cap ESG stocks. Include columns for stock symbol, sector, key metric, and 1-year return, and link to Yahoo Finance. Stock Symbol Sector Key Metric 1-Year Return Link SHLS Renewable Energy 20% revenue growth 35.6% https://finance.yahoo.com/quote/SHLS

HIMS Healthcare $50M FCF 28.4% https://finance.yahoo.com/quote/HIMS

SKY Industrials $30M FCF 42.3% https://finance.yahoo.com/quote/SKY

These stocks, based on Q1 2025 Yahoo Finance data, are your green building blocks. Closing Thoughts: Build a Sustainable Small-Cap Empire Small-cap ESG stocks like SHLS, HIMS, and SKY power sustainable growth through environmental innovation, social responsibility, and strong governance, delivering 10–20% gains. Start with $500 on Fidelity, screen ESG scores on MSCI, and track X for catalysts. This isn’t just investing—it’s designing a greener market future. Grab your blueprint, lay the foundation, and construct your small-cap ESG empire today!